Formula and procedure for calculating the tax on an apartment

The latest amendments to the legislation, which came into force at the beginning of 2015, have significantly changed the situation with the apartment tax, so it is important to know how to calculate it using the new formulas. About it right now.

Property tax, as usual, is paid by all owners:

- real estate (apartment, plots of land with or without houses, owners of garden plots, agricultural land, etc.);

- movable property (cars and other objects that are officially registered to one or more owners).

The cost of the tax for both an apartment and other real estate can be calculated based on one parameter - its price, from which a certain percentage is paid annually to the municipal budget. Together with the land tax, the property tax serves as its main replenishment.

In the realities of domestic tax legislation, the cost of an apartment is calculated not according to market estimates, but with the help of state expertise. It is from the state price of housing that the apartment tax is calculated. There are 2 types of cost:

- inventory().

- Cadastral.

The differences between them are shown in the table.

| comparison sign | inventory value | cadastral value |

| which takes into account | area of the apartment, year of construction of the house and the presence / absence of a full set of necessary utilities | along with these characteristics, it also takes into account the area of the city, the average market price per square meter, the development of infrastructure near the house, etc. |

| market price ratio | much lower | close to her |

| where can i find out | in the certificate, which must be ordered at the local branch of the BTI | at the local branch of Rosreestr (Cadastral Chamber) and on the website |

The commonality between these indicators is as follows:

- Both characteristics are evaluated during the state examination.

- By law, none of these values should exceed the real (market - that is, currently prevailing in the market of a given settlement) price.

Thus, the inventory value is essentially very close to the cost, while the cadastral valuation is the price of housing as close as possible to the market price. It is from these two indicators that the apartment tax is calculated, and the latest changes in the law have affected just the calculation rules; more on this later.

New rules: what has changed in the legislation

In an unfavorable economic environment, the state began to look for new ways to replenish the budget. One of the additional sources for the municipal treasury will just be an increase in property tax, including an apartment. This increase will take place at the expense of citizens, since an important change has taken place since January 1, 2015: now the tax will be calculated not at the inventory, but at the cadastral value, which is much higher than the first.

These amendments do not enter into legal force immediately throughout the country, but partially - i.e. in different regions at different times. The order of changes is as follows:

- The deadline for the transition is set as January 1, 2020 - from this date, without exception, all owners must calculate the tax and pay it only on the basis of the cadastral value of their housing and other immovable objects.

- The specific transition date is chosen by all regions in different ways, which you need to check on the website or directly with the local tax authorities of the region: perhaps your region, republic or region has already switched to a new calculation system.

- Directly from January 1, 2015, residents of 28 regions of Russia, which are shown in the table, are required to calculate the tax in a new way.

Who has to pay tax

- The owner of an apartment or a share in an apartment (for example, the owner of a room in an apartment) always pays the tax.

- If the owner is a minor, the law places responsibility for payment not on him, but on parents, guardians or other legal representatives.

- Finally, if the apartment is still not privately owned (that is, the citizen lives in the territory under a social tenancy agreement), he does not pay any taxes for it (as well as others living in this territory).

Sometimes payment receipts in the name of a citizen may come by mistake. This may be due to 2 cases:

- The apartment is owned by the state, but the citizen living on social employment still received a notification demanding payment.

- The citizen has already sold the apartment (donated, exchanged) more than a year ago, but the tax still comes.

Obviously, such situations should be immediately clarified. Even if the owner himself is not to blame for anything, but an error has occurred, they can collect tax from him in court and freeze the corresponding amount on a bank account (for example, on a salary card). Subsequently, you will have to go to court, provide evidence that the housing has been sold (or is a municipal apartment).

Then the court issues a new decision, with which the citizen is sent to the tax office and only then to the bank that froze the account by decision of the bailiff. The procedure takes quite a lot of time, so it’s better not to get into such situations: if you receive a dubious tax receipt (for an apartment, land, etc.), you should immediately contact the tax service for clarification.

Tax relief

- The tax is not paid in full on one of the real estate objects owned by the beneficiary.

- If there are many such objects, then the payer himself determines for which property he will not pay the contribution, and for the rest he pays in full.

- If an apartment, land plot, garage, dacha is used by a citizen in entrepreneurial activities, the benefit does not apply to such an object.

In the simplest and at the same time the most common version, the owner owns only one apartment or house for which he does not pay tax. We are talking about the following social categories:

- Old-age pensioners (regardless of their seniority).

- Heroes of the Soviet Union and the Russian Federation.

- Full Cavaliers of the Order of Glory.

- Disabled since childhood, as well as disabled people of groups 1 and 2.

- Liquidators of the consequences of the Chernobyl disaster.

- Exposed to the harmful effects of radiation in connection with the tests in Semipalatinsk.

- Military personnel (active and reserve) who have a total service life of 20 years or more.

- Parents, husbands and wives of servicemen who died in the line of duty.

- Owners of outbuildings (with an area of \u200b\u200bno more than 50 m 2), which are intended exclusively for personal needs (private courtyard, personal household).

Accordingly, if a citizen falls into the category of one of these categories, he personally or through a representative acting by proxy, applies to the local tax office, providing:

- the passport;

- certificate of ownership;

- documents confirming belonging to the listed preferential categories.

NOTE. The listed benefits are established for all regions of the country - i.е. are of a federal nature. Along with them, benefits of a particular region may also apply, which you need to find out about on the website of the municipal administration or at the local tax office.

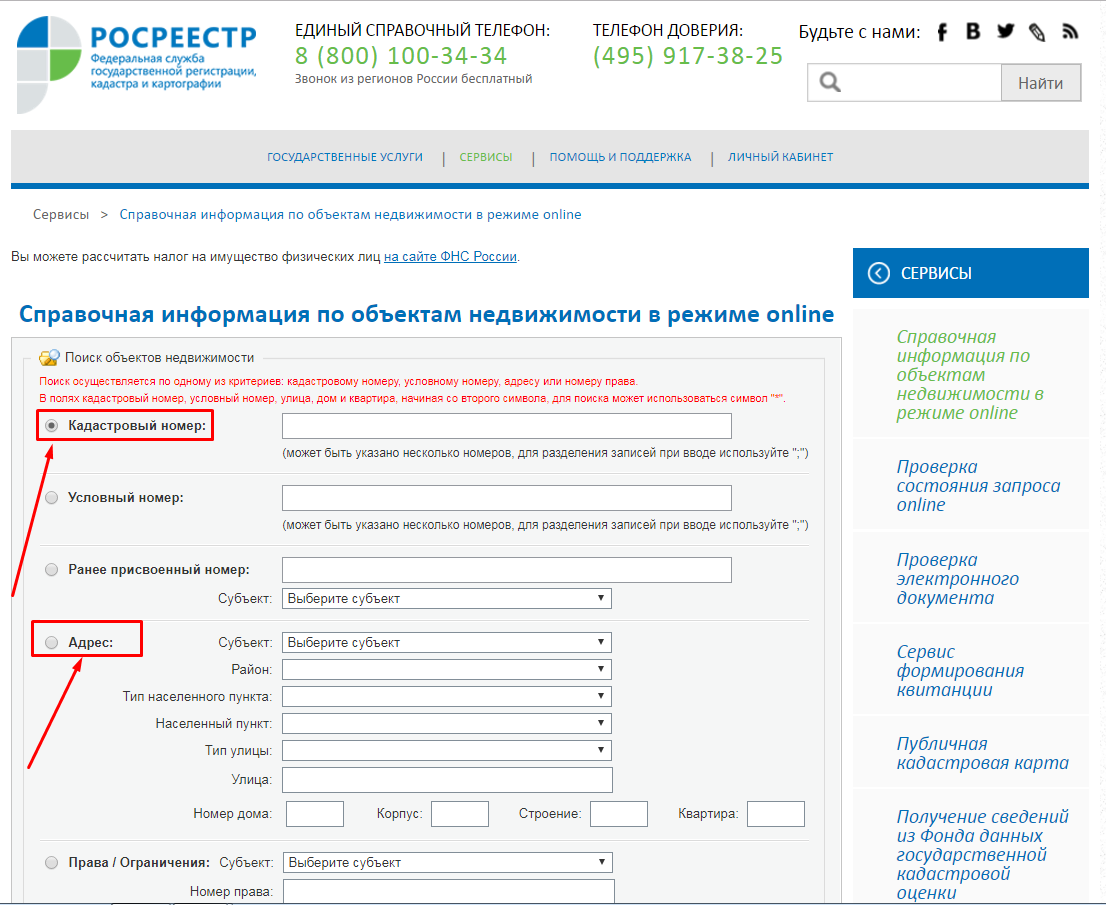

How to find out the cadastral value of an apartment

You can find out the inventory value by contacting the local branch of the BTI and obtaining the appropriate certificate. If the cadastral value is used in the region to determine how to calculate the tax for an apartment, then you can find it out in the course of a personal appeal to Rosreestr or without leaving home - on its official website. You must fill in the fields - either at the address or by the cadastral number (indicated in the cadastral passport of the apartment).

How to calculate tax: step by step instructions and examples

So, when information is received on the cadastral or inventory value of an apartment, you can find out how to calculate the tax on it.

The algorithm is the following:

- Find out from the local tax office exactly how the tax is calculated in your region - according to the inventory or cadastral value.

- Calculate the tax based on the cost of housing.

The formula is simple: the tax base, i.e. the cadastral or inventory value is multiplied by the interest rate.

Thus, in the most common case, it is very simple to calculate such a mandatory payment as an apartment tax: it is 0.1% of its amount estimated by the state (an average of 1000-3000 rubles per year).

- Estimate the payment term. The tax is paid once a year. The deadline for payment is December 1 of the following year.. Those. tax for 2017 must be paid by December 1, 2018. And in the current 2017, you need to pay the tax for 2016 before December 1 (if the owner owned the property in 2016).

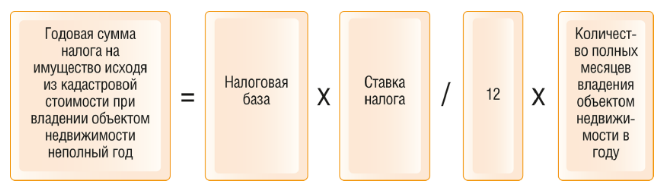

- To find out, for what time you need to pay - meaning tenure time. Those. if the owner owns the apartment for a full year, he pays accordingly for the full year. And if the apartment was bought, for example, in March, payment is made only for the actual number of months according to the formula:

Calculation examples

Here are some simple tax calculation examples.

Example 1. The sole owner of an apartment with a cadastral value of 3,600,000 rubles.

Suppose that a citizen purchased an apartment on September 15, 2015 and continues to own it until today (2017). Then he must pay:

- Until December 1, 2016 for 3 full months of 2015 (October, November and December).

- Until December 1, 2017 - for the full year 2016 (all 12 months).

The tax calculation is defined as 0.1% of 3,600,000 rubles, i.e. per year 3600 rubles. Accordingly, for 1 month the amount will be 3600/12 = 300 rubles, and for 3 months of 2015 he owes the state 3 * 300 = 900 rubles. The total amount payable will be 900 + 3600 = 4500 rubles.

Example 2. Husband and wife own an apartment (ownership shares are equal). The cadastral value is 10,500,000 rubles. Owned since January 28, 2017.

In this case, we are talking about 2 taxpayers who are required to pay taxes of the same amount. However, they don't owe anything in the current year 2017, because the current year is due in the next year. They can be prepared for the fact that before December 1, 2018 they must pay for 11 full months of housing ownership in the current 2017 (provided that they do not sell it, do not give away or change it to another object).

The rate in this case is 0.15%, so the tax will be 10,500,000 * 0.15% = 15,750 rubles per year. We divide the amount by 2 - we get 7875 rubles (for each owner for a full year of ownership). And now we recalculate for the number of full months: 7875/12 = 656.25 rubles. We multiply by 11 months: 656.25 * 11 \u003d 7218.75 rubles - this is the amount each owner must pay before December 1, 2018.

Example 3. A citizen bought an apartment on March 2, 2016, sold it on October 25, 2016. The cadastral value is 2,400,000 rubles.

The owner must pay tax to the state treasury before December 1, 2017 and only for the number of full months of use - in this case from April to September inclusive, i.e. exactly 6 months. The rate applied is 0.1%: 2,400,000 * 0.1% = 2,400 rubles - this is for the year. We recalculate for 6 months, it turns out exactly half - 1200 rubles.