How to pay tax when selling a share of an inherited apartment

The inheritance received is not only a material increase to the heir, but also his obligations to maintain, pay taxes, etc. Most often, the heir is concerned about the taxation of real estate. The heir may decide to keep the inherited property for himself or to sell it.

- When the inheritance remains with the heir, then his concern for the budget is . There are no special difficulties: the inspection itself determines the amount and sends a notification and a receipt.

- Property For Sale. When there are several heirs, for example, for an apartment, most often the division of the inheritance is possible only after its sale. And then a lot of questions arise regarding the tax (personal income tax) when selling a hereditary apartment.

The main questions on the taxation of the sale of hereditary property

- The obligation to pay tax arises if the period of ownership of the inherited property does not exceed 3 years(36 months from the date of acquisition of ownership), rather than 5 years, as the sale of non-legacy property acquired after January 1, 2016.

- You can reduce your taxable income by 1 million property deduction. The costs of acquiring this apartment by the previous owner cannot be taken into account, nor can any repair costs or utility bills be taken into account.

- It is impossible to underestimate the value of the inherited apartment being sold. From 01.01.2016, the value of the property specified in the sales contract reconcile with its cadastral value which is very close to the market. If the contract specifies less than 70% of the cadastral value, the tax will be additionally assessed by the tax authority.

- In case of sale of an apartment by several owners under 1 contract, a deduction of 1 million is provided for the entire object, and not for each owner. Those. everyone receives a deduction, but only according to his share (example: 1/2 share means a deduction of 500 thousand rubles, 1/3 share means a deduction of 333.3 thousand rubles).

- If each owner sold his share under a separate sale and purchase agreement, then everyone has the right to receive a property tax deduction in the amount of 1 million rubles.

- There are no benefits for categories of citizens(pensioners, disabled people, minors, etc.) from the sale of inherited residential real estate - no one is exempt from paying tax. Only those who own it for more than 3 years are released.

To determine whether a hereditary apartment is taxed upon sale or not, you need to look only at the period of ownership of the apartment, it is useless to look for advantages in the status of a taxpayer. It is possible to avoid the tax burden by waiting for a three-year period of ownership of an apartment, or to reduce income to zero with deductions or expenses (if size allows).

How is tenure calculated?

- If the heir did not have a share in this housing before, until the death of the testator, then the period of 36 months is calculated from the moment of the death of the testator.

- If the heir inherited a share in housing in which he already had shared ownership. For all interests, the starting date of ownership will be the earliest date on which the interest in that property was acquired.

Example: the heir had ¾ shares in the apartment since 2007. In 2015, he inherited a ¼ share in the same property. I sold everything in 2016. The term of ownership of the entire object at the time of sale is considered equal to 9 years (from 2007 to 2016). Therefore, no declaration is required.

- If the heir is not a tax resident, the three-year rule does not apply. Non-residents must pay tax in any case (regardless of the time of ownership) and at a rate of 30%.

- Which month to count, which not:

- If the date is before the 15th, then the month is not considered,

- If after the 15th, then the month counts.

What is considered a tax, what is a state duty

Some people confuse tax and duty. These are completely different concepts.

- State duty- paid to a notary for issuing a certificate of inheritance, that is, in order to enter and formalize the inheritance.

- Tax- a transaction for the sale of housing that was owned for less than 3 years (5 years) requires the payment of tax to the state budget on the difference between the income from the sale and the deduction / expenses.

How to calculate tax

The tax is determined according to a standard formula, the same as for the taxation of sales of other residential real estate (not hereditary).

Schematically, the procedure for determining the amount of personal income tax is as follows:

Some mistakenly believe that the property deduction is subtracted from the amount of tax due. The deduction of 1 million is deducted from the amount of the contract of sale, and not from the amount of tax.

Example miscalculation: the object was sold for 11 million rubles. The taxpayer first erroneously multiplied the sale price by the rate (11,000,000 X 13% = 1430,000), and then subtracted the deduction (1,430,000 - 1,000,000 = 430,000). The result was 430,000 rubles, although it should be equal to 1.3 million (11,000,000 - 1,000,000 \u003d 10,000,000; 10 million X 13%).

Contract price

Everything is extremely simple here - this is the amount that is indicated in the text of the contract of sale. There are several points that may confuse the taxpayer:

- The discrepancy between the money actually transferred and the official figure in the documents. The taxpayer attaches receipts to the declaration, refer to witnesses who allegedly confirm the real, and not the "paper" order of the calculated figures. But all this is not important, the tax will only accept the text of the sale. And this is confirmed by judicial practice.

- Installment payment. Some transactions provide for a phased payment. Despite this, the price is determined not as a separate payment (first or last), but as a total amount of payments.

For example, the room is served. The parties have determined that payment is made within 1 year in monthly installments of 50,000 rubles. Moreover, the last payment is 75,000 rubles. The transaction price will be equal to 625,000 rubles. (50 thousand X 11 + 75 thousand).

- Purchase and sale with related transactions. Often, a transaction is accompanied by real estate services, the work of appraisers, insurers, etc. In parallel with the contract, so-called fake transactions (auxiliary transactions) are concluded in order for the general transaction to be successful. The amounts paid for these ancillary transactions do not affect the price of the master contract in any way.

For example, the parties agreed on a price of 1,000,000 rubles. To search for residential real estate, check its legal purity, and assist in paperwork, the buyers entered into a service agreement with a real estate company. For the work performed, 100,000 rubles were paid. The price of the sale and purchase transaction will be 1 million rubles, that is, without taking into account the cost of realtors' services.

- Comparison with cadastral value. Today, the market and cadastral values are approximately equal. The Tax Code provides that for donation (for tax purposes) the value of real estate is applied at least 70 percent of the cadastral value, regardless of the value that the parties indicate in the contract. For the sale and purchase of such a strict framework at the legislative level is not established. However, the tax authorities in their control and verification activities apply this principle of 70 percent. Therefore, with a greatly underestimated transaction price, inspectors of the Federal Tax Service can charge additional tax.

Deduction (expenses)

This is the amount by which the transaction price is reduced before taxation.

- 1 million rubles- This is a property deduction, a fixed amount.

- expenses- a variable indicator and depends on the actual and documented costs. The costs are usually not comparable to 1 million, so they are almost never used in practice, see below for more details on why. In exceptional cases, expenses are used if several properties are sold in one year (and the 1 million deduction can only be used for 1 property).

Bid

- 13% is the amount used by Russian citizens.

- 30% are foreigners or non-residents.

As for the 30% rate, it applies to persons who are not tax residents of the Russian Federation, that is, permanently residing in Russia for less than 183 consecutive days in one calendar year. In addition to foreigners, a Russian may not turn out to be a tax resident, who, for example, has housing abroad and mainly lives there. By and large, it is not citizenship that matters, but the period of continuous residence in Russia.

Where is 3-personal income tax filed

Tax reporting must be submitted to the territorial inspectorate for official address of registration of the place of residence of the reporting citizen. This usually coincides with the place of residence of the taxpayer on a permanent basis.

That is, the documents are not handed over:

- nor at the location of the object of sale,

- neither by temporary residence permit (place of stay),

- nor by actual residence (for example, renting housing without a residence permit),

namely, the registration of a citizen.

Annex to the declaration

List of documents submitted to the IFTS:

- Completed declaration;

- Documents for the apartment. If the declarant uses a fixed deduction, then a contract of sale and a financial document on the income received (receipt, bank account statement, etc.) are submitted. However, the payment document is not always drawn up by the parties to the transaction, but is replaced by the seller's inscription on the receipt of money, made either according to the text of the contract or in the act of acceptance and transfer of housing. In this case, it is enough to present the contract and the act of acceptance and transfer.

- If expenses are taken into account, then the application also includes documents on cash expenses for the purchase of an apartment in the property of the seller.

- Declarant's passport;

- Register of documents.

No statements and notifications (as, for example, when receiving a deduction when buying a home) are to be submitted to the IFTS. It is not necessary to submit documents confirming the status of the owner before the transaction, whether the inheritance was by law or by will, this does not affect the sales tax.

Applications are provided in copies, which are certified by the declarant himself with his signature. The inspection worker may require the submission of originals to confirm the authenticity of the copies.

When reporting is sent by mail, copies of contracts and payment documents are notarized.

Deadline for filing a declaration

- A ready-made package of documents should be submitted to the tax office - until 30 April following the year for which the declarant is reporting.

Example: they received money from the sale in 2016, so the declaration with attachments must be submitted before 04/30/2017.

- If the last day of delivery falls on a weekend, then this day is automatically transferred to the first weekday.

Example: for 2016, the last day for the submission of tax returns will be 05/02/2017.

- Premature (early) delivery in the same year as the income is received is not prohibited. If the taxpayer is sure that there will be no other income, deductions and the reporting does not need to be adjusted, then you can submit it in advance.

Reporting methods

There are three ways to submit income tax returns:

- Personally- that is, a citizen comes to the inspection, applies to the appropriate window and passes everything to a specialist who will accept the reporting documentation and provide the appropriate receipt (or sign on a copy of 3-NDFL).

- By mail- the entire package of documents (original 3-NDFL and notarized copies of applications) can be sent to the tax office by registered mail with a valuable inventory and notification. The postal receipt will be confirmation of the fulfillment of the obligation to provide tax reporting.

- Through the Internet- for this you need to have your own electronic signature, registration in the "personal account" on the website of the Federal Tax Service and a computer program downloaded from the website of the tax service (free of charge) for filling out declarations ("Taxpayer of a legal entity"). Further, everything is simple. 3-NDFL is filled out in the program, signed and sent to the subordinate IFTS. The tax office accepts reports (if everything is technically correctly completed) and sends an electronic receipt to the taxpayer in his personal account. If something is wrong, the inspection immediately sends an electronic notification of refusal to accept with recommendations for correcting the shortcomings.

If the heir does not want / cannot deal with the presentation-dispatch issue himself, then this matter can be entrusted to any trustee, arming him with a special notarized power of attorney.

Deadline for tax payment

Tax must be paid not later than 15 July of the year, which follows after the reporting. But if the last day falls on a weekend or holiday, the deadline is extended to the first working day.

For example, income is declared for 2016. The last day of payment may be July 17, 2017, since 07/15/2017 is a Saturday - a day off.

How to pay tax

Personal income tax can only be paid by bank transfer. You can find payment details:

- take a paper form of the receipt in the tax

- get information about details on the website of the Federal Tax Service

- when submitting the declaration personally, as a rule, the inspector issues payment details.

Actual payment can be made:

- by contacting the office of any bank

- remotely, without leaving home, if you have a bank card, using the Internet bank or the payment service on the tax website, a payment document is generated and money is debited to pay off the tax. True, at present, not all banks support this technical possibility. Only about 30 large banks have entered into an agreement with the Federal Tax Service on online transfers.

The tax amount is rounded to the nearest integer (without a penny balance). If the balance is up to 50 kopecks, then it is considered equal to zero, if 50 or more, then the amount is rounded to the nearest ruble.

Payment is allowed both at a time in full and in installments. The main condition is that the last payment (when the total tax amount meets the required amount) is made before July 15/

Consequences of violation of deadlines for filing a declaration and paying taxes

Late reporting

If the personal income tax reporting is submitted late or not submitted at all, then the inspection, having established such a fact, has the right to impose a fine. The amount of the fine varies from 1000 rubles. up to 30 percent of the amount due tax. The specific value of the fine is determined by multiplying 5% of the amount of personal income tax by the number of months that have passed since the filing of a belated declaration or the discovery of a violation by the tax authorities.

Example: the citizen submitted the declaration on September 10, 2016, that is, with a delay of 4 months and 6 days (the delay period is from 05/04/2016 to 09/10/2016). For the remaining 6 days (incomplete month) 5% is also charged (as for a full month), this is in accordance with the law. The amount of personal income tax amounted to 100,000 rubles. As a result, the fine will be equal to 25,000 rubles. (100,000 X 5% X 5).

Non-payment of tax

Responsibility is also provided for non-transfer of money to the budget.

- Moreover, if such a fact is established by the Federal Tax Service and by its decision obliges the violator to make a payment, then the threat and a fine in the amount of 20% of the amount of the tax payment and penalties -1/300 of the refinancing rate of the Central Bank of the Russian Federation (approximately 0.05%) of the total amount for each non-payment day.

- If the taxpayer still pays the tax, but with a delay, then he can only be punished with penalties (calculated for the period of delay).

It can be said that during the period of tightening tax control, the chance of being convicted of tax evasion is very high. And taking into account fines and penalties, the tax debt will be much more expensive than if it is done in good faith and in a timely manner.

In addition, if in this way they get into the field of view of budget guards, then inspectors can conduct not a selective (desk) audit on a separate tax, but a comprehensive (field) audit of all obligations, which promises an unpleasant prospect of detecting any violations of other obligations in the field of taxation.

Undersize

Checking the reporting, the tax authorities may come to the conclusion that the amount of income is underestimated (this happens when the price of the contract is much lower than the market price, that is, less than 70% of the cadastral value of the property sold). This will lead to negative consequences: a tax audit may forcibly assess the amount of tax, fines and penalties for incomplete payment of tax.

How to fill out a declaration

There are two ways to fill:

- manually. Handwritten reporting is yesterday. Some inspectorates even place announcements on their stands stating that documents “by hand” are not accepted, although such a requirement is illegal, since this type of reporting is provided for by order of the Federal Tax Service of Russia.

- through a special computer program, you can download the 3-NDFL program for free from the website of the Federal Tax Service. Surprisingly, it is very easy to work with it, and the result obtained meets all the requirements and can be checked. The main thing is to fill in the required fields without errors.

If for some reason it is not possible to fill out a program declaration, then 3-NDFL is filled out on the form with a blue or black ink pen without corrections. You can download illustrative examples of filling out reports manually from us and.

In order to avoid mistakes when filling out the declaration yourself, if you have a complicated calculation, there are other incomes and deductions, it is better to contact a specialized accounting / legal office. Issue price from 500 to 3000 rubles. depending on the complexity of the case.

Filling out the declaration using the 3-NDFL program

Setting conditions

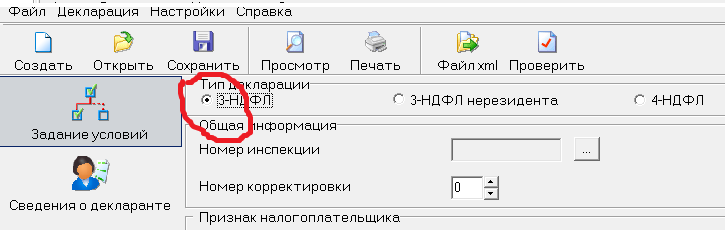

Open the program and in the upper part select the page "Setting conditions", then fill in the sections:

| Section name | Fill option | Graphic image |

| "3-NDFL" |  |

|

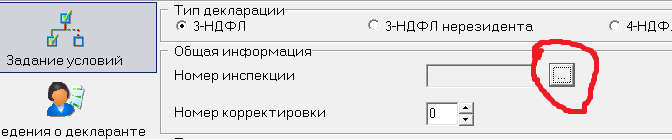

| General information. "Inspection number" | Click on the list button and select your inspection. |  |

| General information "Adjustment number" | If the declaration is submitted for the first time, then the number is “0”, if previously submitted, then the number will correspond to the number of previously submitted 3-personal income tax | |

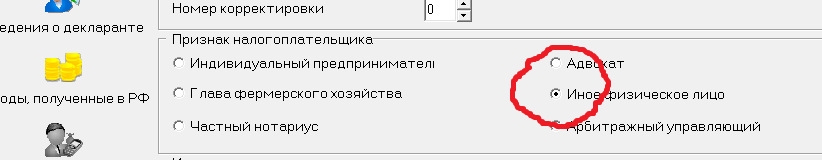

| Sign of the taxpayer | "Other individual" |  |

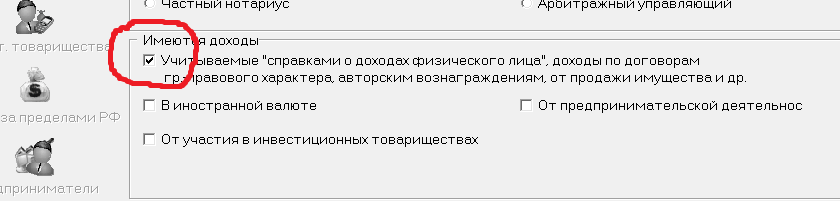

| "Deductible from the sale of property" |  |

|

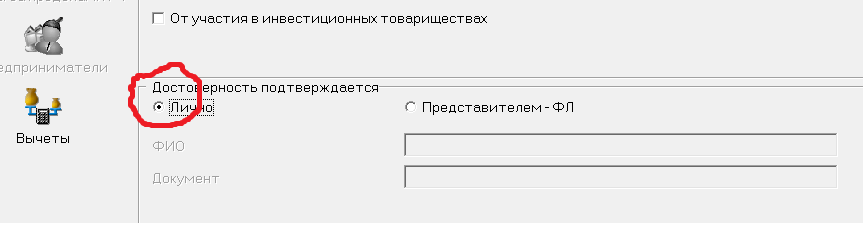

| "Personally". If the declaration is filled out for the child, then it is indicated by "Representative - FL". |  |

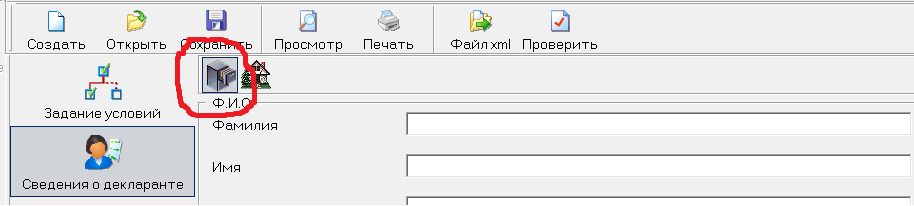

Information about the declarant

- Select the tab "Information about the full name and identity document"

Requisite fields (full name, date, place of birth) are filled in the same way as this information is reflected in the passport.

Requisite fields (full name, date, place of birth) are filled in the same way as this information is reflected in the passport.

TIN is indicated personal (exact combination of numbers), arbitrary data is not allowed. If you do not know your TIN, then you can here.

Code of the country. Russia is selected, its code in the country classifier is 643.

In the "Information about the identity document" section, select a passport, code -21. Passport details are exactly copied from the passport.

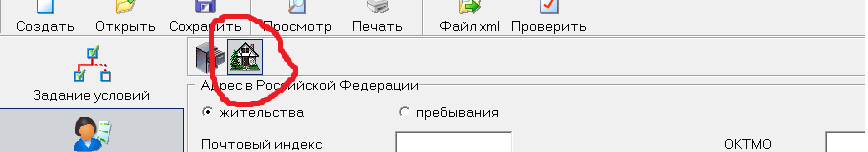

- After that, select the tab "Information about the place of residence"

Depending on the registration (permanent - at the place of residence or temporary - at the place of stay), click the corresponding value.

Depending on the registration (permanent - at the place of residence or temporary - at the place of stay), click the corresponding value.

Making entries in the lines: index, city, district, street, house, phone, etc. does not cause any difficulties.

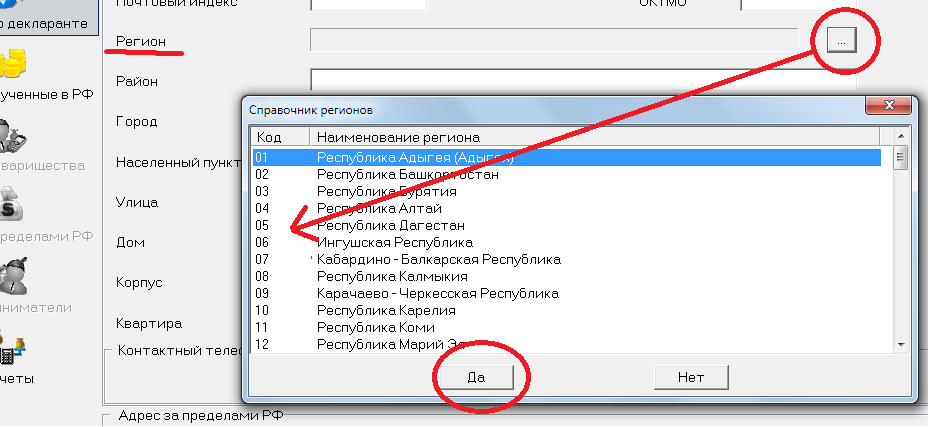

The region code must be selected from the reference window. The OKTMO code of your locality can be found at this link.

Fill in information about income and deduction / expenses

We activate the page "Income received in the Russian Federation".

| Section name | Fill option | Graphic image |

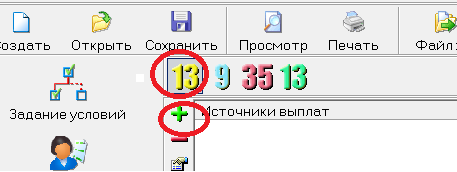

| "Income rate" | We click on the tax rate of 13% (the figure is shown in yellow) and create a form that reflects the source of payments (click on the green plus) |  |

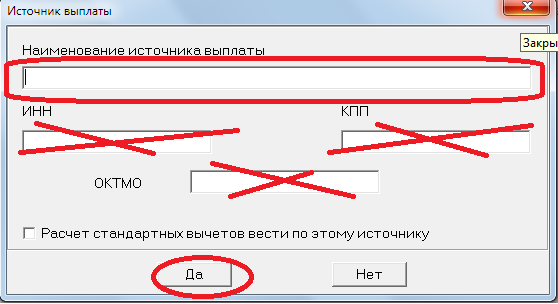

| In the pop-up window, in the top line we write down the full name of the buyer of the apartment. The rest of the lines can be ignored. |  |

|

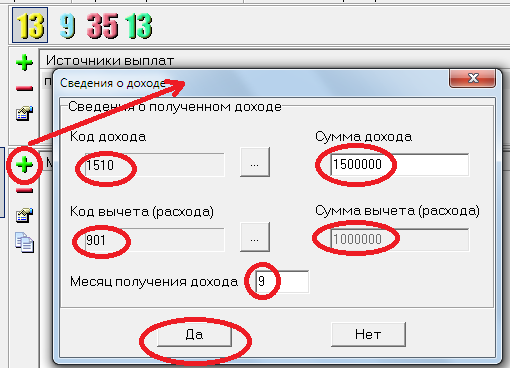

Click on the bottom green plus and fill out the form that appears.

|

|

|

|

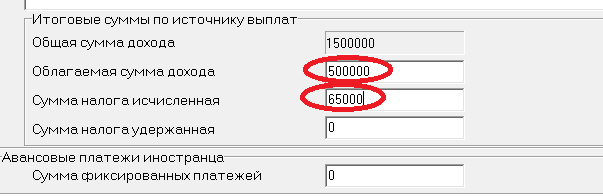

The total amount of income appears automatically. The taxable amount must be paid independently as the difference between income and deduction. The amount of taxation is also calculated independently (the taxable amount is multiplied by 13%). |

|

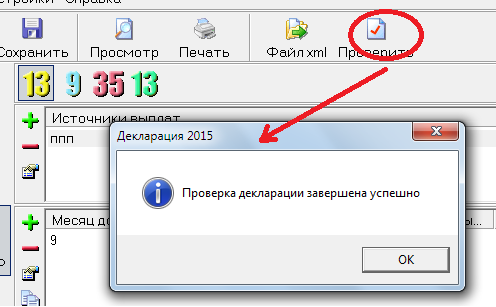

Examination

Seal

Sending for printing. You can print only in one-sided way on a sheet (only on the front side, the reverse side of the sheet is empty).

Why deduction is more often used, but expenses are rarely applied

The goal of a reasonable taxpayer is to reduce the tax. The tax code provides for two legitimate ways of understating proceeds: a deduction or an expense.

Deduction

To exercise the right to a deduction, it is enough to correctly fill out 3-personal income tax, paying attention to the relevant sheets and sections of the declaration:

A declaration made in the above way automatically entails the application of a deduction. Additional actions (sending applications, notifications, letters, etc.) are not required.

The maximum amount is 1 million rubles. This figure is not substantiated by anything, but is applied "blindly", regardless of who sells, what kind of property, when, to whom, and so on.

Example: the selling price was 1.5 million rubles. We get such a result of 500,000 rubles. (1,500,000 - 1,000,000) X 13% \u003d 65,000 rubles.

When the value of the property and the deduction are equal, or the deduction is greater than the value of the apartment sold, then the tax is "0". But if 3 years have not passed - this fact does not exempt from the obligation to file a declaration.

The property deduction has a so-called cumulative distribution property, that is, it is applicable to all residential real estate sold during the tax period (calendar year) in a single amount (1 million rubles).

Example, in 2016, a certain citizen sold 2 apartments, 1 house and 1 cottage, that is, only 4 inherited properties. When calculating the tax base, it is impossible to count on a 4-fold deduction (4 million rubles). The deductible value for all real estate will be equal to 1 million rubles.

Example: A citizen has sold one apartment purchased by him 2 years ago - he can use the cost of its purchase in expenses. And he inherited two apartments and sold them in the same year - for them you can only take into account a property deduction of 1 million rubles.

Expenses

When selling a hereditary apartment, the costs of entering into an inheritance will be quite insignificant, in this regard, it usually makes sense to use them when other expensive real estate objects are also sold in parallel.

The costs of a specific object can only be taken into account in relation to the housing with the acquisition of which they arose, that is, they cannot be transferred to other real estate (its own cost part is applicable to it).

Example: Three apartments sold:

the first for 1 million rubles, hereditary. We apply a deduction in the amount of 1 million rubles,

third for 2.5 million rubles - hereditary, the costs amounted to 100 thousand rubles. (500,000 rubles. The balance from the second cannot be redistributed to the third property).

As a result, personal income tax will be calculated as follows: for the first apartment, 0 rubles. (1 million income minus 1 million deductions), for the second - 0 rubles. (3 million income minus 3 million expenses), for the third - 312,000 rubles. ((2.5 million - 100,000 rubles) X 13%), the total amount is 312 thousand rubles.

Costs that CAN be taken into account

The law states that only direct costs for the acquisition of housing, which are subsequently sold, can be taken into account in expenses. Numerous explanations of the Federal Tax Service of Russia allow us to determine an approximate list of types of expenses:

- state duty and notarial fees paid upon entry into the inheritance;

- the cost of real estate appraisal, as a necessary condition for obtaining a hereditary certificate (if there is no cadastral value, then notaries require a market value appraisal from an independent expert appraiser);

- payments for the preparation of a technical plan and the registration of housing for cadastral registration (if there is no cadastral registration, then without this action it is impossible to register the property as a property);

- fees for state registration in Rosreestr;

- costs of paying for the services of a lawyer / lawyer in inheritance cases (that is, if there were obstacles to recognition of succession and acceptance of property);

- payment for the services of a realtor for the collection, execution and submission of documents for state registration of rights to Rosreestr.

Expenses that CANNOT be taken into account

- index the amount of costs (due to rising inflation, an increase in the minimum wage, an increase in the amount of the consumer basket, exchange rate differences and other references);

- repayment of a mortgage (pledge) or debts of the testator;

- repairs (cosmetic, major, etc.), but if we are talking about equipment and devices necessary for the successful operation of housing (for example, electric machines, a water heater, heating radiators, etc.), then the cost of their purchase may be included in the costs provided that this is indicated in the contract of sale;

- the cost of utility bills, including debts on them, left over from the testator;

- amounts of home insurance against damage, loss, etc.;

- payment of monetary compensations to other heirs and interested persons on account of the waiver of claims to hereditary property.

As in cases with deductions, if the amount of expenses exceeds the sale value of the object, the tax is reduced to zero, that is, there is no minus balance. Accordingly, it is impossible to transfer part of the expense to the next tax year or return part of the money from the budget in favor of the payer.

A special note is made on the choice of expenses in the declaration (without additional statements, notifications, etc.):

How to pay for a minor

If the hereditary apartment / share in it was listed for a minor child, then he is a taxpayer on a general basis. There are no benefits due to young age.

But the teenager himself, up to the age of 18, should not do anything:

- not file a declaration

- nor pay the amount due

- and not even be responsible in case of non-submission / late submission of reporting documents.

All this routine work should be carried out by the responsible parent, guardian, trustee, etc. The legal representative will calculate the amount of personal income tax and draw up reports and submit it to the inspection and transfer funds to the budget.

The declaration is filled out on behalf of the child, and signed by the name of the legal representative.

The letters of the Federal Tax Service stated that it was not necessary to attach a document confirming the status of a parent (guardian, custodian, adoptive parent) to the reporting. But, in our opinion, in order to avoid unwanted reactions from the tax authorities, a copy of such a document will prudently be attached (birth certificate, act on the appointment of a guardian, etc.).

Simultaneous sale and purchase

Often the heirs sell the apartment left by the testator to them, and with the proceeds they immediately acquire more comfortable housing. It turns out that in one calendar year the same taxpayer makes two transactions for the sale and purchase of an apartment.

At the same time, the specified heir is authorized to apply two personal income tax deductions at once (“upon purchase” and “upon sale”).

Example: the heir in 2014 inherited an apartment, which he sold in 2015 for 3.5 rubles. and in the same year he bought another for 3.7 million rubles. Applying deductions, the following result is obtained: from the sold apartment the amount of tax is 325,000 rubles. ((3.5 million rubles - 1 million rubles) X 13%), which is reduced by 260,000 rubles. (2 million rubles X 13%). Accordingly, the amount of 65,000 rubles is subject to payment to the budget. (325,000 - 260,000).

Usually there are problems with the deduction when buying a property, as there are strict applicable conditions for it:

- the amount of the deduction from the purchase amount is not more than 2 million rubles;

- only when buying from non-related parties;

- the taxpayer has not previously used the deduction.

Since the deductions are declared simultaneously in one declaration (submitted the next year after the transactions), the tax authorities will see them in a timely manner, and therefore there will be no confusion.

How to pay tax when selling a share of an inherited apartment

Transactions with shares significantly complicate the life of the taxpayer. Not always, having sold an inherited share in an apartment, it is possible to make a calculation according to the classical algorithm. Consider the features of declaring income in the most common situations.

Sale of a share independently of other co-owners

That is, a transaction in which the shareholder sells only his part of the property is drawn up in a separate agreement. In this case, reporting is formed, just according to a typical model: income taxation is reduced by a deduction of 1 million rubles. or expenses. Thus, each shareholder can use the full deduction of 1 million rubles.

One-time sale (whole) by all co-owners jointly

In this case, there will be one contract of sale and, accordingly, the deduction can be applied in proportion to the size of the share to 1 million rubles. The amount of income (which is subject to taxation) of each shareholder is determined by the parties to the transaction at their joint discretion (this information is reflected in the text of the agreement). You can distribute the sizes as you like, up to the point that one of the sellers (co-owners) will be entitled to “0” rubles, and, accordingly, the entire sale price will go to other (other) equity holders. If distribution by agreement is not made, then it is considered that everyone is due in proportion to the share of the total price of the contract.

Example: the object is being sold by two equity holders with ¾ and ¼ shares. The first owner can apply a deduction in the amount of 750,000 rubles. (1 million X ¾), another shareholder 250,000 rubles.

Different holding periods

An ordinary situation in which the sale of shares in a hereditary apartment by owners with tenure of less than 3 years or more than this period. Difficulties may arise with the deduction. Although everything is very clear here. The first shareholder is exempt from tax in general, and the second has the right to use the deduction in proportion to the size of his share.

Example: three co-owners with shares of 1/5, 2/5 and 2/5. The first one has been holding a share since 1992 (more than 3 years), the others since 2015 (less than 3 years). The apartment is for sale as a whole. The first is exempt from tax on the sale of a share, and the second and third can apply a deduction of 400,000 rubles. (1 million X 2/5).

Deduction or expenses?

Alternatively, income can be reduced by spending. Everything is obvious here: how much was spent (on registration of property), it is possible to reduce the revenue part by that much. Costs are always individual. Proportions and distributive agreements do not apply to them.

Another feature of the one-time sale of shares is that each taxpayer-shareholder has the right to independently decide what he will use (deduction or costs). It will not be a violation if one chooses expenses and the other a fixed deduction. But the latter still has the right to apply a deductible amount proportional to the size of the share in the apartment.

Transactions with multiple shares in residential areas

When in one calendar year more than one share in different real estate objects of one owner is sold, who owns them for less than 3 years, then you should pay attention to the following.

Income is summed up for all transactions by simple arithmetic addition.

Let's say three shares are for sale. Two in apartments: ½ and ¼ each. Plus one in the room, 1/3 in size. In apartments, it is determined that the sale amount of ½ of the part is 750,000 rubles, and for ¼ in another seller-co-owner will receive 500,000 rubles. The room is sold for 900,000 rubles. and there are no conditions on the distribution of income between the selling equity holders, which means that the taxpayer is due 300,000 rubles. (900,000 X 1/3). Thus, from the sale of all parts in real estate, the tax income will be 1,550,000 (750,000 + 500,000 + 300,000) rubles.

Costs can be in any documented amount, in our example, no more than 1,550,000 rubles. True, we recall once again that the costs associated with one property cannot be taken into account (transferred) for another.

Deductions are also subject to summation, but the total amount should not exceed 1 million rubles. It often happens that the proportions of shares to the object as a whole do not allow reaching the maximum deductible limit.

Example: the taxpayer sold four parts belonging to him in 4 apartments (where all residential premises were sold as a whole), as follows: in the first 1/8 share for 500,000 rubles, in the second 1/10 for 450,000 rubles, in the third 1/ 16 for 220 000 rubles. and in the fourth 1/10 for 400,000 rubles. The income will be 1,570,000 rubles, and it can only be reduced by a deduction equal to 387,500 rubles. (from 1/8 share 125,000 rubles (1 million X 1/8) + from 1/10 - 100,000 rubles (1 million X 1/10) + from 1/16 - 62500 rubles (1 million X 1 /16)+ from 1/10 - 100,000 rubles (1 million X 1/8)).

In relation to different real estate objects, both a deduction and expenses can be applied, but on the condition that in relation to each of the objects a simultaneous combination of a property deduction and expenses will not be allowed.

Example: sold two rooms for 1.5 million rubles. each. One of them was previously purchased for 1.4 million rubles, the other was inherited and, for the design of which 30,000 rubles were spent. For the first, expenses in the amount of 1.4 million rubles were applied, for the second - a deduction in the amount of 1 million rubles. This order is correct. But it would be wrong if, in relation to the second apartment, in addition to the deduction, we also add expenses in the amount of 30,000 rubles.

The above are examples of the sale of part (parts) of real estate, which is in common shared ownership.

Let's not disregard the issue of joint ownership (marital shares). Unlike an ordinary apartment (where joint ownership is possible), the hereditary apartment goes into the sole property of the heir. And even if he is married, then the regime of joint property does not arise by virtue of law. This means that there can be no conjugal part, as such. Therefore, all rights and obligations associated with the ownership of real estate relate only to the heir, including the tax burden.

The features of the declaration are as follows.