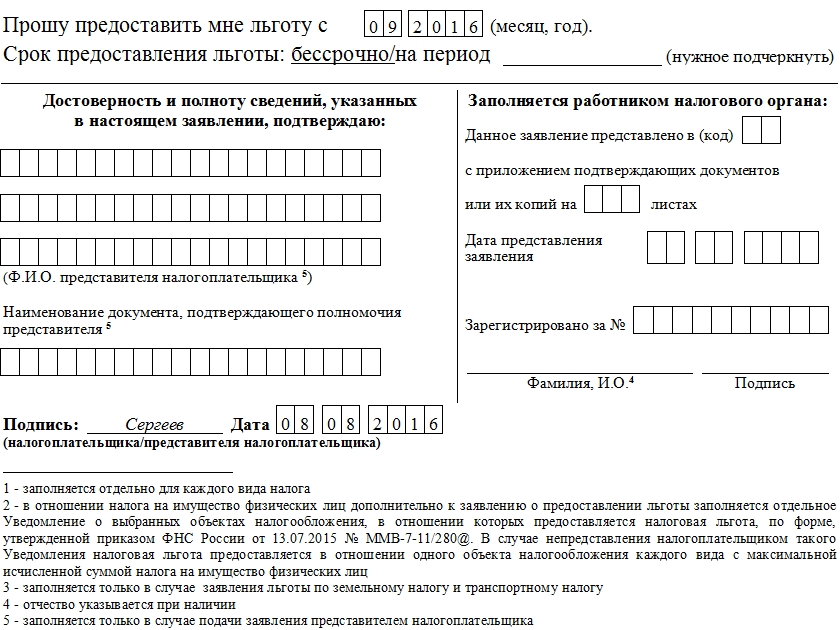

Application for a property tax exemption

Some categories of taxpayers have the right to reduce or completely eliminate the payment of property tax. This type of relief can be granted to both a legal entity and an individual. And if representatives of the first group (legal entities) who have this right may not argue it in any way, since they are clearly indicated in the law by type of activity (with the only condition for the intended use of property), then individuals are required to confirm the right to it documented.

FILES Open these files online 2 files

Important clarification: the tax benefit is not an obligation, but the right of the taxpayer, in other words, in order to be able to pay tax at a lower rate or be completely exempt from it, you need to submit a written declaration of will to the tax authority in the form of a special application.

Who is eligible for property tax relief

The list of persons who have the opportunity to receive benefits for property is quite extensive. This includes military personnel and members of their families, heroes of the USSR and heroes of the Russian Federation, participants in hostilities, disabled people of groups 1 and 2, pensioners and some other categories of citizens. A complete list can be found in the tax code of the Russian Federation.

It should be noted that the property tax applies to local taxes(and there are also federal ones), so sometimes, depending on the region, the list of potential beneficiaries can be significantly adjusted.

For example, in some regions, parents with many children, etc. can use this benefit. Therefore, it will never be superfluous to clarify whether this or that taxpayer in his region of residence is entitled to a property tax exemption.

It must also be remembered that, depending on the territorial affiliation, the tax rates on property.

What properties are eligible for benefits?

The tax can be reduced on the following categories of property:

- houses, apartments, rooms,

- commercial and outbuildings,

- some types of buildings and structures,

- garages and premises (the latter only if they are used for creative purposes, i.e. ateliers, workshops and studios).

At the same time, one should not forget that the exemption can be granted only for one object of each type of real estate from the above. For example, if a citizen owns two apartments and three garages, then he will be able to use the property tax exemption for only one apartment and one garage, and for all other real estate objects he will have to pay the tax in full.

Application for a benefit: rules for registration and address of submission

The document has a unified, officially approved form, which is completely easy to fill out, having a sample in front of your eyes.

The main condition is that the data must be entered in it in block letters, legibly, indicating all the attached documents and the obligatory signature of the applicant.

After it is properly executed and the tax specialist checks it, he will put a mark on the acceptance of the document. From that day on, the application goes for consideration, which also takes place in the manner strictly established by law.

An application for a tax exemption must be submitted to the tax territorial inspectorate to which the potential beneficiary belongs.

How to write an application for a property tax exemption

In this example, we consider applications from a pensioner who wants to take advantage of a property benefit.

If any questions arise during the registration process, you should pay attention to the explanations written in small print and located under the document.

When does the exemption take effect?

As soon as the tax authorities decide that this taxpayer can really use the benefits provided, they come into force. Moreover, if previously a citizen entitled to a tax benefit for some reason did not use it, and at the same time regularly paid property tax, it will be recalculated to him and the overpaid amount will be returned (but not more than three years before applying to tax office with an application for benefits).