How to bring Russians who earn money secretly from the state out of the shadows. Small businesses will be brought out of the shadows Sale of shares in LLC to “special” people

The shadow economy and the volume of gray money continue to undermine political and economic stability in Russia. The Ministry of Finance estimates the shadow sector of the economy to be approximately 15-20% of GDP. “Large sums are hidden in our shadow economy,” said Finance Minister Anton Siluanov. - If our shadow sector is somewhere around 15-20%, and our GDP is somewhere around 60 trillion. rubles, then 15% is 9 trillion.”

According to him, the total tax burden on the Russian economy is 35% - thus, due to illegal business Russian budget is experiencing a shortfall of approximately 3 trillion. rubles of income. The minister noted: “gray” salaries deprive regional budgets of 2 trillion. rubles, and the fight against them is included in the list of tasks of the federal and regional authorities, including tax authorities.

At the same time, earlier the head of the Ministry of Economic Development of the Russian Federation, Andrei Belousov, noted: if small business comes out of the shadows, its share in GDP will be 40-50% versus the current 19% - business ideas are not in short supply in our country. If the issue of illegal business is resolved (according to the minister’s estimates, 18 million people work in it), Russia will be on a par with developed countries in terms of the share of small businesses in the economy.

Meanwhile, experts research institute Global Financial Integrity (GFI) believes that the size of the shadow sector of the Russian economy is much higher - it is estimated at 46% of GDP annually. According to their calculations, from 1994 to 2011, $211.5 billion was illegally withdrawn from Russia. This is income hidden from taxes, bribes, as well as money earned from trafficking in weapons, drugs and people.

According to GFI head Raymond Baker, the country has lost hundreds of billions of dollars that could have been invested in the healthcare system, education, infrastructure and others social spheres. The World Bank also notes: the Russian shadow economy is 3.5 times larger compared to other G7 countries. At the same time, the shadow economy and gray cash flows have been growing steadily over the past two decades due to ineffective political management and the traditional Russian desire of businessmen to avoid paying taxes.

As Anton Soroko, an analyst at the FINAM investment holding, told the Century, it is likely that such high figures obtained during the GFI study are explained by several factors. “Firstly, it seems to me that most of the mentioned outflow occurred in the second half of the 90s - a time of high political instability, low economic transparency and weak consumer confidence. Secondly, a fairly large volume of the shadow economy, which, in fact, becomes a catalyst for these flows.”

With the outflow of capital, the economy loses available funds, which, other things being equal, could be used to finance the infrastructure of the state, social projects, could become the basis for increasing the growth rate of real disposable income of the population, the expert notes.

“One of the main conditions that must be met to reduce shadow turnover cash, is the optimization of the tax system in order to increase accessibility for tax subjects and reduce physical costs for adequate payment of contributions, says Soroko. “We must continue to work on the country’s investment image and improve the microclimate for small and medium-sized businesses.”

According to him, Finance Minister Siluanov's assessment is most likely too optimistic. “I think that the real volume of the shadow sector of the economy is slightly higher - 20-25%,” the analyst believes. - But measures to reduce the share of the “shadow” are already being taken. For example, from 2014, any transactions in cash will be prohibited, provided that the transaction volume exceeds 600 thousand rubles. From 2015, the restriction will become even stricter - from 300 thousand rubles. Thus, increased investment activity will most likely not significantly affect cash flow, since almost all payments must be made through banking structures. I think that these measures will have a positive impact on the occupancy of all levels of the budget. There are much fewer opportunities for fraud in such a situation.”

Bloomberg, citing anonymous sources, reported that Vladimir Putin demanded that government officials ensure the withdrawal of 30 million Russians from the shadow economy. What are the obstacles and side effects of fighting the garage economy?

A couple of weeks ago, Bloomberg, citing anonymous sources, reported that Vladimir Putin demanded that government officials ensure the withdrawal of 30 million Russians from the shadow economy. This happened at a meeting of the Council on strategic development and priority projects. This is probably one of the targeted messages that the president plans to implement in the coming years. About the same as creating 25 million jobs. (Where are they?). And if so, then officials will take the implementation of this order seriously. There is no doubt that tax evasion is a threat economic security and must be stopped. However, what obstacles and side effects are fraught with the fight against the shadow economy?

INVISIBLE OPERATION

A significant share of Russian business is in the shadows in order to pay less taxes. It is worth mentioning that in this case we are talking about the non-criminal part of the shadow economy - that is, the so-called gray (unobservable) economy.

A significant share of Russian business is in the shadows in order to pay less taxes. It is worth mentioning that in this case we are talking about the non-criminal part of the shadow economy - that is, the so-called gray (unobservable) economy.

This includes essentially legitimate economic transactions, the scale of which is understated for the purpose of tax evasion. The broader definition of the shadow economy includes criminal business- drug trafficking, trafficking in weapons, people, smuggling, etc.

Ros The shadow economy in Russia has accelerated since the beginning of the current crisis. From January to September 2014, 1.5 million more people began working in the shadow economy. Their number reached 14.9 million. And from November 2014 to February 2015, informal employment has already increased to 17–18 million people. Every fifth worker from the employed population is employed in the informal sector. Taking into account those who receive part of their salary in envelopes, shadow employment can reach up to 40%.

Does extremist liberal dogmatics influence this process? Undoubtedly.

The entire shadow employment sector can be divided into two parts: 1) companies for which concealment of the tax base is the only condition survival, and 2) companies that could easily survive without going into the shadows.

LIFE IN THE SHADOW

There is another sector of shadow business - small businesses that barely make ends meet and would hardly be able to exist paying taxes in full.Bringing such a business out of the shadows is tantamount to its bankruptcy and liquidation.

There is another sector of shadow business - small businesses that barely make ends meet and would hardly be able to exist paying taxes in full.Bringing such a business out of the shadows is tantamount to its bankruptcy and liquidation.

And this depends, first of all, on economic conditions for activities created by the authorities. Insane lending rates, first of all. Such a business does not bring income to the budget, but it solves the most important problem - ensuring self-employment of the population. Otherwise, people would simply end up on the labor exchange, and the state would have to pay them benefits.

In addition, small businesses contribute to GDP growth (through a multiplier effect on the economy) and support market competition. Moreover, demanding from him export competitiveness, the ability to fulfill government orders (which the Medvedev government is pontificating about) is the height of economic stupidity. This segment of small business is very sensitive to tax pressure. It can hardly be otherwise when profits barely reach the level average salary throughout the country, and profitability is calculated in a few percentage points.

We have already seen the result of unwise regulation of small business taxation when mandatory contributions for small businesses were almost doubled in 2013. individual entrepreneurs. As a result, more than 600 thousand individual entrepreneurs closed in two years. Some went into the shadows, some stopped doing business. The government did it with its own hands. For what?

Going into the shadows for such a business is not a manifestation of greed, but a form of compensation for insufficient state support and increased costs in the form of interest rates on loans (Fig. 1).

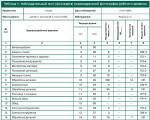

Rice. 1. R results of a survey conducted by the Center for Scientific Political Thought and Ideology during the “Russian Business Meeting on the Problem of Monetary Policy” on March 10, 2016. Respondents were offered n

name the most significant problems of Russian business. The figure shows the percentage of respondents who named the corresponding problem.

Thus, within the shadow economy there are two sectors, the impact on which should be fundamentally different as part of the policy to bring them out of the shadows. Really profitable types of business that actively exploit hired personnel must be fully brought out of the shadows. They must be forced to pay taxes conscientiously and respect the rights of their workers.

As for small businesses balancing on the brink of profitability, the tax burden on them, on the contrary, should be reduced as much as possible by law. The main thing is that monetary policy and loan rates must change. But this is akin to the fact that the government and the president would need to change their faith, or something. Monetarism seems to be in their blood. But society and the political process are not yet able to transfuse blood. At the same time, it is necessary to simplify the administrative procedures for its regulation as much as possible.

All this will increase the number of small businesses. If large taxpayers are effectively removed from the shadows, losses from reducing the tax burden on small businesses will be fully compensated. And the overall economic effect from the growth of small businesses will be even more significant. However, how easy is it to implement such a scenario in Russia?

ECONOMY OF THE PRIVILEGED CLASSES

One of the key problems of Russian public administration the last two decades has been the absence of the rule of law. Legal regulation is fragmented and inconsistent. A state riddled with corruption is unable to ensure that the law is the same for everyone. The strongest players have immunity status, while the weakest bear full responsibility for failure to comply with the law.

So it is in the case of bringing the economy out of the shadows. It is unlikely that the tax authorities will be able to rein in large businessmen who are firmly embedded in the system of high-ranking lobbying and protection protection. And small businesses will very likely have to take the rap for everyone. There is an order! So they will bring the people out of the shadows. By tradition. " Come out of the shadows! A step to the left, a step to the right is considered an escape!».

We have seen such careless execution of initially competent ideas more than once. This and May decrees, turned into mass layoffs of state employees instead of raising their salaries. And laws on public procurement, as a result of which increased red tape and decreased quality, but corruption was never eradicated. And development, instead of which there is crisis after crisis. And much more.

Corruption and lack of normal legal consciousness significantly reduce the effectiveness of any major government undertaking in modern Russia. There is a danger that bringing the economy out of the shadows will not be an exception. If the policy to combat the shadow is unbalanced, small businesses risk being hit.

At the All-Russian conference of commissioners for the protection of the rights of entrepreneurs, business ombudsman Boris Titov presented new program to stimulate the withdrawal of small and medium-sized businesses from the shadows - “Light for the garage economy.”

The administrative and fiscal burden on business has increased, and the situation with the shadow economy has worsened significantly due to decisions taken by the government in 2013-2014, Titov stated. According to him, the state itself is “killing” the positive effect of measures taken to improve the investment and business climate in the country.

Estimates of the informal sector vary. The World Bank estimates the size of the shadow economy in Russia at 50% of GDP, said Vice-President of the Chamber of Commerce and Industry Elena Dybova. Association of Chartered Certified Accountants - 39% of GDP.

According to a study by the Center for Socio-Political Monitoring of the Institute of Social Sciences of the Russian Presidential Academy of National Economy and Public Administration, the share of Russians who over the past year at least sometimes worked unofficially or for a salary in an envelope is about 44.8% of the total number of employed in 2017. The share of those who constantly receive salaries in envelopes increased in 2017 from 28.8% to 31.4%.

According to calculations by the Ministry of Labor and social development, about 15 million people are completely excluded from the formal sector of the economy. Rosstat estimated the hidden wage fund (income of workers in the informal sector and gray wages in the formal sector) at 10.9 trillion rubles in 2015 (13.4% of GDP).

Among the measures that have increased the burden on business are an increase in the rates of social insurance payments, as a result of which more than 0.5 million individual entrepreneurs were deregistered; introduction of a real estate tax for entrepreneurs using a simplified taxation system; increase in penalties; increasing the cadastral value of land; high key rate policy of the Central Bank of the Russian Federation; increase in tariffs of natural monopolies.

New difficulties for business were also brought by the revocation of licenses from banks by the Central Bank, which resulted in the blocking of funds in the current accounts of entrepreneurs. Now this account receives 60-70 requests a day, the manager said. Partner Management Development Group Inc and Ombudsman for the protection of the rights of self-employed citizens and micro-businesses Dmitry Potapenko.

Titov proposed creating a special organizational and legal form “individual entrepreneur without the right to hire” with a simplified regime for registration and deregistration (through the MFC) and reduced fees (payment for a patent should not exceed 10,000 rubles per year. The simplification of the regime was discussed with the Ministry of Economic Development and interested departments, said the Deputy General Director of JSC " SME Corporation» Maxim Lyubomudrov.

Among the measures to stimulate the withdrawal of small and medium-sized businesses from the shadow sector are a moratorium on most inspections, an amnesty for businesses and a halving of fines provided for by the Code of Administrative Offenses for small and medium-sized businesses.

The “Light for the Garage Economy” program also offers a package of measures to financially stimulate small and medium-sized businesses: providing repayable loans for starting a business in the amount of 1 million rubles under the personal guarantee of the entrepreneur; subsidizing up to 5% of annual loans for project financing, canceling Central Bank reservations for targeted loans and using refinancing instruments for securitized loan packages within the project and trade finance system.

According to Titov, consolidated measures will allow by 2025 to increase the contribution of SMEs to GDP from 20% to 30%, and the number of jobs created - from 26% (18.8 million people) to 45% of their total, and GDP as a result will increase by 2.5%.

Most of the proposed measures do not raise objections and some of them are already being discussed by regulators, Lyubomudrov clarified. According to him, the program represents the consolidation of proposals from different departments.

According to calculations by the Institute of Economic Forecasting of the Russian Academy of Sciences, if a package of measures is implemented, up to 60% of Russians could be employed in the SME sector by 2035.

Help button

In addition to the strategic plan, Titov presented at the conference the current functionality - special electronic service“Alarm”, which allows entrepreneurs to receive prompt assistance from an authorized representative in the event of an unscheduled inspection or search. Special mobile application works in “red button” mode and is available for free download in the AppStore.

To use the service, you need to pre-register so that in the future the call center operator can identify the person asking for help when the need arises. When an entrepreneur launches a service, he is asked to provide information about the inspection and inspectors in order to establish its status (scheduled, unscheduled, administrative investigation, whether there is an entry in the register) and record violations. The service allows you to protect the interests of entrepreneurs, counteract illegal inspections, control the actions of inspectors and ensure the participation of an authorized person.

Among the immediate tasks announced by Titov for the commissioners was the creation of a new rating of regions based on the level of business safety. The business ombudsman plans to model such a rating with the help of the FSO: its results can become a tool for interaction with regional authorities, since it will allow assessing the actions of various regional services and departments, and not just the effectiveness of a particular governor.

On November 22, within the framework of the X All-Russian Conference of Commissioners for the Protection of Entrepreneurs’ Rights, experts discussed how to withdraw Russian business from the shadows.

Boris Titov presented a new program to stimulate the withdrawal of small and medium-sized businesses from the shadows - “Light for the Garage Economy”. He also stated that he would propose using it to the President of Russia in the new political season. Among the main decisions of the program is the creation of an Entrepreneurial Code, which will unite all regulatory legal acts on measures of protection and support measures for entrepreneurs.

“Despite the fact that we managed to strengthen our positions in international rankings investment attractiveness, the share of the shadow economy, according to World Bank estimates, has remained at 40% for 7 years. This ensures that we have a tax shortfall of 3 trillion rubles in the state budget and a stable fourth place in the ranking of the largest shadow economies in the world after Ukraine, Nigeria and Azerbaijan,” Andrei Nazarov, Public Ombudsman for the Protection of Entrepreneurs from Criminal Prosecution, pointed out the current paradox.

Boris Titov believes that this is largely due to the contradictory state policy in the SME sector. “The state itself is killing the positive effect of the measures taken to improve the investment and business climate in the country,” he said.

Among the measures that increased the outflow of SMEs into the shadow sector, the business ombudsman named: an increase in the rates of social insurance payments for individual entrepreneurs, the massive termination of lease agreements for the placement of non-profit organizations, the introduction of a real estate tax for entrepreneurs on a “simplified” basis, an increase in penalties and the volume of reporting, growth number of non-tax payments and fees, etc.

The “Light for the Garage Economy” program, as measures to financially stimulate small and medium-sized businesses, proposes to provide repayable loans for starting a business in the amount of 1 million rubles under the personal guarantee of the entrepreneur, subsidizing up to 5% of annual loans for project financing, canceling Central Bank reservations for targeted loans and use of refinancing instruments for securitized loan packages within the framework of the project and trade finance system.

According to Andrei Nazarov, the state also needs to reconsider its attitude towards entrepreneurs, since they take on its functions of employing citizens, paying wages, taxes and social benefits. “A change in vector will help raise the status of entrepreneurship in society, encourage people to bring their business out of the shadows or open new business“he noted.

“Our history already has examples when the state’s attitude towards entrepreneurs allowed them to act as a driver of economic growth: in Tsarist Russia, merchants of different guilds, depending on the amount of taxes paid, received different preferences in the form of benefits and even the weight of their vote when deciding government decisions“, he argued.

“What will prevent us from using this experience today to stimulate entrepreneurs to come out of the shadows? This thesis should be included in the parting words of the business community to the President before the start of the election campaign,” suggested Andrei Nazarov.

According to the estimates of the business ombudsman, if the majority of small businesses are brought into the legal field, this will increase the country’s GDP by 2.5%, increase the number of jobs created by them from 26% to 45% (by 2025) and increase the contribution of SMEs to the country’s GDP from 20% up to 30% (by 2025).

Work to identify cases of informal employment in Komi is yielding results

Employers who have informal relationships with employees should not participate in government procurement. This proposal was voiced by the boss regional administration Ministry of Labor, Employment and social protection Alexander Khokhlov at a meeting of the commission for sustainable economic development and social stability of the republic.

Informal employment, practiced by some employers, causes a noticeable blow to the republic’s economy. This includes a shortfall in contributions to the Pension Fund and tax authorities, and an unreasonable burden on the budget due to the payment of social benefits to citizens who receive wages in envelopes and are essentially not poor, but this can be difficult to prove. According to official data from Rosstat, the number of people employed in the informal sector in 2015 to the total working population in Komi was 16 percent. For comparison: according to Russian Federation this figure was 20.5 percent, in the North-West - 13.7 percent.

To bring business out of the shadows and counteract informal employment, an interdepartmental working group. The results of the work of the interdepartmental group are formed every ten days in the form of monitoring to reduce informal employment in information system Rostruda AIS “Legalization”. Similar groups on the legalization of informal labor relations created in all 20 municipalities of the republic. The working groups include representatives of control and supervisory authorities, which allows issues to be resolved comprehensively. Over the past year, 159 meetings of territorial working groups were held, to which employers practicing informal employment. 747 taxpayers were heard who paid wages below the subsistence level.

The results of these meetings immediately affected both workers’ salaries and budget revenues. Of the 747 employers, 571 raised wages for their workers to the living wage or above. As a result of the wage increase, an additional four million rubles were received into the budget, including 2.3 million into the republican budget. The conclusion of an employment contract does not complete the process of legalization of income; it is necessary that for those employees with whom employment contracts were concluded in the course of the work, employers begin to transfer insurance contributions to the Pension Fund. Accordingly, the amount of incoming contributions to the Pension Fund should increase. In 2015, the amount of insurance premiums accrued and received into the budget of the Pension Fund for the Komi Republic under concluded agreements with employees amounted to 26.6 million rubles. For 2016, excluding the fourth quarter – 91.3 million rubles.

The largest number of people employed in the informal sector is observed today in such industries as construction, trade, vehicle repair, housing and communal services, provision of services, agriculture. People agree to work without obtaining a work book and thereby deprive themselves of any protection from illegal actions of the employer. If they lose their job, become disabled or have a child, they cannot claim any benefits. social guarantees. Without officially registering an employee, the employer deprives him pension provision: the period of work without registration will not be included in the length of service. In addition, a citizen employed unofficially does not have the right to receive a bank loan.

Since without the help of citizens themselves it can be difficult to identify employers who violate labor laws, was organized hotline, where you can call and report facts of non-registration of labor relations or envelope payments of wages.

Separately, Alexander Khokhlov focused on the category of people who, through their actions, also cause damage to the budget. These are the so-called professional unemployed, who are familiar to all specialists at employment centers. With short breaks, they can be registered as unemployment at employment centers for years and receive benefits. Since this is a specific problem that requires special attention, representatives of local employment centers were included in the municipal working groups. CZN employees are working to identify facts of illegal receipt of unemployment benefits.

During January-December 2016, 4,924 cases of unemployed citizens were reviewed. As a result, 139 facts of violations were identified. In particular, 70 people from this number hid the facts of employment or the assignment of a pension to them and continued to receive benefits, although according to the law they no longer had the right to this. Another 64 people hid the fact of their employment, that is, in fact, they worked unofficially and at the same time had the status and benefits of the unemployed. Another five people submitted certificates of secondary education to employment centers. wages, which does not correspond to reality. Thus, the total amount of illegally obtained funds amounted to 590.1 thousand rubles. More than 450 thousand rubles were returned to the state.

As Alexander Khokhlov said, one of the most discussed business topics recently has been a patent for self-employed citizens. A new preferential system of taxation and business registration in the country was introduced in 2016. The authorities plan that in this way they will bring out of the shadows several million economically active people who worked in the shadow business.

People, to one degree or another, encounter informal employment when they are recipients of various services, for example, in housing and communal services. Since the times of the USSR, the practice of unofficial settlement with a plumber or plasterer has been preserved. However, Dr. economic sciences, Associate Professor, Institute of Socio-Economic and Energy Problems of the North Komi scientific center The Ural branch of the Russian Academy of Sciences, Larisa Popova, warns against punitive measures against citizens who personally provide such services. Because as long as there is demand, there is also supply. Often people who advertise in newspapers ensure greater availability of services on the market, but at the same time obtaining a patent for their work for an average of 7,200 rubles is a reasonable alternative to registration entrepreneurial activity and the possibility of legalizing their position. It is very important to change the attitude of citizens towards this practice of informal payments directly, “bypass the cash register”.

On September 21, 2016, Russian President Vladimir Putin made a statement that self-employed citizens should be exempted from paying taxes and mandatory contributions for two years, so that they could calmly enter the normal rhythm of legal work, so that it would not be burdensome for them. There is a classifier of types of business activities in respect of which the law provides for the use of a patent taxation system. A sample application for a patent is also posted there.

Summing up what was said, Alexander Khokhlov noted that to combat informal employment, certain measures must be taken by the state. In addition to the fact that unscrupulous employers should not participate in government procurement, it is also necessary to prevent the payment of salaries in envelopes - limit the circulation of cash and move to electronically settlement between employer and employees. In order to involve an employee in the legalization of employment, the creation of an institution for registering labor relations is required. For example, enter mandatory registration employment contracts in organs local government. In addition, Rostrud will organize work on maintaining electronic work records and a register of employment contracts.