Housing received by inheritance is not uncommon in the real estate market. Risks in transactions with inherited apartments are typical for all parties without exception. Minimize the possibility of large...

READ MORE

If an apartment that was previously inherited is sold, the citizen is obliged to pay personal income tax at the usual rate of 13%. However, in some cases there is no such need....

READ MORE

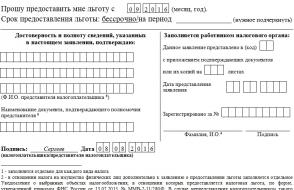

Some categories of taxpayers have the right to a reduction or complete cancellation of property tax payments. This type of relief can be provided to both legal and physical...

READ MORE

Regular payment of taxes by older people has a negative impact on a full-fledged existence, since it takes away a significant part of income. Current regulations contain information about...

READ MORE

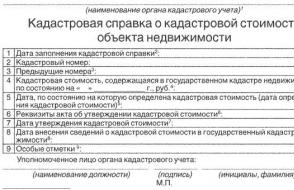

Probably, someone noticed that in transactions with real estate, a tax is levied on income received as a result of sale, exchange or gift, but the amount is calculated not from the total, but from...

READ MORE

When concluding real estate transactions, it is important to have not only all the completed documents, but also reliable information. You can consult with lawyers or specialists...

READ MORE

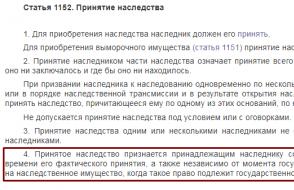

The inheritance received is not only a material increase for the heir, but also his obligations for maintenance, payment of taxes, etc. Most often, the heir is concerned about tax issues...

READ MORE

Legislation imposes an obligation on entrepreneurs, legal entities, and citizens to pay taxes. These payments go to budgets at different levels. The funds are then used to support...

READ MORE

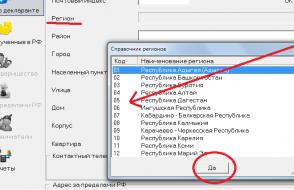

Citizens of the Russian Federation who own real estate must pay property tax. For a long time its value was calculated on the basis of the inventory value of housing. But since 2015, taxable...

READ MORE