How to find out the tax on an apartment

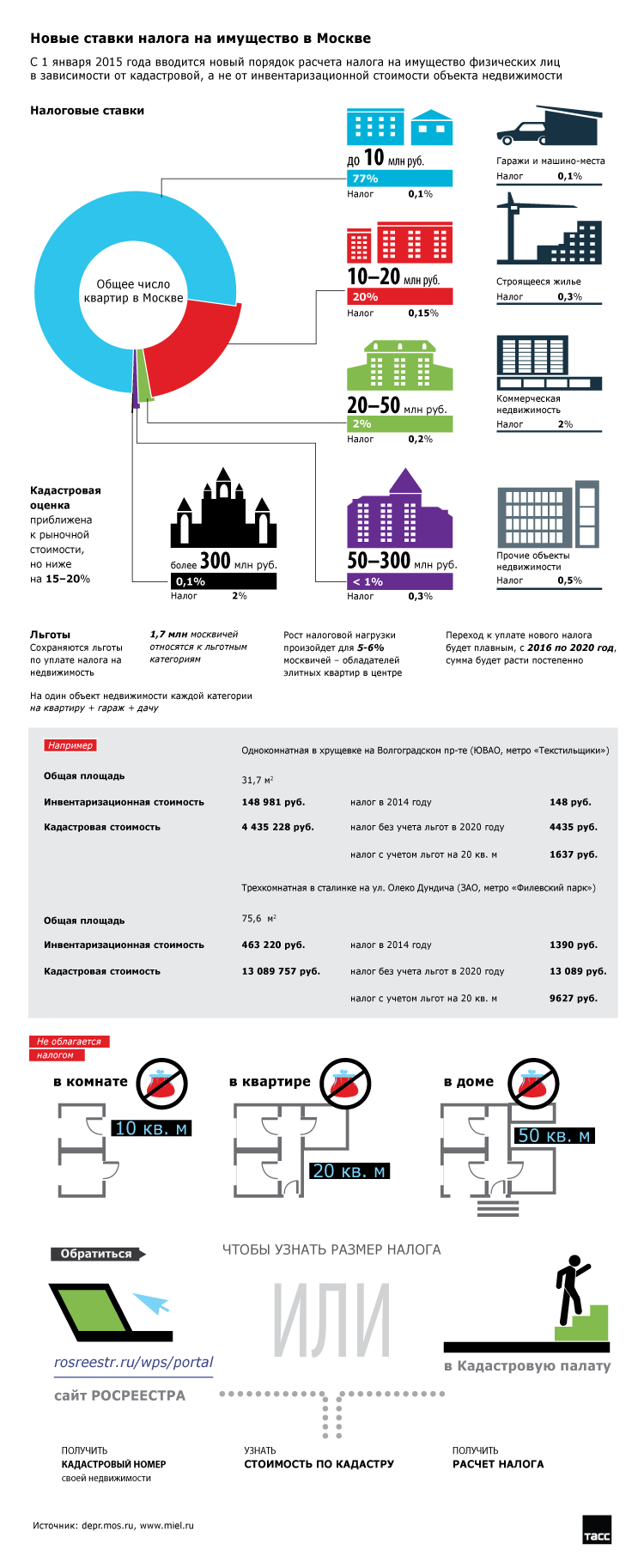

Since January 2015, a law has come into force, on the basis of which the property tax for individuals will be calculated in a new way. The cadastral value of real estate will now be used as the tax base for calculating the tax. Tax notices for paying the tax calculated according to the new requirements will be received by apartment owners in the spring of 2016. The tax must be paid by October 2016.

Page content

The decision to switch to a new system for calculating property tax was made in 28 regions of the Russian Federation. The rest of the regions should make the transition before 2020, having studied the experience of colleagues and setting the size of regional rates. A list of these entities can be found on the FTS website.

A full transition to the new system will be carried out within 5 years, which will be a transitional period. During this period, the calculation of property tax in the Russian Federation can be carried out in two ways: both using the inventory value and using the cadastral value.

Subjects of the Russian Federation that have not made the transition to the new system will charge tax based on the inventory value using a multiplying coefficient (deflator). In 2015, the deflator for calculating property tax is 1.147 (Order No. 685 adopted by the Ministry of Economic Development in 2014).

How to find out the tax on an apartment, calculated according to the new rules, will be discussed in this article.

What objects will be affected by the tax

In connection with the introduction of new rules for calculating property tax, the Tax Code has been supplemented with a whole chapter No. 32, which is called “Individual Property Tax” and determines the procedure for calculating and paying tax.

According to the new requirements of the tax legislation, the following real estate will be subject to taxation:

- a residential building intended for the residence of citizens;

- residential premises, which may include an apartment and a room in a communal apartment, if it is registered as the owner's property;

- garage and parking place, which is a parking space, documented;

- integral property complexes;

- objects, the construction of which is not completed;

- other buildings and structures.

The owners of the listed real estate objects will become tax payers accordingly.

Cadastral value

It is a determining indicator of real estate prices for the state and tax authorities. It is established based on the results of a cadastral valuation carried out on the basis of the Law on Valuation Activities. This price indicator is the main one for:

- tax calculation;

- sale of real estate;

- bail arrangement.

This assessment was carried out by state bodies using the method of mass assessment. The essence of this method was to combine real estate objects into cadastral groups according to similar technical characteristics, as well as factors influencing price formation. Subsequently, these groups were evaluated. This method of valuation, as well as the short time frame in which the valuation was carried out, in some cases led to a low degree of accuracy in determining the price, as a result of which the cadastral price of some objects differs significantly from the market price. This caused a lot of controversy regarding the correctness of its definition.

The cadastral price is a variable value. It may vary depending on market conditions. However, the legislation provides for the possibility of changing it no more than once every three years.

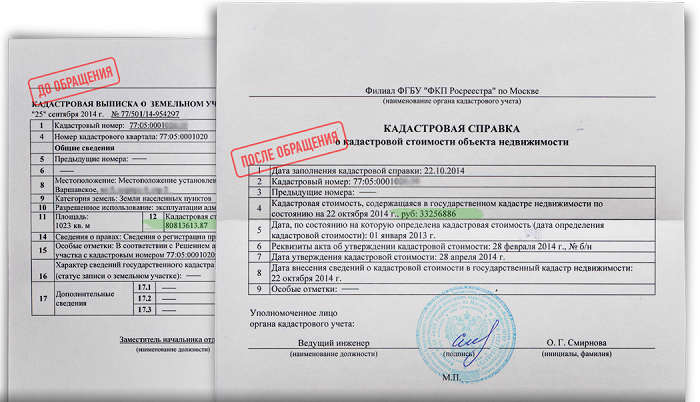

How to find out the cadastral value for tax calculation?

Information about the cadastral value of the apartment is contained in the cadastral passport, which was obtained after 2012. If this information is not in the passport for any reason, or the passport was obtained before 2012, then you can find out the amount of the cadastral value for a particular property by contacting the Rosreestr authorities. This information can also be obtained online by contacting the official website of this organization:

- using a public cadastral map (for this you will need the address of the apartment, its cadastral number or coordinates);

- in the section of electronic services.

In case of disagreement with the size of the cadastral value posted on these sources, the citizen has the right to challenge its size in court. It is also possible to challenge the cadastral value in a pre-trial order, in commissions specially created for this purpose, located under the bodies of Rosreestr.

Beneficiaries of the new tax

The new legislation retained the tax benefits that existed before its entry. But at the same time, they can be provided only in relation to one property of each category. Those tax payers who have several real estate objects belonging to the same category will have to choose which of these objects they will enjoy the benefit. For other objects, the tax will have to be paid in full. If the taxpayer does not make a choice on his own, the decision on which property to provide a benefit for him will be taken by the tax authority.

This is due to the fact that large objects (factories, shopping centers, etc.) are issued to preferential categories of citizens in order to minimize taxation.

- disabled children of childhood and 1.2 groups;

- Chernobyl victims;

- pensioners;

- participants in the hostilities of the USSR and the Second World War;

- military personnel with more than 20 years of experience;

- the family of a serviceman who has lost a breadwinner;

- some other categories of beneficiaries.

Categories of citizens listed in Art. 407 are exempt from paying tax. Documents giving the right to apply the benefits are provided by the citizen to the tax authorities on their own.

When calculating tax, the legislation provides for the possibility of applying tax deduction, by which the tax base can be reduced:

- 10 square meters - for a room in a communal apartment;

- 20 square meters - for an apartment;

- 50 square meters - for the house.

The possibility of applying a tax deduction does not apply to commercial real estate.

Local governments have been given the right to increase the amount of the deduction and establish additional benefits, so the amount of deductions may differ in different regions of the country.

The owner who provides his apartment for rent has a legal opportunity be exempt from paying taxes a kind of tax alternative. To do this, you must register as an individual entrepreneur and acquire a patent. This form of taxation will exempt the entrepreneur from paying tax on real estate, which he uses in his business activities.

3 tier tax rate

The new law also introduced new tax rates.

- 0.1% - this rate will affect the majority of citizens, including owners of apartments, houses, garages, unfinished buildings and outbuildings;

- 0.5% - other buildings and structures;

- 2% - this tax rate will affect only luxury real estate, the value of which exceeds 300 million rubles. Shopping and office centers also fall into this category.

Since the tax refers to local taxes, municipalities and regional authorities are allowed to change the rates of this tax, reducing it to 0% or increasing it from 0.1% to 0.3%.

In 2015, the legislation provides for the application of a reduction factor, which is equal to 0.2. In subsequent years, it will decrease:

- in 2016 it will be equal to 0.4;

- in 2017 - 0.6;

- in 2018 - 0.8.

This coefficient is designed to prevent a sharp jump in tax. The use of a reduction factor allows you to increase the tax gradually, as a result of which it will grow by no more than 20% per year. The application of this coefficient is provided until 2019, after which it will be canceled.

Tax Calculation Examples

As an example, consider a two-room apartment with a total area of 55 square meters. m. Tax, which was previously paid at the inventory cost, amounted to 300 rubles.

The calculation of the apartment tax includes several stages:

- First stage. Clarification of the cadastral value of the apartment.

According to the certificate of Rosreestr, the cadastral value of the apartment is 9,900,000 rubles. We will take this figure as the basis for our calculations. Let's calculate the cost of one square meter of area:

9,900,000 rubles: 55 sq.m = 180,000 rubles

- Second phase. Determining the amount of the tax deduction.

Citizens who own apartments are granted a tax exemption for 20 sq.m of living space, subtracting them from the total area of the apartment.

55 - 20 = 35 sq.m

Taxation will be subject to 35 square meters of the area of the apartment.

- Third stage. Choice of tax rate.

The rate applicable for taxing apartments is 0.1%.

- Fourth stage. Perform tax calculation.

35 km x 180,000 rubles = 6,300,000 rubles

Now let's calculate the tax itself:

6,300,000 rubles x 0.1% = 6,300 rubles.

Thus, a tax in the amount of 6,300 rubles will be payable to the budget.

- Fifth stage. Applying a reduction factor.

During the transition period, in order to avoid a sharp increase in the tax burden on citizens, a special formula will be applied using a reduction factor. The following calculated values are used to apply the formula:

IT - property tax;

NK - tax calculated using the cadastral value;

NI - tax calculated using the inventory value;

K - reduction factor (in 2015 it is 0.2);

The transition formula looks like this:

IN \u003d (NK - NI) x K + NI

Consider the example of the application of the transition formula:

IN \u003d (6,300 rubles - 300 rubles) x 0.2 + 300 rubles \u003d 1,500 rubles.

Property tax in 2015 will be 1500 rubles.

How is the calculation made if the taxpayer owns only a share in real estate

- The area of the apartment that will be subject to taxation (taxable footage) is calculated. To do this, the statutory tax deduction is deducted from the total area of the apartment.

- The cost of one square meter of the area of the apartment is calculated. To do this, the total cost of the apartment according to the cadastre is divided by the footage.

- We calculate the tax base by multiplying the cost of one square meter by the taxable footage.

- We calculate the share of the total cost of the apartment, which will be subject to taxation. To do this, the size of the share belonging to the owner, fixed by title documents, is multiplied by the taxable footage of the entire apartment.

- We calculate the amount of tax.

How do I find out my property tax debt?

Ignoring the requirements of the law is most often associated with ignorance of it. In addition, in some cases, citizens do not receive tax notices about the need to pay tax in a timely manner. Going to the tax office scares taxpayers with long queues and a waste of time.

This delay very often results in fines and litigation, as a result of which the amount of debt increases significantly.

Failure to pay taxes on time will result in:

- accrual of penalties (Article 75 of the Tax Code);

- imposition of a fine of 20% or 40% (Article 122 of the Tax Code);

- debt collection in court;

- recovery of legal costs.

In order to avoid such unpleasant consequences associated with the enforcement of debt collection, it is very important to check its existence in a timely manner and pay tax arrears or appeal against the tax charge if, in your opinion, it was made unreasonably.

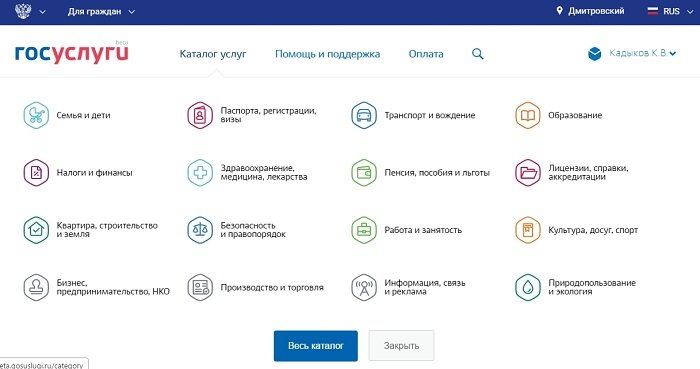

This can be done today quite quickly electronically on the State Services Portal gosuslugi.ru. The Unified Portal of State Services is part of the infrastructure that provides information and technological interaction between information systems of state and municipal services in electronic form.

Responsibility for the accuracy of information on this portal lies with the federal and regional authorities that are involved in its formation. Information is posted on the portal within one working day.

Any Internet user can use the information contained on the Single Portal. To do this, you first need to register. If you are already registered on the portal, you need to go to your personal account. This can be done using a password and your SNILS. By logging into your personal account, you must make an application for information about the amount of tax arrears.

The transition to a new calculation procedure generates a fairly large number of questions. The procedure for calculating the cadastral value also needs to be improved, which often has a significant difference from the market value, which leads to an overestimation of the tax base. From the above examples of calculations, it can be seen that the property tax will increase significantly with the start of the application of the new rules.

This will mainly affect luxury real estate, but for ordinary citizens such an increase may well cause a decrease in the attractiveness of apartments as investment objects. And among the poor, to cause mass relocation to smaller housing, resulting in an increase in demand for small apartments located away from the center.