Planning standards ISA 300 330. Planning an audit of financial statements in accordance with international auditing standards. Features of the audit engagement

Submitting your good work to the knowledge base is easy. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Ministry of Education and Science of the Republic of Kazakhstan

Kazakh National University named after al-Farabi

Higher School of Economics and Business

Department of Accounting and Audit

Coursework

On the topic: Planning an audit in accordance with ISA 300

Almaty, 2012

Introduction

1.2 Stages of audit planning

2.1 General provisions of ISA 300

Conclusion

List of used literature

INTRODUCTION

This paper examines the initial stage of the audit - the planning stage.

An audit is a rather complex process. There are many auditing procedures. Much depends on what procedures, to what extent and sequence the auditor applies: whether the results of the audit will be sufficiently objective, how labor-intensive and risky the audit is, and so on.

Having received an order from a client to carry out audit, first of all, the auditor needs to plan the audit in order to determine the volume of audit work, calculate labor costs, as well as the cost and timing of the audit. When planning an audit, an audit strategy is developed taking into account the individual characteristics of each audited entity.

The rational use of the audit organization’s labor resources, minimizing the costs and time of the audit depends on how the auditor planned the audit.

Audit planning is governed by International Standard on Auditing (ISA) 300, Planning an Audit. financial statements" According to this standard, audit planning involves developing an overall strategy and a detailed approach to the expected nature, timing and scope of audit procedures. Moreover this rule does not contain a clear procedure for planning an audit, so auditors need to independently develop their own internal audit planning standard, which will determine the procedure for the auditor’s actions from the beginning to the end of the audit.

Thus, audit planning is one of the most important stages audit. Therefore, the topic of audit planning is quite relevant in our time.

The auditor's planning work is a strictly organized process, which has certain stages and procedures for maintaining and drawing up documentation of audit procedures. Auditing practice differentiates next steps planning: early familiarization with the activities of the enterprise, preliminary planning of the audit, conclusion of an agreement, development of a general plan, drawing up an audit program.

The entire sequence and separately each stage of the auditor’s planning must comply with the methodological basis for conducting an audit based on international auditing standards in Kazakhstan. The role and significance of these fundamentals are related to the requirements put forward by the international community for accounting and auditing.

The object of the course work is planning in auditing.

The purpose of the test: to consider planning as the basis of the audit process.

To achieve the goal, it is necessary to solve the following tasks:

1. Consider preliminary planning and assessment of the possibility of conducting an audit;

2. Study the audit program as a detail of the overall plan;

3. Consider the assessment of the SBU and ICS;

4. Study planning in international auditing standards.

A significant number of scientific papers and publications are devoted to the topic of audit planning. To one degree or another, many scientists paid their attention to the definition of audit planning, such as: Sheremet A.D., Suits V.P., Dyusembayev K.Sh., Egemberdieva S.K., Akhmetbekov A.N., Dubrovina T. A. etc.

The course work is presented on 20 pages; consists of an introduction, two chapters, a conclusion, and a list of sources used.

In the first chapter of the work it is given general concept audit planning, its fundamental aspects, principles and stages are revealed.

The second chapter of the work discusses the definition of audit planning in accordance with ISA 300 “Planning an Audit of Financial Statements”.

1. Theoretical aspects of audit planning

1.1 Concept of audit planning

Planning an audit consists of determining its strategy and tactics, choosing procedures and methods that allow you to most effectively achieve your goal - confirming the reliability of financial statements.

Audit planning is one of the most important stages of an audit. How thoroughly the auditor prepares for the audit, on the one hand, determines the degree of effective use of specialists participating in the audit, which naturally determines the rational use of their working time and minimizing the labor costs of the audit organization, and on the other hand, the risk of not detecting significant errors in the financial client reporting. All of the above ensures competitiveness audit firm in the market for audit services provided.

Planning, being the initial stage of an audit, includes the development by the audit organization of a general audit plan indicating the expected volume, schedules and timing of the audit, as well as the development of an audit program that determines the volume, types and sequence of audit procedures necessary for the audit organization to form an objective and an informed opinion about the organization’s financial statements.

The audit organization and individual auditor are required to plan their work so that the audit is carried out effectively.

Audit planning involves developing an overall strategy and a detailed approach to the expected nature, timing and scope of audit procedures.

The audit organization must agree with the management of the economic entity on the main organizational issues related to the audit.

The auditor's planning of his or her work ensures that important areas of the audit receive the necessary attention, that potential problems are identified, and that the work is completed cost-effectively, efficiently, and in a timely manner.

Planning allows you to effectively distribute work between members of the team of specialists participating in the audit, as well as coordinate such work. The time spent on work planning depends on the scale of the audited entity’s activities, the complexity of the audit, the auditor’s experience working with this entity, as well as knowledge of the specifics of its activities.

Obtaining information about the activities of the audited entity is an important part of planning work, helping the auditor to identify events, transactions and other features that may have a significant impact on the financial statements.

The auditor has the right to discuss certain sections of the overall audit plan and certain audit procedures with employees, as well as with members of the board of directors and members audit commission the audited entity to improve the efficiency of the audit and coordinate audit procedures with the work of the audited entity’s personnel. In this case, the auditor is responsible for the correct and complete development of the overall plan and audit program.

The auditor plans his work continuously throughout the duration of the audit engagement in connection with changing circumstances or unexpected results obtained during the performance of audit procedures.

Thus, audit planning should be carried out in accordance with the general principles of conducting an audit, as well as with the following particular principles: comprehensiveness; continuity; optimal planning.

The principle of comprehensive planning involves ensuring the interconnection and consistency of all stages of planning - from preliminary planning to drawing up a general plan and audit program.

Continuity of planning is expressed in the establishment of related tasks for a group of auditors and the linking of planning stages by time frame and by related business entities (structural divisions allocated to a separate balance sheet, branches, representative offices, subsidiaries). When planning for a long period, in the case of audit support of an economic entity, during the year the audit organization should promptly adjust plans and audit programs taking into account changes in financial and economic activity economic entity and the results of interim audits.

The principle of optimal planning is that during the planning process it is necessary to ensure its variability in order to be able to select the optimal option for the general plan and program based on the criteria determined by the audit organization itself.

An audit organization must begin planning an audit before writing a letter of engagement and before concluding an agreement with an economic entity to conduct an audit.

Sources of information about the organization of the entity’s activities for the auditor may be:

Charter of an economic entity;

Documents on registration of an economic entity;

Minutes of meetings of the board of directors, meetings of shareholders or other similar management bodies of an economic entity;

Documents regulating the accounting policy of an economic entity and making changes to it;

Accounting reporting;

Statistical reporting;

Documents for planning the activities of an economic entity (plans, estimates, projects);

Contracts, agreements, agreements of an economic entity;

Internal reports of auditor-consultants;

In-house instructions; tax audit materials;

Materials of judicial and arbitration claims;

Documents regulating the production and organizational structure of an economic entity, a list of its branches and subsidiaries;

Information obtained from conversations with the management and executive staff of the economic entity;

Information obtained during inspection of an economic entity, its main areas, warehouses.

The auditing organization must evaluate the feasibility of conducting an audit. If the audit organization considers it possible to conduct an audit, it proceeds to forming a staff to conduct the audit and enters into an agreement with the economic entity.

When planning the composition of the audit team, the audit organization must take into account the working time budget for each stage of the audit (preparatory, substantive and final); expected time frame for the group's work; quantitative composition of the group; position level of group members; continuity of group personnel; qualification level group members.

An overview of the enterprise's activities should include:

Deep understanding entrepreneurial activity client, motives for the elder's behavior management personnel to assess the risk of providing false information;

Preliminary analytical reviews to assess the current financial condition of the enterprise in order to highlight unusual and unexpected balances;

Understanding the specifics of accounting policies;

Assessment of level and materiality.

From the first day of work, the auditor should familiarize himself with the client’s legal documents: charter, registration documents, minutes of meetings of the board of directors and shareholder meetings - they may contain important information (on the distribution of profits, declaration of dividends, payment of remunerations, signing of contracts and agreements, acquisition of property , provision of long-term loans, provision of collateral and guarantees, the circle of persons authorized to sign).

1.2 Stages of audit planning

When planning an audit, it is necessary to highlight the following main stages:

Pre-planning;

Preparation and drawing up of a general plan;

Preparation and drawing up of an audit program.

In the process of preliminary familiarization with the client, the auditor needs to assess the financial stability of the client; the client's position in the economic environment; relationship with the previous audit firm, if any.

The auditor must become familiar with the financial and economic activities of the economic entity and have information about:

External factors influencing the economic activity of an economic entity, reflecting the economic situation in the country (region) as a whole and its sectoral characteristics;

Internal factors influencing the economic activity of an economic entity related to its individual characteristics.

In addition, the auditor should become familiar with:

Organizational and managerial structure of the economic entity;

Types of production activities and range of products;

Capital structure and share price (if the shares of an economic entity are subject to quotation);

Technological features of product production; level of profitability;

The main buyers and suppliers of the economic entity;

The procedure for distributing profits remaining at the disposal of the organization;

The existence of subsidiaries and dependent organizations;

An internal control system organized by an economic entity;

Principles of formation of personnel remuneration.

It is advisable for the new auditor to contact his predecessor, from whom he can obtain information about management's intentions, controversial issues regarding the application of accounting principles, audit procedures or compensation. But first the auditor must agree on the possibility of such contact with the client.

In addition, the auditor can use information provided by lawyers, other audit firms, and entrepreneurs.

Based on the information received, the auditor must decide whether it is necessary to involve specialists and experts (lawyers, tax specialists, technology) for consultations on certain issues.

Additionally, it is important to review contracts, agreements and agreements to clarify the client's obligations.

When starting to develop a general plan and audit program, the audit organization must use prior knowledge of the economic entity, as well as the results of the analytical procedures performed.

The auditor needs to draw up and document a general audit plan, describing the expected scope and procedure for conducting the audit. The overall audit plan should be sufficiently detailed to guide the development of the audit program. At the same time, the form and content of the general audit plan may vary depending on the scale and specifics of the audited entity’s activities, the complexity of the audit and the specific techniques used by the auditor.

When developing the overall audit plan, the auditor should consider:

activities of the audited entity, including:

General economic factors and industry conditions affecting the activities of the audited entity;

Features of the audited entity, its activities, financial condition, requirements for its financial or other reporting, including changes that have occurred since the date of the previous audit;

General level of management competence;

systems accounting and internal control, including:

The accounting policy adopted by the audited entity and its changes;

The impact of new regulatory legal acts in the field of accounting on the reflection in the financial statements of the results of the financial and economic activities of the audited entity;

Plans for the use of tests of controls and substantive procedures during the audit;

risk and materiality, including:

Expected assessments of inherent and control risk, identifying the most important areas for audit;

Establishing materiality levels for the audit;

Possibility of material misstatements or fraud;

Identifying complex areas of accounting;

Nature, timing and scope of procedures, including:

The relative importance of various sections of accounting for the audit;

The impact on the audit of the presence of a computer accounting system and its specific features;

Subdivision existence internal audit the audited entity and its possible influence on the external audit procedures;

Coordination and direction of work, ongoing monitoring and verification of work performed, including:

Involvement of other audit organizations in the inspection of branches, divisions, subsidiaries of the audited entity;

Involvement of experts;

Quantity by region separate divisions one audited entity and their spatial distance from each other;

The number and qualifications of specialists required to work with this audited entity;

other aspects, including:

The possibility that the entity's going concern assumption may be called into question;

Circumstances requiring special attention;

Features of the contract for the provision of audit services and legal requirements;

The length of service of the auditor’s employees and their participation in the provision of related services to the audited entity;

The form and timing of preparation and presentation to the audited entity of opinions and other reports in accordance with the law, auditing standards and the conditions of a specific audit assignment.

The auditor should establish and document an audit program that defines the nature, timing and scope of planned audit procedures necessary to implement the overall audit plan. The audit program may also include the auditable financial statement assertions for each audit area and the time planned for the various audit areas or procedures.

In preparing the audit program, the auditor is required to consider the auditor's assessment of inherent and control risk, the required level of assurance to be provided in substantive procedures, the timing of tests of controls and substantive procedures, and the coordination of any assistance. , which is expected to be received from the audited entity, as well as the involvement of other auditors or experts.

The overall audit plan and audit program should be refined and revised as necessary during the course of the audit.

The reasons for significant changes to the overall audit plan and program should be documented.

When drawing up a general plan and audit program, the audit organization must take into account the degree of automation of processing accounting information, which will allow it to more accurately determine the scope and nature of audit procedures.

The audit organization, if necessary, can agree with the management of the audited economic entity on certain provisions of the general plan and audit program. At the same time, the audit organization is independent in the choice of audit techniques and methods reflected in the general plan and program, but bears full responsibility for the results of their work in accordance with this general plan and this program.

Using analytical procedures, the audit organization must identify areas of significance for the audit. The complexity, volume and timing of the analytical procedures of the audit organization should vary depending on the volume and complexity of the financial statements of the economic entity. The results of the procedures in preparing the overall plan and program should be documented in detail as they form the basis for planning the audit.

The audit program is a development of the general audit plan and represents a detailed list of audit procedures necessary for the practical implementation of the audit plan. The program serves as detailed instructions for auditor assistants, and for the heads of the audit organization and audit team - at the same time as a means of monitoring the quality of work.

The auditor should document the audit program, designate each audit procedure performed with a number or code, so that he can refer to them in his working documents during the work process.

The audit program should be designed as a program of tests of controls and as a program of substantive audit procedures.

Control test program - a list of a set of actions intended to collect information about the functioning of the internal control and accounting system. Tests of controls help identify significant deficiencies in an entity's controls.

Audit procedures are essentially a detailed check of the correct reflection in the accounting records of turnover and account balances. The program of audit procedures is essentially a list of actions by the auditor for such detailed specific checks. For substantive procedures, the auditor should determine which sections of the accounting records he will audit and draw up an audit program for each section of the accounting records.

The auditor's conclusions for each section of the audit program, documented in working documents, are the factual material for drawing up the audit report and audit report, as well as the basis for forming an objective opinion of the auditor on the financial statements of an economic entity.

At the end of the audit planning process, the general plan and audit program must be documented and endorsed in the manner established by the audit organization.

2. Planning an audit in accordance with ISA 300

2.1 General provisions of ISA 300

International Standards on Auditing (ISA) provide the same basic principles that all auditors must follow in their professional activity. They achieve a twofold goal:

Development of auditing in those countries where the level of professionalism is lower than the global one;

To the extent possible, unify approaches to auditing internationally.

International Standard on Auditing 300, Planning an Audit of Financial Statements, addresses the auditor's responsibility to plan the audit of financial statements.

Audit planning involves establishing the overall audit strategy for the audit engagement and developing an audit plan.

Adequate planning helps achieve audit objectives in several ways, including the following:

Helps ensure that important areas of the audit are given due attention.

Helps the auditor identify and resolve potential problems in a timely manner.

Assists the auditor in properly organizing and managing the audit engagement to ensure its effective implementation.

Assists in selecting project team members with the appropriate level of ability and competence to respond to anticipated risks, and in allocating work among project team members.

Facilitates the direction, supervision, and review of project team members' work.

Assists, as needed, in coordinating the work performed by component auditors and experts.

The auditor's goal is to plan the audit so that it is performed efficiently.

The auditor should take the following actions: initial stage current audit agreement:

Performing the procedures required by ISA 220, Quality Control for an Audit of Financial Statements, regarding the continuation of the client relationship and the specific audit engagement;

Assessing compliance with ethical requirements, including independence, as required by ISA 220, Quality Control for an Audit of Financial Statements; And

Establishing the fact that the terms of the engagement are understood, as required by ISA 210, Agreeing on the Terms of Audit Engagements.

The auditor should plan the nature, timing, and extent of directing the project team's work, supervising the project team members, and reviewing the work they performed.

The auditor should include in the audit documentation (ISA 230, Audit Documentation):

General audit strategy;

Audit plan;

Any significant changes made during the audit engagement to the overall audit strategy or audit plan, and the reasons for such changes.

The auditor should take the following actions before commencing the initial audit engagement:

Perform the procedures required by ISA 220 in relation to the acceptance of the client and the specific audit engagement;

Contact the predecessor auditor if there has been a change in auditors, in accordance with ethical requirements appropriate under the circumstances.

The nature and extent of planning efforts will vary depending on the size and complexity of the entity's organizational structure, the past experience of key engagement team members with the entity, and changes in circumstances encountered during the course of the audit engagement.

The planning process does not consist of discrete parts, but rather is continuous and iterative. This process usually begins almost immediately after the completion of the previous audit (or simultaneously with it) and continues until the completion of the current audit engagement. However, when planning the audit, the auditor must take into account the timing of certain activities and audit procedures that must be completed before further audit procedures are performed. For example, planning includes the need to consider issues such as:

Analytical procedures to be performed as part of a risk assessment.

Gaining general knowledge about regulatory framework applied to the subject, and the subject’s compliance with the requirements of this base.

Determining the level of materiality.

Participation of experts.

Perform other risk assessment procedures.

The auditor may decide to discuss planning elements with the entity's management. This is done to facilitate the conduct and management of the audit engagement (for example, to coordinate some of the planned audit procedures with the work of the entity's personnel). Although these discussions occur frequently, the auditor is still responsible for the overall audit strategy and plan. When discussing issues included in the overall audit strategy and audit plan, every effort should be made to avoid compromising the effectiveness of the audit. For example, discussing the nature and timing of detailed audit procedures with management may jeopardize audit effectiveness by making audit procedures too predictable.

Involving the engagement partner and other key members of the engagement team in audit planning leverages their experience and understanding of the issues, thereby increasing the efficiency and effectiveness of the planning process.

2.2 Audit planning procedures

According to ISA 300, each stage of audit planning includes a specific set of procedures.

Preliminary planning is carried out at the stage of getting to know the client before concluding an audit agreement. Pre-planning consists of:

General familiarity with the client’s financial and economic activities;

Determining the composition of specialists to conduct the audit;

Determining the total time spent on conducting an audit.

Performing preliminary engagement work early in the ongoing audit engagement assists the auditor in identifying and assessing events or circumstances that may adversely affect the auditor's ability to plan and perform the audit engagement.

Performing these preliminary engagement activities helps ensure that the auditor plans the audit engagement that:

During the audit, the auditor is independent and has the capabilities necessary to carry out this engagement.

There are no issues related to the integrity of the entity's management that would affect the auditor's desire to continue to perform the engagement.

There is no misunderstanding with the client regarding the terms of the agreement.

Issues related to the continuation of the client relationship and compliance with ethical requirements, including independence, should be considered during the audit engagement as new conditions arise or circumstances change.

Performing initial procedures for both the continuation of the client relationship and the ethical compliance assessment (including independence) early in the ongoing audit engagement means that they are completed before other significant work is completed under the ongoing audit engagement.

For continuing audit engagements, such initial procedures are typically performed almost immediately after (or concurrently with) the completion of the previous audit.

The process of developing the overall audit strategy helps the auditor determine, subject to completion of risk assessment procedures, issues such as:

Resources required for specific audit areas, such as using engagement team members with relevant experience to work on high-risk areas or using experts to work on complex issues;

Allocation of resources to specific audit areas, for example, the number of project team members assigned to oversee inventory counts at inventory locations, the extent of review of other auditors' work in the case of a group audit, or the budget of audit hours to allocate to high-risk areas. level of risk;

The timing of these resources, such as at an audit milestone or cut-off date; And

How these resources are managed, directed, and supervised, such as when project team briefing and debriefing meetings are expected to take place, how review by the project partner and manager will be conducted (e.g., on-site or off-site), and whether a follow-up review will be conducted quality of implementation of the agreement.

The auditor should determine the overall audit strategy, which sets the scope, timing and direction of the audit and serves as a guide in developing the audit plan.

In determining the overall audit strategy, the auditor should:

Establish the characteristics of the agreement that determine its scope;

Establish the objectives of the reporting provided under the agreement to plan the timing of the audit and the nature of the necessary communications;

Consider factors that, in the auditor's professional judgment, are significant in directing the project team's efforts;

Review the results of preliminary work on the engagement and, if necessary, consider whether knowledge gained from the engagement partner's performance of other engagements for the entity is relevant to the audit; And

Establish the nature, terms of use and amount of resources required to fulfill the agreement.

The audit plan is more detailed than the overall audit strategy and includes the nature, timing, and scope of audit procedures to be performed by project team members. Planning for these audit procedures occurs throughout the audit as the audit plan is developed.

For example, planning audit procedures to assess risk is usually carried out at the initial stage of the audit. However, planning the nature, timing and extent of specific audit procedures depends on the results of the risk assessment procedures. The auditor may begin performing audit procedures on certain classes of transactions, account balances and disclosures until more than detailed plan audit of all remaining audit procedures.

The audit plan should include a description of:

The nature, timing and extent of planned risk assessment procedures as defined in ISA 315, Identifying and Assessing the Risks of Material Misstatement Based on Knowledge of the Entity and its Environment.

The nature, timing and extent of planned further audit procedures at the assertion level, as defined in ISA 330, Auditor Actions in Response to Assessed Risks.

Other planned audit procedures that must be performed for the engagement to comply with the requirements of the ISAs.

The auditor should update and modify the overall audit strategy and audit plan as necessary during the course of the audit.

Documenting the overall audit strategy is a record of the key decisions needed to properly plan the audit and keep the project team aware of significant issues. For example, the auditor may prepare a summary of the overall audit strategy in the form of a memorandum containing key decisions regarding the overall scope, timing and conduct of the audit.

Documenting audit plans is a record of the planned nature, timing, and extent of risk assessment procedures, as well as subsequent assertion-level audit procedures in response to assessed risks.

Documentation also provides evidence that audit procedures have been properly planned so that they can be reviewed and approved before they are performed. The auditor may use standard audit programs or audit checklists, adjusted to suit the circumstances of the engagement.

The auditor's documentation of significant changes made to the overall audit strategy and audit plan, and therefore changes made to the planned nature, timing and extent of audit procedures, should explain why the significant changes were made and contain the overall audit strategy and plan that were ultimately accepted.

The documents also reflect appropriate responses to significant changes that occur during the audit.

2.3 Additional audit planning considerations

ISA 300 outlines the following additional aspects of audit planning:

1) Changing planning decisions during the audit

As a result of unexpected events, changes in conditions, or audit evidence obtained from audit procedures, the auditor may need to modify the overall audit strategy and audit plan and, therefore, the planned nature, timing, and extent of audit procedures based on the revised risk assessment.

This may occur when the auditor's attention is drawn to information that is significantly different from the information that was available when the auditor planned the audit procedures.

For example, the auditor may obtain audit evidence from performing substantive procedures that is inconsistent with audit evidence obtained from testing controls.

The nature, timing, and scope of directing the project team's work and supervising and reviewing the work performed by project team members varies depending on many factors, including:

The size and complexity of the entity's organizational structure.

Audit scope.

Assessed risks of material misstatement (for example, an increase in the assessed risk of material misstatement for a given audit area usually requires a corresponding increase in the scope and timely direction of the project team's work and supervision of project team members, as well as more detailed review of their work).

The abilities and professional competence of the members of the project team performing the audit.

3) Aspects characteristic of small entities

When an audit is performed entirely by the project partner, issues related to directing the project team, supervising project team members, and reviewing their work do not even arise.

In such cases, the project partner, having personally carried out all the work, is aware of all relevant aspects.

Forming an objective opinion regarding the appropriateness of the judgments made during the audit may cause practical problems if the same person also performed the entire audit.

For very complex or unusual matters where the audit is being performed by a solo practitioner, it is advisable to plan to seek advice from other auditors with the necessary experience or from a professional accounting organization.

In terms of the audit plan, standard audit programs or checklists may be used, based on the assumption that there are a small number of control activities to be performed, as is likely to be the case in a small business entity, provided that such activities meet the circumstances of the engagement, including the auditor's risk assessment.

4) Additional aspects specific to primary audit engagements

The purpose of audit planning is the same for both the initial audit and the recurring audit.

However, in an initial audit, the auditor may need to increase the amount of planning work because the auditor does not have past experience with the entity that would normally be considered when planning a recurring engagement.

For an initial audit, the auditor may consider additional issues in developing the overall audit strategy and audit plan, including:

Unless prohibited by law or regulations, interaction with the previous auditor, for example, reviewing the working papers of the previous auditor.

All substantive matters (including the application of accounting principles or auditing and financial reporting standards) that are discussed with management in connection with the initial appointment as auditors, the communication of those matters to those charged with governance, and the impact of those matters on the overall strategy audit and audit plan.

Audit procedures necessary to obtain sufficient and appropriate audit evidence regarding opening balances.

Other procedures required by the firm's quality control system for primary audit engagements (for example, the firm's quality control system may require the participation of another partner or senior employee to review the overall audit strategy before significant audit procedures are performed or to review reports before they are issued).

Conclusion

In this course work conclusions were obtained on the corresponding goals set at the beginning of the work.

The course work covers the functioning of audit planning and its provisions in accordance with International Auditing Standard 300 “Planning an Audit of Financial Statements”.

The first chapter covered the theoretical aspects of audit planning. A definition was given of the concept of audit planning, which consists in determining its strategy and tactics, choosing procedures and methods that allow the most effective achievement of the goal - confirming the reliability of financial statements.

Thus, it is shown that audit planning is one of the most important stages of the audit.

Also in the first chapter, the stages of audit planning were identified, which include pre-planning; preparation and drawing up of a general plan; preparation and drawing up of an audit program.

The second chapter discusses audit planning in accordance with International Standard on Auditing 300, Planning an Audit of Financial Statements. The purpose of the auditor’s work, the auditor’s actions regarding the reporting verification work, the dependence of the nature and scale of planning work on the size and complexity of the entity’s organizational structure, past experience, changes that occurred in the circumstances that arose during the implementation of the audit agreement were determined.

Also, the second chapter identifies the necessary audit procedures at all stages of planning (pre-planning, development of the overall audit strategy and audit plan), and defines the documentation of the overall audit strategy and audit plan. In addition, some additional considerations for planning an audit in accordance with ISA 300 are provided.

List of sources used

1 Zharylgasova B.T., Suglobov A.E. International auditing standards: Textbook. - M.: KNORUS, 2007. - 400 p.

2 Sheshukova T.G., Gorodilov M.A. Audit: theory and practice of applying international standards: Textbook. - M.: Finance and Statistics, 2005. - 184 p.

3 Erofeeva V.A. Audit. Lecture notes. - M.: Yurayt, 2010. - 199 p.

4 Lukyanchuk U.R. Audit. - M.: Allel-2000, 2011. - 64 p.

5 Kamzolov V.A., Radachinsky V.I. Audit. - M.: Allel-2000, 2005. - 64 p.

6 Morozova Zh.A. Planning in auditing. Practical guide. - NalogInform, 2007. - 93 p.

7 Sokolova E.S., Sitnov A.A. International auditing standards. M.: MFPA, 2004. - 54 p.

8 Sheremet A.D., Suits V.P. Audit: Textbook. - M.: INFRA-M, 2006. - 448 p.

9 S.P. Suvorova, N.V. Parushina, E.V. Galkina. International auditing standards: Textbook. - M.: Publishing House "FORUM": INFRA-M, 2007. - 320 p.

10 Collection of International Standards on Auditing and Quality Control. - Almaty, 2009. - 985 pages.

11 Collection of International Standards on Auditing, Assurance and Ethics. - Almaty, 2007. - 1260 p.

12 Konkov V.I. International auditing standards: Textbook. - Arkhangelsk: ASTU Publishing House, 2007. - 226 p.

13 Arkharova Z.P. International Standards of Auditing (ISA): Educational and methodological complex. - M.: Publishing house. EAOI Center, 2008. - 104 p.

Posted on Allbest.ru

Similar documents

The essence, goals and objectives of audit and auditing activities. Contents of preliminary audit planning. Construction of an internal control system. Audit planning in a computerized environment. Methodology for auditing financial statements.

course work, added 06/19/2015

Ensuring the quality of work of the audit firm in accordance with the requirements of international standards. The auditor's responsibility to address fraud and error during the audit of financial statements. Audit of evaluative knowledge, objectives of audit control.

test, added 02/12/2010

Criteria for auditing standards. Evaluation of FPSAD 1 “The purpose and basic principles of the audit of financial (accounting) statements” and ISA 200 “General objectives of the independent auditor and conducting an audit in accordance with international auditing standards.”

abstract, added 12/13/2011

The concept of audit, planning principles. Sources of obtaining information about the organization. Drawing up a general audit plan. Control test program. Calculation of risk level for planning. Sample plan for an audit of fixed assets.

course work, added 10/25/2012

Principles and stages of planning. Activities for conducting audits and providing related services carried out by audit organizations and individual auditors. Preliminary planning, preparation and preparation of a general plan, audit program.

abstract, added 10/26/2009

The essence of audit and auditing activities, its goals and objectives. Determining the audit strategy. Audit planning. Preparation of a general audit plan and program. Rights and responsibilities of auditors. Subjects and objects of audit control.

abstract, added 09/28/2006

Concept, goals and economic conditions of audit, types of work in auditing activities. Historical aspects of the emergence and development of audit in Russia and abroad. International auditing standards, classification of auditing standards.

course work, added 02/25/2010

Features of planning an audit of the financial (accounting) statements of an enterprise. The concept of materiality in auditing, methods for determining its level. The essence and types of audit risk. Assessment of accounting and internal control systems during the audit.

abstract, added 06/30/2010

Characteristic features of an audit in accordance with the Federal Law “On Auditing Activities”. Differences between audit and audit. Scope of the auditor's tasks. The concept of internal audit according to the Russian Federation audit standard “Study and use of internal audit work.”

test, added 11/04/2012

Difference between auditing and accounting. Types of audit. Types of audit, its purpose and objectives. Audit standards. Auditing activities in Ukraine. Planning audits. Stages and areas of audit. Audit procedures. Audit evidence.

Topic: ISA 300 Planning an audit of financial statements

Type: Test| Size: 83.73K | Downloads: 56 | Added 04/03/17 at 10:14 | Rating: 0 | More Tests

University: Financial University

Year and city: Moscow 2016

ISA 300 Planning an audit of financial statements. 3

LIST OF REFERENCES USED... 13

ISA 300 Planning an audit of financial statements

On the territory of the Russian Federation, international auditing standards are applied, adopted by the International Federation of Accountants and recognized in the manner established by the Government of the Russian Federation, which complies with the requirements of the Federal Law “On Auditing Activities” (No. 307-FZ dated December 30, 2008 (as amended on October 2, 2016).

Moreover, from 2017, in order to conduct an audit of accounting (financial) statements prepared for any reporting periods, it will be necessary to apply international auditing standards introduced by Orders of the Ministry of Finance of Russia dated October 24, 2016 No. 192n, dated November 9, 2016 No. 207n, and if the agreement to conduct an audit of the accounting (financial) statements of the organization was concluded before 01/01/2017, the audit can be carried out in accordance with the standards that were in force before the entry into force of these ISAs.

Let us note that the federal rules (standards) of auditing activities (FPSAD) were previously developed in accordance with the ISAs, but much more slowly than the process of improving the ISAs themselves took place. Thus, 24 FPSAD out of 38 currently in force correspond to the outdated version of ISA, which was in force for audits of financial statements for periods beginning on or after December 15, 2004, nine - in force for audits of financial statements for periods beginning on or after December 15, 2009. , five - effective for reporting periods beginning on or after 06/15/2005. or 12/15/2006, .

Let us recall that currently, the set of ISA documents consists of 49 Standards, including a quality control standard, audit standards, review standards, standards for other assurance engagements, as well as standards for the provision of related services.

The procedure for planning an audit is determined by ISA 300 “Planning an Audit of Financial Statements” and FSAD No. 3 “Planning an Audit”.

ISA 300 “Planning an audit of financial statements” includes: introduction, audit planning, plan (audit program) governs the planning of an audit of financial statements. The need for planning is determined by the goal of audit efficiency.

International Standard on Auditing (ISA) 300, Planning an Audit of Financial Statements, should be read in conjunction with ISA 200, Essential Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with International Standards on Auditing.

In addition, we note that one of the main practical advantages of ISAs is the presence of cross-references included in the texts of ISAs themselves or in footnotes in them, which allow the auditor to prioritize the application of a particular standard during the audit, while in the FPSAD there are cross-references are missing, because regulatory documents, operating in the Russian Federation, it is not customary to make cross-references.

As a rule, each FPSAD contains requirements and recommendations relating to one area of the audit, without indicating the order of its application during the execution of the engagement, for example, separate standards governing documentation, samples, analytical procedures, external confirmations, related parties, materiality and others audit areas. In ISAs, the link to the time of application of a particular standard by the auditor is implemented through cross-references in them (figure):

Rice. Risk-based approach when planning an audit of financial statements (based on ISA 300 and other ISAs),

The figure schematically illustrates the requirements and recommendations of which international standards, other than ISA 300 “Planning an Audit of Financial Statements”, should be followed during audit planning.

Following a risk-based approach allows auditors to perform audits more effectively and efficiently. The auditor's understanding of the risks of the audited entity's business activities significantly increases the likelihood of identifying the risks of material misstatement of information in the statements. Before the risk-based approach was reflected in ISAs, auditors, based on their professional judgment, tended to select for audit the areas of reporting that were the most significant from a quantitative point of view, which was fundamentally wrong, since it always existed and exists the probability of violation of the “completeness” premise, i.e. not fully reflecting balances on accounting accounts, business transactions and disclosures. As a result, areas not selected for inspection due to the insignificance of their valuation could contain a significant misstatement that escaped the attention of the auditor.

ISA 300, Planning an Audit of Financial Statements, outlines the scope of this standard by specifying that the standard applies to repeat engagements and separately providing additional notes relevant to first-time audit engagements. The role is indicated (development of a general audit strategy for the assignment and drawing up an audit plan), planning periods, effective date (from 12/15/2009).

This ISA reflects the following objective - the auditor's objective is to plan the audit so that it is conducted effectively.

Requirements are listed, incl. actions of the auditor in preliminary work on the assignment; planning activities are listed; documentation, incl. references are provided to ISA 230 “Audit Documentation”, ISA 220 “Quality Control in an Audit of Financial Statements”.

Application guidance and other explanatory materials are presented, and an Appendix is provided - considerations for developing an overall audit strategy.

Note that ISA 300 “Planning an audit of financial statements” is set out on 12 pages; it corresponds to the Russian auditing standard, namely, auditing standard 3 “Audit planning”, which is set out on only 2 pages. Those. the results of a formal comparison of these standards show that Russian analogue the international standard is much more concise, as a result it is six times shorter. In order to understand the reasons for this difference, let’s consider comparing the structure and content of these standards in the form of an analytical table (table):

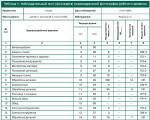

Comparison of planning standards according to ISA 300 and PSAD 3

|

ISA 300, Planning an Audit of Financial Statements |

PSAD 3 “Audit Planning” |

|

|

Introduction |

Scope of application |

Introduction |

|

Role and timing of planning |

||

|

Effective date |

||

|

Requirements |

||

|

Planning Activities |

Work planning |

|

|

Documentation |

||

|

General audit plan |

||

|

Audit program |

||

|

Changes to the overall audit plan and program |

||

|

Practical Application and other explanatory materials |

Role and timing of planning |

|

|

Involvement of key audit team members |

||

|

Preparatory activities for the assignment |

||

|

Planning Activities |

||

|

Documentation |

||

|

Job Options |

||

|

Reporting objectives, audit timing and nature of communication |

||

|

Material facts, preparatory activities for the assignment and information obtained during the performance of other assignments |

||

|

Nature, timing and scope of resources |

||

A more thorough study of the texts of both standards essentially allows us to assess the qualitative differences in standardization in terms of international rules and domestic. They boil down to the fact that the domestic document is a framework document, while the international one contains clear detailed instructions describing many nuances and sequential actions linked to specific clauses of other standards, the requirements of which must be fulfilled in a particular case.

ISA 300, Planning an Audit of Financial Statements, sets out the development of an overall strategy and detailed approach to the expected nature, timing and extent of the audit so as to reduce audit risk to an acceptably low level. Proper planning ensures that all important audit issues are given due attention and that potential problems are identified and resolved. Those responsible for the audit engagement participate in the planning process. The audit must be carried out efficiently and in a timely manner.

Planning an audit engagement is an ongoing process. Preliminary planning should provide assurance that the auditor has considered various events and circumstances that could adversely affect the ability to perform the audit in a manner that reduces audit risk to an acceptably low level. Based on the results of preliminary planning, an overall audit strategy is developed to help the auditor determine the nature, timing and amount of resources required to fulfill all the conditions of the audit engagement.

After the audit strategy is adopted, audit tactics are developed in the form of a detailed plan (program). In accordance with ISA 300, Planning an Audit of Financial Statements, planning an audit allows you to:

Identify the most important areas of the audit;

Effectively distribute the amount of work among auditors;

Determine the size of the entity, the complexity of the audit;

Acquire knowledge about the client’s business;

Identify significant events and transactions affecting the financial statements.

The form and content of the audit plan may vary depending on the size of the business of the economic entity; audit difficulties; specific techniques and technologies used by the auditor in the audit process. The auditor may discuss elements of the audit plan and specific audit procedures with the client's management in order to coordinate his activities with the work of the client's personnel to ensure the effectiveness of the audit. However, the auditor retains responsibility for the audit plan and program.

In accordance with the requirements of ISA 300 “Planning an Audit of Financial Statements”, the audit plan contains the following sections:

Business Understanding: Reflects general economic factors and industry conditions affecting the entity's business; important characteristics of the entity, its business, results of financial and economic activities and requirements for its reporting, including changes that have occurred since the date of the previous audit; general level of management competence;

Understanding the environment and internal control: accounting policies and changes thereto; the impact of new accounting or auditing regulations; the auditor’s accumulated knowledge of SBU and ICS, as well as the corresponding attention expected to be paid to control tests and substantive procedures;

Risk and materiality: expected assessments of control system risk, as well as identification of important audit areas; establishing materiality levels for audit purposes; the possibility of material misstatements, including historical misstatements, or fraud; identifying complex areas of accounting, including those related to valuation knowledge; a possible shift in emphasis towards specific audit areas; the impact of information technology on auditing; the work of the internal audit unit and its expected impact on external audit procedures;

Nature, timing and scope of procedures: involvement of other auditors in the audit of components, for example, branches, subsidiaries and divisions;

Coordination, direction of work. supervision of it and its analysis: involvement of experts;

Other aspects - for example, staffing requirements; the possibility that the going concern assumption of the enterprise may be called into question, etc.

Comparative analysis international auditing standards ISA 300 “Planning an audit of financial statements” with the Russian auditing standard FSAD No. 3 “Audit planning” is presented in the table:

In fairness, it must be admitted that the third generation federal standards (FSAD) are closer in spirit to international standards, but even they are not specific enough and are often declarative in nature. However, the quality of the text in the Russian version has noticeably deteriorated compared to the standards of the first and second generations. For those involved in audit methodology, these are known facts.

In conclusion, we note that the transition to ISA in Russian Federation is an important step towards increasing the efficiency and quality of audits conducted by Russian auditors, as well as increasing confidence in audit results on the part of users of financial statements and society as a whole.

With all the understandable difficulties and costs of the transition period, which for many Russian auditors will most likely be 2017, the numerous advantages of using ISAs by Russian auditors are beyond doubt. Such advantages are both general conceptual and purely practical. And while the conceptual benefits of applying ISAs are rather a matter of interest to users, the auditing profession and society at large, practical advantages, only some of them will fully “crystallize” and become obvious to Russian auditors in the course of performing specific audit assignments under ISAs and as they accumulate knowledge and experience with ISAs.

LIST OF REFERENCES USED

1. “On auditing activities” Federal Law of December 30, 2008. No. 307 - Federal Law (as amended on October 2, 2016).

2. On approval of the Federal rules (standards) of auditing activities.” Decree of the Government of the Russian Federation dated September 23, 2002 No. 696 (as amended on December 22, 2011).

3. International Auditing Standard 300 “Planning an Audit of Financial Statements” (put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated October 24, 2016 No. 192n).

4. Baranenko S.P., Busygina A.V. Problems and prospects for the implementation of international financial reporting standards in Russia // Economy and society: modern development models, 2014, No. 8, pp. 70 - 82.

5. Gaidarov K.A. Comparative analysis of federal auditing standards and ISA: issues of quality control of audit organizations // Auditor, 2014, No. 6. URL: http://base.garant.ru/57569142

6. Zubova E.V. Nadezhdina M.E. Advantages of applying international auditing standards // Audit Gazette, 2016, No. 11. - P. 9 - 12.

7. Kozmenkova S.V., Kemaeva S.A. Audit: problematic issues and development paths // International accounting, 2015, No. 3. - P. 24 - 27.

8. Serebryakova T.Yu. International audit standards as an object of research // International accounting, 2015, No. 4. - P. 16 - 22.

If the Test work, in your opinion, is of poor quality, or you have already seen this work, please let us know.

Identifying errors in financial statements is the main purpose of the audit.

Purpose of ISA 240- establishing standards and providing guidance regarding the auditor's responsibility to address fraud and error during the audit.

Errors- this is an unintentional distortion of reporting:

Mathematical errors;

Account errors;

Skipping FHD facts;

Incorrect application of UE.

Fraud is a deliberate act committed for the purpose of obtaining illegal benefit:

Manipulation;

Falsification;

Distortions in reporting;

Asset misappropriation;

Hiding or omitting accounting information in documents;

Reflection of non-existent transactions;

Incorrect application of UE.

To detect fraud and errors, the auditor may make inquiries to the client's management regarding:

management's assessment of the risk of material misstatement due to fraud and error;

accounting and internal control systems;

identifying management's awareness of fraud and errors.

Carrying out such work is necessary to reduce audit risk(MSA 400).

At the planning stage, the auditor must assess the risks arising during the audit. Risk is influenced by:

Doubts about the integrity and competence of management;

Pressure on the auditor;

Unusual operations;

Problems in collecting sufficient and relevant evidence.

Audit risk means that the auditor may express an inappropriate opinion when the financial statements contain financial misstatements.

The auditor should perform testing procedures that indicate possible misstatements.

The auditor should document fraud risk factors.

The auditor is required to communicate this information to the client's management if misstatements and fraud are detected (ISA 260). This message should contain information about significant deficiencies in internal controls.

When violations are serious and constitute deliberate fraud, the auditor is required to report to law enforcement.

The auditor may refuse to perform an engagement if there are serious misstatements and disagreements with the client's management.

PSAD does not contain the terms “error” and “fraud.”

8. MSA 300 – planning an audit of financial statements

Planning for the purposes of ISA 300 Planning refers to the development of an overall strategy, as well as detailing the nature, timing and scope of the audit.

Proper planning of the audit work ensures that all important aspects of the audit are given due attention. Planning also allows you to identify possible problems in order to complete the work in the shortest possible time.

The planning process makes it possible to distribute assignments among auditor assistants and coordinate the work of other auditors and experts (technical, legal, and information technology).

The scope of audit planning is influenced by:

Size of the economic entity;

Difficulty of auditing;

Experience of the auditor working with the audited entity;

Knowledge of the business of an economic entity.

During development general audit plan The auditor is required to consider audit procedures and the risk of errors and fraud not being detected.

On the size of the economic entity;

Difficulties of auditing;

Specific techniques and technological processes that are expected to be used during the audit.

When developing an audit plan, the following must be considered:

Information about the business of the economic entity;

Understanding of the accounting system and internal control;

Risk and materiality;

Nature, timing and scope of procedures;

Coordination, supervision and analysis of work;

Other aspects.

Audit program– a set of instructions for auditor assistants, as well as a means of monitoring the performance of work.

The audit planning process is carried out continuously throughout the audit due to possible changes in various circumstances; changes must be documented.

Kolobaeva Yulia Borisovna

Bachelor's student of the Department of Accounting, Analysis and Audit, Federal State Budgetary Educational Institution of Higher Education "Financial University under the Government of the Russian Federation", Moscow, Russian Federation

Abstract: The article analyzes the implementation of international auditing standards on the territory of the Russian Federation and its consequences. Thus, auditors must submit a new form of report designed to increase the transparency of reporting. The ISA requirements for planning an audit of financial statements, the content of the audit plan, and the information interaction of auditors with persons responsible for corporate governance in the audited organization are set out.

Keywords: international auditing standards, audit planning, audit plan, information communication

Planning of the audit of the financial statements in accordance with International Standards on Auditing

Kolobaeva Julija Borisovna

student of Department of accounting, analysis and audit, Financial University under The Government Of The Russian Federation Moscow, Russian Federation

Abstract: the article analyzes the introduction in Russia of international standards on auditing and its consequences. Auditors are required to submit a new form conclusion designed to enhance the transparency of reporting. The requirements of ISA to the audit planning of financial statements, presentation of audit plan, communication between the auditor and the persons responsible for corporate governance of the audited entity are presented.

Keywords: international auditing standards, audit planning, audit plan, communication

The conditions of financial and economic activity are changing, more attention from the state and business is paid not only to the form, but also to the content of accounting (financial) statements. A step towards increasing the publicity and transparency of organizations' reporting was the introduction in the Russian Federation of international auditing standards (ISA), which contain procedures and requirements for auditing. Since January 1, 2017, 30 auditing standards have been put into effect on the territory of the Russian Federation, according to Order of the Ministry of Finance dated October 24, 2016 N 192n. Also, by Order of the Ministry of Finance dated November 9, 2016 No. 207n, 18 more new auditing standards were introduced from January 1, 2017.

The Federal Law of December 30, 2008 N 307-FZ “On Auditing Activities” in Article 7, paragraph 1 now establishes that “auditing activities are carried out in accordance with international auditing standards, which are mandatory for audit organizations, auditors, self-regulatory organizations of auditors and their workers..." The standards were also officially published by the Ministry of Finance. In this regard, the research questions of ISA are relevant; it is necessary to achieve a common understanding by auditors of the basic principles of auditing and the formation of an audit opinion.

Instead of the usual form of an auditor's report on several sheets with standard text, for all new contracts for mandatory audits concluded from January 1, 2017, a more information-rich report is drawn up in accordance with ISA. Leonid Zinovievich Shneidman (Director of the Department for Regulation of Accounting, Auditing and Financial Reporting of the Ministry of Finance of the Russian Federation) emphasized that investors in recent years have expressed sharp criticism of audit reports due to the insufficient amount of information provided. In his opinion, the new form of conclusion will not only contain an assessment of the company’s reporting, but also draw attention to significant points in the activities of the audited entity, that is, what attracted the attention of the auditor and carries significant risks, etc.

There is an opinion that the transition to ISA will increase the labor intensity of the audit by 30-40%, since in order to meet the requirements of ISA, the number of audit procedures, new forms and tables to fill out, and other auditor documents will increase. On the other hand, L.Z. Shneidman noted that the transition to ISA will improve the quality of the audit.

International Standard on Auditing (ISA) 300, Planning an Audit of Financial Statements, sets out the auditor's responsibilities for planning an audit of financial statements (Table 1). According to paragraph 2 of this ISA, audit planning involves developing an overall audit strategy for the engagement and drawing up an audit plan. This article will outline the approximate contents of the audit plan included in the information letter.

In the Russian Federation it was used Federal Rule(standard) of auditing activities N 3 “Audit Planning”, developed taking into account ISA, establishing requirements for audit planning, the responsibility of auditors to plan work so that the audit is effective.

In general, FPSAD 3 is an analogue of ISA 300. It should be noted that the terms “general audit strategy” and “audit plan” ISA 300 are called “general audit plan” and “audit program” in PS No. 3. Therefore, according to the author, audit organizations are ready to transition to new standards. It should be noted that ISA 300 covers audit planning requirements a little more fully, which should improve the quality and efficiency of the service.

Planning plays an important role when conducting an audit of financial statements because:

1) helps the auditor pay attention to important aspects of the audit;

2) identify and eliminate problems in a timely manner;

3) properly formulate the task and manage the process of its implementation so as to complete it effectively;

4) assists in the selection of audit team members with the appropriate skills and qualifications to mitigate risks and in the allocation of work;

5) contributes to the management and control of members of the audit team, analysis of the results of their work;

6) helps to coordinate the work of auditors of the components of the audited entity and experts.

The planning work depends on the size and complexity of the auditee, the experience of key audit team members, and the circumstances that arise during the audit.

As noted in ISA 300, planning is not a separate stage of the audit. It is continuous and cyclical in nature: it often begins immediately after the completion of the previous audit engagement and continues until the completion of the current engagement. Planning is concerned with the analysis of the duration of work and audit procedures that must be completed before the next procedures can be performed. For example, before the auditor identifies and assesses the risks of material misstatement, a list of analytical procedures for assessing risks must be established; gained an understanding of the legal acts of the organization and how it implements them; procedure for determining materiality; feasibility of attracting experts.

According to ISA 300, the auditor's objective is to plan the audit so that it is effective.

Table 1 - ISA 300 requirements for planning an audit of financial statements

|

Participation of key members of the audit team (clause 5) |

The engagement partner and other key engagement team members should be involved in planning the audit, including planning and participating in discussions among engagement team members. |

|

Preliminary work according to instructions (clause 6) |

At the beginning of the audit engagement, the auditor should take the following actions: Perform the procedures required by ISA 220 in relation to the continuation of the client relationship and the audit engagement. Assess compliance with relevant ethical requirements, including independence, in accordance with MCA 220; Obtaining an understanding of the terms of the audit engagement is required by ISA 210 |

|

Planning work (clauses 7-10) |

The auditor must develop an overall audit strategy, 9. develop an audit plan; make changes to the overall strategy and audit plan; plan the nature, timing and scope of work to direct and supervise members of the audit team and to review the results of their work |

|

Documentation (clause 12, A16-A18). |

Includes the overall audit strategy and plan, significant changes thereto, and the reasons for them. Documentation of significant changes in the overall audit strategy and audit plan, changes in the planned nature, timing and scope of audit procedures explains the reasons for making these changes, and the overall audit strategy and audit plan are accepted as final. Documents reflect appropriate responses to significant changes occurring during the course of the audit. |

|

Additional requirements for audit engagements performed for the first time (clause 13) |

Before performing a first-time audit, the auditor shall perform the procedures required by ISA 220 in relation to acceptance of the client relationship and the audit engagement; within the framework of ethical requirements, exchange information with the predecessor auditor |

Source:

As part of the planning requirements of ISA 300, the auditor's responsibilities are established to develop the overall audit strategy and audit plan (Table 2).

Table 2 - ISA 300 requirements for the overall audit strategy and plan

|

General audit strategy (clauses 7.8, A16) |

Audit plan (clause 9, A17) |

|

Reflects the volume, timing and general focus of the audit, the basis for developing an audit plan. When developing, the auditor should: Identify the features of the audit engagement that are decisive for its scope; Confirm the reporting objectives of the audit engagement to plan the timing of the audit and the nature of information communication; Analyze factors that are significant in determining the direction of the audit team; Study the results of the preliminary one, determine whether the experience gained previously while performing tasks in the interests of the organization will be useful for performing new ones; Establish the nature, timing of use and volume of resources for conducting the audit. |

Includes description: The nature, timing and extent of planned risk assessment procedures (ISA 315 (Revised) Planned subsequent audit procedures at the assertion level (ISA 330) Other audit procedures to ensure compliance of the audit engagement with the requirements of ISAs |

|

Documentation of the overall audit strategy - a record of the key decisions necessary to properly plan the audit and communicate significant matters to members of the engagement team. The overall audit strategy may be in the form of a memorandum containing decisions on the overall scope, timing and procedure for conducting the audit. |

Audit plan documentation – a record of the planned nature, timing and extent of risk assessment procedures and subsequent assertion-level audit procedures in response to assessed risks. Documentation provides evidence of the proper planning of audit procedures, which can be reviewed and approved before the procedures are performed. The auditor may use standard audit programs or checklists tailored to the specific circumstances of the audit engagement. |

Source:

In the introduction to the audit plan of the conditional organization “B” (the audited entity), the following words may be given, reflecting the essence of the information message: “The contents of this report (Audit Plan) relate only to issues that have attracted our attention, which we believe should be communicated to you as part of our audit. It is not a comprehensive account of all relevant matters, which may be subject to change, and in particular we cannot be responsible for keeping you informed of all risks that may affect B or any weaknesses in your internal controls.”

After an official request from an economic entity to provide audit services (letter of offer), the audit organization draws up and sends a letter to the client regarding the audit. You can attach to the audit letter preliminary plan audit to coordinate it with the client’s management.

According to ISA 300, Planning an Audit of Financial Statements, in order to facilitate the performance and management of the audit engagement (for example, coordinating audit procedures with the work of the entity's personnel), the auditor may decide to discuss certain aspects of the planning with the entity's management. When discussing issues related to the overall strategy or audit plan, care must be taken not to jeopardize its effectiveness. For example, discussions with management about the nature and timing of audit procedures may compromise the effectiveness of the audit by making the audit procedures too predictable.

The audit plan helps the auditor pay attention to the important aspects of the audit, so it includes a description of the activities of the auditee and the factors influencing them. For example, a description of the understanding of the auditee's activities may include problems or opportunities that auditors respond to (Table 3): “When planning our audit, we must understand the problems and opportunities that we face. We provide a summary of our understanding."

Table 3 - Understanding of the activities of the audited entity

|

Challenges/opportunities |

Response actions |

|

1. Purchasing and commission activities. Movement from procurement services to a full commission business model; Delivering savings through improved procurement and more innovation management contracts |

We will review the progress that what you have done to ensure efficiency in terms of financial sustainability mechanisms |

|

2. Alternative delivery models. Development of your local trading companies, Increased partnerships with other organizations and the non-profit sector |

We will achieve an understanding of C's growth rate and its impact on B as a service provider; we will review governance arrangements in place as Services B and other partnership agreements develop |

|

3. Collaboration with company S. Development of new work measures |

We will discuss your plans in this area through our regular meetings with senior management and those charged with governance, providing input where necessary |

|

4. Financial regulation. Cost calculations showed a 6% reduction in the purchasing power of cash in 2015/16 |

We will consider your mid-term financial plan and financial strategy as part of work on financial sustainability mechanisms |

|

5. Decision making and performance management. Continued pressure on non-financial policy and strategy; internal audit and deficiencies in the internal control system |

We will monitor management reports and assess whether there is an impact on service delivery; We will consider internal audit findings to assess the control environment, which will inform our financial statement testing strategy |

The audit plan outlines “events relevant to the business and the audit”: “When planning our audit, we also consider the impact of key industry events and consider the requirements of auditing standards.” For example, in the area of legislation and financial regulation, the impact of legislative changes may be discussed at regular meetings with senior management and those charged with governance.

In accordance with ISA 300, the auditor must develop an audit plan that includes a description of the nature, timing and extent of the planned risk assessment procedures as required by ISA 315 (Revised).

Paragraph 15 of ISA 260 (Revised) requires the auditor to provide those charged with governance with a summary of the planned scope and timing of the audit, which includes communicating the significant risks identified by the auditor.

The audit plan describes the risks of material misstatement: “In this section, we will describe the significant risks of material misstatement that we have identified. There are two perceived significant risks that apply to all audits in accordance with auditing standards (International Standards on Auditing - ISAs) (Table 4).

Table 4 – Risks of material misstatement

|

Significant risk |

Description |

Independent audit procedure |

|

The revenue cycle includes fraudulent transactions |