How to deregister in the tax office online cash desk. Deregistration of an online cash register: how to close the registration of a cash register in the tax office independently Deregister a cash register in the tax

Deregistration online KKM -2 500 rub

we draw up documents for the removal of cash registers from tax accounting

Where and how to remove an online cash register (KKM) from tax records in 2020

Reasons for withdrawal cash register taking into account

termination of activity of an individual entrepreneur or organization

theft of the device or detection of any malfunctions in it

end of service life of KKM (according to the law - 7 years from the beginning of operation)

purchase of a new KKM model, etc.

Removal of online KKM from the register with the IFTS takes place in the IFTS

for individual entrepreneurs at the place of registration

for organization at the place of business

The inspector at the IFTS checks the submitted documents. During the audit, acts are drawn up and a decision is made to remove KKM from tax records

Closing the activities of the IP

You can remove KKM from the register both before and after the closure of the IP

Why is it necessary to deregister a cash register?

Some entrepreneurs, after the completion of the activities of their company or individual entrepreneur, stop using KKM. However, the law obliges the owner to deregister his cash register, as there is a risk that unauthorized persons can use it.

Online cash register can be deregistered

1. at the request of the owner

2. by decision of the tax authority

In the first case, the online cash register will have to be removed from registration if the cash register

transferred to another user

lost or stolen

out of order

In the second case, the tax inspectorate will independently deregister the CCP if

non-compliance with the requirements of the legislation of the Russian Federation was found. Re-registration such a CCP is possible with the elimination of identified violations

upon expiration of the fiscal attribute key in the fiscal accumulator. Within one month from the date of deregistration of the cash register, all fiscal data that are stored in the fiscal drive should be submitted to the inspection

Applying for deregistration online of CCP

An application for deregistration of an online cash desk must be submitted to the tax office no later than one business day from the date of transfer of the cash register to another user or loss (theft)

An application can be submitted (clauses 1, 10, article 4.2 of Law No. 54-FZ)

to any tax office - in paper form

in electronic form through the KKT office. The date of submission of the application will be the date of its placement in the KKT office

through the fiscal data operator. The date of submission of the application will be the date of its transfer to the fiscal data operator

The application for deregistration should indicate (clause 6, article 4.2 of Law No. 54-FZ):

full name of the organization or full name individual entrepreneur

TIN of the taxpayer

KKT model name

factory number of a CRE copy registered with the tax authority

information about cases of theft or loss of cash registers (if there are such facts)

Application form for deregistration cash register approves the Federal Tax Service of Russia (clause 12, article 4.2 of Law No. 54-FZ). There is currently no such form.

Together with an application for deregistration of a CCP (except in the case of loss or theft), it is necessary to submit to the inspection a report on the closure of the fiscal accumulator (clause 8, article 4.2 of Law No. 54-FZ).

CCP can be used in a mode that does not provide for mandatory transfer fiscal documents to the tax authorities, for example, if trade takes place in areas remote from communication services. In this case, the fiscal data of all fiscal documents contained in the fiscal drive should be read and the data should be submitted to the inspectorate along with the application (clause 7, article 2, clause 14, article 4.2 of Law No. 54-FZ).

Formation of a card on deregistration of cash register equipment

The date of deregistration of the CRE is the date of formation of the card on deregistration of the CRE. Such a card is generated by the tax authority and issued (sent) within 5 business days from the date of application (clause 7, article 4.2 of Law No. 54-FZ).

In it, the tax inspectorate must indicate (clause 9, article 4.2 of Law No. 54-FZ):

full name of the organization or full name individual

entrepreneur

TIN of the taxpayer

KKT model name

serial number of the copy of the CCP

date of deregistration of the CCP.

Controllers must send the card within 5 working days from the date of deregistration of the cash register. The inspection has the right to do this (clause 11, article 4.2 of Law No. 54-FZ)

through the KKT office

through the fiscal data operator

Also, a card on deregistration of a CCP can be obtained from the tax authority in paper form (clause 12, article 4.2 of Law No. 54-FZ)

Call us and we will help you

prepare documents and remove the online cash register from tax records

Removal of CCP from tax accounting

In order to remove a CCP from the register with the Federal Tax Service, the following conditions are required:

All data must be transferred to the OFD.

The FN archive must be closed at the checkout.

To do this, it is necessary that the tariff is valid at the checkout (activation code or annual \ quarter \ three-year). A cash register connected to the Internet will transfer previously unsent documents. After that, you can proceed to the procedure for closing the FN archive at the checkout. This is done through the CCP driver installed on the computer to which the cash register is connected, or by a sequence of commands described in the manual for specific model KKT. After the FN archive is closed, you need to make sure that it has been transferred to the OFD and there is no data left at the checkout for transfer to the OFD. If everything is correct and the report on closing the FN is displayed in the list of receipts in the "monitoring cash registers" section, and the cash register itself is in the "FN archive closed" status, you can turn off the cash register and remove the fiscal drive from it.

If in OFD the cash desk is activated by a quarterly, annual or three-year tariff, it is necessary to stop the billing of the cash desk in the "cashier management" section. The rest of the funds will be returned to the balance personal account. It can be used to activate another cash desk or make a refund through the accounting department. If the cash register is activated with an activation code, it is impossible to stop the tariff, it is also impossible to transfer it or return money for it.

The fiscal accumulator is subject to responsible storage within 5 years from the date of closing the archive and may be requested by the tax office. The cash register itself, after deregistration of the cash register with the tax office, can be re-registered with a new FN to another organization (the cash register can be sold).

To deregister a cash register with the NFS, you need to go to the taxpayer's personal account on the nalog.ru website and remove the cash register from tax records, this will require data from the closing report (date, time, fiscal sign).

It should be noted that in the OFD Personal Account, the status "deregistered" is not displayed, the Federal Tax Service does not return information to the OFD about this state. Thus, the state "FN archive is closed" is final.

For the convenience of navigating through the Personal Account, in the "Monitoring of cash desks" section, you can create an additional outlet (button + outlet) and transfer deregistered cash desks to it. The name of such a point of sale is used arbitrary (example: "removed from the account", "written off" ...). Using a hierarchy of access rights to outlets for users, you can prevent users from accessing such an outlet and its containing cash registers. Thus, LC users will see only active cash desks. Important: - the administrator (the creator of the Personal Account) sees everything outlets and all modules of the personal account system.

In our country, entrepreneurs are not allowed to engage in retail without a cash register duly registered with the tax authorities. It is logical that KKM, which has a unique identification number in the tax registry and is assigned to a specific individual entrepreneur or legal entity, cannot be transferred to another person, sold or disposed of just like that. Before performing any of these actions, cash registers must be deregistered.

When may I need to deregister a cash register?

The need for re-registration or complete removal of KKM from tax records may appear both when the organization is closed, and in the course of its activities. This happens in such cases:

- Replacing the cash register with another model (newer and more functional).

- The KKM model used is outdated and deleted from state register KKT. The service life of cash registers is only 7 years from the start of operation.

- Sale, transfer for use free of charge or for a fee (for rent) to another individual entrepreneur or organization.

- The cash register is not in use, but is in open access for employees of the company, outsiders. To avoid unauthorized use, it must be deactivated if you do not plan to use it for its intended purpose in the future.

- IP closure, liquidation legal entity also serve as the basis for deregistration of the cash register.

What should I pay attention to when deregistering a cash register?

The essence of the whole procedure is to check the compliance of the information in the cash register and the data contained in the fiscal memory of the device, deactivate the machine, remove and transfer to storage the ECLZ block (secure electronic cash register tape). However, the process itself in different regions and even in different inspections of the Federal Tax Service can take place in its own way.

There are some nuances that need to be clarified in advance in a specific territorial tax authority - in the one in which the KKM was registered. Many IFTS require the removal of fiscal reports by a service center specialist only in the presence of an inspector. In this case, having previously agreed with the TsTO engineer, you need to drive up to your inspection on a certain day, taking with you the cash register and all prepared papers.

Some inspections turn a blind eye to such strictness and do not ask to bring equipment and a cash desk to them. For them, correctly executed documents are sufficient, the main thing is that they be provided by a certified TSC and presented to the registrar in a timely manner.

With a “simplified” procedure, an employee of the cash register service center independently removes fiscal memory and forms a package of documents for deregistration of KKM. The owner of the cash desk can only take the application to the tax office (in person or send a representative with a power of attorney) on the same day or within three days, depending on the rules established by the local IFTS.

When planning to remove a cash register from registration, it is necessary to clarify whether all tax reporting rented for this moment, whether there are any debts to the budget, whether the bills of the TsTO are paid. It is advisable to carefully study the journal of the cashier-operator for the completeness and correctness of the information entered, as well as check the marks in the log of the technician's call. If everything is in order, it's time to start preparing the documentation.

List of documents for the IFTS

KKM, subject to deregistration in the Federal Tax Service, must have the following accompanying package :

- registration card issued upon registration;

- journal of the cashier-operator (form KM-4);

- cash register passport and EKLZ passport;

- maintenance call log;

- a copy of the balance sheet for the last reporting period (marked tax), cash book or book of income and expenses (for LLCs and individual entrepreneurs, respectively) - these documents are not required, but may be needed for the work of a tax inspector.

In the process of removing the memory of the cash register, the CTO employee provides:

- an act on taking readings from the meters of the device (form KM-2);

- a receipt with a fiscal report for the entire period of KKM operation;

- 1 receipt-report for each of the last 3 years of operation of the cash desk;

- monthly fiscal reports for the same period;

- report on the latest ECLZ;

- a receipt for closing the device's memory archive;

- an act on the transfer of a block of memory for storage.

The representative of the organization - the owner of the CCP presents the tax inspector with a passport (a power of attorney is needed if it is not the director himself or individual entrepreneur) and a completed application. In 2014, an application for deregistration of KKM is issued on a universal one, which since 2012 has been the same for everyone registration actions with CCP (when registering and making changes to registration cards).

The procedure for deregistration of CCP

So, we list the main actions for deregistration of a cash register:

- We clarify the nuances of the work of "our" tax office.

- We are preparing a set of documents.

- We contact the CTO for coordination and implementation of the procedure.

- We pay a visit to the IFTS.

As you can see, the instructions for deregistration of cash registers are simple and clear, and the process itself does not take much time. With a good combination of circumstances, going to the tax office will not take more than 15 minutes. If the cash register department is not fast-paced or accepts only a few days a week, then you will have to wait up to 5 days.

After that, you can do anything with the cash register: give it as a gift, rent it out, sell it, or rent it out for a commission to the CTO. True, this applies only to those machines that are still listed in the state register: they are equipped with new memory and are again put into operation. Devices that have expired the depreciation period (7 years) are not subject to further use.

The ECLZ block in case of a desk audit must be kept in the organization for 5 years after deregistration.

Deregistration of a cash register is necessary if the cash register is no longer needed, transferred to another legal entity or individual entrepreneur, stolen or lost.

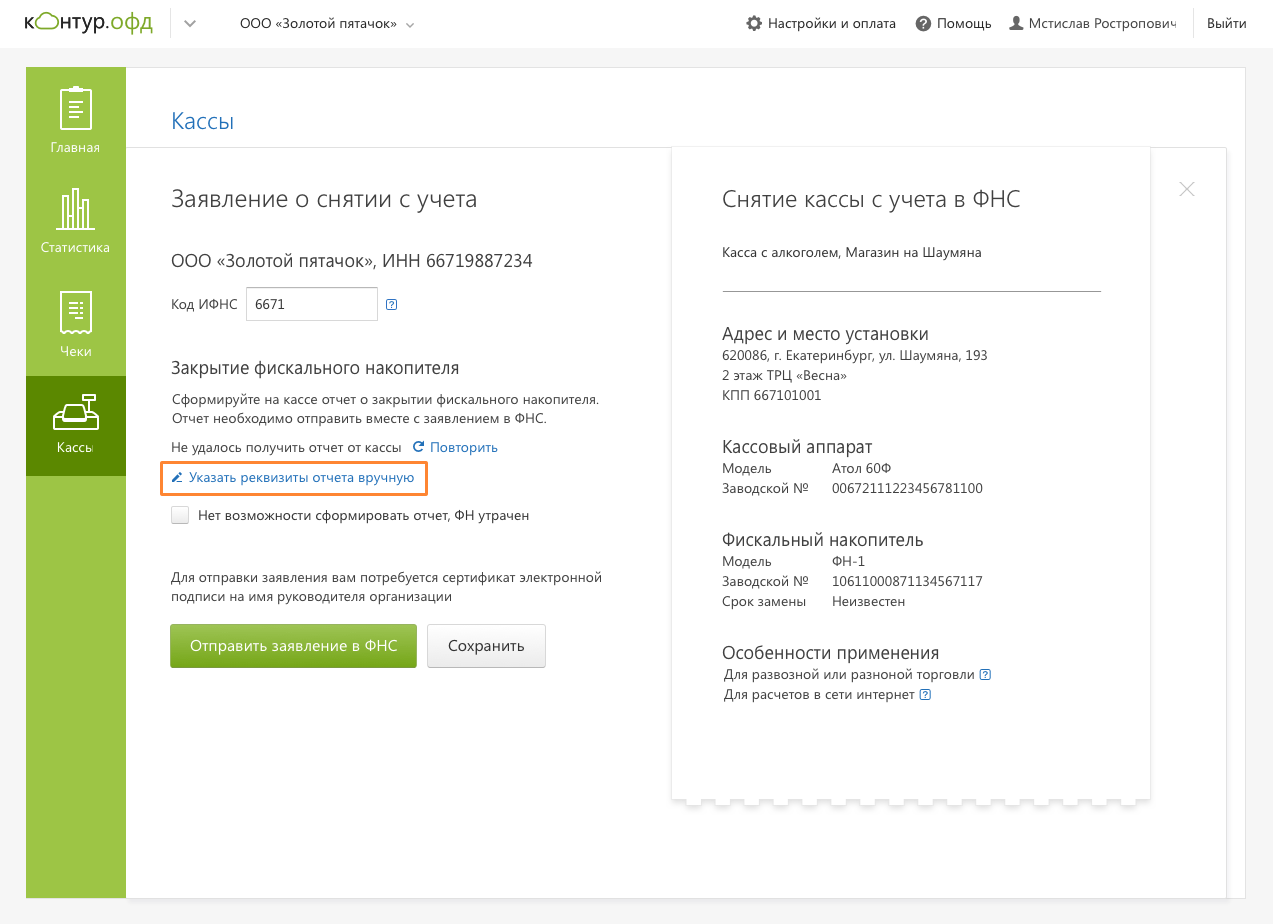

There are three ways to apply for deregistration: in person at tax office, on the portal of the Federal Tax Service or in personal account(LC) operator of fiscal data. Users of Kontur.OFD can deregister the cash register with the tax office on their own in the personal account.

Before deregistration of the cash register, generate a report on the closing of the fiscal accumulator (FN) at the cash desk. If the FN is broken and the report is not generated, the cash register can be removed from the register only through the Federal Tax Service. You can close FN using the utility for registering a cash register on a computer.

If the cash register is stolen or lost, file a complaint with the police and receive a certificate of registration of the complaint. This certificate is needed when re-registering the cash desk through the branch of the Federal Tax Service.

If you apply online, you do not need supporting certificates.

Deregistration of an online cash register through the Federal Tax Service

- In the "Cashier" section in the LC Kontur.OFD, go to the cash register card and click the "Remove from the register with the Federal Tax Service" button.

- Enter the IFTS code. The data of the report on the closing of the fiscal accumulator will appear in the application automatically if the cash desk has a connection with the OFD and Internet access.

- If the cash desk has no connection with the OFD and the report on the closing of the FN did not appear in the application, you can specify its parameters manually.

The date, time and other parameters must be taken from the printed report on the closure of the FN.

- If it is not possible to generate a report on the closure of the FN due to the loss or theft of the cash register, indicate this.

- Sign the application electronic signature head of the company and send.

The body has 10 working days to respond from the submission of the application to Kontur.OFD.

When the Federal Tax Service approves the application, a withdrawal card will come to the personal account. The card has been generated - the cash desk has been deregistered.

You no longer need it - a registered cash register that has brought undoubted benefits to the company. You, or, or maybe the equipment simply fell into disrepair. Deregistration of cash registers in the tax office is a fairly simple procedure that will take a minimum of time and cost.

What documents are needed?

Deregistration is usually carried out within one business day, and in some federal inspections tax service(IFNS) it takes 15-20 minutes. As a rule, the terms depend on the workload of specialists and the presence of a queue.

Removal of the cash register from the tax account is usually carried out within one working day.

The main thing in this case is to provide the fiscal authority with a complete list of documents:

- Statement of 2017, used to deregister KKM.

- This is the form KND-1110021 already familiar to you. Since 2014, the universal form has been used both for deregistration and registration of cash registers with the tax authorities. Filling out the form is not difficult if you carefully study the order of the Federal Tax Service of the Russian Federation of November 21, 2011 No. MMV-7-2 / 891.

- fiscal report.

- Registration card and passport of KKM.

- The passport.

The tax inspectorate cannot require other documents.

Necessary steps

The procedure for deregistration of KKM is as follows:

- Fill out the application form and call the engineer of the company that services your cash register. The specialist must remove the fiscal report.

- Take the package of documents to the tax office, which is your cash register. If you can’t visit the fiscal authority yourself, you can send the papers by mail, through the public services website or with a representative. In this case, a notarized power of attorney is required.

- Based on the results of consideration of the application, tax inspectorate specialists, in the presence of TsTO engineers, take readings of control and summing money counters and draw up an act.

- The tax authorities make an entry in the passport and the KKM registration card, then make an appropriate note in internal documents- KKM accounting book and registration coupon.

You may be refused to remove the cash register if the package of documents is incomplete or the forms are filled out incorrectly. If everything is in order after entering the data into the appropriate database, the cash register is considered closed.