How to reduce the cadastral value of real estate

When concluding real estate transactions, it is important to have not only all the documents, but also reliable information. You can consult with lawyers or experts of a different kind about all the subtleties. But it is also worthwhile to study all the freely available information on the Rossreestr website yourself in order to understand in which direction you should move and what steps you need to take to solve this or that problem in court or without it. One of these problems can be on a house or building. It is important to know how it is determined and what a reduction in the cadastral value is, if such a situation arises.

Save your time and nerves. and within 5 minutes you will receive free consultation professional lawyer.

What is the cadastral value of a house?

This is the amount for which a particular property is valued by certain appraisers who have been selected by the authorities. And who are independent representatives of Rossreestr. It is the cadastral value of houses and land plots that is the basis for calculating taxes and rental rates. And, accordingly, if the cadastral valuation turns out to be too high, then people will have to pay fabulous money for renting and buying real estate. Since last year, a new tax law has been adopted, which provides for a single calculation for land and an apartment, or for a house and land, but it will be calculated separately and based on the cadastral value. Now there is a trend when the cadastral value is very similar to the market price of the building and much higher than the inventory.

This is the amount for which a particular property is valued by certain appraisers who have been selected by the authorities. And who are independent representatives of Rossreestr. It is the cadastral value of houses and land plots that is the basis for calculating taxes and rental rates. And, accordingly, if the cadastral valuation turns out to be too high, then people will have to pay fabulous money for renting and buying real estate. Since last year, a new tax law has been adopted, which provides for a single calculation for land and an apartment, or for a house and land, but it will be calculated separately and based on the cadastral value. Now there is a trend when the cadastral value is very similar to the market price of the building and much higher than the inventory.

If we talk about land tax, then it is calculated from the cadastral value of the land, and property tax from the inventory and, accordingly, lower.

Many people who own several properties at once in the form of a house or apartment are forced to pay two or even three times more than the prescribed value. Not surprisingly, the practice of filing lawsuits in this regard is growing every year.

The entire cost of a house or land is set by representatives of the Bureau of Technical Inventory. They are chosen on a competitive basis by the authorities of this locality, conclude an agreement with them, and after that they start their work. They choose their own assessment method. After carrying out all the procedures, the documents are sent to self-government or regional bodies, which approve and legitimize them. Thus, in addition to a passport and a certificate, you receive a document about, which is not so easy to challenge, but only if there are grounds provided for by law. And the very essence of this process is to reduce the tax on taxable real estate.

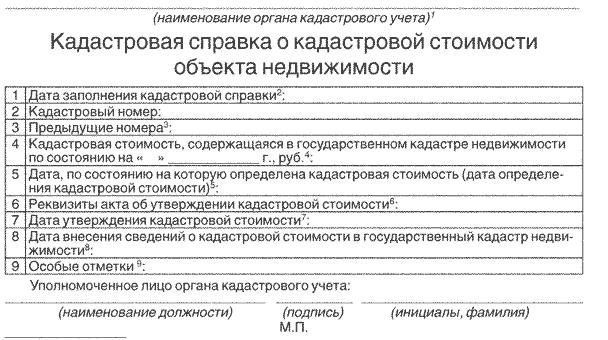

You can also view the cost of an object on the official website of Rossreestr.

To do this, just enter the address you are interested in, and you will receive basic information about the building. If you are the owner, you can get an official document that will be sent to your email or you will receive it personally. But in order to receive it in person, you must visit the cadastral chamber and fill out a number of documents, pay a state fee. All these documents are issued within 5-10 business days.

How is the cadastral value of a building reduced?

This can be done in court or out of court. For this, there is even a separate law “On valuation activities”, as well as a specialized commission from Rossreestr, which will consider this type of disputes about real estate.

The law provides for two cases when the cadastral value can be reviewed and reduced with the help of the court:

- inaccuracy of information about the property;

- unless it was taken into account that the value of real estate could change over the years.

Thus, pre-trial proceedings include filing an application with the cadastral chamber, the creation of a commission by Rosreestr, reviewing the complaint and making a decision. And all this takes no more than six months. If you are not satisfied with the result, then you will have to continue the case and apply to the court. But before you do this, you must soberly assess your chances of winning. Because there is such a practice when the money and efforts you spent may not pay off.

You will have to submit the statement of claim that you issue to the executive authority of the subject of the Russian Federation. It is he who will make the final decision on the cadastral valuation of the house. You must understand that in order to file an application with the court, you, first of all, had to submit it to the relevant commission of Rossreestr, otherwise there will be no grounds for starting a lawsuit.

You will have to submit the statement of claim that you issue to the executive authority of the subject of the Russian Federation. It is he who will make the final decision on the cadastral valuation of the house. You must understand that in order to file an application with the court, you, first of all, had to submit it to the relevant commission of Rossreestr, otherwise there will be no grounds for starting a lawsuit.

The deadlines for submitting such applications are also important. You can do this no later than three months after you found out that the cost is illegal.

And finding an expert who will re-evaluate your home should also be done by you. And it is better to do it in advance. These experts can be any technical specialists or cultural figures who have certain knowledge in this area, but are not state experts or members of the commission. Experts advise choosing those individuals who have already had experience in conducting such examinations, because this will increase your chances in court for a positive verdict.

decrease  The decision of the cadastral value is a very topical issue that worries the majority of the population. The solvency of people is reduced, and the tax is only increasing. Therefore, each of us has to become experts on this issue, or at least try to master the maximum amount of information that Rossreestr provides in order to understand how to act in various situations, and what is the algorithm for solving the problem associated with reducing the cadastral value of a house. To do this, you will have to spend your time, money and effort, but the result is worth it. Do not be afraid or inactive because of the belief in the futility of such enterprises. As practice shows, everything that you will do is supported by the laws of the court. The main thing is to follow all the rules and regulations. And then the result will only please you. And maybe after that you will help someone with the same legal problems.

The decision of the cadastral value is a very topical issue that worries the majority of the population. The solvency of people is reduced, and the tax is only increasing. Therefore, each of us has to become experts on this issue, or at least try to master the maximum amount of information that Rossreestr provides in order to understand how to act in various situations, and what is the algorithm for solving the problem associated with reducing the cadastral value of a house. To do this, you will have to spend your time, money and effort, but the result is worth it. Do not be afraid or inactive because of the belief in the futility of such enterprises. As practice shows, everything that you will do is supported by the laws of the court. The main thing is to follow all the rules and regulations. And then the result will only please you. And maybe after that you will help someone with the same legal problems.

The information in this article is provided for informational purposes only.

We recommend you to our lawyer.