Tax on the sale of an apartment received by inheritance

If an apartment is sold that was previously inherited, the citizen is obliged to pay personal income tax at the usual rate of 13%. However, in some cases this is not necessary. A detailed analysis of current legislation, examples of tax calculation - all this can be found in the material below.

From the point of view of legislation, when selling an apartment, the owner receives income, therefore, from this income he is obliged to pay personal income tax (for Russian citizens at a rate of 13%). If the apartment was previously inherited, then the current owner actually receives income in its pure form: he acquired the property as a gift, therefore, when selling, he makes a net profit. The obligation to pay the corresponding tax is provided for by the Tax Code.

However, the same code states that if the owner officially owns his home for 3 years or more, he may not pay the corresponding sales tax.

In this case, 3 situations are possible:

- If the apartment was inherited and registered in ownership before December 31, 2015 inclusive, the owner must own it for 3 years or more. Otherwise sales tax charged on a mandatory basis.

- If the registration of ownership occurred after this date, the minimum period of ownership for exemption from the contribution is 5 years.

- Finally, if the object was inherited from a close relative, the 3-year rule again applies (regardless of the date of death and the date the property was registered in ownership). Relatives include those relatives who are listed in the Family Code.

The countdown of the ownership period does not begin from the moment when the owner registered his right in Rosreestr, but from the day of the official death of the previous owner, which corresponds to the norms of the current civil legislation.

Comment: the day of opening the inheritance is the day of death (according to the data of the death certificate or a court decision on declaring dead). A statement about this can also be found in the Civil Code.

Also, taxpayers should pay attention to the fact that they pay tax only on the transaction amount that exceeds 1 million rubles (TC, article 220).

Also, taxpayers should pay attention to the fact that they pay tax only on the transaction amount that exceeds 1 million rubles (TC, article 220).

Since when receiving housing by inheritance, a citizen does not incur any expenses (unlike buying an apartment), he is not entitled to other types of deduction. Therefore, only 1 million rubles can be taken away from the transaction amount - all other funds are related to the tax base, i.e. It is from them that personal income tax will be withheld.

Expert opinion

Salomatov Sergey

Real Estate Expert

You should not confuse the tax on the sale of an apartment with a notary fee (when registering an inheritance), as well as with a tax on the ownership of an apartment received: these are different concepts. Also, a state duty is separately allocated, which is paid for registration (in Rosreestr upon receipt of a certificate of ownership or an extract from the USRN).

Tax rate and calculation examples

To determine a specific rate, it is important to determine the category of the taxpayer:

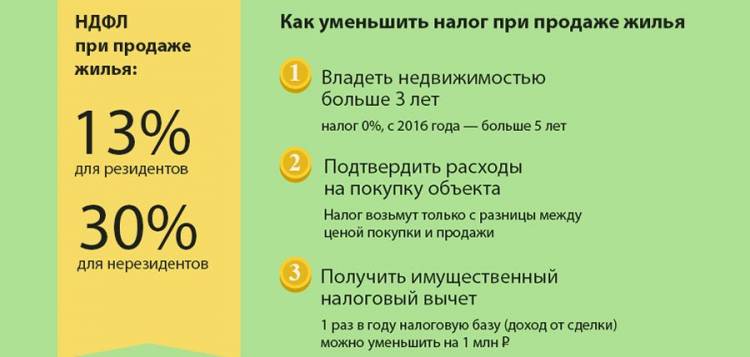

- A citizen of Russia pays a contribution at a rate of 13%. Exactly the same tax amount was approved by the legislation for residents. They are understood as persons who, in the year of the sale of the apartment, lived continuously in the country for more than 183 days.

- Otherwise, the rate will be 30%. Other categories of persons are not subject to any rules on tax deductions or exemption from payment (if a person owns housing for 3 or 5 years).

Thus, in the case of real estate that was received by will, it is possible to reduce the tax only in 2 cases:

- Wait with the transaction from 3 to 5 years.

- Guaranteed to receive a deduction for 1 million rubles, i.e. take into account only the amount that exceeds this value.

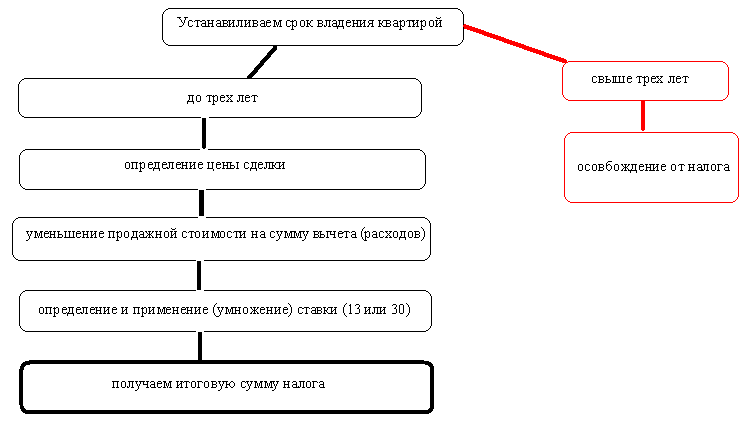

Therefore, in the general case, the scheme for calculating the amount of tax looks like this.

Expert opinion

Kharitonov Andrey

Leading Mortgage Expert

DUE DATE. As a general rule, the declaration must be submitted to the tax authority by April 30 inclusive. And to pay the tax itself - until July 15 of the same year. We are talking about the year following the year of the transaction with the immovable object.

Examples of calculations for citizens and residents of the Russian Federation

In this case, the current legislation is fully observed. A citizen either does not pay tax, or pays it at a rate of 13% (only from the amount that is more than 1 million rubles). Here are some examples of calculations:

A citizen inherits an apartment from his own mother, who was declared dead by the court on April 13, 2016. Officially, the ownership was formalized on December 1 of the same year. In this case, the rule of a minimum tenure of 3 years applies (since we are talking about inheritance from a close relative - the mother). The term begins to be counted from April 13, when the court declared the former owner dead. Therefore, it is possible to sell housing without paying tax from April 13, 2018.

The nephew inherited an apartment from his uncle on January 2, 2016, formalized the ownership on August 1 of the same year. He sells an apartment on April 10, 2018 at a price of 4 million rubles. Then the obligation to pay the tax still occurs, since the receipt of housing by inheritance occurred already in 2016, and the uncle and nephew are not close relatives. The amount for taxation (minus 1 million) is 3 million. Therefore, the nephew must fill out a declaration before April 30, 2019, and pay tax before July 15, 2019 in the amount of 13% * 3 million = 390 thousand rubles.

The heir and testator are not related, the former owner died on December 30, 2015. The new owner took over on July 1, 2016. However, he decided to sell the premises for 10 million rubles on February 1, 2018. Then personal income tax will have to be paid, because the tenure is 3 years expires only on December 30, 2018. Accordingly, the tax is paid from the amount of 9 million rubles (until July 15, 2019). Amount payable 9 million * 13% = 1 million 170 thousand rubles. Thus, in this case, it is advisable to sell the apartment no earlier than the beginning of 2019 - then personal income tax is not paid.

A citizen inherits a share (1 room in an apartment) on January 28, 2017. On November 1 of the same year, he decides to sell it for 900 thousand rubles. In this case, no tax is levied, since 900 thousand is less than the amount of the deduction (1 million rubles).

Expert opinion

Salomatov Sergey

Real Estate Expert

The deduction of 1 million rubles upon sale can be applied an unlimited number of times (for any immovable object). If a citizen buys an apartment, the deduction is applied only once.

Calculation example for non-residents of the Russian Federation

If a person does not belong to the category of citizens of the Russian Federation, and in addition, in the year the apartment was sold, he stayed on the territory (officially) less than 183 days in a row, only 1 rule applies - you must pay 30% of the transaction. For example, an apartment was sold for 5 million rubles on April 10, 2018. Then you need to submit a declaration no later than April 30, 2019, and pay tax no later than July 15, 2019. Its amount will be 30% * 5 million = 1.5 million rubles.

Features of share sale transactions

A share can also be inherited (one, two rooms or just 1/3, 1/2 part of the apartment, etc.). In terms of taxation, the situation looks exactly the same. A citizen must transfer personal income tax in favor of the state only if the object has been owned for less than 3 or less than 5 years. The same rules about the rate, terms of payment, as well as the tax deduction apply.

The only exception is the case when at the same time the shareholder was the deceased. For example, a citizen acquires ½ shares in his father's apartment on September 1, 2015. The father dies on September 1, 2016, the share remaining after him goes to his son in accordance with the requirements of the law (in full). Now the son becomes the full owner of the entire apartment.

In this case, the holding period will be counted from the moment the share was purchased, i.е. from September 1, 2015. Thus, in this case, the rule of a minimum tenure of 3 years applies. It is advisable for a citizen to start selling this object no earlier than September 1, 2018 - then no fees need to be paid.

However, if the sale takes place, for example, on August 1, 2018, it is necessary to pay personal income tax only on the share that was inherited. If, for example, the total amount of the transaction is 3 million rubles, then the tax is paid only on half of this amount, reduced by the deduction of 1 million: 3/2-1 = 0.5 million rubles. As a result, the owner must pay before April 15, 2019 13% of 500 thousand rubles, i.e. 65 000 rubles

How to pay tax: step by step instructions

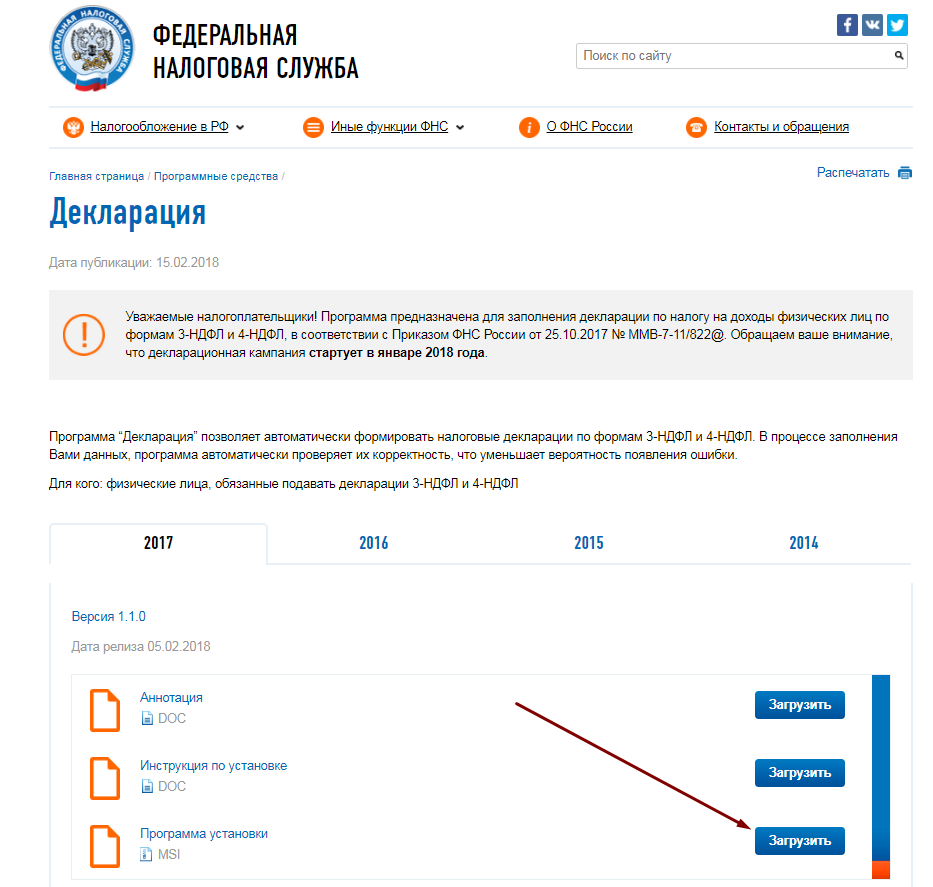

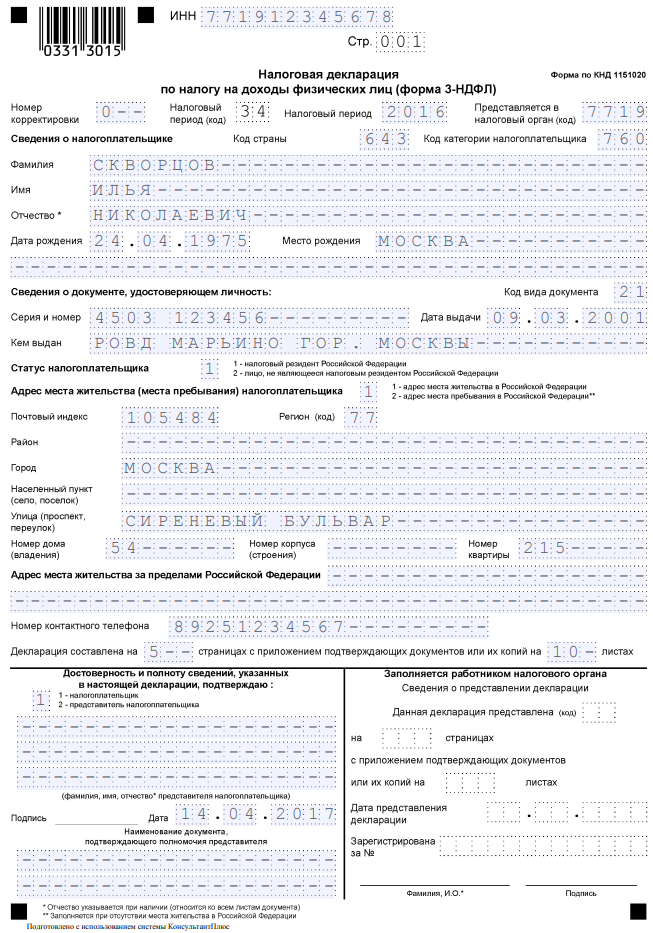

It is assumed that a citizen independently, on his own initiative, discloses his income and voluntarily fills out the appropriate declaration (form 3-NDFL). A blank form can be taken at the local tax office or downloaded from the official website.

Step 1. Filling out the declaration

You can fill out the document both manually and using a special program that is downloaded for free from the official page of the Federal Tax Service.

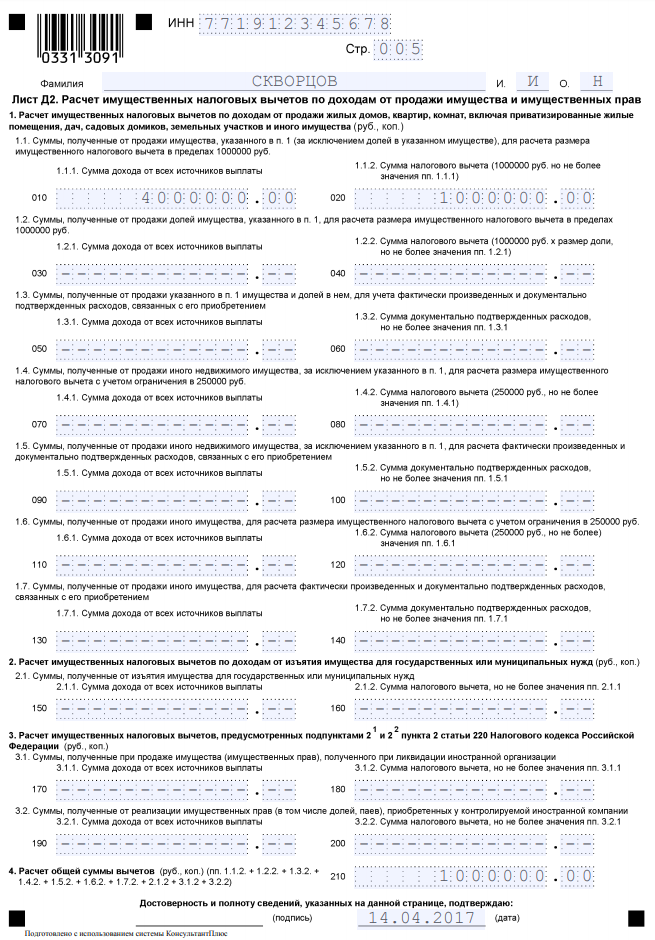

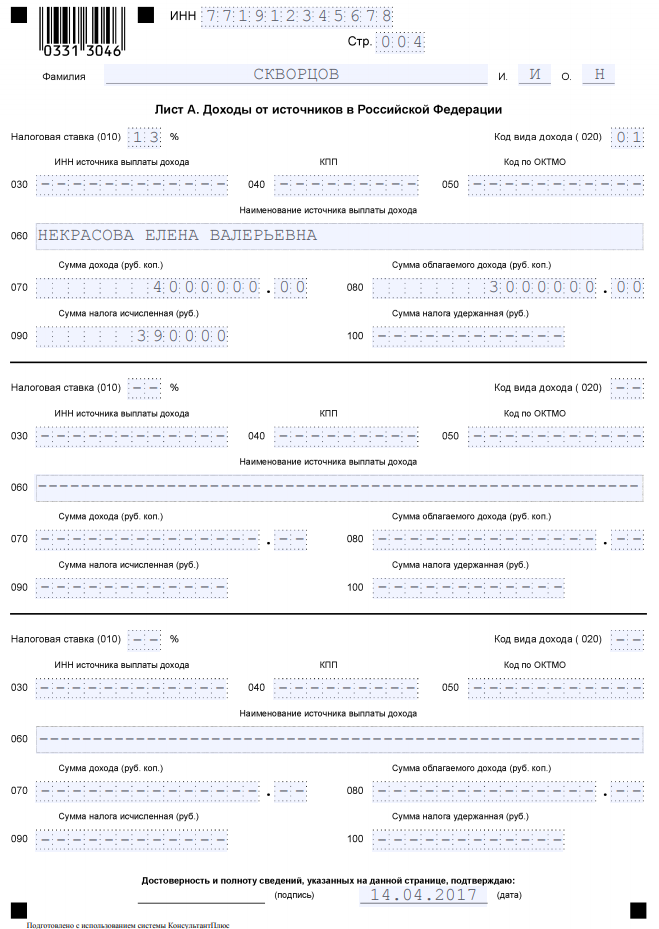

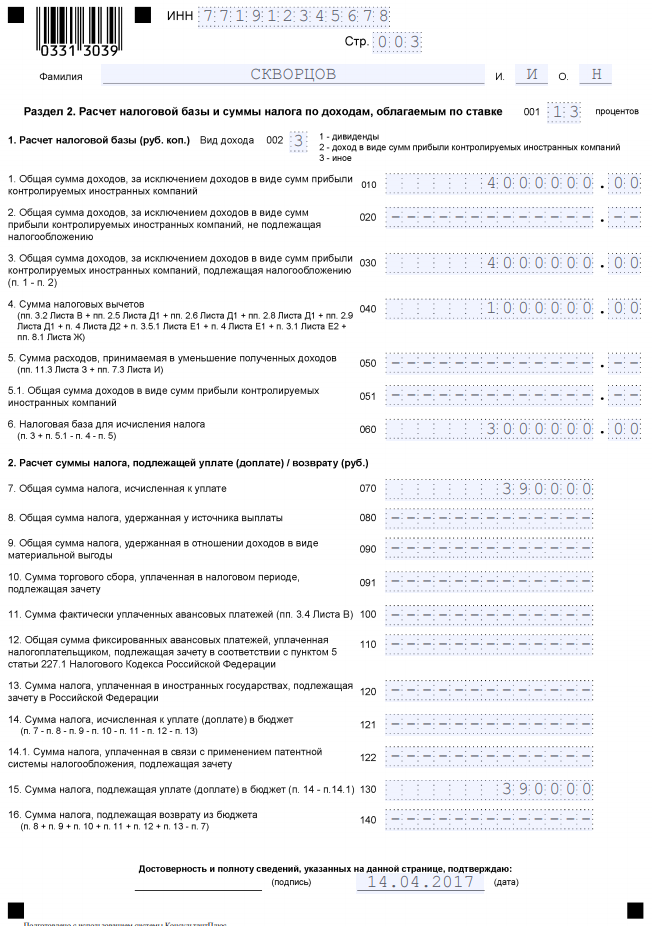

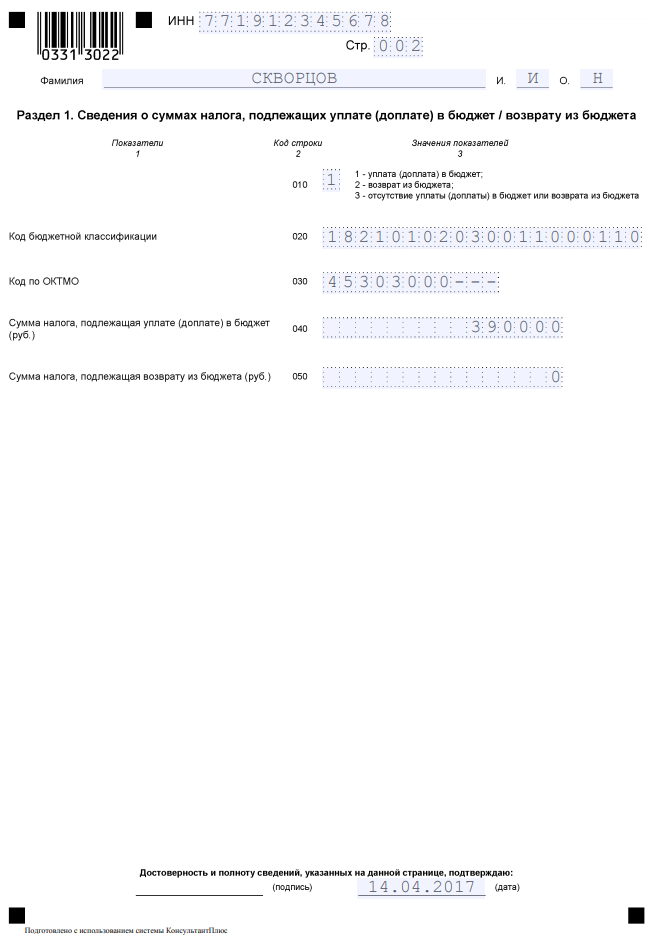

In the declaration, it is necessary to fill in all the fields legibly - sections 1 and 2, as well as sheets A and D2. “01” is written in the field with the income code (since it is assumed that the cost of selling the apartment was determined by agreement between the seller and the buyer).

The fill pattern looks like this.

Video instruction for filling.