Passive income on the Internet: programs, applications, add-ons, browser extensions, services and projects with and without investments. How to create passive income from scratch Investing money to generate active income

How to create passive income - 14 working methods + 12 tips for beginning businessmen.

To answer the question: how to create passive income, you need to understand how the mechanisms work passive income, how money accumulates in the account, and also, what to do in order to start earning money without investing your time and effort?

Features of creating passive income and its difference from active

The main difference between passive income and active income is that it does not require investment of time and labor.

The money arrives into the account by itself.

Of course, you will have to put in some effort to ensure that the profit flows into your account, but it pays off and brings you money in the future.

Active income requires constant work, visiting the workplace and performing one’s duties.

To receive passive income, you need to perform certain actions once to receive it.

Receipts will occur over a certain period of time.

To get rich, you must have at least 1-2 sources of passive income, in addition to the main income received from a permanent job.

Many people talk about this in their books and interviews.

When creating several sources of profit, you can completely leave your work activity “to your uncle” and start your own business.

How to create passive income: 14 best ideas

Government payments.

They can be received by disabled people, large families or people who have retired due to age.

Bank deposit.

Investing money in a bank as a deposit is not a great passive income, but for the most part allows you to save money.

However, still, with large amount It is quite possible to receive not at all extra 3-10 thousand per month.

Sale of securities and mutual funds.

Not a bad option long-term investment capital for the purpose of making a profit.

However, it must be approached very carefully.

Gather all the information about the organization in which you are investing your money.

Income from shares becomes large only after about 7 years have passed since their acquisition.

Own business.

A very good option for receiving passive income, but it requires a lot of effort and time before it starts to generate profit.

Venture investments and profits.

To receive venture capital royalties, you must invest in a newly launched company.

After a few years, you can start receiving a very substantial amount, depending on the amount of the contribution.

Investing money in investment and trust organizations.

Profit is generated through the redistribution of capital.

However, in this case there is a high risk of losing your investment.

Purchase of housing under construction and its sale after construction.

A profitable option if you have the funds to purchase one or more apartments under construction.

You will buy it for 500,000 rubles, and sell it for 1,000,000.

However, most likely, repairs will have to be made, at least cosmetic.

When choosing a developer, you should be extremely careful.

Buy housing only from reliable, well-known developers who have been working in the housing market for several years.

Create your own website or blog on the Internet and promote it.

In this case, passive income is achieved by paying for advertising.

On average, on one site, a beginner can earn about 12,000 rubles.

But you can sell a site where the total number of visitors exceeds 5,000 people for 200-250,000.

You can not only make passive money from this, but also build a highly profitable business.

An alternative to the website is maintaining a VKontakte group.

One well-promoted group can bring the owner from 8 to 15,000 rubles per month.

What if there are five such groups?

Selling your own seminars and training courses.

This option is suitable for those who have graduated from higher education educational institution and has a teaching license.

The most difficult thing is recruiting listeners.

However, if the topic is interesting, people will find you.

Write a book.

Income from the work "royalty" goes to the author until the book is removed from sale.

Create an intelligent product.

For example, a computer program.

By obtaining a patent for it, you can also receive regular royalties from sales.

Or a car.

Even a one-room apartment can generate income comparable to the average monthly salary of a citizen in Russia.

Salon rental, hairdressing place.

The average price of one seat in a salon per month is 8,000 in a small city, and in a salon – more than 20,000 rubles.

Search for the most best option of the many existing ones - it’s not a matter of one day.

You should carefully consider the steps, evaluate the initial capital and decide what is best suited.

Many people, thinking about how to create passive income, do not want to do anything about it.

However, in the beginning you will have to work hard in order to reap the sweet rewards in the future.

12 tips for beginning businessmen to create passive income

To become a free person in terms of finances, not to depend on the opinion and mood of the employer, you will have to work hard.- To become a wealthy person, strive to create several sources of passive income.

- Improve your financial literacy.

- Break your cash capital into several parts and invest in different projects.

- Find a mentor or coach who has already walked your path and can give you some ideas.

- Be prepared for the fact that to create good passive income you will have to work for some time, invest not only money, but also time and effort.

You are always looking for the best option for investing and starting a business.

Look for new assets that will later turn into liabilities.

Be an educated person, read books, attend courses and lectures.

Live the life that rich people lead.

Before investing, study all options, do not invest money at random.

Always have it on hand necessary documents, confirming your investment in a company or bank.

Calculate the risks of losing your invested money.

If the risks are minimal, take the risk.

However, if intuition and common sense scream that the investment is not worth making, stop, no matter how profitable the offer may seem.

Think about your future every day.

Decide what you want to achieve.

Open your website on the Internet and develop it.

If there is a lack of capital, the site can be sold for a good amount of money.

Don't try everything at once.

Focus on one project, and when you finish it, try another.

By focusing on several projects at once, you can get confused and lose your investments.

How to create passive income on the Internet?

Organizing your own financial project is a great way to create passive income.

You can open a business both in real life and on the Internet.

If not initial capital, or it is relatively small, the option of creating a business on the Internet is preferable.

Choose the business that you are best at.

This could be website creation, group administration in social networks, copywriting, Forex trading.

To start trading on the Forex exchange, you need to undergo a month of training and conclude several trial transactions.

On initial stage invest minimal amounts and develop.

Robert Kiyosaki talks about how to create passive income in the video:

How to create passive income and gain financial freedom?

In books on self-development, achieving success and wealth, millionaires give advice on achieving financial freedom.We have selected the best ideas:

To avoid remaining poor throughout your life, find time to create passive income, even while working your day job.

In a month or a year, these efforts will more than pay off.

Always strive to create as many sources of passive income as possible.

When you make a profit, invest it again.

Develop yourself.

Financial literacy – prerequisite for those who want to get rich.

Start by at least reading books by the world's millionaires and billionaires and follow their advice.

People who think about how to create passive income, are already a step above the rest.

Move forward, apply the recommendations we have described and become a millionaire.

Useful article? Don't miss new ones!

Enter your email and receive new articles by email

-

Procedure cash transactions in the Russian Federation: requirements

Procedure cash transactions in the Russian Federation: requirements -

How to open a current account for an individual entrepreneur: necessary documents

How to open a current account for an individual entrepreneur: necessary documents -

What is VAT?

What is VAT?

A variety of ways to earn passive income are thriving online. What is the most popular?

Income from a website or blog

You need to choose a profitable project: carefully study its activities, collect as much information as possible about it, and evaluate the prospects of the resource. If you are interested in a project, you invest your own money in its development and subsequently receive a profit from the investment. You can also sell your share at a higher price.

The entry threshold is quite low: sometimes a few tens of dollars are enough. However, there is always a risk - the project may turn out to be unviable, and its owner may be dishonest.

Lending via Webmoney

Webmoney allows you to provide cash loans users of the system. The lender and borrower agree on all terms. The lender sets the loan rate and repayment period. The borrower receives the money. The agreed interest is credited to the lender's account from the borrower's account every month.

The system acts as a third party in the relationship between the debtor and the investor and does not bear any responsibility for repaying the loan, so there is a risk of losing your money. But the minimum loan amount is only $10.

But engaging in usury is not very good karmically, so I do not recommend this method.

Creating your own services

Mailing list services, services for learning foreign languages, exchanges for website promotion, systems for analyzing websites or content - this list goes on and on. Each of these projects provides clients with both free and paid services, which means they are a reliable source of income for their owners.

The main difficulty awaits entrepreneurs at the start. To create a competitive project, you need to have serious knowledge of programming or have the finances to hire specialists.

It is also worth considering that in this case, this will not be passive income, because... you will need to constantly keep your finger on the pulse.

Infobusiness

Information business is a classic example passive income. One day you release a video course, a book, or even an entire program from teaching aids and video lessons and sell its replicated copies automatically. You can also implement your own affiliate program and share a small part of the income for attracted clients.

However, there are some difficulties here too. If you teach people website development or web design, then you understand that programs and Internet platforms are constantly updated, some working methods become outdated, and new approaches to work appear. You need to update your courses from time to time.

PAMM accounts in the Forex market

Currency trading on Forex market- a profitable but risky activity. It is not at all necessary to go on a risky voyage without experience and knowledge. You can transfer your money to an experienced trader and receive interest as an investor.

The technology is simple:

- register with a broker;

- create and top up your account;

- go to the “PAMM” section;

- select a trader;

- confirm that you accept his offer by clicking the “Accept” button;

- After the trader’s account appears in the list of PAMMs, click the “Top up account” button.

You can withdraw money after the trading period of a given trader has expired. The trading period for some may last a week, for others – 3 weeks, depending on the strategy. An application for withdrawal of funds must be submitted in advance.

Mutual funds and shares

A common way of investing is stocks and mutual funds. You can choose and buy shares yourself. By turning to mutual funds, you entrust your money to other people to manage.

UIF - investment fund. In such financial organization an investment portfolio is formed from several financial instruments: shares, bonds, bank deposits. You can buy a share in this portfolio. After the stipulated period, your account will earn interest on the money invested. The larger your share, the more money you will receive. Some risk of losing money this method investing is also present. There is no universal recipe for success, so it is better to divide your savings into parts and invest money in different organizations.

Where should you not invest?

You should not consider financial pyramids, casinos, dubious and illegal projects. All of these are obviously losing enterprises. Read reviews of sites and companies on third-party resources before you spend your money on someone.

Also, many are looking for passive income without investments, but this is impossible by definition. "Passive" can be obtained through investments, watch the mat part of the video from Kiyosaki:

This article contains 12 best ideas to create passive income from scratch on the Internet. It offers proven and working ways to make money. Answers to popular questions about passive income are given. And also a lot of useful videos from experts.

Many people dream of doing nothing, traveling, enjoying life and making money at the same time. Unfortunately, in real world It doesn't happen that way. To earn money, you have to work.

But there is one activity that does not require constant work. You only need to invest effort, time and money in the beginning. And then you just need to monitor and maintain the established system. We are talking about passive income on the Internet.

What is passive income: a brief analysis of the concept

Passive income is an activity that does not require a person to daily work. That is, there is no need to go to hated job and carry out boring orders from your superiors there.

When creating passive income, a person first either invests his time and energy, or hires those who will do it for him. Once the system is established, less and less action and investment is required.

12 ways to make passive money on the Internet

1. Passive income from a website or blog

The list is headed by the most popular method of passive income on the Internet lately. Its essence is as follows:

- A person creates a website and chooses a suitable topic. For example, you can choose something that you are good at: computer repair and maintenance, mobile phones or auto, construction, business, fishing or other familiar topic.

- After developing the design, site pages and setting it up, the resource is filled with articles. You can write them yourself or hire a copywriter for this task.

- After a couple of dozen articles, visitors begin to come to the site and read published materials.

- Upon reaching a certain traffic indicator, the site is added to the Yandex and Google advertising networks and from that moment passive income begins.

- The site owner receives money for the fact that users click through advertising blocks to advertised resources and services.

This type of income can also be considered banner advertising or selling links.

How much do you need to invest at the start?

Financial investments can be minimal - payment for hosting and domain name. But this is provided that the person understands how sites are developed. If there is no knowledge in this area, then you will need to invest an average of 10,000 rubles. for web developer services.

The same goes for articles. If the owner of the resource can write articles himself, then he will only invest his time. If not, then you will need to regularly pay the copywriter from 3,000 rubles. per week.

You may have to spend money on an SEO optimizer who will select a list of suitable topics based on the data search engines, and will advise on search engine promotion of the site. Here you will need from 5000 rubles.

To save money, you can familiarize yourself with web programming and SEO. There is a lot of free information on these topics on the Internet.

How much can you earn?

Everything will depend on the activity of site development. Regular and daily publications of materials will allow you to earn from $500 to more than $1000 per month. For rare publications, for example 1-2 times a week, you can receive $100.

But you need to understand that earnings depend on the chosen topic. It is better to create a website on topics such as cars, computers, construction and repair, business, finance and health.

2. Investment in a website or blog

This earnings are similar to the first option. The only difference here is that the site does not need to be created and promoted from scratch. It is enough to buy a ready-made resource that is already profitable.

The price of a website can vary - from a couple of thousand to several million rubles. It all depends on the age of the resource, its traffic and the profit it brings.

By purchasing several sites at once, you can achieve a monthly passive income of more than $5,000.

3. Earning money from a group or community on VKontakte

Earning money from a VKontakte group or community consists of posting paid advertising posts.

To create a group, investments are not needed, since VKontakte makes it possible to do this for free. You will only have to spend money on attracting participants. To do this, you can use targeted advertising, promotional posts and paid entries in other groups.

The downside of making money this way is that you have to publish interesting posts every day. Therefore, you will either need to spend personal time or money on a specialist who will do everything himself. Community administrator services cost from 3,000 rubles. per month.

4. Earn money from your own YouTube channel

YouTube is a well-known and popular video hosting site that allows you to make money on your channels.

Earning money consists of making a video, preferably a high-quality one, and publishing it on your channel. When there is at least a thousand audience and the video has several hundred views, the YouTube channel can be monetized in the following ways:

- Contextual Google advertising- an advertising block that pops up at the bottom of the video on a topic that interests the user.

- Direct advertising in video - placement at the beginning of the video advertising information a product or service of another person or company. In this case, the advertiser pays for advertising the price set by the owner of the video.

- Affiliate links - they are placed in the video description to attract, for example, referrals to some project. For each person attracted or purchase, the channel owner receives a percentage and thus passively earns money while doing what he loves - shooting videos.

- Someone else's video - the channel owner does not post his own videos, but other people's. After their promotion, he begins to earn money in any suitable way. A simple example is a collection of jokes or road accidents.

It is difficult to specifically state the amount of earnings. We can only note that there are people earning $1,000,000 a year on YouTube.

5. Selling training courses

If a person has experience in a certain field, then he can create a training course and start selling it online and offline. But at the initial stage, you need to invest a lot of effort, spend time and test the created product.

Online training courses have been in steady demand for the last 15 years. But in order for people to start buying them, you need to create a personal brand and establish yourself in the niche as an expert who can be trusted. Therefore, creating a name and the course itself can take from six months to more than a year.

Earnings will depend on promotion channels, quality of training, price and much more. There are trainers who earn $100-$500 per month, and there are those who consistently receive their $1000.

6. Information business: webinars, online trainings, workshops

This income is suitable for experts in a specific niche.

If a person is well versed in marketing, then he can train marketers and businessmen. Knows family psychology, then you can help families get out of crisis situations and improve relationships.

Webinars do not have to be livestreamed. You can record them and offer recordings to people. It's the same with online training.

The only thing you will have to devote time to is workshops, since you need to be present at such an event in person and supervise the work of the participants. And we definitely need to update our webinar and training programs.

7. Selling educational e-books

This method of earning money is similar and can even complement the previous one.

The bottom line is that you need to write the most useful e-book, and then receive income from its sales. However, here you will have to spend a lot of time writing a book, testing it for free among friends or colleagues, and only then releasing it to the masses.

Here you will have to invest not only time in writing a book, but also in promoting it, as well as creating the name of the author and positioning him as an expert in a specific niche.

8. Selling this book

People still buy real paper books, even though they cost more than e-books. As numerous studies show, it is easier to read from paper than from a PC monitor or smartphone.

To start earning money in this way, you just need to write a useful and interesting book, find a publisher, publish your work and receive your percentage of sales.

In this case, the book does not necessarily have to be educational. You can write a novel, detective story, comedy or another genre. But for all this desire will not be enough - you need talent and a lot of free time.

You also need to be prepared for refusals from publishers - a normal practice in the work of modern authors.

9. Selling photos in photo banks and photo stocks

This passive income is suitable for photography lovers. Here you need to take high-quality photos and put them up for sale on special platforms.

The income from such an activity is small, but at least a person can combine it with other work and at the same time earn money from what he really likes.

10. Earning money from affiliate (referral) programs or affiliate marketing

Such earnings are based on receiving a percentage of sales.

For example, there is one that sells computer equipment. A person receives a referral link and advertises with it on his website, forums, and social networks. People follow the link, buy the product, and the person receives a percentage for this, set by the owner of the online store.

You don't need to have any specific knowledge here. It is enough to distribute your referral link through all possible channels. The better the channels, the more conversions, purchases, user actions and profit from such earnings.

But it is still worth noting that high incomes You shouldn’t count on it here and it’s better to combine this type of income with other activities from this list.

11. Sale of paid programs for PCs or applications for smartphones

This kind of income is only suitable for people who understand programming.

The point is to develop a useful program or application that can then be sold to the desired target audience.

For example, you can come up with software to automate some processes in online stores. Or an application to simplify some actions for smartphone users. That is, here you need to carefully consider what software will be in demand.

You can sell programs either immediately or through monthly or annual subscriptions. It is also appropriate to make several prices depending on the included options. For example, the starter version might sell for $5, the pro version for $10, and the premium version for $30.

12. Earning money by sending information

This involves creating a paid online service for sending letters. Such services are actively used by entrepreneurs who, through letters, share useful information about their products, goods, services, announce promotions, discounts and various events.

You will also need to spend on advertising and promotion of the service. With proper marketing, all investments will be returned within 6 months or 1 year, after which passive income will begin, since you will not have to do anything else - except to monitor the proper operation of the service and answer user questions.

Earnings from such a service can be more than $1000. But on condition large quantity users and a competent marketing strategy.

Answers to popular questions about passive income on the Internet

What is the difference between passive income and active income?

Most people are actively making money. They go to work, carry out instructions from their superiors, receive a fixed salary and have no opportunity to increase their income.

Passive income is about investing time, effort or money in the future. That is, a person creates something that will bring money automatically. You don't have to work every day here. With such earnings, income is not fixed. However, the risks here are high: if a person official work receives a stable salary, then with passive income on the Internet there is always a risk of a decrease in income due to a number of external factors.

Is it possible to create passive income if there is no money?

Yes, the Internet allows you to create passive income without starting capital. However, the lack of costs is initially covered by a large investment of time and effort. Knowledge in the chosen niche is also required.

How to accept payments online?

Earned money can be received in electronic wallets. The most popular are: Webmoney, Yandex.Money and Qiwi. Some services provide direct withdrawal of money to a bank card.

How to withdraw money from electronic wallets?

All modern electronic wallets allow you to withdraw money directly to a card or bank account. To do this, it is enough to identify your data - send an application and a copy of your passport. But for this procedure you need to reach adulthood.

Are passive income subject to taxes and require individual entrepreneur registration?

Any income of citizens in mandatory are subject to taxes. Failure to pay or deliberate concealment of income can result in a large fine or imprisonment. To protect against problems with tax service It's better to register as individual entrepreneur and pay taxes under a simplified taxation system.

Types of passive income are those in which the availability of stable financial income does not depend on daily labor activity. Any of us has heard about people who live off such income - those who do not have to go to work. They are called "rentiers", that is, living off rent.

Rent is the income that the owner receives from fixed capital placed in real estate, deposits, securities, etc. “From the same opera” - sources of passive income associated with copyrights. By the way, the last option is not ordered to anyone these days. Everything is simple here: having created something once and registered the copyright on your own brainchild, you will have such royalties with each next sale.

If you are a professional (no matter in what field) you have a real opportunity to monetize your own knowledge. Simply record the training course on video or audio and release it to the market.

Why are we not rentiers?

Today we will look at options for passive income and its possible sources. Its huge advantage is the freeing up of personal time, which can be spent on your favorite activities, family, recreation, household chores, or somewhere else. Anyone who works hard all day at work is almost completely deprived of such a wonderful opportunity.

Managing personal time at your own discretion does not mean wasting your life in entertainment venues, or lying on a warm beach - many people would be happy to engage in charity work, helping the sick and homeless, or creating works of art. To start making all these dreams come true, you need the most stable passive income.

Everyone has heard the expression “money to money.” What does it mean? Nowadays, it is not uncommon for a person, having a generally good salary, to “eat up” it completely, buy things on credit and borrow from relatives and friends from payday to payday. This continues for years and decades.

But why is this happening? It seems that the main problem of such people is that the idea of passive income does not even occur to them. They are not able to create an asset that will work for their well-being in the future. These people immediately spend everything they earn, and thus deprive themselves of the only chance to ever escape the captivity of financial slavery.

Do you recognize yourself?

Some of these consumers can be classified as “financial zombies.” These are those whose assets have long been a negative value. That is, their expenses are greater than their income. Debts accompany them throughout their lives. Having given one loan, they immediately take out the next one and so on.

The other category is a little more prosperous (but this does not make it any easier) - it tries to somehow correlate its expenses with the amount of earnings. They sometimes have a set of necessary goods - housing, a car, etc. Most of this was purchased on credit, which puts the owners in a dangerous and unstable position. After all, if any unforeseen financial circumstance happened, their well-being would crumble like a house of cards.

There is progress...

In contrast to the above categories, there are those whose assets can be considered positive. That is, their income is higher than their expenses. The majority of ordinary citizens from this group prefer not to have debts or reduce them to a minimum and even have some savings, but such saved finances do not play a fundamental role, since they accumulate extremely slowly and are located either under the mattress or (at best) on a savings account.

The most advanced of our fellow citizens are those who are haunted by the idea of passive income. They try to seize every opportunity to invest free funds and create their own additional financial source.

Let's turn to the authorities

Many people know the name Robert Kiyosaki. This investor and businessman has written a number of popular books on the basics financial literacy, which will not be superfluous for anyone to read. For example, one of the interesting and most effective tips from this author looks like as follows: the mistake of almost all of us is that, having earned a certain amount, we try to distribute these funds to anyone, but not ourselves. We pay rent and public utilities, but at the same time we leave nothing for ourselves. You should start with yourself by creating your own monetary asset. Subsequently, it will become the basis for investing in a business or another source of permanent income.

Another “pro” in financial matters named Rockefeller once said that a person who works full time has absolutely no time to earn money. Despite all the paradoxical nature of this saying, its wisdom lies on the surface - indeed, working in an office or in production, each of us is able to earn money for ourselves personally only for current expenses to maintain daily existence. There is neither strength nor free time left for actions leading to wealth and prosperity.

The conclusion is this: the main resource is time, as any wealthy person knows well. The idea of passive income is based on the correct distribution of this invaluable asset. And only after achieving this can you begin to move towards financial success. Everyone knows that everyone who achieved wealth initially had a specific list of goals. Well, the third, most important component for creating passive income is active, targeted work over a number of months or even years.

The result should be a legal opportunity to quit your unloved job and start living on dividends.

Passive income: examples and options

Now let's talk about the ways in which passive income is created. All of its sources can be attributed to four types - investment (or financial), intellectual, marketing or legal (that is, the one that we are entitled to by law). Passive income in Russia is no different from that in any other country in the world.

We will receive passive income of a financial or investment nature if we invest in a certain financial instrument, which will bring us a certain percentage of profit. Sources of such investment may exist in the form of real estate, securities, bank deposits, our own business (if purchased), or equipment owned by us that can be leased.

The second of the listed options, called intellectual, arises, as mentioned above, through the creation and implementation of any product of mental labor. This is the principle on which the Internet, which is widely used these days, is based. information business. Many professionals in various fields develop and design their own training courses, then release them for sale an unlimited number of times.

"Affiliates" is an interesting topic

In the same way, it is possible to purchase the rights to resell a similar product, which can bring no less income. This type of earnings is called affiliate marketing. Other sources related to this item may include royalties, patents for completed inventions or developed technologies.

Earning money from affiliate programs is an excellent way out for those who do not have too much hope in creating their own intellectual product - because this saves time and mental resources. You just need to join such a program or purchase the right to resell (resell) a selected book, video or audio course.

Other earnings without investment

Marketing passive income is one in which you organize your own marketing system or several of them. An example of such a structure could be your own website on the Internet or a personal brand, the right to use which you can also sell. A combination of several of the strategies mentioned is also possible.

What is meant by the concept of a personal brand? This is a commercial use of a famous name. An example is filming, television and sports stars filming commercials. Becoming the “face” of a specific trademark, they get good money.

The fourth type - legal income of a passive nature - includes all cases when people, in addition to a certain (sometimes not too high) remuneration for their work, receive certain bonuses from the state. This could be, for example, early retirement with a guaranteed receipt, which is typical for the military, etc.

Going online

Creating a website for making money on the Internet (or blog). These days, this does not require a lot of complex technical knowledge and skills. You can make an acceptable website with your own hands by mastering the minimum information that can be easily and freely found on the Internet. There are many step-by-step instructions and video courses.

Of course, your own blog or website will not immediately bring you financial returns. To promote it and bring it to an acceptable level, it will take at least six months, and most likely a year or two. All this time you have to work on own project on a regular basis, optimize it and bring it to mind. This work will take several hours every day. However, you can count on the first small revenues within a few months from the start.

Having created and promoted a website, you can sell it, and for a very good amount. It is quite possible for a person who has mastered this technology to organize own business for the “production” and further sale of profitable Internet pages.

How do they make money on them? The most popular methods include generating income by placing blocks of contextual advertising and similar articles on resource pages, of course, not for free. The sites place affiliate links and sell advertising space; they also actively offer training courses to customers, both their own and those of partners.

In a word, there are a lot of ways to use such a valuable resource as a blog or website on the Internet, and you always have the opportunity to choose something that suits you.

For those who are not deprived of intelligence

Creating a product that has the status of an intellectual product (this includes books, educational videos, new technologies, etc.) implies the presence of a certain talent, as well as a high level of professionalism in any of the areas.

If you are an inventor or developer of an industrial design that has become fundamentally new, then your labor products can safely be classified as intangible assets. This term refers to those derivatives of our intellect that generate income in the absence of a material form. Examples include trademarks, brands, or patented inventions.

Let's go down to earth

Income from renting out an apartment (or other real estate, if available) is a well-known and very common option. But there are others similar to it: it is possible to “let out” not only buildings or retail space, but also equipment related to a variety of industries - trade, construction or manufacturing.

And other expensive items (for example, automobile equipment) will bring you good dividends. Sometimes it is more profitable to manage equipment than real estate. In particular, by purchasing tools and equipment for construction, you will actually organize a good and quite profitable business, based on their rental. The payback on such activities is very high and in time significantly exceeds a similar indicator for rented real estate.

Do you want to become a shareholder?

Investments in securities (or other financial instruments, which include huge amount banks, PAMM accounts, mutual funds) is a widely accepted practice these days. This activity is considered one of the types of business.

Replenishing the number of professional investors is not an easy task. This activity is quite complex and requires a competent approach, as well as quite serious training. Proficiency in financial instruments is impossible without a more or less acceptable education in this field, the ability to compare various flows of information, take into account risks and predict the situation.

Investments in securities have certain advantages compared, for example, with bank deposits, in the form of a higher level of profitability, but at the same time, the high risk of losing invested funds sometimes cancels out all the existing advantages. When you decide to dive into the world of stocks, mutual funds and PAMM accounts, remember that with the exception of long-term loan bonds, stable income is not so easy to achieve here, and the risk of incurring significant losses is always quite high.

Everything can be sold!

A relatively simple and, perhaps, generally accessible option for creating a source of passive income is considered to be participation in network marketing. Sum initial investment, if they exist, are not too large and rarely exceed a hundred dollars.

A necessary condition for those who are trying to succeed in this field is communication skills and a willingness to contact a large number of people. In the future, these people - your team - are able to bring in money without your participation by organizing own network, the percentage of the income from which you will receive.

Do you need a lot of money?

The classic and, perhaps, best way was and remains to create your own business. If this action takes place in virtual reality, that is, on the Internet, global financial investments At the initial stage, as a rule, it is not required. That is, this option is available to people with very limited material resources.

Even earning money without investments is quite possible, or you can earn money by accumulating a small initial capital right here, on the Internet.

There are a huge variety of options for starting and promoting your own business, both online and in real reality. In "life", of course, this requires high costs and overcoming many organizational and legal difficulties. In addition, the competition here is very, very high. But still, by looking around carefully, you can spot your own niche, not yet occupied by your rivals.

What's in reality?

For example, very promising business with passive income in our time - purchase and placement in large hypermarkets and other crowded places with machines for various purposes - from payment terminals to units selling coffee and pies. Such a business is called vending. A person purchases at his own expense and installs machines, which then provide him with a constant and stable income.

In a short article, we do not have the opportunity to consider all types of passive income - there are very, very many of them. Variants of it are offered to us today by the media, and the Internet has been and remains their irreplaceable source. We want to conclude our material with important tips.

A few parting words

- At any cost, try to regularly find time left over from your main job, which you will spend on creating your future asset. Constantly think about how to best use it. Your goal is to ensure that earnings from your main job do not remain the only source of money for you. You must find sources of passive income that allow you to make a profit more than once or twice.

- Don't limit yourself to creating a single source like this. There can and should be several options for passive income, and the more, the better. After all, there is always a risk of losing one or most of them. In this case, losses will be compensated through parallel channels. You can see the importance of this postulate by reading about multiple sources of income from Robert Allen.

- Don't forget to educate yourself. Knowledge is an asset that will not hurt anyone. Understanding the world of finance, understanding how money is made, where it comes from and where it goes, is no less important than inventing it. interesting idea for an investment or to be lucky enough to be in the right place on time.

The principles of creating passive income do not contain any special secrets. If you are firmly committed to success, have the necessary minimum knowledge and some free time, the result is likely to please you sooner or later.

Many people dream of passive income and ask: “How to create passive income from scratch? Where can I find proven passive income ideas? But not many people know that today this type of income has become available to everyone. And largely thanks to His Majesty the Internet! In this article, I will expand on the concept of “passive income” (residual income), talk about the sources of this type of income and describe several ideas for creating it that I use myself.

If you have already thought about the possibility of creating passive income and are striving for the life that passive income provides, then this article will be useful for you!

is a type of income characterized by stable cash inflows, regardless of daily activities. Most likely, you have already encountered (or heard of) people who live off passive income. These people usually "don't go to work." Such people are called rentiers.

A rentier is a person who lives off rent - income received from the capital that he placed in business, deposits, income-generating real estate, securities, as well as income from copyrights.

For example, you are an expert in a certain field. This means you can “sell” your knowledge by recording a training course (audio or video, it doesn’t matter). You have created a high-quality course once, and it will generate income for you whenever someone buys it (this can last for more than one year).

We have defined the concept of passive income. Now answer this question for yourself:

Why do you need passive income?

Many are attracted by luxurious life - luxurious beaches and houses, cars and yachts. But some people take this life calmly and are happy with what they have. I am one of these people because I understand that a luxurious life is just the tip of the iceberg.

I think the main advantage of building passive income is that you will be able to free up your precious time for your favorite activity, which you cannot do now because you are “working at work.” I know people who would like to devote themselves to serving other people - the homeless, children in orphanages.

With the help of passive income, you can start making your dreams come true.

2. “Money goes to money”?

The expression “money leads to money” quite often justifies itself. Today it so happens that people with average incomes spend all the money they earn without a trace, purchase goods on credit and borrow from friends and acquaintances until their salary or advance payment.

Why does it happen that people 30–40 years old cannot earn a good living? Now I will answer this question.

IMPORTANT! The point is: people don't know how to focus on creating assets. capable of solving material problems. It turns out that people are driving themselves into financial slavery, which is flourishing these days.

In the educational cartoon, which you will find at the end of the article, in simple language the basics are taught personal finance and a classification of people is given depending on the ability to manage them (which category do you belong to?):

1. Zombies (financial). Their expenses exceed their income and their assets are negative. Those. they live from paycheck to paycheck and are always in debt. Almost all their money goes to pay off their debts.

2. Kamikaze (financial). Their p A collections are approximately equal to their income, assets are negative. They often look wealthy: they have an apartment, a car... However, this is all on credit. They walk on a razor's edge, and in case of unforeseen circumstances they easily fall into the ranks of financial zombies!

3. Maniacs (financial). Their income is equal to or slightly higher than their expenses, and their assets are zero. They usually have no debts, but they also have no savings. They are at the mercy of the consumerism syndrome: they never have extra money, because they will always find something to spend it on right away.

4. Turtles (financial). Their income exceeds their expenses and their assets are positive. They have no or minimal debts, they have savings. But like turtles, they accumulate slowly, because they prefer to keep their savings under the mattress, and the most advanced turtles - in a bank.

5. Sages (financial). Their income exceeds their expenses, their assets are positive. They differ from turtles in the level of investment. Investments net assets generate passive income for them.

Do you recognize yourself from the description? For example, I see that since I started thinking about personal finance and studying books on financial literacy, I gradually began to move towards the 5th category.

In order to learn how to create assets, I highly recommend that you read books on financial literacy by the famous businessman and investor Robert Kiyosaki. And be sure to give these books to your children to read. Start with books Rich dad, poor dad And Cash Flow Quadrant. If you prefer books in “paper” form, you can purchase them, for example, on Ozone (they have free delivery) - Rich dad, poor dad , Cash flow quadrant.

I like Kiyosaki's simple, but very effective advice to create your own asset. As soon as you receive some income, you begin to distribute it to others - pay for an apartment, for school, for a hairdresser, for a concierge at the entrance. You give your money to everyone, but not to yourself! This is a fatal mistake for everyone who has not yet built passive income.

You must first of all “give” money to yourself, and therefore to everyone else! In this way, you will begin to create your asset and then you will be able to increase it by investing in your business or in some other way (which we will discuss below).

Here's a simple exercise. You can easily become a millionaire if you save just $1 a day! Don't believe me. Then open any deposit calculator on the Internet, for example this one. And you will see that if you give up one cup of coffee a day for 30 years (figuratively speaking), you can become a “hryvnia” or “ruble” millionaire.

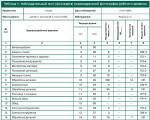

I can’t believe it?! Look at the screenshot: a deposit at 12% with monthly top-ups of only $30 ($1 per day) with monthly capitalization will turn into 2.7 million hryvnia or 7 million rubles ($108,000). And it's only $1 a day.

TIP #2: UNDERSTAND that someone who works all day has no time to make money!

John Rockefeller said: “He who works all day has no time to earn money!” Think about his words.

Indeed, working in an enterprise, production, office, or no matter where, people earn money for “current” expenses. And you can become a millionaire only in your free time from your main job.

It follows that TIME IS OUR MAIN WEALTH. Remember: “Time is money” - this is what wealthy people take advantage of.

Consider the day ordinary person: goes to work in the morning, works all day in the afternoon, goes home in the evening. On the way home, perhaps he goes to shops, cafes, and at home - dinner and TV. Naturally, such monotony does not set the stage for progress in the future, especially if you take into account that many make money by doing something they don’t really like to do.

Naturally, the creation of passive income is preceded by active work over a period of time (this could be several months or several years). But then you can leave yours " unloved job"and enjoy life.

TIP #3. GAIN knowledge in the field of personal finance.

TIP #3. GAIN knowledge in the field of personal finance.

The famous financial literacy specialist Robert Kiyosaki, whom I mentioned above, DEFINED WEALTH BY THE LENGTH OF TIME during which, while continuing to live comfortably, a person can not work.

« Cash flow» - this is the name of the world-famous game by Robert Kiyosaki, which can help you figure out how to “turn time into money” by creating a constant passive income.

There are several versions of the Cash Flow game - 101, 202, 303 and 404. Each of them teaches investing skills, building your own business and competent handling of personal finances. Don't think this is just child's play. The game “Cashflow” will be interesting and challenging for all adults - not only for an office worker, but also for the owner of his own large business.

You can buy the game in a bookstore, but it will cost 30 or even 50% more than in an online store. You can order the game on the trusted website (online store) ozon.ru with free delivery. Here is the link Board game Cash Flow 101 (2016 edition).

If you want to learn more about the Cash Flow game, I recommend this interesting and useful with a detailed description of it.

IMPORTANT! I think you already understand that to build passive income, the first thing you need to do is learn financial literacy. Neither our parents, nor schools, nor universities give us this knowledge. Even if you work as an accountant in a large enterprise or a financial analyst in a bank, this does not always mean that you have knowledge in the field of personal finance.

3. Types and sources of passive income

We answered the question, what is passive income? I think it’s time to satisfy your curiosity by revealing the “secrets” of ways to create and sources of passive income. We will talk about this later. You just need to choose the method that suits you.

Many are not happy with the fact that they will have to wait (months, years). But we need to get out of this psychological trap. Think about it, working age lasts 25–40 years, ending with retirement age and receiving a pension, which can hardly be called “deserved and worthy.”

It turns out that we can work for several decades doing something that you don’t really like, but ensuring financial independence for ourselves is “beyond our strength.” But you will have the opportunity to retire much earlier than the period established by the state (not at 55 or 60 years old, but at 35 - 45).

Are you sure you want to create passive income so you can have more free time? Then start TODAY to take decisive action in this direction. Make up your mind and take action!

So, more about the types and methods of creating passive income

There are 4 types of passive income:

- investment (financial),

- intellectual,

- marketing,

- legal (required by law).

Agree, not very much. The types of passive income in Russia are the same as in other countries in the world. Now let’s figure out what ways you can provide passive income.

1st type. Investment (financial) passive income

Created in case of investment (investment) of funds in certain financial instruments and items. From the investment we receive a certain amount in the form of interest or profit.

Sources of profit can be:

- real estate;

- bank deposit;

- securities;

- our business (if we buy it);

- equipment (if you rent it out).

2nd type. Intellectual passive income

Sources of income can be:

- Royalty;

- Patent for invention (technology)

If you don’t like the idea of creating an information product yourself, you can earn income from promoting other people’s information products through affiliate programs. I myself earn income from this online business. I consider Evgeniy Vergus to be the main expert on making money on affiliate programs. You can immediately start earning money while studying this course. "PARTNER SALES WORKSHOP". You can easily recoup the cost of the course by studying the course and at the same time earning money by advertising affiliate information products. *

3rd type. Marketing Passive Income

This type of income is possible if you create a marketing system(s). For example, your website on the Internet or a personal brand for rent. Either one or several options are possible.

Personal branding involves using your name for commercial purposes.

For example, screen and sports stars are often involved in filming advertisements, thus becoming the “face” of a certain brand or company. They receive decent fees for using their name.

In this case, sources of passive income can be:

- own developed network marketing structure;

- commercial structures using your personal brand;

- your website;

- a business that generates profit from the operation of a marketing system (for example, an information business).

All these sources of passive income will provide you with passive income on the Internet without investment.

4th type. Legal passive income

I think there is no particular need to dwell on this view. I will only note that these are payments due to you “according to the Law.” By the way, there are people who rely on this type of passive income. For example, civilians work under contract in military units for low pay. But then they retire earlier and are guaranteed to receive a “military” pension.

4. Ideas for creating passive income

You have already learned about the types and sources of passive income. It's time to get acquainted with the options for creating it.

I propose to consider the most common and current ideas. Perhaps one of them will suit you to ensure a regular cash flow.

1. Information site or blog

If you know how or want to learn how to create and launch websites, and know the basic principles of marketing, then you can organize passive income, practically from scratch. It’s not for nothing that organizing passive income using the Internet is becoming increasingly popular.

For example, the blog you are currently on also generates passive income.

In addition to the above skills, you will need free time, as well as a desire to learn. You you can make your own website even if you do not have any special technical skills. Especially for those who have decided to make money with their blog or information site, I have prepared a series of articles with step by step instructions, videos and screenshots. In less than a week you will have your website ready for content. Here is the link .

To organize passive income using your website, you will, of course, need some time (from six months to two years). This time will be needed to regularly work on your project (several hours a day) in order to improve and optimize it.

Do not be mistaken that by creating a website, you have done everything necessary to receive passive income, and now you can “sit back.” No! To turn a site into a full-fledged “money machine” you will have to work on it for 1-2 years. But you will start receiving your first money within a few months after the start of the project.

Once you turn your site into a “money machine”, you can sell it ( ready business!). Moreover, the proceeds from the sale can exceed the amount of monthly passive income by 20 times.

For example, my colleague bought a 3-year-old working website for 1,500,000 rubles.

The arithmetic is simple: If your website brings in 10 thousand rubles a month, then you can sell it for 200 thousand rubles. and more expensive.

Therefore, you can make money by creating income-generating websites and organize your business in this way.

Ways to make money on your website:

- accommodation contextual advertising;

- placement of paid advertising articles;

- sale of advertising space;

- placement of affiliate links;

- selling your own training courses.

2. Intelligent product

Having a certain talent, it is possible to create your own intellectual product (book, technology, educational video, etc.). This product can become a source of your passive income if you start replicating it or renting it out.

Let's consider an example of passive income, when an intellectual product (a book) made the author a millionaire. Today, it is perhaps difficult to find a person who does not know the name JK Rowling. But it was the books about Harry Potter that brought her a multimillion-dollar fortune.

An invention, a fundamentally new industrial design or technology can also become a source of passive income. They will be your intangible asset.

An intangible asset is a product of intellectual labor that, without having a material form, is capable of generating income. For example, a patent for an invention, trademark or brand.

3. Property rental

Of course, the most common way is to rent out real estate. But let's look at other passive income options. For example, construction, commercial or industrial equipment and other expensive things. Moreover, passive income from real estate is often lower than from equipment.

For example, by purchasing construction equipment and tools, you can rent them out, thus organizing your business. If a drill or hammer drill costs, for example, 20 thousand rubles, then you can rent out the tool for 100 - 500 rubles per day. The tool will pay for itself in quite a bit short term(less than a month).

4. Securities, bank PAMM accounts, mutual funds

One of the common ways to create passive income is by investing in financial instruments.

Investing, in some ways, can be thought of as a business. But to become professional investor, it is necessary to first study this complex topic. You can learn more about financial instruments on this useful website Club of private investors “Where to invest money - ways to invest.”

Of course, there are advantages to investments (higher income compared to a bank deposit), but they also have disadvantages, namely: high risks.

PAMM accounts, mutual funds and securities are not able to provide stable income (excluding bonds). There is a high risk of losses. Take this into account!

5. Network Marketing

Network marketing is considered one of the most available ways creating passive income. Perhaps because the first investment usually does not exceed $100.

The condition under which you can organize this kind of passive income is communication skills. Because in this case you will need to be able to communicate with people, win them over, ensuring friendly communication. The main thing is that you do not fall into a financial pyramid!

To protect yourself from this risk, check out this helpful article “What is a financial pyramid?” .

6. Own business

Organization of an entrepreneurial project, perhaps best way creating passive income.

Internet business is suitable for people with any financial situation current moment. Even if you do not have large enough finances, the network can provide opportunities to start with virtually no investment. Thus, your income will gradually turn from “active” to “passive”.

The most difficult step towards starting your own business is simply making a final and irrevocable decision. It's best to start with a simple business without investment. With organization ideas business without investment for beginners entrepreneurs read . The information in this article will help you organize a business and create passive income from scratch.

Let me give you my example of passive income. I built my own vending business - I bought several payment terminals (invested my own capital), and installed terminals in supermarkets under a lease agreement. The terminals are collected by a third-party organization under a maintenance agreement. I receive income that can be called passive, although I participate in it (I carry out settlements with my counterparties). This business takes very little time - 1-2 days a month.

I highly recommend investing in a vending business, where machines work for you and you receive income. The potential of this business, based on statistics, is huge!

5. Recommendations and tips for acquiring financial independence

You have already become acquainted with the concept of “passive income” and learned about its types and methods of organization, about the ideas of passive income. You know enough to take action. As soon as you make up your mind and start taking action, you will have the opportunity to gain financial independence, leave your “unloved” job, start traveling and do what you have dreamed of all your life, for example, charity.

1) Take the time to build assets.

Don't limit yourself to just income from your day job. Think about what you can do so that, having done this once, you will receive money many times over - replicate your efforts!

I hope that you are not striving for a “beggarly” existence, which, unfortunately, a pension can provide.

2) Strive to organize several sources of passive income.

In this case, you will protect yourself from possible risks: The loss of one source can be compensated by another. And at some point it will support you.

How important this is is described very well in his book.

3) Increase financial literacy

Self-education is the first thing you should do! Invest in yourself! I recommend carefully reading books considered fundamental: Robert Kiyosaki "Rich Dad Poor Dad" and Bodo Schaeffer "Money or the ABC of Money", - they will help you understand more deeply the principle of the functioning of money and the principle of creating passive income.

Please note that there are no special “secrets”. For success you only need desire, time and certain knowledge.

Watch this educational cartoon about what passive income is so that all the puzzles fit into a clear picture and you have the confidence to start moving towards creating passive income. You should start by educating yourself on personal finance. It is also extremely important to pass on this knowledge to your children!

I wish everyone confidence and determination!

I managed to create several sources of passive income, so you can too!

Write in the comments which category of people you belong to from a financial point of view and did you manage to move to a category closer to 5th?

Subscribe and receive the most interesting blog materials - subscribe below. When you subscribe, you will receive the first biography of Elon Musk, one of the leaders in financial literacy today, for free.