Is it worth buying a ready-made business: real facts. Reasons for selling an existing business Why people sell a business

It would seem that it is impossible to buy an existing business, since no one will get rid of their business, which feeds their family. But there will probably be reasons why they sell ready business, thanks to which the buyer will receive or, at least, promising project with further investments. Such options occasionally appear on the market, but extremely rarely, most of the offers are dummies inflated by the sellers themselves, unable to bring a penny to the owner.

After thinking about the topic, you can easily find a number of reasons for selling a business. As in any other area of commerce, there are cunning sellers and unprofitable goods in this business. And, as you know, even buying potatoes at the market, you can buy a very low-quality product, and this, despite the fact that the seller swore by his mother that the root crop sold was of excellent quality. What can we say about buying a business? For example, about purchasing a small service station?

The buyer will need to carefully check the proposal from the title documents (its legal purity) to the condition of the premises and the service life of the hydraulic lifts. Everything must be in working condition. Assess the situation, visit competitors, perhaps even talk to them about their business. It happens that people are willing to share their experiences and can give good advice.

Negative reasons

Unfortunately, in business trading, the seller has personal goals. Some of them are negative, as a result of which the businessman does not even try to make money, but simply gets rid of his brainchild. The most common reasons are listed and described below.

Fraud

It is not uncommon to stumble upon scammers when purchasing a business. Having bought a workshop for the production of canned fish, it may turn out that the premises that were transferred to the buyer are pledged, and the conveyor and all the equipment belong to completely different people, since they were sold a few days before the buyer concluded the deal.

Such cases are not uncommon, and to avoid them, you should hire an experienced lawyer. But the risk of becoming a victim of fraudsters is high, since even specialists sometimes cannot view sophisticated schemes.

Such cases are not uncommon, and to avoid them, you should hire an experienced lawyer. But the risk of becoming a victim of fraudsters is high, since even specialists sometimes cannot view sophisticated schemes.

Debts

People often resort to selling to pay off debts for a number of reasons. Debt repayment is required as soon as possible, and the company is not able to provide the required amount in a short period of time. In this case, there is a risk of stumbling upon an offer, the material part of which has been seized or is in collateral. This reason today is common cause sales.

Lack of competitiveness of business

Top 8 reasons for selling a company on video:

This reason is very common. It's easy to check profitability. It is enough to delve into the documentation of the enterprise and observe the process of selling products or services. This also includes low demand for manufactured goods or services.

Problems with the law

This can also be easily determined by using the services of an experienced lawyer. Besides legal assistance exists open base, which provides information about legal entities, with which you can find out all the ins and outs regarding the activities of the company and its owner. This service is paid, but can greatly reduce the risks associated with the purchase. When purchasing a ready-made business, you should not miss out on such verification methods, spending little money on their implementation.

These reasons motivate sellers of ready-made businesses and occupy the lion’s share of all options offered on the market, since they rarely abandon a profitable business.

These reasons motivate sellers of ready-made businesses and occupy the lion’s share of all options offered on the market, since they rarely abandon a profitable business.

Neutral reasons

Neutral reasons are not so common among company owners, but they have a right to exist.

Founders' expenses

When production at the beginning of its journey requires investments that entrepreneurs cannot provide for further work. In this case, you need to raise the accounting department of the enterprise and carry out calculations, with the help of which you can determine the costs of carrying out activities and the amount of final profit.

Personal circumstances

The reasons for selling a profitable business are described in the video:

Reasons such as divorce or health problems are less common. By buying a company from a person who has such problems, the likelihood of getting a profitable business increases significantly.

Change of residence

An extremely rare reason, however, one that occurs in life. Usually, when selling his business for this reason, a businessman takes everything that can be taken with him, for example, the remains of products or equipment.

Need for money

This is a common reason, but when faced with such sellers, we can conclude that their business has not reached the level of self-sufficiency.

Creating a business for sale

An excellent example of selling a ready-made business is this. By opening a new catering outlet, an entrepreneur invests in gradual payback. At the same time, the businessman does certain big investment. Having sold the franchise, he receives instant money, plus, regularly his business in someone else’s hands brings in a percentage of the profit, in addition depriving him of the problems associated with organizing and running production.

Another example is the sale of a turnkey business. When a company opens production for considerable money, making money from installing and configuring equipment, as well as training and selling business-related products.

Another example is the sale of a turnkey business. When a company opens production for considerable money, making money from installing and configuring equipment, as well as training and selling business-related products.

Desire to invest in something else

The reason is controversial, but it still exists. Having opened a business and established activities, the founders had the opportunity to expand it, or move in a different direction that would open up new horizons, but there were no funds to implement a new project.

Stress and fatigue

Such a reason will most likely be a signal that the seller is disingenuous and his business is completely unprofitable, since a good business can always be given to a manager or family member, occasionally controlling it, but will not completely get rid of stable profits, especially in these difficult times .

How much does a ready-made business cost?

When selling a business, entrepreneurs will not give away their brainchild for next to nothing, into which they have invested, in addition to money, a lot of time, effort and priceless ideas. An exception may be a sale due to problems with the same business or personal ones, such as debts, fraud, family problems, illness of family members. But no matter how the seller throws out arguments, the buyer is obliged to check everything and make sure of the profitability of the enterprise by plunging into the kindly provided accounting department.

It often happens that an entrepreneur sells his business for fabulous money, however, the cost of the enterprise is estimated much cheaper. The seller will justify his material interest with high profitability or the prospect of large profits.

It often happens that an entrepreneur sells his business for fabulous money, however, the cost of the enterprise is estimated much cheaper. The seller will justify his material interest with high profitability or the prospect of large profits.

Business cleanliness check

When buying an existing business, there is no need to rush. The buyer must start from the understanding of the situation that at any time, and especially in our wolf times, a person will not give up his means of subsistence. And the desire to sell a profitable business should, at a minimum, be alarming. You can verify the profitability of the object for sale.

First of all, it’s enough to just observe. For example, when buying a restaurant, sushi bar or fast food stall, it is enough to visit the outlet several times catering. Check the establishment in the morning, at lunchtime, when clients come for a business lunch, and, of course, in the evening, when the establishments are filled with the most people. Naturally, such trips should be divided into several days. During the work week you can come in the morning and at lunchtime. In the evening - definitely on Saturday. This will be enough to assess the profitability of the business, as well as the honesty of the seller.

If you are satisfied with the picture of the visit, you can move on to next stage– verification of a legal entity. This procedure can be carried out upon application to the tax authority or using a service that can be officially purchased on the tax authority’s website. When purchasing a ready-made business, you should not neglect the services of legal specialists, the opinion of an independent expert and an accountant. By collecting analytical data from different sources, you can make a balanced and deliberate decision, which will certainly be correct.

If you are satisfied with the picture of the visit, you can move on to next stage– verification of a legal entity. This procedure can be carried out upon application to the tax authority or using a service that can be officially purchased on the tax authority’s website. When purchasing a ready-made business, you should not neglect the services of legal specialists, the opinion of an independent expert and an accountant. By collecting analytical data from different sources, you can make a balanced and deliberate decision, which will certainly be correct.

How to sell a business quickly and profitably

There are several simple rules to quickly sell your own business.

Firstly, when demonstrating a business to a potential buyer, you need to choose the best time, when, for example, an influx of visitors begins at a public catering point, or during the issuance of an order, if the business represents some kind of production. If things are extremely bad, then the company should be shown during non-working hours, when the buyer does not see a complete lack of demand.

Secondly, when demonstrating documentation that the buyer may ask for as evidence of high profitability. Despite the seller’s numerous eloquent promises, the entrepreneur has the right to familiarize himself with documents confirming high income. To do this, you need to collect information on the most profitable transactions or sales days.

Secondly, when demonstrating documentation that the buyer may ask for as evidence of high profitability. Despite the seller’s numerous eloquent promises, the entrepreneur has the right to familiarize himself with documents confirming high income. To do this, you need to collect information on the most profitable transactions or sales days.

Starting a business from scratch - an alternative

This has its pros and cons. When starting a business, an entrepreneur will have to:

This is just a part of the long list of problems that an entrepreneur will face in the process of starting his own business. But by creating a business on his own, he deprives himself of many risks. And if organizational issues can be dealt with, then acquiring an unprofitable business will not cause problems for the buyer.

The most serious risk a businessman may face when purchasing an existing business is becoming a victim of a fraudulent scheme in which the purchased business not only will not bring dividends, but may not even belong to him at all.

You can also become the happy owner of an unprofitable business, in which you will have to invest certain amounts in order to promote it. Against the backdrop of such problems, starting a business from scratch, even without experience, does not seem like an overwhelming task.

You can buy a ready-made profitable business, however, you should approach this issue as seriously as possible, using all methods to evaluate the object being sold. Perhaps in most cases, it is better to think about your business from the ground up.

Write your question in the form below

Why are they selling a ready-made business in Moscow, reasons for the sale

Having analyzed possible reasons selling a business, you can understand how profitable this deal will be. The sale of a business is not always accompanied by fraudulent activities. Sometimes there is a really good reason.

No reason to worry:

A business can be sold for personal reasons. Sometimes there is simply not enough time for its development. Perhaps the owner is going to move to another city or wants to try himself in a completely new field.

Sometimes part of the business is sold because one of the partners cannot continue to operate together. For example, if spouses who jointly own a company divorce, most likely someone will decide to retire and sell their share.

If the reason for selling a business is personal, we can assume that things are really going well, and the company, with skillful management, will remain afloat.

A business can also be sold for commercial reasons. A certain category of people organizes a business with the aim of resell it later. However, in this case the price may be too high.

Hidden reasons

The business owner may not give any real reasons for selling his business. Sometimes hidden reasons can lead to the collapse of a company in a few months.

These reasons include:

- company debts;

- financial difficulties;

- bad business reputation;

- non-renewed contracts with strategic partners.

Sometimes owners can commit a crime and forge client base, show falsified financial statements, simulate a large number of orders, which means vigorous activity.

A conversation with company employees will allow you to get an idea of the company’s affairs even before signing the contract.

Regardless of what reason for the sale of the business was announced, the company must be checked before signing the contract. It is necessary to clarify the presence of receivables and tax debts, judicial considerations. Sometimes, when there is a change in management, many experienced employees leave their previous place of work.

It makes sense to assess the company’s prospects in the market and analyze the activities of competitors.

Do I need to buy a ready-made company?

To answer this question, you need to determine the purpose of the purchase.

Aspiring entrepreneurs may consider purchasing a franchise. In this case, the company will have the opportunity to quickly respond to changes in the market. In addition, franchise companies have strong legal support.

For experienced entrepreneurs, purchasing a ready-made business is an opportunity to quickly earn income by promoting the organization on the market.

When using article materials, a direct, active link visible to search engines is required! Business Trade

There are two opposing camps on the topic of buying an existing business. The first unites those who believe that buying a ready-made business is pure fraud. Nobody will sell what makes a profit. The second includes everyone who believes that a ready-made business is the best way to start their own business. Both camps are right in their own way. Not every ready-made business is honest, but not every one is a scam. Let's look into these subtleties.

So far, unfortunately, the prevailing opinion among most people is that there is quite a lot of fraud in this area. But, if every ready-made business sold on the market was a fraud, then trust in such transactions would have been lost long ago. However, this did not happen. And we know examples of successful purchases of ready-made businesses. In this specific market, there are exactly as many unscrupulous sellers as there are in any other area of sales.

So where does the preconception about total deception in this area come from? The product itself - a ready-made business - is quite unique with characteristic features and difficulties. Buying it is akin to purchasing an expensive used car. But in the latter case, the technical condition can be at least somehow reliably and qualitatively assessed. And when buying an existing business, it is very difficult to do this without having the necessary knowledge and experience.

So it turns out that by buying a business “without looking”, the new owner will soon be faced with the specifics of running it. And being unprepared for this, he loses the vector of development, making fatal mistakes, quickly moving towards unprofitability. This is where the subjective opinion arises that buying a ready-made business is obviously an unprofitable enterprise. We should not forget the folk wisdom in this matter - money loves silence. Those who quickly achieve certain successes in the purchased business most often remain silent about it, so as not to breed competition. But buyers who fail will definitely tell everyone how disgusting this purchase of a ready-made business is. Keeping silent about your own “merits” on the way to the imminent failure of the chosen ready-made business.

Therefore, in order to avoid failure in choosing, let’s consider the classification of a ready-made business in terms of the reasons for its sale.

Good types and reasons why ready-made businesses are sold

As a rule, when selling a modern ready-made business, there are a combination of several reasons and their various options. Based on this, we can identify several characteristic features of the sale of a business, as well as identify the main types and directions of such proposals.

Seasonal ready business

The main activity in this direction is the creation of a business for subsequent sale. A business is not created to receive direct profit from the company's activities. It may not exist. The main money for an entrepreneur will come from the successful implementation of his business.

Most often, such a business is created by experienced people, most likely having their own established business in the same field. In this way, they try to “monetize” their own experience and knowledge by quickly creating and promoting a new business. With its subsequent sale.

Mostly popular in this niche are enterprises with clearly visible profitability depending on the time of year or a specific event. Moreover, the business itself does not have to be seasonal. This characteristic, where there is excess profitability in a limited period of time, is perfectly used in various schemes for the sale of a ready-made business.

For example, the most prominent representative of this approach is hotel business- from traditional hotels to hostels and other similar establishments. An entrepreneur who knows about the nuances of such a business opens his hotel before the influx of clients - in early to mid-spring. Over the summer, with proper promotion (the entrepreneur is experienced in this matter): the hotel gains positive reviews from guests; begins to be heard; returns money invested in promotion and opening; positive financial indicators, including those supported by documents; staff is developing; and so on. As a result, after six months or a year we see a business with good performance, reviews and profitability. The entrepreneur receives a “high-quality” ready-made business, which he will put up for sale. In the future, as in any business, such an enterprise will face problems, such as the dilapidation of the number of rooms, the development of competition, and staff turnover. But for now this is a ready-made hotel with good performance, and all the problems will fall on the shoulders of the new owner.

The first signs of such proposals are quite obvious. A hotel sold as a ready-made business has a short lifespan, usually not exceeding a year. The sale takes place immediately after the profitable season - late autumn, early winter. All rental agreements, services utilities and the like, have short terms. Of course, the above are not reliable signs that the business was created specifically for sale, but it’s worth thinking about these points.

Ready-made business on hype

In addition to seasonal types of business, they are popular in the field of selling ready-made businesses. business trends. Popular topics or hype will always be a source target audience. Therefore, many entrepreneurs involved in creating and selling ready-made businesses take into account current business trends. Moreover, the popularity that arises in this area allows us to “turn a blind eye” to many of the shortcomings of the company being sold. For example, such as that a hype business usually follows the path of cloning, without any serious indicators.

The latest bright waves in this area of ready-made business sales include the following:

- Coffee shops. Such establishments owe their popularity to one international famous network coffee shops It was her popularity that pushed entrepreneurs. Coffee shops of various formats began to open throughout the cities - from small islands to shopping centers to large establishments. The peak of popularity passed quite quickly, demand is fully satisfied by current offers.

- Online stores. Especially online stores selling high-margin goods. The business is quite popular because the initial investment is minimal. No need to open yours point of sale, no office needed. You don't even need a warehouse. We know an example where one entrepreneur found a good supplier, designed his price list in the form of an online store, adding his own markup to the wholesale price. That's all. Every day, purchasing orders from the supplier, the entrepreneur sent them to the customers’ addresses. Quick money - good advertising ready business.

- Popular goods and services stores. Almost the same as online stores. It’s just that a physical point of sale can be sold at a higher price than a virtual one. They sell the most popular products, popular now. We all remember them. Spinner shop, hoverboard shop. And before that, stores of consoles and console games, computer stores. In addition, all kinds of goods advertised in television stores - from unique pillows to original dishes and zirconium.

- Blockchain. They tried to bring everything under cryptocurrency, sometimes without understanding all the mechanisms of action. Even now, blockchain is selling well as a ready-made business. In the form of ICO of various projects.

When addressing business trends, you should understand important point. While the trend is being heard, offers of ready-made businesses appear in it like an avalanche. And this means only one thing - competition. She will be serious. Most entrepreneurs who start a business based on business trends quickly sell their businesses. Unable to withstand falling demand, changing trends and competition. Their offers can be found on any bulletin board. Ready business cheap. And as a rule, only those who start selling a ready-made business on time make money in this area.

A good ready-made business where there is regular demand

Of particular note is the sale of a ready-made business in area of regular demand. That is, in areas where there is a constant need for goods and services. First of all, ready-made businesses here are most often sold as franchises. But you can also find individual proposals.

The types of businesses sold in this category differ stable income. True, it will be small. This category can include various stores with general goods (from grocery to household goods); workshops providing services to the population (key making, shoe repair, sewing workshops, telephone repair, etc.); auto repair shops and car washes; private kindergartens; hairdressing and beauty salons.

The main criterion for choosing a business from a given niche can be called attentiveness. Since in a business with regular demand, there are offers where the organization of processes is very poor. That is, the buyer, instead of developing the business, will be concerned about eliminating all the jambs and errors.

Among all the offers for selling a ready-made business created specifically for implementation, there are certainly good options. Especially created by professionals with knowledge of the matter. So it's best to look away seasonal business. A business on hype, if you invest in a recession, will not bring profit. You can create a business with regular demand from scratch yourself, it will be much cheaper. But it is seasonal enterprises, where the foundation of business processes has been established, subject to constant development, that are easiest to turn into a highly profitable type of business.

Illiquid business as ready

This is precisely the moment when the sale of illiquid assets is disguised as the sale of a business. Simply put, it’s a deception of the future owner. The most common form of sale.

It is formed for various reasons. For example, a business owner, unable to cope with the circumstances, constantly goes into the red, or works on self-sufficiency without profit. Such a business can either be closed or sold. Some choose the second path. And before implementing it, they increase business indicators.

All actions when selling such a business are aimed at inflating the price. Everything comes into play. Linden financial statements with the words that they are real, and those that are “real” are just so as not to pay a lot of taxes. Cosmetic repairs that hide, for example, traces of a faulty sewer system or a leaking roof. An audience can be “attracted” to the store during a buyer’s visit, creating excitement and the appearance of purchases. And much more that requires additional verification.

In any sale, there are conscientious people, and there are scammers. Therefore, before purchasing a business, you should study all the nuances and factors associated with the purchased enterprise.

How to check a purchased ready-made business

Before you begin a serious audit of the business you are buying, you can check it yourself. There may be no need for further verification.

The seller of the business can be verified using special programs verification of counterparties. There are both paid and free (limited functionality) versions. You need to check everything - from registration individual entrepreneur to the founder of the legal entity. Because a license and lease can be issued to a legal entity, and everything else can be issued to an individual entrepreneur. To minimize costs and taxes. In addition, you can see the entire financial history of the institutions, persons and enterprises affiliated with the seller, reviews about the company and other useful information. Don't forget to check for court cases and property seizures.

In addition to legal information, it is necessary to check financial indicators. These could be extracts from 1C or CRM. A conscientious seller will not refuse to show them to the buyer.

For a small business, premises are of particular importance, especially if it is a catering outlet. As a rule, it is rented from a business. Before buying, you should get to know the lessor better, find out everything about the seller - terms and arrears of rent, property and equipment owned, and inseparable improvements (air conditioners, windows, doors, etc.) on the lessor’s balance sheet, the presence of various claims. In addition, you should ask for a letter of guarantee from the landlord stating that he will enter into a lease agreement with the new owner. And preferably under the same conditions.

Often additional assets are transferred with a ready-made business - a website (hosting and domain name), accounts in social networks, statistics counters and the like. They should be checked for the ability to quickly change data - logins, passwords, etc. There are situations when a site is transferred with a ready-made business, which turns out to belong to the developers, but this becomes clear much later. And the business, in case of disagreement, may be left without a website.

So, having found out all this, you can begin a detailed study of purchasing an existing business. By attracting specialists and brokers. After all, no one wants to be left in the cold, especially without money!

The history of active development of private entrepreneurship in Russia goes back no more than 15 years. During this time in the country, for a significant part of society, the main source of income became profit (entrepreneurial income) from own business. Naturally, many entrepreneurs, starting with “ clean slate", changed their activity profile several times due to changes in legislation, market conditions, and the emergence of new areas of capital investment. Companies that had outlived their usefulness most often were simply “abandoned” or transferred to friends and only occasionally were closed through liquidation procedures.

About 6 years ago, the beginnings of a civilized buying and selling market appeared in Russia. operating enterprises, not associated with the alienation of a block of shares (interests), often in a hostile manner, and bankruptcy. Having gone through the formation process, the market for ready-made businesses is acquiring more and more distinct features and strives for the standards developed by developed countries over many years.

For owners of small companies, there are several ways to exit the business: - closing the company with the sale of assets at liquidation value; - transfer to hired management; - sale of the company as an existing business.

Selling an existing business is the most correct decision for owners of successful companies. The sale allows you to get not only a fair price for existing assets, but also a premium for an existing business, which can exceed the value of the assets many times over. In addition, the business founded by the previous owner takes on a new life, since the buyer who offered the maximum price almost always acts as a successor and strives for the development and growth of the company. In most cases, the proceeds from the sale of a business are invested in the development of new businesses, contributing to the economic growth of the country and further development market purchase and sale operating enterprises.

In order to understand which companies will be discussed in the future, it is necessary to define the very concept of “small and medium business" It so happens that there is no legally established definition of what “small business” is in Russia. The concept of a small enterprise exists in tax legislation and is intended to enable very small companies to use a simplified taxation system. In the 90s there was a gradation in the number of personnel, currently at simplified system Enterprises with an annual turnover of no more than 15 million rubles have the right to taxation. There are also federal and regional support programs for small businesses, but the criteria for defining exactly “small” businesses are not clearly stated.

Based on our existing experience of working with small and medium-sized business owners, we can propose our own gradation of enterprises both by business size (assets, sales volumes) and by other criteria. The most active objects of the market for the purchase and sale of existing businesses are companies valued from several thousand dollars to 5-10 million US dollars. Conventionally, this group can be divided into three subgroups:

1. Very small companies (LLC, CJSC) and private entrepreneurs (PBOLE). The maximum value of such companies rarely exceeds 100-150 thousand US dollars. These are small trade and service enterprises, public catering, intermediary firms, small telecom operators, and handicraft industries. Main distinguishing feature for such enterprises is that the basis of the economic attractiveness of owning such a business is providing employment for its owner. Its owner associates running his own business with the opportunity to accumulate capital, provide work for family members, and the opportunity to realize skills and talents. The main concern of the owner is the question of “how to do it” as opposed to the question of “who to entrust.” In quantitative terms, they occupy up to 70% of the total number of businesses for sale. Entrepreneurs in this category can achieve success through persistent pursuit of goals, rejection of excesses and innovations, and personal modesty. There are many examples of how people with a low level of education or no business experience achieve success by striving to acquire knowledge and business skills and take companies to a higher level. Currently in relevant committee The State Duma is preparing a bill giving such companies and private entrepreneurs the status of “microbusiness”, corresponding legal status and benefits.

2. Companies occupying the “golden mean” are the most interesting from the point of view of valuation and sales methods. They can be confidently called the “workhorses” of the country’s small businesses. Compared to enterprises from the first group, they are generally more complex to manage, require more business skills and experience, and the ability to manage a much larger number of diverse processes and a larger number of employees. The essence of such enterprises is the management of the company (often using borrowed funds) using various levers, with intensive use of the professional skills of the owner or managers, capital, new ideas, modern equipment, qualifications and experience of personnel. For the most part, these are still “family” companies with non-transparent reporting, strong dependence on the first person and other risks inherent in closed companies. However, there is already an understanding and desire of company owners to separate ownership and management, establish business processes and management accounting and thus increasing the value of the business. In the future, when using the concept of “small business enterprises”, we will mean companies from the “golden mean”.

3. Companies that have grown from “family” ones, have become stronger and strive for growth through development new products and entering the markets of Russian regions, CIS countries and abroad. The author characterizes them with the term “accelerators”. Due to the closed nature of the business, non-transparency of reporting, lack of well-structured business processes and access to “long-term” money, the risks when purchasing such companies are quite high, which negatively affects their value. The cost range here is quite vague and can range from 1 to 10 million dollars, and sometimes higher. It is for such enterprises that sale to a strategic investor is often the only chance to move into the category of medium-sized companies or corporate structures. Such companies make up no more than 10% of the total number of companies sold.

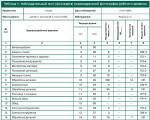

The list of reasons is ranked by frequency of reasons for sale (in descending order) and is based on statistics of calls to company specialists:

1. Unprofitability, lack of expected profits. The main reason for the sale of enterprises that were initially built without proper marketing or on an ill-calculated business idea, or driven to bankruptcy by the unprofessionalism of the owner and managers. Such businesses could initially be built on favorable terms for lending or leasing equipment, benefiting from low rent or non-payment of taxes, personal connections in government agencies, or simply a “fashionable” market niche at that time was chosen, which was then filled with a huge number of competitors..

2. Sale non-core assets(for entrepreneurs with several businesses or for holding structures);

3. The emergence of more attractive investment objects, including mutual funds and real estate investment funds. This reason is often stated as the second by owners of non-core assets and unprofitable businesses;

4. Change competitive environment business, threat of death of business due to increased government regulation industry or the emergence of new technologies. For example, for these reasons, paging companies, small meat production, objects located in areas planned for development

5. Urgent need for cash. More often - to return borrowed funds, less often - for personal reasons;

6. Fatigue, reaching retirement age, the need to “return” to family and children.

7. Moving to a new place of residence, including abroad;

8. Disappointment in doing business in Russia, fatigue from constantly changing legislation, many checks, and the impossibility of medium-term planning. The reason is not very common, but even high profitability sometimes does not compensate for the fatigue from eternal competition with the state.

ACHIEVEMENT OF A FAIR PRICE FOR A PURCHASE AND SALE TRANSACTION OF AN OPERATING ENTERPRISE.

When selling a successfully operating small and medium-sized business, the company owner quite reasonably expects to receive fair price. What is a fair transaction price and how to achieve it will be discussed in this article. As practice shows, only a small part of entrepreneurs who have decided to sell their company have an idea of its real value, therefore business valuation is the most important integral part pre-sale preparation. Depending on the purposes of the assessment, there are several types of value of an operating enterprise. The purpose of the assessment is to determine the desired value on a certain basis. The term "cost" will be present in the vast majority of situations. The basis for determining value may be reasonable market value, fair value, going concern value, investment value, or other, a wide variety of types of value.

In most cases, when preparing a business for sale, it is important to determine its value as a going concern. The value of an operating enterprise is defined as the cost of a single whole, taking into account the contribution of individual assets and components of the enterprise to a given business and is considered as their use value for specific enterprise and its owner. Items that do not contribute to overall profitability are considered excess assets. The assessment of an operating enterprise assumes that the business has favorable development prospects.

However, there is another very important concept: “price,” which refers to the amount of money required, expected or paid for a certain product or service. It is a historical fact, that is, it refers to a specific time and place. Depending on financial opportunities, motives or special specific interests of the buyer and seller, the price for which a going concern changes hands may differ from the value. So, we come to the concept of the price of a purchase and sale transaction, which must be fair for both parties. A fair price is the amount for which a business will pass from the hands of an owner who wants to sell it to a buyer who wants to buy it, provided that both parties are properly informed about all the characteristics of the business being sold and the terms of the transaction, and neither party does not feel forced to buy or sell.

There are many different methods for valuing an existing business, allowing you to determine its real value using mathematical formulas. However, it must be remembered that formulas and techniques are merely a tool to help determine an economically meaningful range of value that the company being valued may have.

There is always a difference between the value of a business and its sale price, determined by the difference in motivations of the seller and the buyer. The final sale price always reflects two simple truths:

1. The buyer acquires the future of the company, but pays for its past;

2. The seller can only agree to the offered price.

The final price always reflects the buyer's expectations regarding the future performance of the acquired business. Maximum price is determined by the acceptable relationship between risk and reward, i.e. it represents the maximum amount of money that the buyer is willing to risk for the sake of a projected profit. However, the acquirer will be willing to pay the maximum if there are grounds for this, confirmed by economic forecasts.

When preparing a business for sale, the correct assessment of the value of the enterprise is key factor success. However, it is impossible to set a fair price for a company without determining the range of potential buyers and their preferences. Moreover, each buyer group has its own idea of a fair price. Currently, in the market for the purchase and sale of existing enterprises, four main categories of buyers have taken shape quite clearly.

Strategic buyers. The role of strategic buyers of small businesses are companies that see strategic benefits in the acquisition in the form of increasing market share, developing new markets and technologies, obtaining synergy effects, and cost savings. At the same time, the attention of strategic buyers is focused precisely on future benefits, and they use information about the performance of the acquired companies for past periods as the basis for making forecasts. The main criteria that guide strategic buyers:

1. The current management must remain at the enterprise;

2. The company must occupy a unique position market niche or be a necessary link in the buyer's strategy;

3. A reasonable purchase price is usually calculated based on discounted future cash flow.

Many business owners jump to the conclusion that their best buyers will be industry buyers—competitors, suppliers, or customers. However, this premise can seriously harm the sale of the company because such buyers are not motivated by strategic objectives. When determining the value of a business to buy, industry buyers typically focus on existing assets, rather than considering the value of so-called “goodwill.” Their own considerations do not allow them to recognize the existence of value beyond the cost of assets, and many company owners initially confuse them with strategic buyers.

Typically, industry buyers are guided by criteria such as:

1. No requirements regarding minimum volume sales;

2. The company's management must be changed;

3. Necessary equipment must be in good condition.

In most cases, the option of selling a business to buyers already working in the industry should be considered last resort in the absence of other proposals, except for the following cases: 1) if the company’s income is not commensurate with the capital invested in it; 2) if there are difficulties in transferring to the new owner the experience necessary to operate the enterprise, and the company does not have the infrastructure to continue operations without the participation of its current owner.

A qualified buyer may be an investment group (a group of private investors) that has personnel with management talent and also has at its disposal internal sources financing. Like strategic buyers, investment groups focus on future earnings. They may have established relationships with sources of financial and credit funds. However, when personal funds are used to finance the purchase, the price is negotiated less aggressively. Qualified buyers are often the best buyers because they are most likely to take future earnings into account when setting a price. In order to attract these buyers, it is necessary to document the company's prospects for future growth and future profitability based on credible, sound assumptions and assumptions.

The fourth type of buyer is the financial buyer. This is usually an individual, but qualified buyers may also fall into this category if given the opportunity. These buyers' attention is focused on the present, and they view future benefits as a potential opportunity. These buyers assume that any improvements can only be achieved through their own efforts, so they are willing to pay only for current income.

A buyer driven by financial considerations usually needs vocational training and assistance from management. In addition, the perception of risk by such buyers may limit the amount of initial capital investment in the enterprise. They are sometimes also called lifestyle buyers. General criteria that guide such buyers:

1. The business must meet the buyer’s requirements regarding providing an appropriate lifestyle and lifestyle and providing new opportunities to improve the activities of the enterprise;

2. Current income must provide a level of well-being that allows the buyer to lead a normal lifestyle and receive income on invested capital;

3. The management team should stay in the company to train the new owner and support the business.

However, even in the buyer groups themselves there may be people with different views on business, willingness to take risks, and payback periods. What one perceives as an area of risk, another perceives as a sea of opportunity. It even happens that a company that is not doing everything right turns out to be attractive to a buyer who is confident in the possibility of improvement with minimal risk. If the buyer has a negative perception of the environment in which the company exists, then his perceptions of future profits are also negative. A negative perception means that the sale will not take place at all or will take place at the lowest price; a positive perception means a sale at the optimal price.

Thus, the buyer's choice is a decisive factor in determining future prospects. A well-chosen buyer should have the following opinion about the acquired business: “There are many things that are not being done right in this enterprise, but this is precisely what opens up excellent opportunities for improving its activities.”

If we consider the transaction as a kind of game between the seller and the buyer, then success can only be achieved if the “win-win” matrix is applied by both parties. The task of every competent seller and buyer is to identify and take into account those key requirements, needs and obstacles that determine the difference between the value of a business and its selling price.

In order to achieve success in negotiations, experts recommend using a method called “empathy,” i.e., it is necessary to mentally take the position of the opposite party in order to discern its emotional, subjective and immediate needs behind financial considerations. This is important even in cases where the buyer is large company, since the people involved in the transaction have, in addition to corporate ones, their own plans.

So, the seller:

1. Sells the fruits of his own labor;

2. Entrusts the fate of people (employees, clients, suppliers) to a person unfamiliar to him;

3. Sometimes ends his career without clear plans for the future;

4. Refuses a position that gives power and prestige;

5. He is convinced that there is no adequate replacement for him in his business;

6. Concerned about the fate of relatives and friends working in the company;

7. Concerned about setting a fair price and ultimately getting all the money.

On the other hand, the buyer has many worries of his own:

1. Does he really need this particular company?

2. Will he be able to quickly get used to the role of an entrepreneur and adapt to it?

3. Will he be able to successfully manage the business and develop it?

4. Will staff, suppliers and clients be retained?

5. How to purchase of this business will it affect your lifestyle, habits, family structure?

6. What will happen to the company in the event of unforeseen circumstances, economic downturn, increased competition, government intervention?

7. Is it prudent to invest the funds accumulated with such difficulty in this enterprise?

Obviously, in addition to all of the above, both sellers and buyers must turn to an analysis of the factual material relating to the transfer of business. How well, how accessible that data is, and how well they can analyze it will determine their success in securing a fair deal price. Any entrepreneur who has experience in acquiring an existing enterprise or has at least once attempted to buy an existing business knows well that this is far from a simple matter. The market for the purchase and sale of operating enterprises is a market in which sellers have a number of advantages. Many companies for sale have serious problems or are offered at inflated prices.

As a rule, at the first stage of getting to know the company being sold, the owner is not ready to give out complete information about the business, much less allow the potential buyer access to financial, marketing and other important information. Therefore, to achieve a fair price, written guarantees of the parties' liability are important. In the best way A deposit agreement that allows the interests of the parties to be taken into account as much as possible and the transaction to be given the proper legal form is a deposit agreement. According to Art. 380 of the Civil Code of the Russian Federation, a deposit is recognized as a sum of money given by one of the contracting parties against payments due from it under the contract to the other party, as proof of the conclusion of the contract and to ensure its execution. The agreement on the deposit, regardless of the amount of the deposit, must be made in writing.

The subject of the deposit agreement is: 1) the obligation of the company owner to sell an operating business that has certain characteristics within a specified time frame at an agreed price; 2) the obligation of the acquirer to buy out the company within a specified time frame at an agreed price. Since an operating business is a special kind of product, it is of utmost importance that the business meets the characteristics stated by its owner. The purpose of the entire business transfer procedure is to confirm the legal, managerial, financial and other parameters of the company being sold.

A standard list of checks carried out when entering almost any business and prescribed in the deposit agreement:

Checking the availability of statutory, permitting and other documents, certificates and licenses that allow the legitimate conduct of this business;

Inventory of company equipment and property;

Verification (full or partial) of accounting documentation;

Inventory of accounts payable and receivable;

Inventory of carry-over balances of raw materials, containers, packaging material and finished products.

For businesses that own real estate, it is important to confirm rights to real estate. If the business is conducted on leased premises, the question very often arises, what is the likelihood that the one-year lease will be renewed again. If the landlord is the owner of the building, it is imperative to provide for a meeting between the buyer and him and obtain guarantees (sometimes verbal ones are sufficient) of continuing constructive relations in the future. If an enterprise has complex, expensive equipment, there is a need to check its condition and performance with the involvement of specialists. The correctness of accounting and complete payment of taxes can be confirmed by a certificate of absence of debt to the budget, and sometimes by an audit report.

Maintaining a balance of interests of the parties is a rather difficult task, so it is advisable to attract specialists who will take on the legal part, as well as act as a third party in negotiations and accept a deposit for safekeeping and dispose of them according to the agreement.

Alexey Moskvich company "Gurus". www.gurus.ru

Is it worth buying a ready-made business: types of businesses in the Russian Federation + 4 resources for searching for advertisements for the sale of a business + 5 reasons why a business is being sold + 3 ways to bypass scammers + 2 main options for buying a business + 6 factors influencing the price.

Is it worth buying an existing business? Or is it better to start from scratch?

Each of these paths to becoming a successful entrepreneur has its own advantages and disadvantages.

Today we will examine in detail the issue of buying a business.

Do you need it? How to avoid falling into the clutches of scammers? How to buy a company that won’t go bankrupt in a week or two?

But first, decide for yourself exactly how much money you have available to start your new business. If funds are not enough, consider whether you are ready to take out a loan.

Remember, the bank will only give you a large loan if you have real estate or a sufficiently large monthly income.

If enterprises sell precisely for this reason, then the buyer must be informed about this.

Of course, selling a company with debt is considered a scam. But if you fall into such a trap, it will be extremely difficult to prove anything and get your money back.

Before a transaction, make inquiries about the company’s activities from their suppliers and employees to protect yourself from losses.

How to protect yourself when purchasing?

The surest way to protect yourself before buying a business is to check the activities of a specific legal entity using government online resources.

The following sites will help you understand whether it’s worth buying an existing business:

- Unified Federal Register of Bankruptcy Information: https://bankrot.fedresurs.ru

- Database of the Federal Antimonopoly Service: https://solutions.fas.gov.ru

- Federal tax service: https://egrul.nalog.ru

- Debt center: https://www.centerdolgov.ru

These services will help you find out whether the company has debts, check the accuracy of the data and obtain other important information that will secure the transaction.

How to understand that a business is unprofitable?

Understand that they want to sell you debts, not profitable business- difficult. Nowadays there are many tricks that scammers profit from.

There are several rules that will help you avoid an erroneous transaction:

If you are not given documents upon request, it means that there is something wrong with them.

There is no need to rush to buy this business.

Sometimes management asks for a deposit.

Do not do this under any circumstances. As practice shows, after a money transfer it is impossible to find either the office or the managers.

If you are buying a ready-made business with staff and everything necessary equipment, and not just documentation, then check the serviceability of everything that comes into your hands.

Invite an independent technician who will assess the condition of all instruments.

If everything is in order with the above points, then you should carefully check the documentation.

Even the contracts of all employees need to be reread. Be sure to request a rental agreement, as well as a certificate confirming the absence of debts.

You need to buy a business only after a certified documented inventory.

If you do not understand some of the nuances, then it is better to hire an experienced lawyer or accountant who can check the documentation in all respects.

2 options for purchasing an existing business

Option No. 1 – purchasing only documents for the company.

Many people mistakenly believe that a ready-made business will significantly save money and time on paperwork...

This is not true, because when selling a company with “clean” documentation, the company’s managers will ask for 5-10 thousand rubles more than it would cost you to complete the paperwork on your own.

In addition, in any case, you will have to re-register documents in your name. This takes approximately 5-7 days.

It takes 5-10 days to register an LLC, if the collected documents do not have any “deviations from the norm.”

If you choose in this case between buying a company, then it is better to do everything yourself and save money for the development of your business.

PS. Typically, the price of a package of documents for a company varies within 20,000 rubles.

Option No. 2 – acquisition of an existing business.

This option is more tempting, because you are already acquiring a ready-made and established business, which includes a team of employees, clientele, suppliers, ready-made contracts, etc.

This is a big plus, but there is a considerable risk that you may be deceived by scammers.

Sometimes a business is sold because large quantity debts The value of the company will be underestimated, and this will be the first signal of danger for you.

PS. Minimum cost ready-made enterprise starts from $15,000.

Pricing policy

There are many factors that affect the price of a business:

Supply and demand.

Even a novice entrepreneur must understand that every business is built on the relationship between demand from customers and supply that comes from the enterprise.

How more demand has a business, the higher its price will be.

Type and type of business.

If a company has a narrow specialization, then its price will be lowered due to the lack of great demand among potential buyers.

A business with “clean” accounting will be very expensive for the new owner, but he will have peace of mind for his invested money.

Availability of assets.

Enterprises with all the equipment, supplier base, concluded contracts, employees, etc. are sold at a high price.

Popularity.

The more famous the company, the higher its market price.

Urgency of the deal.

Sometimes a legal entity, for a number of reasons, may be in a hurry to sell its business, then the price will be lowered in order to quickly find a buyer.

Buying an existing business can be great start for an entrepreneur.

The main thing is to understand what you will do with it next.

The owner of a beauty salon shares her personal experience:

Franchising as an option to start your own business

Another way to purchase a ready-made enterprise, and at the same time be sure that everything will work out, is this.

This term in business denotes a form of relationship between two organizations that begin cooperation and are interested in the development of the business on both sides.

In simple words, a well-known company (in the transaction it calls itself franchisor and you will call yourself franchisee) offers to buy you the right to use its famous “name” and sales methodology.

In turn, you receive a ready-made trademark, which you just need to further promote, as well as look for sales sources, etc.

What do you get from this deal:

- when concluding an agreement, you will have a ready-made working method, you don’t need to invent anything;

- a customer base that will be happy to purchase goods from a well-known supplier from you;

- the franchisee also receives the image that the franchisor company will create for him, and at the same time new clients and partners in the future.

Of course, this is not a charity project for those new to entrepreneurship.

You agree to pay the franchisor a certain amount and a percentage of turnover. These details are prescribed in the contract without fail.

Of course, to answer the question, Is it worth buying a ready-made business? or opening a business on your own is difficult. Especially if you don't have the skills to run a business.

Purchase risk finished project is great, but there are also disadvantages and pitfalls in starting your own business.

The most important and biggest advantage in purchasing a ready-made project is the opportunity to receive income immediately after signing the contract. If you open your own business, you will have to wait for more than one month for income...

Useful article? Don't miss new ones!

Enter your email and receive new articles by email