Calculation of property tax for individuals

For a long time, the calculation of the tax on the property of individuals was carried out in accordance with the Law of the Russian Federation N 2003-1 “On Taxes on the Property of Individuals” dated 12/09/1991 based on the inventory value of the object of taxation, but since January 1, 2015 this law has become invalid and now property taxes individuals are regulated by the Tax Code of the Russian Federation and are already calculated based on the cadastral value of real estate. In the current publication, we will talk about how to calculate the tax on property of individuals, what are the requirements of Chapter 32 of Part Two of the Tax Code of the Russian Federation (introduced by Federal Law of 04.10.2014 N 284-FZ), what is the responsibility for non-payment of taxes.

We will analyze the terminology, namely: who are taxpayers, what is the tax base, object of taxation, tax period, rates, procedure and terms for paying taxes on property of individuals.

How is personal property tax calculated?

Property taxes go to the budget of the municipality in which the property has passed state registration, since they are related to local taxation. The taxpayer for this type of tax is an individual who owns taxable property. The reporting period for which the tax is calculated is one calendar year.

The property tax payment deadline is December 1 of the year following the reporting year. That is, for 2018, property tax must be paid before December 1, 2019.

The tax inspectorate must send a notice of payment of property tax 30 days before the due date for payment.

If a notice of payment of property tax in relation to any object is not sent, the taxpayer must send a message to the tax authority about each object of taxation for which he did not receive a notice. The deadline for sending such messages is December 31.

What threatens non-payment of personal property tax

If the taxpayer has violated the terms established by law for the payment of property tax, then the following sanctions may be applied to him:

- Accrual of interest on the amount of unpaid tax.

- Penalty for non-payment of property tax of an individual. The amount of the fine in the general case is 20% of the amount of tax arrears and 40% if the tax authority has evidence of deliberate non-payment of tax.

- Enforced collection of penalties and arrears, that is, unpaid tax amounts, through the court.

In some cases, the Federal Tax Service makes mistakes in calculating the tax on property of individuals. In this case, you will have to draw up an application to the tax authority with an explanation of the error, then wait for a new notification and pay the tax.

If the tax was overpaid, the taxpayer also draws up an application to the Federal Tax Service, after consideration, the amount of the overpayment can either be set off against future payments, or received back.

The main thing is to submit an application no later than 3 years from the date of payment of the disputed tax. The FTS takes a decision on offsetting or refunding funds within 10 business days after receiving and registering the application. Overpaid money can be returned within a month.

Calculation of the property tax of individuals based on the cadastral value of the property

Having received a notice of payment of property tax, the taxpayer should check the correctness of the calculation of the amount of tax. For this:

- Check if the property on which the tax is calculated is correctly indicated.

- Check the correctness of the determination of the taxable base (cadastral value of the property).

The cadastral value, in fact, is the market value of real estate, most often it is many times higher than the inventory value, according to which property tax was charged until 2015, which many owners of real estate, both apartments and land plots, were dissatisfied with.

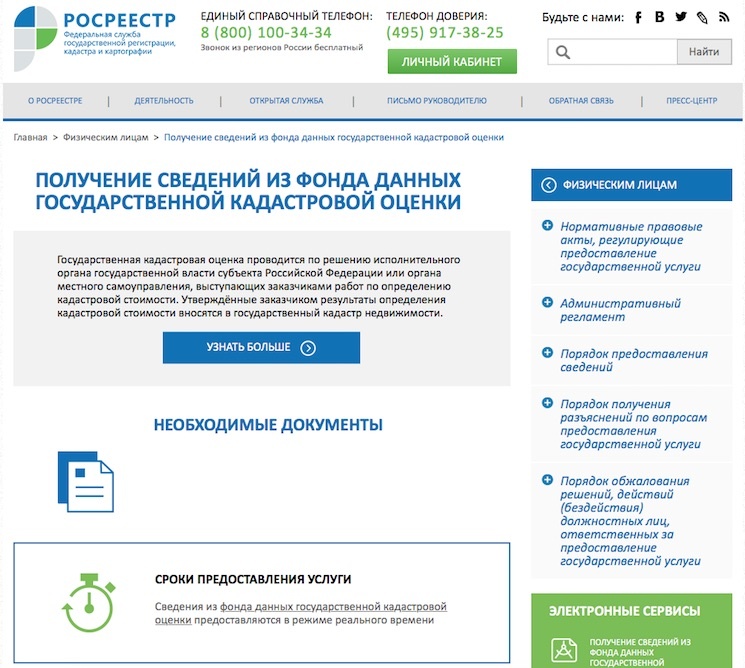

You can find out the cadastral value of real estate, and not only your own, using the online service on the Rosreestr portal - “Reference information on real estate objects”. At the same time, it is important to remember that Rosreestr shows the cadastral value on the day of the last update of the service database, so if you are interested in the cadastral value on a certain date in the past, then you better take an extract from the Unified State Register of Real Estate (Unified State Register of Real Estate, which was created in 2017 as a result of merging into one database of the Unified State Register of Real Estate and the State Property Committee / State Real Estate Cadastre).

Keep in mind that if you received a notice in which you saw an upward recalculation of tax, then this recalculation can only be for the last three years. That is, if the notification was received in 2019, then recalculation can only be for 2016-2017, since 2018 is the year for which tax is paid in accordance with the notification received. There are no recalculation fees.

- Check to see if you are eligible for tax benefits.

- Specify the tenure of the property.

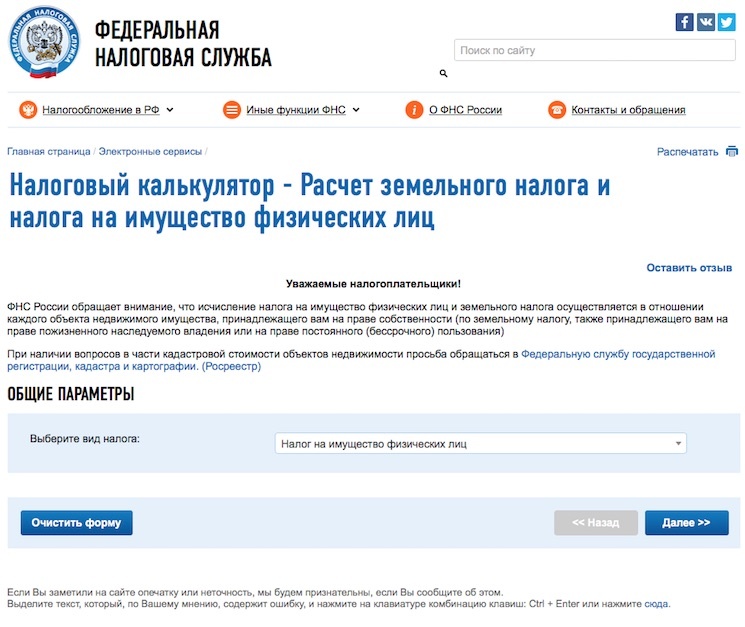

The calculation of the amount of property tax can be done on the official website of the Federal Tax Service.

The scheme for calculating the tax on property of individuals based on the cadastral value is as follows:

- Specify the cadastral number of your property. The system will offer to find this number, if you do not know it, at the address of the object using the Rosreestr website. If the number is entered, click the "Next" button.

- The following characteristics of the object will be displayed on the screen: its area, cadastral value.

- It is proposed to fill in the size of the share, the period of ownership of the object, the available tax sow, the tax rate and the amount of the tax benefit;

As a result of entering all these data, the system will calculate the tax.

You can check this information directly in the department of the Federal Tax Service.

Real estate tax rates based on cadastral value

Please note that for residential buildings, residential premises, unified immovable complexes, which include at least one residential premises (residential building), as well as utility buildings or structures, the area of each of which does not exceed 50 m2 and which are located on land provided for personal subsidiary, dacha farming, gardening, gardening or individual housing construction - tax rates are applied, in the following amounts:

- garages and parking spaces - 0.1% of the cadastral value of the object of taxation;

- objects of construction in progress if the intended purpose of such objects is a residential building - 0.3% of the cadastral value of the object of taxation;

- objects of taxation, the cadastral value of each of which exceeds 300 million rubles - 2.0% of the cadastral value of the object of taxation;

- other objects - 0.5% of the cadastral value of the object of taxation.

The tax base for individuals, homeowners is determined for each residential property minus the cost of a certain number of square meters, depending on its type.

With this method of calculation, the tax base in some cases may take a negative value, in which case it is recognized as zero.

An example of real estate tax calculation based on cadastral value

Consider the example of calculating the tax on property of individuals.

Let's say citizen A is the owner of a room of 18 square meters. m., the cadastral value of which is 1,000,000 rubles. The cost of 1 sq. m. \u003d 1,000,000 / 18 \u003d 55555.555 rubles.

Taking into account the fact that the tax on a room is calculated with a decrease of 10 sq.m., that is, in rubles it will be 10 * 55555.555 = 555,555.555 rubles.

Taxable base 1,000,000 - 555,555.555 = 444,444.445 rubles.

This is the amount that will be taxed.

If the same room is owned by several people, a deduction of 10 sq. m. is produced once, regardless of the number of owners. But if our citizen A has several rooms in her property, the deduction is made for each room.

Information on the cadastral value of objects of the Federal Tax Service takes in Rosreestr. Accordingly, claims for incorrectly calculated tax must be correlated with the objectively available cadastral value, to which the Federal Tax Service has nothing to do.

The law provides for a smooth transition to the calculation of tax based on the cadastral value within 4 years. Special discounts have been introduced into the formula, designed to reach the resulting full-fledged tax smoothly, over 4 years. Changes were also made to taxable objects, in particular, parking lots and objects of construction in progress, registered in the ownership, were added to them.