Formats of retail trade enterprises. Retail formats. Main formats of stores selling food products

Retail resellers are the most important participants in distribution channels, and their role and interactions with other channel members largely depend on their format. Retailer format) reflects a set of characteristics that determine its market position (range, scale, forms, service methods, etc.). The choice of the format of a retail trade enterprise is a consequence of the implementation of a specific marketing strategy.

Strategy retail enterprise determines the choice between stationary and semi-stationary, mobile and non-store trade. The bulk of goods and services are supplied to consumers through enterprises of a stationary and semi-stationary format, which involve the organization trade service in a specially equipped room - a store.

Competition forces retailers to strive to achieve maximum coverage of the audience of potential buyers, increase the volume and intensity of sales. Along with the emergence of new opportunities for organizing trade services related to the achievements technical progress, this leads to the fact that in parallel, mobile and parcel trade are increasingly developing.

Stationary (stationary retail) And semi-stationary (semiportable retail) trade provides customers with a large selection of goods and services, creates comfortable conditions for making purchases, attracts with the opportunity to get acquainted with new products (display in trading floors, promotional materials, demonstrations and tastings of goods, etc.). This type of trading is represented in a number of formats.

Supermarket - self-service store with a sales area of at least 400 m2, which offers food products predominantly for everyday demand, and in which no more than 25% of the retail space is allocated for non-food products.

Hypermarket (hypermarket) - enterprise retail, selling food and non-food products of a universal range, mainly in a self-service format, with a sales area of 5000 m2.

To the supermarket (superstore) - short for “universal self-service store” - a store whose assortment includes a wide selection of goods of different categories, but most of them are food products. Unlike a regular store, in a supermarket most goods are located on shelves in the public domain. Appeared in the first half of the 1990s. varieties of supermarkets - “supermarket” and “hypermarket” - are much larger in size retail space and the fact that food and industrial goods presented there in an assortment of comparable volume.

Department store - a large store offering a wide range of mainly non-food products.

Discounter, discount store (discount store) - a store with a wide range of goods at wholesale prices. The management of such a store is aimed at maximizing the reduction of distribution costs, thanks to which goods can be offered to the consumer at minimal prices.

Warehouse store - a discount food store that offers an average amount of food products and a minimalist store environment.

Convenience store, convenience store - small store, located in a residential area, open daily from morning to late evening, offering a limited range of popular food and non-food items for everyday use. This format is characterized by an average level of prices, design and service.

Variety store) - a store that sells a wide range of inexpensive and popular products, such as stationery, gifts, accessories for women, sanitary and hygienic and cosmetic products, small tools, toys, household goods. In addition, services such as key cutting and shoe repair are often provided.

Specialty store - a store that offers a narrow group of products with a significant depth of assortment.

“Categoiy killer” - specialty store, undisputed leader in terms of “depth of assortment”, offering the maximum variety of goods within a specific product category in relatively low prices. The opening of such a store makes it unprofitable to include goods of this category in the assortment of stores located in its trading area.

Power center - a retail enterprise with approximately 5-6 “category killer” stores and a number of diverse stores or several complementary stores specializing in a specific product category. A power center usually occupies an area of 22-45 thousand m2 and is located on a main highway or intersection.

Shopping center - group trading enterprises, united by a common architectural ensemble, which is owned and managed as a single entity. Shopping centers often provide conditions for a wide variety of leisure activities (restaurants, cinemas, skating rinks, etc.), and provide a large parking area. Depending on the scale of activity and the size of the serviced trade area, they are divided into neighborhood shopping center, regional (regional shopping center), urban (community shopping center) and the so-called malls (megamall).

Outlet-center - large stores on the outskirts or outside the city, where products of leading brands are presented at a discount of 30-70%.

Boutique - a small store of exclusive goods with a narrow specialization and a personalized service system.

Cassette (casek.it) - a fashion store (clothes, shoes, underwear) with a specific set of features. Occupies an intermediate niche between a standard store and a boutique.

Factory outlet - a store owned by a manufacturing company, which uses it to sell goods of its own production. It often sells products for which orders have been cancelled, products discontinued for various reasons, trial batches, etc.

Small wholesale store selling for cash (cash-and-cany)- a large store offering a large assortment of goods, sold mainly in small wholesale quantities with significant discounts with minimal service.

Warehouse dub- a retail trade enterprise that provides significant discounts to club members who pay annual membership fees. This store offers limited service and is aimed primarily at price-sensitive shoppers.

Flea market - the place where large number Retailers sell a wide variety of products at bargain prices.

Among semi-permanent formats, the most common are pavilion and kiosk.

Pavilion) - a closed equipped building with a sales floor and a room for storing inventory, designed for one or more workplaces.

Kiosk, tent (kiosk) - it is closed, equipped with commercial equipment, designed for one workplace seller's premises that does not have a sales area and a separate place for storing goods.

Mobile retail includes auto shops and other facilities adapted for peddling. This also includes trade, in which merchants organize the sale of popular goods (sweets, newspapers, flowers, etc.) in busy places. Street trading includes the sale of everyday goods (bread, dairy products, eggs, fruits, vegetables), organized in residential areas using mobile vehicles.

On wheel retail- a mobile structure that does not have a sales floor and storage facilities, designed for one seller’s workplace. Magazines on wheels are equipped special equipment: refrigerators and freezers, frying surfaces, gas grills, work tables, counters, etc., as well as energy and water supply, ventilation and heating systems.

Carrying out transactions outside a specific place of trade is called non-store retailing.

Trade from trays and trade from hand can be classified as both mobile and non-store types of trade.

Trading from trays (stall retail)- trading from small portable tables or carts, sometimes equipped with special equipment for displaying goods (for example, brackets for sunglasses).

Street-hawking- trading by hand in busy places. The seller has a limited amount of goods that he carries with him.

Personal sales (personal retailing)- sales carried out through personal communications between the seller and potential buyers in the latter’s places of residence and work - the so-called door to door selling - or places of leisure (for example, sales meeting at home - sales party). One of the forms of organizing personal sales is "pyramid selling"- is based on the involvement of as many participants as possible in the system.

Mail order- retail trade carried out on orders that are carried out using postal services.

Vending machine (vending machine)- a form of retail trade in which the sale of small goods is carried out using special mechanisms controlled by the buyer himself. Vending machines eliminates the need for sales personnel and time constraints.

Video kiosk- an interactive terminal that allows you to receive information about the product on the monitor online and make the appropriate order. To facilitate the process of selecting a product, touch screens are increasingly being used.

Exhibition shop - an exhibition where the goods on display can be sold. Samples of products are usually displayed, and buyers can place an order based on them or purchase samples directly. It is a temporary format, because sales are carried out only during the exhibition.

TV-shop - organization by an enterprise of the sale of goods through their television visual presentation, which makes the offer more dynamic and demonstrates the functionality of the product.

Telemarketing - the enterprise's use of the telephone as a tool for direct sales to customers. Depending on the use of the telephone (to actively convey information to the buyer or to receive an order for the sale of an already selected product), outgoing and incoming telemarketing are distinguished.

Online store (Internet-shop) - a virtual store that organizes retail trade through interactive interaction between the buyer (using the Internet access tool available to him) and the seller via the World Wide Information Network.

In this article we will talk about what store formats there are and how they differ. In addition, you will learn what the specifics of Russian retail outlets are.

The current state of retail

Retail trade is becoming increasingly important nowadays. It connects the processes of production, distribution and consumption, forming a single complex. Trade today has undergone significant structural changes. The number of markets organized spontaneously has decreased significantly. became larger, and competition between them intensified. Currently retail turnover is formed mainly by commercial organizations, as well as individual entrepreneurs who operate within fixed networks.

In an increasingly competitive environment, stores offer everything and services. Today, the state of the market is characterized by the presence of rigid structuring. In addition, new store formats are emerging. The development of trade is characterized by significant changes in the forms of service and in this regard, “Soviet” classifications no longer reflect its current state.

Classification criteria

It is more appropriate to divide retail enterprises not only by type and type, but also by format. The classification criteria in this case are as follows:

- assortment;

- square;

- price;

- form of trade service;

- atmosphere;

- location;

- target group of consumers;

- promotion.

Main formats of stores selling food products

In Russia today there are 5 main store formats that specialize in:

- convenience store;

- discounter;

- warehouse store;

- supermarket;

- hypermarket.

Let's look at each of them briefly.

Hypermarket

Do you know the difference between a hypermarket and a supermarket? Many people cannot determine what the difference is between them. These retail store formats differ in area and assortment.

A hypermarket is a store that is larger than the size of a supermarket. Its area is at least 10 thousand square meters. m. It also differs from the expanded supermarket, which ranges from 40 to 150 thousand positions.

One or more large parking lots are organized for clients. This is explained by the fact that customers usually come to hypermarkets by car. In these stores, unlike other formats, great attention must be paid to the convenience of visitors staying in them for a long time. It is necessary to have toilets, catering outlets, playgrounds, food packaging areas, recreation areas, etc.

Supermarket and convenience store

The area of the supermarket is from 2 to 5 thousand square meters. m. This format implies a spacious room, access roads, convenient store locations, a cozy atmosphere, and beautiful interior design. The assortment ranges from 4 to 20 thousand items.

Hypermarkets and warehouse stores operate in the economy and middle segments of the market. Compared to supermarkets, they are more democratic. The economical supermarket is divided into separate categories based on price. In addition, it can be complemented by a convenience store, a new format. It is conveniently located, has extended opening hours, and sells a limited selection of everyday items.

Warehouse store

A warehouse store is often opened by wholesale companies that can purchase large quantities of goods at significant discounts from manufacturers or other suppliers. They can also be organized by companies that are distributors of certain products. Currently, the share of wholesale trade is decreasing every year. Many manufacturers work directly with retailers. The warehouse store in this case is a good “transitional” stage from wholesale to retail trade.

This format was formed back in the 1960s. At first, the clients of such stores were representatives of medium and small businesses interested in purchasing small quantities of goods at a low price. This format is determined precisely by the contingent of buyers, and not by sales volumes. This involves paying for the purchase in cash, and then the client takes the goods away himself. Cash and self-pickup allow such stores to increase the turnover of goods on goods, while reducing

Discounters

Speaking about discounters, it should be noted that they attract not only buyers with low incomes. They are visited by consumers with average and even high income. Thus, discounters adapt to the needs of customers.

As you remember, store formats are distinguished by area, assortment, price of goods and other criteria. As for discounters, their area ranges from 500 to 1.5 thousand square meters. m. The range of goods is quite narrow, additional services are not provided. There is no interior design provided, except for corporate network design and consumer information.

These stores are located in residential areas as it is expected that visitors may not have their own transport. A small number of discount stores aimed at car owners are located at the intersection of major highways, usually within the city.

Specifics of Russian stores

The new store formats listed above are united by the use of the following methods of organizing sales and trade: consumer self-service, the presence of a mixed assortment, and networking. At the same time, Russian enterprises that operate within their framework have a number of peculiarities. Firms operating in the hypermarket format mostly meet Western standards. However, the operating principles of Russian discounters, supermarkets, and convenience stores have their own specifics. They do not meet the standards of formats accepted abroad. This concerns mainly pricing policy.

For example, Western convenience store companies set high markups on goods. This is explained by the fact that these stores have a convenient location, which is considered as a service. The “at home” format adopted in Russia is somewhat different. Its specificity lies in the fact that this store corresponds to the purchasing power of the residents of the area where it is located.

Clothing store formats

Market, department store, pavilion are concepts that every Russian can define. The formats of small clothing stores designed for buyers with an average or low income are also familiar to us. However, today more and more new words are appearing to denote types. We invite you to consider some formats of clothing stores that have emerged relatively recently in our country.

Boutique

Boutique is a word of French origin. This is the name of a small store of expensive and fashionable goods. A boutique is a store that sells exclusive clothing and accessories. Its assortment may include clothing from several brands, but not necessarily. The boutique can also be the official outlet of famous fashion houses. In other words, it can be either multi-brand or mono-brand.

This term in the modern fashion industry also refers to an expensive and fashionable clothes, which is distinguished by a high level of service, exclusive room design, product range, bright corporate style and has a specific target audience (men and women with middle and high incomes).

Showroom

Showroom is a word translated from English meaning “showroom”. This store format involves a room with a showroom in which samples of the brands’ collection are presented. Companies that do not distribute their products themselves provide only distributor addresses and information about products in their showrooms. At the showrooms of companies distributing goods, it is possible to make wholesale purchases.

In our country, many such stores organize sales of clothing samples that are presented in them. In addition, they can specially import shoes, clothing and accessories from abroad that are not sold on the Russian market. They sell these things on “demonstration sites”, which, by the way, contradicts the format of the world’s showrooms.

Concept store

More and more new store formats are gradually penetrating our country. One of them is a concept store. Translated from English, this word means "multifunctional store." These retail outlets are not yet very popular in our country, but in Europe concept stores are ubiquitous. The term itself originated in the late 1990s. It was then that a new way of organizing multi-brand boutiques was invented. The main idea was to present visitors with an expensive "lifestyle".

Items sold in concept stores are often completely dissimilar, but they are united by a certain concept (idea). This store must create a special atmosphere and space that helps convey a certain worldview to the buyer. Classic concept stores present exclusively rare and limited products, but they are designed for consumers with different levels income.

Currently, these and other store formats are becoming increasingly popular. Russia is gradually learning from the experience of Western countries, where trade is still better organized than in our country. Foreign store formats, the types and types of which can already be found today in the territory of the former Soviet Union, are constantly evolving. We must assume that big changes await the residents of our country in the future.

Marketing and trade economics

Shop building. Construction of shopping centers, expansion of networks

Retail formats

In it we will consider:

Firstly,

Secondly

AND thirdly,

- Technologies

- testing of goods,

- and others.

- .

General trends in the market:

- .

- opportunity to communicate,

- good service,

- pleasant atmosphere,

- convenience for the buyer.

- Impact of the real estate market.

supermarket

Retail Mistakes

- Poor choice of location

How to avoid mistakes?

Based on the results of the analysis:

website in collaboration with Kira and Ruben Kanayan, the Kanayan Retail & Development Consulting group of companies is starting a series of publications dedicated to the development of formats in retail trade.

In it we will consider:

- Various sectors and specializations of trade: brief overview development of formats of large federal and regional chains of the Russian Federation, examples of stores and shopping centers.

- New retail formats that appear on the market.

- Trends and prospects for the development of each format.

Development of retail formats

The issue of the concept and format of stores and shopping centers continues to be one of the most pressing. Significant changes are taking place in the retail market, and we need to work for the future, not limited by the experience and realities of today.

The situation now is radically different from what it was twenty or even ten years ago: many formats were already working abroad, there were enough materials and techniques for them. You could look at examples, learn from them, adapt successful experience to Russian realities and open a new format in your city. Now this is not the case in many new areas in retail and commercial real estate. We can say that everyone started at the same time.

We have to analyze, invent, try, and many issues are in the process of being resolved - not only here in Russia, but throughout the world. In this article, we will look at retail factors that influence the development of formats, as well as typical retail problems and mistakes that are made when launching new projects.

Many traders and commercial property owners realize that work has become much more difficult.

Firstly, The high saturation of areas makes itself felt, and competition becomes more intense.

Secondly, many traditional sales techniques have weakened - they either stopped working completely, or buyers became less sensitive to them

AND thirdly, investors who want to invest money in development have become more cautious.

Therefore, we have to ask ourselves the questions: “What will the stores and shopping centers of the future be like?” and “Which retail directions and formats will be the most relevant, in demand not only today, but also in the medium term, and will ensure high commercial performance.”

Every year something new appears on the trade and entertainment market. Promising directions on current moment(early 2018):

- combined store formats that combine trade with entertainment and leisure, catering and even trade with sports;

- automated trading and the use of virtual and augmented reality technologies for product presentation and sale;

- new in the format of “shop near home”, “shop along the way”;

- and, of course, the omni-channel, which is popular today, integrating all known channels of communication between the seller and the buyer.

They are working on all this in parallel: network retail companies, IT companies, wholesale and logistics companies, gas station chains, development consultants (including us). And tomorrow will bring new trends.

There are examples when the new turns out to be “well forgotten old” in a new version. For example, peddling, which almost disappeared in the 20th century, has returned in the form of online stores and delivery services, and instead of ruddy-cheeked peddlers (“oh, my box is full, full, there is chintz and brocade in it”), employees rush to customers in uniform with the same full boxes, and we see them every day in the subway and in our own yards.

Modern “customization” in the fashion market is a descendant of milliners of the 19th century and “tailoring” of the 20th century.

The fashionable word “sharing” is a modern analogue of rental, common in Soviet times, and “co-living” is essentially the same “dorm”.

“Pop-up” shops (temporary trading points) were opened by merchants in the 19th century upon temporary membership in one of the merchant guilds. And in fact, many points in resort towns - Gelendzhik, Anapa, etc., operate using this technology. Most shopping centers and markets have a temporary rental area. Although many traders do not know this term...

Trading from catalogues, samples or using showrooms has been known for several centuries: many representatives of the Russian aristocracy and wealthy merchants furnished their mansions using this form of trade.

The distribution points have also been known for the fourth century. Thus, the Utkonos network at one time relied on the experience of Soviet order tables, and those, in turn, relied on Western and pre-revolutionary domestic experience.

And “fresh markets”, “gastro” and “delhi markets” are a fundamentally not new phenomenon, only now these formats have become more widespread and accessible to the average buyer, and not just a narrow stratum of the wealthy population.

When creating new retail chains, it is interesting to invest in the most promising areas. Of course, you have to take risks, like all innovators, but the degree of risk depends greatly on the approach. If the approach is “to make a cool, fashionable feature,” then there is a greater likelihood that the money will fall into the abyss, and the “trick” will leave extremely unpleasant memories of itself in the form of stone-faced bank employees or the sale of a new Lamborghini.

Any experiment must be very carefully calculated and prepared, and we will talk about this later.

For existing networks, proper “formatting” also brings benefits:

- are being reduced operating costs due to standardization,

- you can fully compare all similar stores, plan and analyze,

- adjust the typical parameters of a network retail outlet (area, assortment, composition of services, etc.),

- as well as assess the potential of each format and allocate more resources to promising formats, reducing obsolete or low-profit ones.

Factors influencing the development of retail formats:

- Technologies. This is the most important factor. Developments are emerging in various areas that can and should be applied in stores and shopping centers. For example, these are technologies:

- product presentations (3D models, augmented reality for interior products, clothing, equipment, etc.),

- testing of goods,

- design and finishing materials for facade and interior,

- promotion via the Internet and social networks,

- communication with clients and employees at various points,

- collecting and analyzing data for assortment planning and working with customer bases,

- product distribution, interaction between wholesale and retail,

- automation in trading floor, in the warehouse and during the provision of services,

- and others.

- Changes in various trade sectors.

General trends in the market:

- Changes in consumer behavior, habits and values.

The generation that is used to buying and consuming in new ways has grown up and its share has increased. These are young families who do not have a TV (why is it needed when all the news can be found on the Internet, and films can be watched in the cinema or on a mobile device), girls who are indifferent to furs and gold jewelry and do not have a pocket mirror in their bag (they use it instead again a smartphone).

In general, among buyers there has been a tendency to view shops and shopping centers not as a banal place for obtaining necessary things, but as a place for receiving emotions and new impressions, making acquaintances, having a pleasant time, learning and development. Accordingly, traditional stores still have the advantage of using the emotional factor in the sales process.

In the future, people will increasingly value in stores what cannot be found on the Internet:

- opportunity to communicate,

- good service,

- pleasant atmosphere,

- interesting presentation of the product and the possibility of direct contact with it,

- convenience for the buyer.

- Impact of the real estate market.

When opening new stores and retail chains, it is important to analyze the supply of premises on the retail real estate market and highlight opportunities and limitations.

In our practice, there have been several cases when our clients, retail chains, first independently developed a new retail format and only then began to analyze the space market - already at the stage of searching for sites for rent. As a result, it turned out that there were not enough suitable sites in the city!

For example, a convenience store was planned with a typical sales area of 450 sq.m., but very few premises of this area were offered, and not all places were suitable in terms of location and environment. But the market was replete with supply of areas of 100–150 sq. m. m, and here it was already possible to choose really good places.

Another example is a local or regional chain developing a “non-food supermarket” format with an area of 700–1000 sq. m. m and also cannot find sites for it. All the best locations in concept shopping centers are given to federal or international operators, leaving a narrow choice in less significant centers and street retail.

For small formats in large cities, high rental rates, especially in walk-through and conspicuous places. One of the regional networks, which works well in its region, was forced to curtail its project in the capital due to the fact that the “rental load” (an indicator of the share of rent in turnover) turned out to be much higher.

Therefore, the correct approach is to ensure the availability of sites and take this into account when developing format parameters. It should be noted that a multi-format chain has a much greater chance of increasing its presence and occupying space in almost all strategic locations - in shopping centers and street retail. And also develop a territorial coverage strategy and select the optimal locations for opening the first points.

Retail Mistakes

Why do unsuccessful formats occur? Here are a few typical retail mistakes that traders and store owners make:

- "Rediscovering America with the reinvention of the wheel and bicycle" - poor knowledge of the history and experience of trade, both domestic and foreign. Ideas arise that have long been implemented. If you don’t study experience and follow trends, you will collect all possible bumps on this difficult path of the “discoverer”. At one time, this concerned the development of supermarkets and hypermarkets, today - the development of omni-channel, delivery windows, combined and hybrid stores.

- “Me and my friends like it”. This approach works well only if the interests of the owner and his friends coincide with the interests of the target audience, and (which is very important) this target audience is available in sufficient numbers. Let's remember the law of large numbers and use vegetarian products as an example. According to statistics, we have about 2% of vegetarians, including orthodox trends - vegans, raw foodists (judging by the results of some surveys in Russia, in 2016-17 this figure increases to 3-4%). In the West there are slightly more of them - up to 10%. Accordingly, in Moscow (population according to statistics as of January 1, 2017, 12,830.66 thousand people), the market for vegetarian products numbers 256,613 people and is sufficient to open a store or even a small chain. In Penza (523.73 thousand people) this will already be 10,475 people, in Tambov (290.37 thousand people) - 5,807, and in Morshansk (39.36 thousand people) - only 787 people. Accordingly, the market capacity varies significantly, and a vegetarian seller in a small town will sadly sit behind the counter and look at the empty drawer of his cash register.

- Poor choice of location. Again about vegetarians. Even in the huge metropolis of Moscow, there was an example when vegetarian stores of the same chain existed perfectly in the center - a place of intense consumer flows and accumulation of all types of “non-traditionalists”, but not a single store took root on the outskirts. One more bad example was the opening of a vegetarian fast food chain in a city with a population of over a million. Many points opened near public transport stops in residential areas where low-income people lived. It is not surprising that workers rushing home from work after a shift continued to buy unhealthy but satisfying hamburgers, pasties and pies fried in oil along the way, and completely ignored the new point.

- “We haven’t had this before” (variation: “Why not try?”). One of the pearls in our collection is the “Clothing from Peru” store in the city of Yakutsk. For those wishing to surprise buyers in their hometown, we remind you of the size of the target audience and the regularity of consumption.

- . We have already written a lot about this in our books. The fashion of recent years is markets and fresh markets, trampoline parks and petting zoos. Fashionable - let's put it on! Today, even on the remote outskirts of Belgorod and Taganrog you can find mini-trampoline centers and well-fed cats in cute cages. Only the buyers have already jumped on and polished themselves, and clearly they need to look for something new. Before the cockroaches and mice prevail... It’s better to think about what customers need and what they will be willing to spend money on regularly and over a long period. It is this format that takes into account the needs that will be successful.

- . It often occurs when simply transferring a foreign and metropolitan format to the regions.

- . New retail formats need to be planned for the future. Until now, some companies offer an option (concept, layout, design) similar to a successful Western shopping center - but only built 10-15 years ago. It is immediately clear that such a standard solution is suitable for an underdeveloped market and is in no way suitable for modern Russian cities with a high saturation of space in shopping centers and a variety of types of shopping centers - the project is already obsolete, and it is risky to do it. The market has changed in recent years. Therefore, if the project was developed even 1-2 years ago, and you are starting to implement it today, it is necessary to conduct additional research and make adjustments.

How to avoid mistakes?

The complex of research when developing a new format should include:

- Analysis of main competitors, market players and existing formats;

- Analysis of technologies in the production and sale of goods, logistics;

- Analysis of the consumer environment and trends in purchases of each type of product;

- Analysis of areas for development (country, city, district, city district);

- Analysis of the supply of space in existing and under construction facilities.

Based on the results of the analysis:

- The main parameters of retail outlets are being developed: total and retail space, assortment matrix, form of trade and presentation of goods, optimal trade equipment etc.;

- Unique is created trade proposal(USP);

- The geography and the most promising territories for opening new stores are determined;

- Resources are assessed (time, money, people);

- Are formulated uniform requirements to location, criteria for choosing a location and selecting premises for new stores;

- A forecast is made for three scenarios: optimism, normal situation, pessimism (don’t forget about this! Until now, many entrepreneurs consider only the desired, optimistic option);

- A promotion program is being drawn up;

- A location (or several locations) is selected for a “pilot” project.

1.2 Classification of retail formats

The format of a retail store is determined primarily by the size of the retail space, as well as the assortment matrix of goods. Currently, modern store formats compete with traditional formats, such as counter-service stores, covered markets, pavilions and kiosks. Retail trade turnover through stores of modern formats is growing at a significant pace, but the share of modern formats in the total volume of retail trade remains significantly lower than the share of trade through retail outlets of traditional formats.

A feature of the Russian retail market is the gradual erosion of store formats, which thus seek to attract more groups of buyers. Therefore, more and more often Russian stores features of several formats can be detected. The Russian retail market is still in the development stage, and its agents are in search of the most optimal formats. The more developed European retail market is distinguished by a deeper positioning of stores in a certain format. In this regard, the European classification of retail stores is taken as a basis, taking into account Russian specifics.

At the moment, there are five modern store formats in retail trade:

· hypermarket and Cash

· megamarket and supermarket;

· discounter;

· “convenience store”;

· specialized store.

The stores of the first four formats are distinguished by the sale of products mainly for daily use, such as food products, hygiene products, etc. However, large stores due to wide range and significant areas have the opportunity to sell durable goods.

The latter type of stores is separated into a separate format, as retailers of durable goods and non-daily use goods. This type of store is not intended for daily visiting.

Hypermarkets and Cash&Carry stores are large-format stores that have recently gained increasing popularity among the population. They are self-service stores with an area of more than 5,000 thousand square meters. m, and are designed to meet the wide needs of consumers for goods of various profiles. Their assortment should include food and non-food products of everyday demand, and the share of the latter should occupy up to 50% of the store’s retail space (recommendations of the Ministry of Economy of the Moscow Region). Due to their size, hypermarkets are usually located on the outskirts of the city.

Additional distinctive features of this format can be an assortment matrix numbering at least 35-40 thousand items of goods (less for Cash&Carry, which is due to the specifics of the presentation of goods in retail space), free parking, the availability of related services (financial services, entertainment, food outlets, household and pharmaceutical services, etc.). Retail space occupies 60-70% of the total store area, the rest of the space is allocated for related services and small-format stores. This format includes several retail chains operating on Russian market, - Auchan, METRO S&S, “Lenta”, “Mosmart”, “Carousel”, “Our Hypermarket”, Real, “Bakhetle”, “OKey”.

It is worth noting that these distinctive features are characteristic mainly of Russian hypermarkets located in large cities, while in Europe and in medium-sized Russian cities their sizes can be significantly smaller.

A hypermarket and a Cash&Carry store are also somewhat different. Cash&Carry stores specialize mainly in small wholesale and retail trade, and payment for purchases is made only in cash. This allows you to reduce the costs incurred by the store in the case of using credit and debit cards (deduction of interest to banks for carrying out transactions), as well as in the case of using invoices (risks of non-payment of the purchase by the consumer).

Cash&Carry stores are also distinguished by their desire to minimize storage costs by using retail space to store products. The presence of large, small-scale wholesale lots on the sales floor significantly reduces the opportunity to increase the variety of assortment. As a result, the presented line of goods does not exceed 15-20 thousand items in the same area as a hypermarket. A consequence of saving space is the absence of some services designed to attract a wide range of consumers characteristic of a hypermarket, such as household services, financial services and more. This type of store includes METRO C&C, Lenta, AMIK C&C.

The price level in hypermarkets, which target various consumer groups, including high-income consumers, is quite high and corresponds to the price level in supermarkets. However, some groups of goods, mainly essential goods, have a minimum markup of 5-10%, which creates the impression of low prices.

For other product groups, the trade margin can reach 20-25%. Small wholesale trade in Cash&Carry stores allows you to make a 10% markup on most groups of goods.

It is also common for hypermarkets to produce their own FMCG (fast-moving consumer goods, mainly food), which allows them to reduce their retail price. So, the most common is in-house production bakery products, salads, meat products. Cash&Carry stores, as a rule, do not have such production facilities.

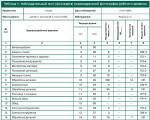

Table 1 Characteristics of the largest hypermarkets in Russia by turnover

Megamarkets and supermarkets include stores with an area from 700 to 4.5 thousand square meters. m, that is, slightly smaller than the area of a hypermarket. The assortment line is about 5-20 thousand items of goods. A classic supermarket also assumes the presence of related services, including the production of essential products. Free parking is also an attribute of supermarkets.

Table 2 Characteristics of the largest supermarkets in Russia by turnover

Providing additional services to the population, significant costs for the design of retail space, as well as location in central and densely populated areas with high land costs make supermarkets relatively expensive stores. In this regard, the price level in supermarkets is much higher than in hypermarkets. The trade margin is about 20-25% for most groups of goods. Supermarkets are designed to satisfy large groups of the population, mainly the middle class and people with high incomes.

In Russia, there are several large chains that adhere to the supermarket format - these are Paterson, Perekrestok, and Sedmoy Continent.

Discounters mainly target middle- and low-income shoppers.

This strategy defines appearance, assortment and pricing policy store, as well as a set of additional services to the population.

The sales area of discounters ranges from 200 to 800 sq. m. m. Discounters offer a limited range of goods. The number of products can vary from 1 to 4 thousand items.

Additional services typical of large-format stores are usually absent.

This type of store has recently become very popular, especially in the regions. This is primarily explained by the relatively low incomes of the population in small towns in relation to the population of megacities. TO well-known networks operating in this format include “Pyaterochka”, “Magnit”, “Kopeyka”, “Dixie”.

“Convenience store” is one of the most promising store formats. It has not yet become widespread in Russia, but is very popular in Western countries. This is a small store - 150-300 square meters. m, serving residents of a small area or block.

These small-format stores attract customers good quality products, as well as those located within walking distance. Stores of this type adhere to the average price level, which distinguishes them from discounters. In addition, they usually offer a wide range of products, including the non-food segment.

Table 3 Characteristics of the largest discounters in Russia by turnover

The niche of “convenience stores” is currently poorly developed, which is explained by the lack of attention to this segment on the part of large chains. However, recently a number of large networks have begun to develop this segment.

Table 4 Planning and implementation of projects for opening “convenience stores”

Specialized stores are usually identified as a separate store format, since they are characterized by different specifics of selling and promoting goods than other formats.

The main difference between specialized stores is that they sell goods mainly for medium and long-term use and are not intended for daily use. These stores include stores household appliances, stores selling cellular and radio communications, bookstores, stores selling clothing, medicines, cosmetics, DIY construction stores, etc.

There is no limit on store size, although in most cases it will not exceed the size of a supermarket. A set of additional services is also optional. Assortment matrix determined depending on the nature of the products sold.

Currently, the upward trend in the share of household expenditure on non-food products compared to food products, which was interrupted last year, has resumed. First of all, this was caused by rising incomes and increased well-being. In addition, the strengthening of the ruble had an impact, which led to cheaper imports. Considering that most household appliances and cell phones are foreign-made products, this type of product has become more accessible to consumers, and therefore stores specializing in this segment have shown a significant increase in turnover.

Examples of stores in this group are household appliance stores - Eldorado, M.Video, Tekhnosila, Electronics Store Mir; cellular communication stores - Euroset, Svyaznoy, Dixis; cosmetics and perfumery stores - “Alcor”, “Arbat Prestige”, “Yuzhny Dvor”, “United Europe:SB”; pharmaceutical stores - Pharmacy Chain 36.6, Pharmakor, Rigla, Natur Produkt Holdings Limited S.A.

As for clothing and accessory stores, some of them are represented by Russian distributors (Mercury, JamilKo), who have rights (often exclusive) to represent well-known brands. In addition, international groups are increasingly opening subsidiaries in our country.

For example, the world's largest luxury goods retailer LVMH (Louis Vuitton, Christian Dior and others) took this path.

Table 5 Characteristics of the largest specialty stores in terms of turnover in Russia

|

Retail networks |

Turnover in 2005 (millions of US dollars) |

Increase in trade turnover compared to 2011 (%) |

Average store area (sq. m) |

|

|

Household appliances and electronics |

||||

|

"El Dorado" |

||||

|

"M.Video" |

||||

|

"Technosila" |

||||

|

"Electronics store "Mir" |

||||

|

Cellular communications and digital technology |

||||

|

"Euroset" |

||||

|

"Svyaznoy" |

||||

|

"Dixis Holding" |

||||

|

"Concern "White Wind" |

||||

|

Cosmetics and perfumes |

||||

|

"Alcor" |

||||

|

"Arbat Prestige" |

||||

|

"Southern Dvor" company |

||||

|

"United Europe:SB" |

||||

|

Pharmaceuticals |

||||

|

"Pharmacy Chain 36.6" |

||||

|

"Pharmacor" |

||||

|

Natur Produkt Holdings Limited S.A. |

Analysis of retail trade turnover of the enterprise LLC "Fresh Products"

Analysis of trade turnover of a trading enterprise

The population receives the bulk of material goods that are used for personal needs through trade. Quantitative and qualitative characteristics commodity mass, which moves from the sphere of production to the sphere of consumption...

The range of services of retail trade organizations of various formats and their impact on the culture of trade services using the example of the retail chain "Pravilny Chick"

There are now countless retail organizations of varying shapes and sizes around the world. Due to the fact that potential consumers show loyalty to different forms of trading activity...

Marketing activities in wholesale and retail trade

marketing retail wholesale trade In the process of movement of goods from manufacturers to consumers, the final link that closes the chain of economic relations is retail trade...

Operational Marketing

The main economic entities in the consumer market engaged in retail sales of goods are trading enterprises ( legal entities) and individual entrepreneurs (individuals)...

Features of changing trade formats of retail trade enterprises

Signs of retail trade and wholesale fair

The concept of “retail trade services” is unknown to civil legislation in its enforcement and contractual meaning and directly contradicts it. Retail trade is the process of circulation of goods...

Promotion of a plus size boutique using the example of Atlant LLC, Elena Miro boutique

The clothing trade infrastructure has developed very rapidly in Russia in recent years. And although clothing markets continued to meet the needs of a considerable number of consumers; network trade has dominated large cities for several years now...

The classification of retail trade enterprises can be based on the following characteristics: · Features of the device; · Form of trade service; · Type of building and features of its space-planning solution; · Functional...

Development of retail trade in the Russian Federation and Tatarstan

Retail trade formats are developing all over the world according to the same logic, and the Russian retail market repeats the main stages of development of markets in more developed countries...

Development of retail trade in consumer goods in the Russian Federation

The concept was developed in accordance with the main provisions of the “Social and Economic Development Program Russian Federation for the medium term (2002-2004)" and "Strategies for the socio-economic development of Russia for the period up to 2010...

Retail. Retailer Marketing Solutions

Retail businesses are divided into independent retailers, chain stores, retail franchises, leased departments and cooperatives. Independent retailers. They usually own...

Russian retail chains as a format of modern retail trade

Considering the scale of the global financial crisis and its consequences for other sectors of the Russian economy, 2008 can be characterized as quite favorable for the Russian retail market...

Classification of retail formats

The format of a retail store is determined primarily by the size of the retail space, as well as the assortment matrix of goods. Currently, modern store formats compete with traditional formats, such as counter-service stores, covered markets, pavilions and kiosks. Retail trade turnover through stores of modern formats is growing at a significant pace, but the share of modern formats in the total volume of retail trade remains significantly lower than the share of trade through retail outlets of traditional formats.

A feature of the Russian retail market is the gradual erosion of store formats, which thus seek to attract more groups of buyers. Therefore, more and more often, Russian stores can find features of several formats. The Russian retail market is still in the development stage, and its agents are in search of the most optimal formats. The more developed European retail market is distinguished by a deeper positioning of stores in a certain format. In this regard, the European classification of retail stores is taken as a basis, taking into account Russian specifics.

At the moment, there are five modern store formats in retail trade:

· hypermarket and Cash

· megamarket and supermarket;

· discounter;

· “convenience store”;

· specialized store.

The stores of the first four formats are distinguished by the sale of products mainly for daily use, such as food products, hygiene products, etc. However, large stores, due to their wide range and large areas, have the opportunity to sell durable goods.

The latter type of stores is separated into a separate format, as retailers of durable goods and non-daily use goods. This type of store is not intended for daily visiting.

Hypermarkets and Cash&Carry stores are large-format stores that have recently gained increasing popularity among the population. They are self-service stores with an area of more than 5,000 thousand square meters. m, and are designed to meet the wide needs of consumers for goods of various profiles. Their assortment should include food and non-food products of everyday demand, and the share of the latter should occupy up to 50% of the store’s retail space (recommendations of the Ministry of Economy of the Moscow Region). Due to their size, hypermarkets are usually located on the outskirts of the city.

Additional distinctive features of this format can be an assortment matrix numbering at least 35-40 thousand items of goods (less for Cash&Carry, which is due to the specifics of the presentation of goods in retail space), free parking, the availability of related services (financial services, entertainment, food outlets, household and pharmaceutical services, etc.). Retail space occupies 60-70% of the total store area, the rest of the space is allocated for related services and small-format stores. This format includes several retail chains operating on the Russian market - Auchan, METRO S&S, Lenta, Mosmart, Karusel, Our Hypermarket, Real, Bakhetle, O'Key.

It is worth noting that these distinctive features are characteristic mainly of Russian hypermarkets located in large cities, while in Europe and in medium-sized Russian cities their sizes can be significantly smaller.

A hypermarket and a Cash&Carry store are also somewhat different. Cash&Carry stores specialize mainly in small wholesale and retail trade, and payment for purchases is made only in cash. This allows you to reduce the costs incurred by the store in the case of using credit and debit cards (deduction of interest to banks for carrying out transactions), as well as in the case of using invoices (risks of non-payment of the purchase by the consumer).

Cash&Carry stores are also distinguished by their desire to minimize storage costs by using retail space to store products. The presence of large, small-scale wholesale lots on the sales floor significantly reduces the opportunity to increase the variety of assortment. As a result, the presented line of goods does not exceed 15-20 thousand items in the same area as a hypermarket. A consequence of saving space is the absence of some services designed to attract a wide range of consumers characteristic of a hypermarket, such as household services, financial services, etc. This type of store includes METRO C&C, Lenta, AMIK C&C.

The price level in hypermarkets, which target various consumer groups, including high-income consumers, is quite high and corresponds to the price level in supermarkets. However, some groups of goods, mainly essential goods, have a minimum markup of 5-10%, which creates the impression of low prices.

For other product groups, the trade margin can reach 20-25%. Small wholesale trade in Cash&Carry stores allows you to make a 10% markup on most groups of goods.

It is also common for hypermarkets to produce their own FMCG (fast-moving consumer goods, mainly food), which allows them to reduce their retail price. Thus, in-house production of bakery products, salads, and meat products is most common. Cash&Carry stores, as a rule, do not have such production facilities.

Table 1 Characteristics of the largest hypermarkets in Russia by turnover

Megamarkets and supermarkets include stores with an area from 700 to 4.5 thousand square meters. m, that is, slightly smaller than the area of a hypermarket. The assortment line is about 5-20 thousand items of goods. A classic supermarket also assumes the presence of related services, including the production of essential products. Free parking is also an attribute of supermarkets.

Table 2 Characteristics of the largest supermarkets in Russia by turnover

Providing additional services to the population, significant costs for the design of retail space, as well as location in central and densely populated areas with high land costs make supermarkets relatively expensive stores. In this regard, the price level in supermarkets is much higher than in hypermarkets. The trade margin is about 20-25% for most groups of goods. Supermarkets are designed to satisfy large groups of the population, mainly the middle class and people with high incomes.

In Russia, there are several large chains that adhere to the supermarket format - these are Paterson, Perekrestok, and Sedmoy Continent.

Discounters mainly target middle- and low-income shoppers.

This strategy determines the appearance, assortment and pricing policy of the store, as well as a set of additional services to the population.

The sales area of discounters ranges from 200 to 800 sq. m. m. Discounters offer a limited range of goods. The number of products can vary from 1 to 4 thousand items.

Additional services typical of large-format stores are usually absent.

This type of store has recently become very popular, especially in the regions. This is primarily explained by the relatively low incomes of the population in small towns in relation to the population of megacities. Well-known networks operating in this format include Pyaterochka, Magnit, Kopeika, and Dixie.

“Convenience store” is one of the most promising store formats. It has not yet become widespread in Russia, but is very popular in Western countries. This is a small store - 150-300 square meters. m, serving residents of a small area or block.

These small-format stores attract customers with good quality products, as well as the fact that they are located within walking distance. Stores of this type adhere to the average price level, which distinguishes them from discounters. In addition, they usually offer a wide range of products, including the non-food segment.

Table 3 Characteristics of the largest discounters in Russia by turnover

The niche of “convenience stores” is currently poorly developed, which is explained by the lack of attention to this segment on the part of large chains. However, recently a number of large networks have begun to develop this segment.

Table 4 Planning and implementation of projects for opening “convenience stores”

Specialized stores are usually identified as a separate store format, since they are characterized by different specifics of selling and promoting goods than other formats.

The main difference between specialized stores is that they sell goods mainly for medium and long-term use and are not intended for daily use. Such stores include household appliance stores, stores selling cellular and radio communications equipment, bookstores, stores selling clothing, medicines, cosmetics, DIY construction stores, etc.

There is no limit on store size, although in most cases it will not exceed the size of a supermarket. A set of additional services is also optional. The assortment matrix is determined depending on the nature of the products sold.

Currently, the upward trend in the share of household expenditure on non-food products compared to food products, which was interrupted last year, has resumed. First of all, this was caused by rising incomes and increased well-being. In addition, the strengthening of the ruble had an impact, which led to cheaper imports. Considering that most household appliances and cell phones are foreign-made products, this type of product has become more accessible to consumers, and therefore stores specializing in this segment have shown a significant increase in turnover.

Examples of stores in this group are household appliance stores - Eldorado, M.Video, Tekhnosila, Electronics Store Mir; cellular communication stores - Euroset, Svyaznoy, Dixis; cosmetics and perfumery stores - “Alcor”, “Arbat Prestige”, “Yuzhny Dvor”, “United Europe:SB”; pharmaceutical stores - Pharmacy Chain 36.6, Pharmakor, Rigla, Natur Produkt Holdings Limited S.A.

As for clothing and accessory stores, some of them are represented by Russian distributors (Mercury, JamilKo), who have rights (often exclusive) to represent well-known brands. In addition, international groups are increasingly opening subsidiaries in our country.

For example, the world's largest luxury goods retailer LVMH (Louis Vuitton, Christian Dior and others) took this path.

Table 5 Characteristics of the largest specialty stores in terms of turnover in Russia

|

Retail networks |

Turnover in 2005 (millions of US dollars) |

Increase in trade turnover compared to 2011 (%) |

Average store area (sq. m) |

|

Household appliances and electronics |

|||

|

"El Dorado" |

|||

|

"M.Video" |

|||

|

"Technosila" |

|||

|

"Electronics store "Mir" |

|||

|

Cellular communications and digital technology |

|||

|

"Euroset" |

|||

|

"Svyaznoy" |

|||

|

"Dixis Holding" |

|||

|

"Concern "White Wind" |

|||

|

Cosmetics and perfumes |

|||

|

"Alcor" |

|||

|

"Arbat Prestige" |

|||

|

"Southern Dvor" company |

|||

|

"United Europe:SB" |

|||

|

Pharmaceuticals |

|||

|

"Pharmacy Chain 36.6" |

|||

|

"Pharmacor" |

|||

|

Natur Produkt Holdings Limited S.A. |

Risks of retail trade development in Russia

Macroeconomic risks

The development of retail trade may be negatively affected by all those risks that slow down the growth of the country’s economy as a whole - a decrease in real incomes of the population, new wave crisis associated with events in the eurozone, etc. For example, in the forecast of the Ministry of Economic Development for a negative scenario for the development of the Russian economy in 2013-2015. - a sharp drop in oil prices - the growth rate of retail trade turnover will be 1.5% in 2013, 2.7% in 2014 and 3.6% in 2015. However, as an industry, trade is more resistant to such disasters than, say, industry, due to its proximity to the end consumer.

Country risks

Trade development is hampered by the inherent weakness of the Russian economy.

Poor road condition and low level transport services- primarily in railway transport - reduce the efficiency of trading enterprises.

Institutional risks

Regulation of trade, which is carried out by the Law on Trade No. 381-FZ of December 28. 2009, unfriendly towards network trading in FMCG retail. In addition, central departments and regional authorities, in the event of an increase in food prices, are primarily inclined to blame retail, with its supposedly high markups. In this case, widespread inspections of trading enterprises, especially online ones, begin.

Risks associated with amplification government regulation, also exist in pharmacy retail.

Industry risks

Competition between players is intensifying in almost all retail segments.

This requires trading organizations to pay great attention to ensuring operational efficiency. Otherwise, they risk leaving the market.

In addition, in the non-food trade segment, especially in the electronics and household appliances sector, traditional forms of trade are under strong pressure from online commerce.

Political risks

Political risks are minimal. Of course, as for other businesses, there is a risk of political destabilization, but it will not affect retail trade as painfully as businesses with a long-term investment horizon.

Thus, the development of retail trade and the presence of retail trade formats is predetermined by the presence of various risks.