Arkady Kuznetsov Rosneft. Oil in exchange for managers. What experience do you have in sailing

Since the mass exodus of the top management of Rosneft to private structures in 2012-2013, not a single bright managerial character has stood out in the company. It is expected that former helmsmen, longtime associates of Igor Sechin, Eduard Khudainatov, Alexei Tesler, Andrey Chirikov and other leading oilmen, geologists and financiers will now return to Rosneft.

Eduard Khudainatov is a recognized locomotive of the Rosneft management team. He replaced Sergei Bogdanchikov as president of the company in 2009, then gave way to Igor Sechin, becoming vice president. Khudainatov oversaw a number of key promising projects Rosneft and very effectively implemented a large-scale investment program by modernizing old production facilities. Under him, Rosneft's production in 2011 increased from 115.8 million tons to 118.7 million tons, in 2012 - by another 2.8% to 122 million. In 2012, Rosneft approved a record investment program in 480 billion rubles - 70% more than in 2010, the vast majority of investments went to the development of production, a third - to the modernization of refining capacities. Under Khudainatov, the reconstruction of the old Tuapse refinery built in 1929 was carried out. It was the only Russian refinery in the region that worked almost entirely for export. Reconstruction with rather economical financing made it possible to double the depth of oil refining, and the capacity - up to 12 million tons of oil per year.

In 2013, Khudainatov left Rosneft, establishing his own Independent oil company". NOC has already become a serious player in the oil market and is preparing to receive funds from the National Welfare Fund for one of its projects.

Things are worse in Rosneft. In 2014, at one of the brainchild of Khudainatov, the Vankor field, the annual increase in production fell by 5.5 times - to 0.56 million tons from 3.13 million tons in 2013. Yuganskneftegaz also gave a serious decrease (by 2, 6% to 64.48 million tons). At Orenburgneft, production decreased by 0.97 million tons (5.3%), at Samotlorneftegaz - by 0.57 million tons (3.4%), at Purneftegaz - by 0.41 million tons (6 .4%), at Severnaya Neft - by 0.25 million tons (8.2%). Things aren't going any better this year.

Rosneft is also one of the largest debtors. According to Energy Compass, Rosneft's net debt is $43.8 billion. Rosneft's financiers are very constrained in their movements due to sanctions, and the development of new projects is structurally necessary.

The disagreements between the state-owned company and the government have also escalated - Rosneft may lose its monopoly on exploration and development of the Arctic shelf. This was a strategic advantage over powerful private corporations. The admission of private companies to the shelf ahead of Rosneft “is, in fact, support for sanctions,” commented Rosneft spokesman Mikhail Leontiev on the position of the Ministry of Natural Resources.

In this situation, Rosneft's position is best strengthened by a "man from the government", namely Deputy Energy Minister Alexei Teksler. Given the good relations between Eduard Khudainatov and Energy Minister Alexander Novak, there are no obstacles to such a reshuffle. In addition, in February, Texler's candidacy was proposed to the boards of directors of Rosneft and Gazprom. The Ministry of Energy explained the need for the presence of its employee by the need to promote solutions that will be unpopular from the point of view of business decisions, but justified and necessary from the point of view of the state. Texler, like Khudaynatov, is an oil specialist with a thorough knowledge of the entire process of exploration, production and transportation; before his ministerial position, he worked as the managing director of CJSC Polyus.

If new appointments in Rosneft take place, we can confidently predict the alignment of the indicators of one of the world's largest oil corporations. The crisis is an occasion for optimization, which will certainly be successful under the guidance of the most intelligent managers.

ROSNEFT. Bribes and Extortion of Officials

A loud statement was made by the head of Rosneft, Igor Ivanovich Sechin, who in an interview with the media announced his "principled" position in relation to the case of the former Minister of Economic Development of Russia Alexei Ulyukaev.

“For me it was a matter of honor. I felt my responsibility to ensure that the fight against corruption in our country received an additional result.”

Bravo! Very heartfelt words from a "true" fighter against corruption, and it is on the scale of the Country.

The only question to Mr. Sechin I.I. - falls under jurisdiction Russian Federation PJSC NK Rosneft subordinated to him? And do the high criteria for the fight against corruption apply to the country's largest oil and gas company, which Igor Ivanovich heads?

After such statements, it's time for Mr. Sechin I.I. descend from the horizon of the scale of the geopolitical tasks being solved, and pay attention to the CORRUPTION LAW that is actively developing within the company. Or can this also be justified by lofty goals, in order to achieve which one can easily walk over the bones of hundreds of ordinary Russian companies?

What higher goals Is it possible to justify the extortion of multimillion-dollar bribes that the leaders of Rosneft imposed on ordinary contractor organizations that conscientiously carry out Rosneft orders and are not among the elite?

Thus, since 2017, a large-scale extortion campaign was launched by the management of a subsidiary of PJSC NK Rosneft - LLC RN-Vankor, which is the operator for the development of fields

Vankor cluster, located in the Krasnoyarsk Territory.

Without special ceremonies, the general director of RN-Vankor LLC, Mr. Andrey Vladimirovich Chirikov, announced almost identical conditions for further interaction to all heads of contracting organizations connected by existing contractual relations. At the same time, the basis was not the timeliness and quality of the work performed, but banal bribes, in the amount of 10 to 15 percent of all financial payments for previously completed work, and in cash. Where? Where do you get "cash" in such volumes??? none of the gentlemen are interested. After optimizations carried out twice within two years - a revision of prices under existing contracts, where the payment from Rosneft was unilaterally underestimated by 30-40%, such a continuation indicates an unprincipled violation of all obligations and actual robbery. Among the officials of Rosneft, a cynical slogan describing this situation with contractors - "PAY AND DIE" quickly spread and gained a foothold.

The economic calculation is extremely simple. Contractors who refused to pay bribes, at the command of Mr. Chirikov A.V. block payments under all possible pretexts, which in a short time is detrimental to any company. Unilateral termination of contracts by intractable contractors inevitably threatens them with huge penalties and irreparable financial losses.

So where are you, Igor Ivanovich??? dear you are our Fighter against Corruption??? How you are missed by thousands of mere mortals, ordinary employees of contracting organizations who are not paid wages who are massively reduced, who do not know how to fight corruption. And they just know how to work. Who is on the excavator, who is on the pipeline. Maybe just a shovel, in the north, minus fifty. But you will rob them too, do not disdain.

Because the Goals are High!

Let's pay tribute to the former deputy CEO for economic security of RN-Vankor LLC Yaroshko Viktor Anatolyevich. Either out of his own courage, but they say in Rosneft - stupidity, he collected several official statements from the heads of contractors about the above extortion and flew to Moscow, got to the high office of Ural Latypov, vice president of PJSC NK Rosneft for security, and ...... the Order was already flying back to dismiss Yaroshka for "an attempt to discredit the top management of the company."

And several more subsidiaries of Rosneft Oil Company PJSC, including Krasnoyarskneftegaz LLC, represented by Rubin Rashidovich Kuchumov, Advisor to the General Director, joined the requisitions. An interesting position is an adviser, and if you call a spade a spade, then an INTERMEDIARY in solving private issues.

Where are our law enforcement agencies? Or they didn’t get the information about massive extortions and extortions, which lasted for a year! is exaggerated in almost every division of RN-Vankor LLC. Discussed in every office corner of hundreds of contractors. Can you help Igor Ivanovich and his numerous staff of specialists in economic and own security bring Andrei Vladimirovich Chirikov to clean water. Or is it still not in Chirikov's business???

In this region, law enforcement agencies are represented by serious comrade generals! Head of the Ministry of Internal Affairs for the Krasnoyarsk Territory Rechitsky A.G. and the head of the FSB, Kalashnikov A.P. By the way, both of them position themselves as great specialists, namely in the direction of the fight against corruption, Igor Ivanovich was just lucky with them. Comrade officers, we beg your pardon, but for now you are just the guards of this whole corruption masquerade!

And if someone does not agree with these accusations, respond to this information! Do at least a superficial check of the above facts. Talk with the same Yaroshko V.A., with others officials Rosneft system, with employees of contractors. I am sure that you as soon as possible provide comprehensive facts criminal activity Chirikova A.V. and his colleagues.

Someday a film based on real events will be made about the Rosneft company. Or, rather, a whole series that will dwarf House of Cards, Rome, and even Game of Thrones, because it will have everything: almost unlimited power, huge money, behind-the-scenes games, big politics, extreme cynicism and real, a non-fictional drama unfolding on the ruins of a once great empire.

I don't know of any other company that is so infused with the spirit modern Russia would help to understand its essence, meaning, values and driving forces so well. Rosneft is always on the radar, and scandals with its participation follow one after another, but only by covering the whole picture do you understand what a grandiose and at the same time tragic phenomenon you are dealing with.

From the vague contours of events that have remained in the past or are still emerging in the future, an image of a gigantic monster is formed, worthy of the pen of Stephen King. This monster is gloomy, dangerous, capable of casually crushing anyone who gets in its way, but, despite all its power, is doomed.

So that you can imagine this, I sketched out a synopsis of the script for the series based on the history of Rosneft, which will definitely be filmed someday. Of course, all the events in it are fictional from beginning to end, and all the coincidences of names and company names are absolutely random.

Episode 1. On the bones

The real story of this monster did not begin in 1991, when Rosneftegaz was created. And not in 1993, when it changed its name to Rosneft.

The starting point that determined its modus vivendi was a conversation between Khodorkovsky and Putin on February 9, 2003. At a meeting between the oligarchs and the president, Khodorkovsky accused Rosneft of corruption, and Putin responded by reminding Khodorkovsky of Yukos' tax problems. Well, I reminded you .. Rather, I promised.

Two weeks later, a criminal case was opened against the employees and owners of Yukos, on October 25, 2003, Khodorkovsky was under arrest to spend 10 next years, and in December, a re-inspection of the Ministry of Taxes and Duties suddenly found serious violations at Yukos and the company received the largest fines in Russian history, effectively becoming bankrupt.

On December 22, 2004, Rosneft through a fly-by-night company with authorized capital for 10,000 rubles, with a legal address in Tverskaya rum and a director from the village of Dmitrovo, she bought Yuganskneftegaz, owned by Yukos, for a third of the price, which provided 2/3 of Yukos' production.

By August 2007, Rosneft had bought up 80% of Yukos' remaining assets for 43.4% of the market price. As a result, in 2007 the former assets of Yukos gave Rosneft 3/4 of oil production. Simply put, Rosneft treated Yukos like a female praying mantis: she had it, tore off her head and ate it.

Everyone in this story received something of their own: Rosneft - Yukos assets, Khodorkovsky - 10 years, the investment climate - an aspen stake right in the heart, and the oligarchs - a reminder that they received their wealth during the loans-for-loans auctions not just like that, but in what in a sense, on the security of their loyalty, conscience, freedom, if you want - the soul.

Episode 2. Shadow of the President

year 2012. Putin returned to the presidency for the third time, and Medvedev - to the chair of the Prime Minister of the Russian Federation. The Constitution was rewritten for the elections, the opposition and journalists from the very beginning declared the illegitimacy of the elections and huge number violations, mass protests began in the country.

Against this background, two weeks after Putin took office, Sechin became the president of Rosneft, taking the second place in the ranking of the highest paid Russian top managers in terms of Forbes versions and yielding in this only to the head of Gazprom Miller.

Sechin, a philologist by training, worked as a translator in Mozambique during the civil war there, then visited the hot spots of Angola. At the same time, apparently, he began to cooperate with the KGB, although there is no official information about this anywhere.

Sechin met Putin in 1991, when he was working in the St. Petersburg mayor's office, and has since become one of his most loyal companions. Wherever Putin went, Sechin followed him like a shadow and put his most valuable asset in the hands of his own. faithful companion was at least logical.

The appointment of Sechin as President of Rosneft proved to be difficult: Medvedev, moving from the presidency to the post of prime minister, had his own views on this position and on Rosneft's financial holdings. And although Putin was almost the only person in the country who tried not to publicly humiliate Medvedev, the appointment took place in Putin's favorite mode of special operation: Medvedev learned about him after the fact.

Episode 3

On October 22, 2012, Sechin reported to Putin that Rosneft was buying a 100% stake in TNK-BP from the AAR consortium and the British oil company BP for $61 billion. It was planned that as a result of the deal, Rosneft would receive 40% of the Russian and 5% of the world oil production market .

For this transaction, Rosneft borrowed on international financial markets$ 55 billion and on March 21, 2013 in London, Sechin announced the completion of the deal. Experts called this deal "brilliant", "one of the best in the history of the Russian oil sector", and Sechin was included in the list of 100 most influential people in the world according to Time magazine.

In the spring of 2014, two more significant events for Russia took place - the triumphal Olympics in Sochi and the annexation of Crimea. Probably, this moment was the peak of the power of the two empires: Russia and Rosneft simultaneously reached the apogee of their power and it seemed that even larger victories and acquisitions awaited them ahead.

Episode 4. Like a downed Boeing

Already in July 2014, oil prices collapsed, and a Boeing 777 flying from Amsterdam to Kuala Lumpur was shot down over Donetsk from the Russian Buk. From that moment on, the streak of success for both Russia and Rosneft was interrupted.

The fall in oil prices and sanctions forced Rosneft to more than double in price in the blink of an eye.

Paradoxically, the value of Rosneft, together with the acquired TNK-BP, turned out to be lower than the value of BP alone before the merger, and amounted not to $120 billion, as planned, but only $50 billion.

In December 2014, Rosneft issued bonds in the amount of 625 billion rubles to make payments on debts for the purchase of TNK-BP. Without hesitation, she converted them into currency and the whole country shuddered: at one moment the dollar rose to 80 rubles, the euro - to 100.

The Central Bank barely managed to extinguish the panic in the market and stop the fall of the ruble by raising the key rate from 10.5 to 17 percent and, in fact, stopping investment and GDP growth in the country.

It was hard to imagine a more serious fiasco .. Exactly until a doping scandal erupted and it turned out that the gold of Russian athletes was obtained not by labor and talent, but by meanness and meldonium.

The high-profile victories of Russia and Rosneft, Putin and Sechin turned into shameful defeats in one moment.

Episode 5

In 1932, oil was found on the territory of the modern city of Ishimbay. Thus began the history of the association, which in 1954 came to the fore in the USSR in terms of oil production. In 1975, it became known as Bashneft, and since 1995 it has become an open joint stock company.

In 2002, Bashneft was privatized by unknown LLCs. Yes, they privatized it so much that already in 2003 the Accounts Chamber called this deal "an unprecedented case of theft of assets from state property." It is not entirely clear what exactly the Accounts Chamber had in mind - that they are indignant about this or that they admire the business acumen of the new owners, but no one was imprisoned for this, so the second option is more likely.

Moreover, the lucky one who profitably privatized Bashneft through a chain of shell companies, by a strange coincidence, turned out to be Ural Rakhimov, the son of the President of Bashkortostan Murtaza Rakhimov.

In 2005 and 2009, large stakes in Bashneft were acquired by AFK Sistema, owned by Yevtushenkov (AFK's most famous asset is the operator cellular communication MTS). And everything, in general, went on as usual until 2014. It would seem, where does Rosneft?

Episode 6

In September 2014, the state caught on, and the Investigative Committee opened a criminal case into the theft of Bashneft shares. But it was not even surprising that the investigation was 12 years late, but that Yevtushenkov, an absolutely conscientious buyer of shares that had previously passed through a long chain of companies, was under arrest.

However, Yevtushenkov was kept under arrest for several months and released immediately, as soon as the Bashneft shares were seized by the Arbitration Court in favor of the state. Despite the loss of several billion dollars, Yevtushenkov did not grumble, but the event turned out to be out of the ordinary: an oligarch loyal to Putin - and under arrest? This has not happened since Yukos.

The attempt on the results of privatization - the sacred cow and the cornerstone of modern Russian political and economic system? It doesn't fit in at all anymore. In a sense, for the Russian elite, this is worse than the Maidan.

What forces turned out to be capable of such a thing, and for what did the foundations of the system shake? Not to replenish the treasury, after all.

The answers to these questions became clear when Putin removed Bashneft from the list a year later. strategic enterprises, Medvedev immediately included it in the privatization plan for 2016, and on October 6, 2016, the government issued a directive instructing Rosneft to acquire a stake in Bashneft.

The most complicated deal, which required the coordination of a number of ministries and departments, which would have taken any other company months, if not years, took place after 6 days.

Surprising efficiency, especially considering that the Ministry of Economic Development was against this deal (because the privatization of a state-owned company state company this is nonsense), and immediately after the completion of the deal, the Minister of Economic Development put a letter of resignation on the Prime Minister's desk due to unprecedented pressure.

Episode 7. Sechin's special forces

In 2004, a new division appeared in the structure of the FSB: the so-called 6th service of the FSB's own security department.

The governor of the Sakhalin region Alexander Khoroshavin, the head of the Komi Republic Vyacheslav Gaiser, the governor of the Kirov region Nikita Belykh, the mayor of Vladivostok Igor Pushkarev and other high-ranking officials were detained by employees of this particular unit.

It is difficult even to imagine broader powers in modern Russia: a special service within a special service, an oprichnina of the 21st century. This unit was led by General Feoktistov, also known as "Big Oleg" and "General Fuchs".

In the summer of 2016, he quit, but already in September he found a use for his talents - he was hired by the head of the Rosneft security service.

And already on November 15, 2016, the unprecedented happened again: right in the office of Rosneft. The very Minister of Economic Development Ulyukaev, who was against the deal with Bashneft.

The accusation sounded at least surreal:

- Ulyukaev threatened Rosneft,

- run by Igor Sechin, one of Putin's closest associates,

- whose security service is headed by an FSB general,

- extorting a $2m (0.04%) bribe from a $5bn deal

- for the Bashneft deal, which has already been completed.

As it turned out later, Ulyukaev's audition began back in August. The whole thing from beginning to end is a “set up” of the purest water, or rather, reprisal. Moreover, for a country where Serdyukov, who stole 16 billion rubles, escaped with a slight fright, unusually cruel.

On March 7, 2017, having worked as head of the security service for less than six months, General Feoktistov left Rosneft and, apparently, returned to the service. Or maybe he never left.

It remains only to understand why the FSB CSS has such a reverent attitude towards Rosneft, that its generals are severely cracking down on a minister who dared to object to one of the deals, even a large one?

The casket is opened simply: in 2004, the 6th service of the CSS of the FSB was created personally by Sechin, who oversaw the power bloc in the government.

Episode 8

The epic of Bashneft did not end there.

While owning Bashneft, AFK Sistema prepared the company for an IPO, unraveled the looped intricacies of the company's ownership structure that had accumulated over the years, got rid of non-core assets, bought back its own shares from minority shareholders - put things in order. At the same time, the oil company's revenue increased 3 times from 215 billion rubles to 637 billion rubles; oil production increased by 46%, and the company's capitalization increased by 7.8 times - up to 432.4 billion rubles. To put it mildly, not bad, especially against the backdrop of a depreciated Rosneft.

And, nevertheless, on May 3, 2017, Rosneft filed a lawsuit against AFK Sistema with the Arbitration Court of Bashkiria for the recovery of losses incurred by Rosneft and Bashneft as a result of the restructuring carried out by Sistema. At first, the amount of the claim was 106.6 billion rubles, and then grew to 170.6 billion.

It is absurd to even think about losses at such rates of company growth. It is absurd to complain about how the previous owner managed the company: if you don't like the result, don't buy it. And taking into account the fact that Rosneft bought Bashneft from the Federal Property Management Agency, but is suing Sistema, the claim seems absurd in the cube.

In theory, in Arbitration Court at the sight of such a lawsuit, they should have twisted a finger at their temples, and then told about it as if it were a joke, but .. Instead, they accepted the lawsuit for proceedings.

Moreover, the court ordered AFK to provide evidence of the absence of losses from the reorganization of Bashneft and positive economic effect from reorganization (actually, the plaintiff must prove the losses), and also, as an interim measure, he arrested 31.76% of the shares owned by AFK Sistema and Sistema-invest in authorized capital MTS PJSC, 100% of shares in the authorized capital of Medsi Group of Companies JSC and 90.47% of shares in the authorized capital of BPGC JSC.

The stock market reacted instantly: the shares of AFK Sistema fell by 36.92% in a day, in July the capital outflow broke the record of the last three years (minus $1.6 billion), the shareholders of MTS and other companies whose shares were under arrest lost more than 150 billion rubles, and another nail was driven into the coffin with the inscription "investment climate in Russia".

After the Yukos case, this was the most serious shock for the market. However, the situation with the investment climate of the Russian Federation is perfectly reflected by the words of the Greyjoys from the Game of Thrones: “What is dead cannot die,” so it has not become fundamentally worse.

Episode 9

When the largest Russian oil company buys $8.5 billion worth of crude oil, it looks strange. When she buys it, having paid in advance, it is doubly strange. While having debts in the amount of annual revenue - triple. And when it buys it from a country that is on the brink of civil war and is almost guaranteed to be unable to meet its obligations, it becomes clear that Rosneft is not exactly an oil company.

Venezuela has avoided defaults on government bonds at least twice already, and the government of Nicolás Maduro has retained power thanks to the money of Rosneft, which actually lent for future supplies, first a billion, then another one and a half, and on August 11, 2017 - six billion dollars at once.

In Venezuela, for four months now there have been continuous anti-government protests in which more than 120 people have died. In the economy - inflation, recession, structural crisis, shortage of food and medicine. Rating agencies assigned the long-term obligations of Venezuela a CCC rating, that is, a pre-default state. Investing in such a country is obviously insane. But..

Episode 10

We come to the main point. At first glance, Rosneft may appear to be a highly inefficient company: judging by the latest big deal with shares of Rosneft (), Rosneft, together with all subsidiaries, is now worth $57.89 billion. Immediately after entering the IPO, Rosneft was worth a full $79.8 billion, which is already fundamentally more.

And if we consider that since that moment Rosneft has acquired the assets of TNK-BP for $55 billion, the assets of Yukos, the value of which was estimated by the Hague Arbitration Court at $61.1 billion, and Bashneft for $5.17 billion, then now it should have cost not $57 89, and (taking into account Yuganskneftegaz acquired before the IPO) $184.07 billion - more than three times more expensive.

Failed investments, mediocre operating efficiency, sanctions, projects that turned into empty shells - all this would have killed any oil company long ago, and sent top management to the labor market with a wolf ticket, but Rosneft is not an oil company.

Its business is foreign and domestic politics, its function is to accumulate and redirect financial flows, her tools are the FSB, the courts and ministries, her income is fat pieces of companies torn apart. And in this she is super effective. What is there, she simply has no equal.

No one else is capable of doing what Rosneft is doing in Russia. Because in a sense, Rosneft is Russia. At least they have the same owner. The destinies of the country and the company are so closely intertwined that it is difficult to even imagine them separately, and they experience all the ups and downs almost simultaneously.

Epilogue: Future

In principle, Rosneft has no reasonable reasons to chase business performance indicators or increase shareholder value because they can't be saved. The tragedy of the largest oil company in Russia lies in the fact that, with all the power and influence of its existence, a limit has been put.

Sooner or later, renewable energy sources and electric cars will collapse oil prices, and then the entire grandiose empire of Rosneft will begin to crumble like a house of cards.

Rosneft could, as many Western energy companies do, invest in new technologies, in the future, but in modern Russia with a disgusting investment climate, lack of guarantees of private property, total bureaucracy and weak infrastructure, this is pointless.

In another Russia, where you can’t set on the one you like private company FSB and tax, and then gobble up the company in parts, there is no place for Rosneft. Yes, and the old, semi-feudal Russia, with an elite that exists on oil and gas rent, cannot survive the change of energy eras in its former form.

Both Russia and Rosneft as we know them share the same fate. Their story began at the same time and will end at the same time .. And then, as always happens, on the ruins of the empire, new life, and our descendants will look with bated breath at the events that have become for them something like a fairy tale - scary, but far and safe.

How he managed Rosneft and created his own business at the same time

Khudainatov joined Rosneft in 2008 at the invitation of then Deputy Prime Minister Sechin, but since then he has been planning to go into his own business more than once: he wanted to prove that he is capable of building a company from scratch on his own. In less than two years, he managed to collect mining assets and create an NOC, which included Musa Bazhaev's Alliance Oil. Today NNK is the operator major project with more than one hundred million oil reserves, and their development can be supported public funding. Eduard Khudainatov is probably helped to feel comfortable even in difficult conditions by the fact that most of his career is connected with the oil and gas sector - here it is difficult to surprise or frighten him with anything.

NNK: a portrait against the backdrop of oil

The independent oil company was actually created at the end of 2012, Khudainatov sat in the chair of its president in August 2013. The first assets purchased were the Saratov-based CJSC Geotex and OJSC Payakha, operating in the Krasnoyarsk Territory. In April 2014, a merger with Musa Bazhaev's Alliance Oil took place, and already in the fall of the same year, Khudainatov bought out Bazhaev's share. The amount of the deal was not disclosed.

Having left the state company Rosneft in July 2013 to create his own business, Eduard Khudainatov was able to enlist the support of the state: the Ministry of Energy recently approved his application for funds from the National Wealth Fund for the development of the Payaha project. The project is strategically important for the industry, it will give impetus to the development of a whole cluster of fields in the Dudinskaya oil and gas province, Energy Minister Alexander Novak explained the decision. Funding is provided to support the Payakhsky and Severo-Payakhsky oil fields on the Taimyr Peninsula in the Krasnoyarsk Territory, their total recoverable reserves are 106.7 million tons.

The only problem with NOC is that the company grew by borrowed funds. Last year, NOC attracted several loans, including 14 billion rubles. - from the Bank of Moscow. At that time, no one expected that oil prices would begin to dive: in the previous three years, the average price of a barrel of Brent was around $100. “The economics of many projects have changed, a significant part of the development has become unprofitable,” IHS analysts say.

In addition, according to IFRS reporting, Alliance Oil's revenue in 2014 amounted to $3.5 billion, EBITDA - $666.6 million, oil refining increased by 1.2%, to 4.5 million tons, production fell by 5%, to about 2.8 million tons of oil, but the company received an $881.1 million loss due to foreign exchange differences from financial activities. Exchange rate differences are the problem of most commercial structures last year, a company representative explained. This year, another tax maneuver began to work (a sharp increase in the MET and a reduction in duties), which hit companies with a low supply of their own raw materials and a shallow degree of processing more painfully. NOC was among the most affected: the output of fuel oil at the Khabarovsk refinery is almost 40% against 28% on average in Russia. This has become the weak link in NOC's business under the current conditions.

Nevertheless, although many prospects for the oil and gas market now look vague due to lower prices, NOC is not afraid of this: the company plans to start production in Taimyr in 2017 and increase it to 3-3.5 million tons by 2019. By 2022 The company plans to increase production to 25 million tons and processing to 12 million tons.

At the helm of Rosneft

Although many call Khudainatov a universal manager, his career is mainly associated with oil industry. He graduated from Tyumen State University. In 1993, Khudainatov headed the oil company Evikhon (Nefteyugansk), in 1995–1996. - "Yuganskpromfinko", after 1996 he worked in the administration of Nefteyugansk - first as deputy head of administration, then first deputy head of the Nefteyugansk region; headed the administration of the village of Poikovsky. In 2000–2003 Eduard Khudainatov worked as a federal inspector for the Nenets Autonomous Okrug of the Office of the Plenipotentiary Representative of the President in the North-West federal district. Khudainatov came to Rosneft from the position of General Director of Severneftegazprom, a subsidiary of Gazprom, which owns the right to develop the Yuzhno-Russkoye gas field.

The President of the NOC has always been called the closest associate of Igor Sechin and the man of his team. At Rosneft, he initially oversaw capital construction, and in September 2010 he was appointed president of the state-owned company, replacing Sergey Bogdanchikov, who had worked in this post for almost twelve years. Indeed, having stood at the helm of Rosneft, Khudainatov set the task of accelerating development. “Since we want to even more rapidly raise the bar for the development of the company in the field of mining and processing, naturally, it will probably require both a correction in the renewal of personnel and the involvement of world-class specialists,” said Eduard Khudainatov. “I am sure that life experience, deep knowledge of the industry and the company will allow Eduard Yuryevich to take Rosneft to a new stage of development,” Igor Sechin encouraged him upon appointment. Khudainatov coped with the task of building a new stage in the development of the company: in 2011, production increased by 2.5%, to 118.7 million tons, in 2012 - by 2.8%, to 122 million tons. It is noteworthy that the growth was "organic", that is, it was due to effective work rather than by taking over oil companies.

Growth was driven by projects in Eastern Siberia and the Far East, the main one being the Vankor field with reserves of more than 400 million tons and an annual production of 22 million tons. Not all officials then believed in the prospects of Vankor. The project is important not only for Rosneft, but also for the industry, Khudainatov argued: without Vankor, oil production in the Russian Federation would not have shown an increase of 2.3%, but stagnation at the level of 0.3% in 2010, followed by a decline in 2011 –2012

Forcing investment in mining projects was among Khudainatov's priorities. In 2012, Rosneft approved a record investment program of 480 billion rubles, which is 70% more than in 2010. The vast majority of investments went to the development of the upstream segment, and a third to the modernization of oil refining. Among the merits of Khudainatov is the reconstruction of the Tuapse refinery: the plant was built back in 1929 and needed a radical restructuring; as a result, the refining capacity increased to 12 million tons of oil per year, the refining depth reached 98%.

Khudainatov managed to spur major joint projects with foreign companies. Among them was an agreement signed in 2011 on strategic cooperation with the global leader ExxonMobil in the development of sites in the Kara and Black Seas. The share of participation of Rosneft was the majority - 66.7%. In those years, an agreement was signed with Crescent Petroleum on the creation of a joint venture in the UAE, the company also entered the group for the development of fields in Venezuela.

After leaving

In May 2012, after the change of government, Igor Sechin himself became the president of Rosneft, and the functions of the first vice president were delegated to Eduard Khudainatov.

According to sources close to the leadership of the state-owned company, Sechin appreciated Khudainatov, considered him a systemic person who could be entrusted difficult questions. Together with Sechin, Khudainatov went on almost all business trips and participated in most of the negotiations. Khudainatov advised Igor Sechin to diversify sales markets (excessive dependence on one region makes business too vulnerable) and make a breakthrough to the east, which Rosneft implemented after Khudainatov left.

True, Khudainatov several times tried to leave Rosneft: he always wanted to prove himself in business, having received space for independent work, but Sechin opposed. Prior to joining NOC, Khudainatov was appointed president of Itera Oil and Gas Company, 51% owned by Rosneft. But the experience of independent work was short-lived: after the consolidation of Itera, Khudainatov left the post of president of the company. Ultimately, develop private business Khudainatov was able to do it only after leaving Rosneft on the basis of a rather little-known OJSC established at the end of 2012. This structure did not have significant assets, so the main task was to find and acquire them. The assets of Geotex, which produces gas in the Saratov region, and OJSC Payyakha, operating in the Krasnoyarsk Territory, were later successfully incorporated into NOC, and Alliance Oil, which owns assets in Tatarstan, Kazakhstan and the Khabarovsk refinery, was among the strong acquisitions.

Eduard Khudainatov was able to assemble a team of professionals at NOC: not only leading geologists (including Andrei Chirikov, ex-general director of Vankorneft), but also financiers from Itera came to the company with him. Meanwhile, as Bank of America Merill Lynch points out, the outflow of personnel has deprived Rosneft of strong production workers, so in the long term the company may lose the main catalyst for growth. It is unlikely that Eduard Khudainatov, when he left Rosneft, predicted that the foundation he was building would begin to burst at the seams.

On May 5, the board of directors of Rosneft extended Igor Sechin's presidential powers for five years in accordance with a government directive. The decision to reappoint Sechin was dictated by the situation within the company, Rosneft spokesman Mikhail Leontyev said. “Sechin is a political figure in the leadership of Rosneft, his triumph has already taken place,” said Donald Jensen, a researcher at the Center for Transatlantic Relations (USA). However, analysts point out that Rosneft needs to strengthen the top echelon of professional oil workers in order to return to a sustainable growth trajectory. According to experts, Khudainatov's return to Rosneft would significantly strengthen the company's position in the long term and play a positive role in improving its current performance.

Vasily Lvov

Andrey Chirikov is an entrepreneur, investor, EMBA graduate of the Moscow School of Management Skolkovo. Leaving large corporation, Andrey entered Skolkovo, got the missing knowledge there, found new friends, invested in start-up projects and found a new hobby - sailing.

How did you get into the Skolkovo team?

I am a graduate of the School of Management. Studied on a course Executive MBA, and it was in the 7th group, where the main part of the Skolkovo Sailing Team was formed: Yura Mitin, Ruslan Mukhametzyanov, Sasha Matveev, Sergey Mulyar, Evgeny Zorin, Sergey Popper, Maxim ... I did not immediately begin to go to train with them. I had other yacht trips, including those combined with diving.

I was invited to the team from the very beginning, and I said, “Yes, of course, yes. I'm with you! But I'll join later. There's a lot more you need to learn, more experience to gain."

But when they started moving by leaps and bounds, I thought: “This is speed and attitude! I won’t have time now! ”, And quickly joined and now we are learning sports yachting together and participating in competitions.

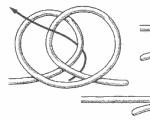

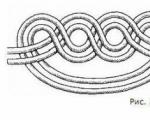

What experience do you have in sailing?

If we talk about the experience of the skipper, then I have a small one. Ran a few times in Montenegro, V Sochi I went to Beneteau. But there is enough experience in other positions. He mainly raced as a clew or pitman, he was also on the mainsail and staysail. Last year I competed in Monaco on J70, just in the position of a pitman, he carried a gennaker. We raced in the same crew with Zhenya Semykina, a member of the Skolkovo Sailing Team. IN Portsmouth was clew, there was one of the most difficult regattas.

I know how to steer a boat because of cruising experience, not racing. And now we managed to steer in the race. The recently held Melges 20 regatta in Monaco gave me a unique chance to gain experience in boating in a difficult regatta situation. Here you need to know how to act correctly in a critical situation, how to control the boat at the start, when there are a lot of boats and we need to take an advantageous position, how to properly bear off, use our rights and many more different details. What I read and listened to in theory about racing tactics, I have now put into practice.

Where did your passion for sailing come from?

As a child, together with my brother, I went to the school for young Nakhimov students in the Central House of Pioneers in Moscow. Even then there was a craving for the sea.

For the first time I raised my own sail in the White Sea. I think I was nine years old.

I went out in a small bay, a small boat was leaking and I was bailing out water with a bucket. But it was more child's play than sport.

What other sports do you do besides sailing?

Heli-skiing on a snowboard, for example. This is a kind of freeride when you are picked up by a helicopter and landed in the mountains on wild and unexplored slopes. We fly around the world and choose untouched corners of the mountains. I also play tennis myself and hold tournaments in our tennis club, other hobbies are diving, classic car rallies, football, although now I play less and less due to injuries.

What is the most important thing in sailing?

Strategy. You need to clearly follow the chosen line, quickly respond to a change in the situation and be as focused as possible on your task. In addition, you can see very clearly how much your mistake can change the balance of power in the race.

Very important, however, as in many sports, the coherence of the team.

If there is a team that feels and listens to you, and you support each other, then you can achieve a lot. Alone in the field and in the sea is not a warrior.

Such skills must also help in business?

Very! I have many lines of business. I don't work alone anywhere. There is always either a partner or a team. Without the talent of the guys who help, business is difficult. And I always keep in touch with the team. We are friends and we work.

And vice versa? Are there any skills that have migrated from sailing to your business?

I believe that business and sailing have a lot in common.

Targeting is very important. If you start to rush about, change your strategy every day, as a result you lose.

For example, a setting wind can instantly affect the sail and the boat will lose speed. If you start to panic and change course, looking for the right direction, then be in trouble. And if you show a little restraint and patience, stay on course, then the wind will increase again, and you will take yours and win. In business, the same is true. Such analogies help me a lot not to panic, especially in these difficult times.

What role does business education play now, in a difficult time, as you put it?

Defining, I would say. My studies at Skolkovo coincided with a new stage in my life: I moved from a large corporation and began to work own business. I had management experience, sales experience, but I had no experience in forming a long-term strategy, building a company, or a business. And I wanted not only to start new business but also to develop existing own projects.

It was very interesting to study. I acquired a lot of knowledge in corporate finance, began to understand accounting, in general, on all topics that I did not deal with while working in a large corporation. And the first thing I needed to learn was how to write a business strategy. Here the Skolkovo education helped me a lot.

Moreover, the acquaintances acquired in Skolkovo have become business contacts for me. We hold each other, help each other. I have invested in five projects related to Skolkovo, many of which have become international and are developing. Skolkovo is a turning point in my life.

What projects are you currently working on?

I have two current projects. One of them is the ship-owning company Saturn Shipping. My partner and I invested in the construction of tankers. Now several of them have been bought by large state-owned companies. My other business is a terminal in Murmansk, from where we exported oil products. But now I'm more involved in investment projects.

For example, one of the projects came to me from Startup Village Skolkovo. I helped the guys make pitches and fate led me to interesting project- online education for parents on raising children from 0 to 6 years old, BabyStep TV The idea was to shoot educational clips. Each one-minute video provides one piece of advice related to the education of children from 0 to 6 years old for each point in the child's development. I was interested in this project because I myself have three children. I am interested in children's education and I myself love to mess around with children. My partner is also a father of many children. We thought and decided to invest a fairly large amount in Baby Step and now the project has become international: the videos are filmed in USA, and our main market, in which we are moving forward now, is China. The project has won many prizes in startup competitions and is now available in 13 languages. I'm the strategist for this project. I also have several projects related to agriculture.

Skolkovo Sailing Team is a sailing team of graduates of the Skolkovo Business School. The team was formed in 2013, and in 2014 won silver in the regatta among the world's leading business schools RSM MBA Regatta.