Delay in payment of wages by 1 day. New salary payment deadlines, employer delays, salary commissions. What is “Payment Delay”

Delay wages in 2019, as before, it threatens employers with liability in accordance with the Labor Code and other regulations (Part 1 of Article 142 of the Labor Code of the Russian Federation). So, according to Art. 236 of the Labor Code, an employer who delays the payment of wages, even if it was not his fault, bears financial responsibility, and under Parts 6-7 of Art. 5.27 of the Administrative Code - and administrative (from 10 to 20 thousand rubles for officials and from 30 to 50 thousand rubles for legal entities).

In addition, if the employer’s desire to profit from employees is proven when wages are delayed by more than 2 months, then the head of such an enterprise can be brought to criminal liability under Art. 145.1 of the Criminal Code of the Russian Federation.

In addition, the employee has the right to suspend work by notifying the employer in writing if wages are delayed by more than 15 days.

What are the deadlines for paying salaries?

In Part 6 of Art. 136 of the Labor Code strictly states that earnings must be paid to the employee at least 2 times a month; in this case, the final payment for the month worked must be made no later than the 15th day of the month following it. And if this is provided for by the enterprise, then payments can be made three times a month.

Don't know your rights?

Moreover, for individual categories employees, according to Part 7 of Art. 136 of the Labor Code, other terms for payment of wages may be established if this is provided for by law. Specific terms for payment of wages at the enterprise must be fixed in the local normative act and in employment contracts.

IMPORTANT! According to Part 4 of Art. 136 of the Labor Code, the period for payment of wages in non-monetary terms is stipulated in the labor and/or collective agreement.

How many days can an employer delay wages under the Labor Code of the Russian Federation?

As mentioned above, the employer delays wages in accordance with the norms labor legislation entails legal consequences in the form of material, administrative and even criminal liability. In this case, liability begins on the very first day of non-payment of wages on time.

However, by delaying payment of wages to its employees, the employer can count on the fact that production process will not be stopped for at least the next 2 weeks. According to Part 2 of Art. 142 of the Labor Code, employees will be able to suspend work on the 16th day of non-payment of their wages and until the employer repays the debt. At the same time, they may not go to work, but the employer will have to pay them for these days average earnings(Parts 3-4 of the above article).

Therefore, if an employer has allowed a debt to arise to employees, but does not want to stop the enterprise, he must pay off all his debts on unpaid wages within 15 days.

So legal grounds The employer does not have the option to delay employee salaries. Moreover, failure to pay it on time is fraught with various types of liability, including criminal liability.

Art. 136 of the Labor Code of the Russian Federation obliges the employer to pay wages to its employees at least once every half month. In this case, the day of payment of monetary allowance is determined by the internal regulations of the organization: a collective or labor agreement.

Not all managers respect, much less abide by, the letter of the law - almost every second of them delays salary payments. Are there any levers of influence on an unscrupulous employer and how to use them correctly - two questions that primarily concern those who fail to receive their honestly earned money on time.

What does the labor code say?

The Labor Code of the Russian Federation states that if an employer allows itself to delay the payment of wages, then employees have the right to report such an offense to supervisory and regulatory authorities.

When receiving a complaint from employees, supervisory authority must carry out an inspection. 30 days are allotted for studying the appeal itself. During this period, a decision must be made to conduct an inspection of the employer. When conducting an inspection, inspectors are required to check all the facts described in the complaint, and also request documents from the employer regarding the payment of wages. If violations are discovered, an order will be issued, which will indicate all detected violations, as well as the deadline for correcting them.

After this period, inspectors will visit the employer again and conduct a re-inspection. If the violations are not eliminated, the employer will already be held accountable. The powers of inspectors from the labor inspectorate include issuing decisions to bring the employer himself, as well as officials through whose fault the delay occurred, to administrative liability.

What to do if there is a delay

The date of payment of wages must be specified in the wage regulations. The employee must be familiar with it when applying for a job. As a rule, an advance is given at the end of the month, and the remaining part of the salary is given at the beginning of the next month. The exact dates when payments will be made are specified in local regulations. If the date is written so that in the current month it falls on a weekend or non-working holiday, then the salary must be paid the day before, on the last working day.

For example, the regulations on wages stipulate that the employer must pay its employees on the 8th of each month. In March it is a non-working holiday. Therefore, salaries for February must be paid on March 7. If payments are not made on the established day, this is already a violation of the rights of workers.

Actions of an employee in case of delay in payment of wages

An employee who does not wait for the payment of wages within the period established by the collective or labor agreement has every right to begin defending his interests the very next day.

- Contacting the labor inspectorate at the location of the enterprise. This is the first step that must be taken in order to stop the employer’s illegal actions and speed up the payment of wages. The application to the inspectorate is drawn up in free form, but it must indicate specific violations of the employee’s rights. In this case, this is the fact of delay in payment of the allowance, the number of days of delay and the amount due.

- If the situation does not change within 15 days after the salary was due to be paid, the employee has the right to suspend his work until the violation of his rights is eliminated, that is, until he actually receives his salary. It is important not to forget to warn the manager about this in writing, referring to the provisions of Art. 142 Labor Code of the Russian Federation. If the employer begins making payments, it must also give proper written notice to employees. That is, the employer must ensure that the employee receives the notice in person and signs for its receipt. It can be done as follows:

- personally visit the employee and give him a notice. You need to prepare 2 identical copies. One is given to the employee, the second remains with the employer, and the employee puts his signature on it;

- sent via Russian Post. Notice must be sent by registered mail with a notice and a description of the contents. Once the postal notice is returned to the employer, he will know on what date the employee received the notice. As soon as the employee receives notice that payments will begin, he must return to work. If he does not do this, this action will be regarded as absenteeism and may become grounds for dismissal.

An essential point: the right to suspend work does not exist for civil servants, as well as for workers servicing hazardous types of equipment or production, or those whose work activities are directly related to ensuring people’s livelihoods: employees of ambulance stations, power plants, water supply enterprises, and so on.

Another important point! Actions in the form of suspension labor activity are legal only in cases where the employee is not paid wages. If there is a delay in payment of compensation for vacation, then such actions may be regarded as absenteeism. - Simultaneously with the suspension of work, it is worth filing a claim in court to recover from the employer not only the amount of arrears of wages, but also compensation for the delay in payment. Before filing a claim, you should find out whether the salary has been accrued, since if there is no dispute about the existence of a debt, as well as about the amount to be paid, there is no need for court hearings - a writ of execution can be issued almost immediately after the application.

- For those who have not been able to receive their salary within three months, it makes sense to contact the prosecutor’s office or the police - in this case, the employer’s actions fall under Article 145.1 of the Criminal Code or, what is less serious, but also unpleasant, Article 5.27 of the Code of Administrative Offenses.

Employer's liability

The Labor Code of the Russian Federation states that the employer must be held accountable for delays in wages. The right to work and its payment is guaranteed not only by labor legislation, but also by the Constitution of the Russian Federation. For violation of these rights, the employer can be held liable for the following types of liability:

- Disciplinary punishment. In Art. 192 of the Labor Code of the Russian Federation states that the boss himself and officials who allowed delay and non-payment of wages can be held accountable. The highest form of such punishment is dismissal.

- Financial responsibility. In Art. 234 - 236 of the Labor Code of the Russian Federation states that from the first day of delay in payments, the employer is obliged to pay compensation to its employees in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation on the day the debt arose.

- Administrative responsibility. If the guilt of the employer or its officials is fully proven, then inspectors have the right to bring them to administrative responsibility. Punishment is applied in accordance with Art. 5. 27 Code of Administrative Offenses of the Russian Federation. If the violation occurred for the first time, then inspectors can only issue a warning or issue a ruling to pay a minimum fine:

- officials - from 1,000 to 5,000 rubles;

- Individual entrepreneur - from 1,000 to 5,000 rubles;

- legal entities- from 30,000 to 50,000 rubles.

- for officials - from 10,000 to 20,000 rubles;

- entrepreneurs - from 10,000 to 20,000 rubles;

- legal entities - from 50,000 to 70,000 rubles.

- Criminal liability. They are called to it in cases where it is proven that the manager did not pay wages for selfish reasons. Punishment: up to two years in prison.

In accordance with Art. 145.1 of the Criminal Code of the Russian Federation, the employer is held criminally liable in the following cases:

- wage arrears were repaid in the amount of less than half of the debt;

- the period of delay is more than 3 months;

- it was proven that the non-payment was due to the employer’s selfish motives and interests;

- the subject is the director of a legal entity, branch or other separate division legal entity.

The following penalties can be applied to the employer:

- a fine of up to 500,000 rubles;

- a fine commensurate with salary or other sources of profit for the last 3 years;

- prohibition on holding a certain position for no more than 5 years;

- forced labor for up to 3 years;

- arrest for no more than 3 years.

The punishment will be chosen in accordance with the severity of the offense. It is important to distinguish between partial non-payment and complete non-payment.

Partial nonpayment - nonpayment of wages in the amount of less than half of the total debt. A complete non-payment is a non-payment of the entire amount earned by each employee in the last 2 months. The severity of the consequences is determined by the court through careful consideration of the specific case. The duration of the crime, the amount of wage arrears, the number of victims, etc. are taken into account.

Consequences of a delay of 1 day

According to the provisions of the Labor Code of the Russian Federation, a delay in wages even by 1 day can lead to unpleasant consequences for the employer in the form of compensation payments. Compensation is accrued from the 1st day of delay in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation, which was established on the day the debt arose. To receive compensation, an employee does not need to fill out any paperwork or write additional statements. All calculations and payments are made by the employer independently. They must be carried out together with the payment of the delayed wages.

If the delay is 1 or several days, you can write a claim addressed to the employer demanding to pay not only wages, but also compensation for each day of delay. If the letter is ignored, you can complain to higher authorities.

However, the claim must be submitted in writing and must be properly recorded as an incoming document. The employer will then have to provide a formal written response.

Compensation for delayed payment of wages

Protecting the rights of workers, Labor Code RF in Art. 236 obliges the employer for untimely provision of his employees monetary allowance, pay compensation in their favor. Its size is clearly defined by the same rule of law: for each day of delay, starting from the day following the day when payment should have been made, an amount not lower than 1/150 of the key rate established by the Central Bank at the time of calculation of compensation is due.

Such measures began to apply in October 2016. Previously, compensation was calculated based on the refinancing rate of the Central Bank of the Russian Federation. But Central Bank recognized such a mechanism as ineffective, and moral and material damage was “tied” to the key rate.

In addition, from the same moment the minimum compensation amount has been doubled. Previously it was necessary to calculate as 1/300 of the refinancing rate.

The amount of compensation can be increased at the request of the employer, but not reduced. If management wants to set the size compensation payments in an increased size, this point must be specified in the relevant local documents- labor or collective agreement.

Example: the salary is 10,000 rubles, the delay period is 14 days, as of 02/09/2018 the key rate of the Central Bank of the Russian Federation is 7.5%.

The calculation of compensation for 14 days of delay is as follows:

10,000 * 7.5% * 1/150 = 5 rubles for each day of non-payment of wages

5 * 14 = 90 rubles must be paid by the employer for the 14th day of delay in payments

10,000 + 90 = 10,090 rubles must be received by the employee

Attention: financial liability occurs to the employer, regardless of the presence or absence of his guilt in the delay in wages to employees. According to the provision set out in paragraph 55 of the Resolution of the Plenum of the Supreme Court No. 2 of March 17, 2004, the accrual of interest for late payment of wages does not deprive employees of the right to index the amount of debt due to depreciation of the debt due to inflation.

27.08.2018

The Labor Code of the Russian Federation strictly regulates the procedure and terms for payment of wages by an employee. Every employer must comply with these rules, regardless of the legal form of the enterprise. Otherwise, he can be held accountable. Below we will try to provide practical instructions, relevant for 2018, for use by an employee in the event that the company’s management delays wages.

What is “Payment Delay”

The employer is obliged to pay its employees remuneration for the work performed. Payments must be made at least 2 times a month and every 15 days. That is, wages must be paid to the employee no later than 15 days from the end of the month for which it was accrued. For example, salaries for July must be paid no later than August 15.

Deviation from these deadlines in the direction of increase is called “wage delay”. This is a violation of workers' rights, which is punishable in accordance with labor and administrative legislation.

The dates for payment of remuneration for labor must be specified in the employer’s local documents. Such documents may be:

- collective agreement;

- employment contract;

- another document that regulates the payment of wages at a given enterprise.

The employer is obliged to adhere to the deadlines specified in these documents. Otherwise, for each day of delay in payments, he will have to pay workers compensation.

What actions can an employee take?

If wages are delayed for 15 days or more, then the employee has the right to take the following actions:

- send a written notice to the employer that he is ceasing to perform his direct labor responsibilities. The reason is non-payment of wages for more than 15 days. Such a notification is drawn up in 2 copies and sent to the authorities. The main condition is that the document is correctly registered as an incoming document. The copy that remains with the employee must contain the number of the incoming document, the date of its acceptance, as well as the signature of the responsible person who accepted it. Such actions must be taken to ensure that these days are not counted as absenteeism by the employee. If everything is done correctly, the employer will have to pay for this period;

- the employee has the right not to go to work and not perform his duties until he receives written notification from his superiors that the salary will be paid in the coming days;

- sue statement of claim about violation of workers' rights.

In addition to the court, an employee can write a complaint to:

- Prosecutor's Office;

- Federal Labor Inspectorate.

If wages are not paid for more than 3 months, the employee can initiate a procedure for declaring the employer bankrupt. To do this, he needs to submit to arbitration court statement of claim.

If wages are not paid to one employee, but to several, then it is better to defend your rights collectively. Applications from a group of citizens are considered faster, and measures taken on them are more effective.

Consequences of delay

Delayed wages can lead to unpleasant consequences for the employer. He will have to pay his employees compensation for each day of delay, and also pay a fine for allowing such an offense.

Compensation for delayed wages is 1/150 of the key rate of the Central Bank of the Russian Federation on the day the delay occurred. Compensation is paid for each day of non-payment. For example, a local act states that wages must be paid on the 5th of the next month. If this does not happen, then from the 6th the compensation will already begin to “drip”.

Some employers mistakenly think that legal consequences only occur if wages are not paid on time. This is wrong! Consequences occur if there is a delay:

- vacation pay;

- severance pay in case of reduction or liquidation;

- disability benefits;

- others social benefits in favor of the employee.

In addition to the amount of compensation, the employer will also have to pay a fine.

Penalties

According to Art. 5. 27 Code of Administrative Offenses of the Russian Federation, sanctions in 2018 for this violation are as follows:

- if a partial payment occurs, the employer will face a fine of up to 120 thousand rubles, as well as imprisonment for up to 1 year;

- if the salary and compensation are not paid in full, then the fine will be slightly larger - up to 500 thousand rubles, and the prison sentence will be slightly longer - up to 3 years.

Worker's compensation

Every employee should know that compensation in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation is paid from the first day of delay. However, many people think that 5 days of delay is normal, that the employer’s responsibility begins only from the 16th day. This is wrong!

If the documents indicate that the salary should be paid on the 5th, then it should be so. If the payment is made on the 11th, then compensation for 6 days must be paid in addition to the salary. In practice, no one pays attention to this! And this is already a delay in wages!

To protect his rights, an employee has the right to apply to various government bodies. As a rule, in FIT. But first you should try to solve the problem peacefully.

Before contacting various government agencies, you can try to solve the problem with the help of a commission on labor disputes. It should consist of representatives of the employer and the employee. The number of representatives must be equal. If within 10 days after the convening of the commission a peaceful solution to resolve the conflict is not found, then the working party has the right to turn to other bodies to protect their rights.

If you cannot resolve the conflict peacefully, then you should complain. You can also go to court by filing a claim for payment of wages and compensation. A calculation of all amounts must be attached to the claim. The plaintiff must do it himself.

How to do the calculation yourself

Calculating compensation yourself is quite simple - you need to know your salary and the exact number of days of delay. The last indicator must be correctly calculated from the day specified in local documents.

To calculate, you must use the following formula:

KV = ZrP * Class.St. / 150 * KDP, where

KV - compensation payment that the employer must make in favor of his employee;

Salary - the amount of wages that must be paid to a specific employee on a strictly established day;

Class.St. – this is the key rate (in percentage) of the Central Bank of the Russian Federation on the day the delay occurred. In the period from March 26, 2018 to September 16, 2018, the key rate is 7.25%;

KDP – number of days of delay.

Calculation example: At the enterprise, wages for the second half of the month are paid on the 6th of each month. For July, payment was made only on August 14. P.’s salary is 52,500 rubles. What amount should he receive on August 14? No additional payments were provided for July.

Calculation: CV = (52,500 * 7.5% 150) * 8 = 52,710 rubles, of which 210 rubles are interest for a delay of 8 days.

How to correctly write a complaint to the FIT

The first authority to which employees usually complain if they cannot resolve the problem with the employer peacefully is the labor inspectorate.

In Art. 7 of Law No. 59-FZ specifies the information that must be contained in a complaint to the FIT. This:

- about herself labor inspection– full name, address of location;

- information about the applicant - full name, address of registration, position, contact information(phone number and email address);

- title of the document;

- essence of the complaint. It is necessary to indicate the problem itself, provide examples of how the applicant tried to solve the problem before contacting the FIT, provide links to the norms of the Labor Code of the Russian Federation and other regulations;

- a request to conduct an inspection and timely notify the applicant of its results;

- application. If there are documents confirming the described facts, then you must attach copies of them. This may be an employment contract or another document that states the date of payment of wages;

- date of document preparation;

- the applicant’s signature, and also its transcript.

A complaint can only be made in writing, subject to the following rules:

- without swear words and phrases;

- without insulting the honor and dignity of others;

- containing only reliable information.

If an appeal to the FIT does not produce results or the employee wishes to immediately go to court, this is his right. But it is necessary to comply with the application deadlines.

Sample letter to FIT regarding non-payment of wages

How to write a statement of claim correctly

In Art. 392 of the Labor Code of the Russian Federation states that an employee has 1 year to go to court to resolve a dispute over the payment of wages. Therefore, he has time to appeal to the FIT, and then to the court. The period begins to run from the day on which the payment should have been made.

For the court it is necessary to draw up a statement of claim. The document is drawn up according to the same rules as a complaint to the FIT, but in compliance with the requirements prescribed in Art. 130 – 131 Code of Civil Procedure of the Russian Federation.

The statement of claim must contain the following information:

- full name of the court. It is necessary to choose the right jurisdiction for the case under consideration;

- information about the plaintiff - his full name, position, registered address, contact information;

- information about the defendant, that is, about the employer. This is the full name, legal address, position and full name of the manager, contact information;

- "body" of the claim. Here it is necessary to indicate the reason for filing the claim, when the payment should have been made, what the total period of delay was, whether the employer took measures to eliminate the debt, and other information;

- references to legal norms that the employer violated;

- a request to the court to make a decision in favor of the plaintiff, a demand for payments and the amount of compensation, as well as bringing the employer to other liability;

- application. This is a list of documents that must be attached to the claim to support your words. This:

- a copy of the claim for the defendant;

- a copy of the applicant's passport;

- calculation of the amount to be paid that the plaintiff requires;

- a copy of the employment contract;

- certificate 2-NDLF;

- other documents if necessary.

- date of filing the claim;

- the applicant's signature and its transcript.

Sample statement of claim demanding payment of wages and compensation

Download document forms

Below you can download forms (blanks) standard documents, ready to be filled. Which will then be accepted by any authorities when sent. If your case is not a typical one, then you can always resort to our services, and the initial consultation is free with us.

One of mandatory conditions, which must be included in the employment contract of every worker, is the timing of payment of wages. And the employer is obliged to comply with them and pay the workers due cash during.

Salary payment terms

The timing of the payment of wages is regulated by Article 136 of the Labor Code of the Russian Federation, according to it it is paid:

- By issuing cash or transferring money to a person’s account.

- At least every 15 days, respectively, at least twice a month.

- Wages for a particular month must be issued to the worker no later than 15 days after the end of the month.

- Salary amounts are paid personally to the person (transferred to his account), unless otherwise provided by law.

All other issues related to wages can be decided by the head of the company at his own discretion, provided that he does not violate the above rules. Thus, the employer has the responsibility to:

- Determining the place for issuing funds.

- Determining the frequency of issuance (payments can be made more often than twice, for example, every week).

- Determining specific dates for the employee to receive advance payments and wages.

One of the common mistakes made by employers is to set a period rather than a specific date of issue. For example, wages will be issued from the 5th to the 10th. This is incorrect, the above article says that a specific date for the payment of salaries must be determined.

How to determine the payday and delay period

The Labor Code of the Russian Federation indicates that if the day designated as the date of transfer of advance payment or wages falls on a weekend, then the issuance of funds is carried out on the last day of work before it.

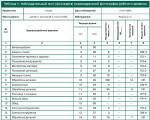

The table below shows several situations when you need to pay wages in advance and how this can affect the delay period.

| Date of payment of wages (advance) | Date to which payment must be postponed | Delay period |

| The date of payment of wages is determined on the 2nd of the month. May 2, 2020 according to production calendar will be a public holiday. | In this case, the salary must be paid no later than April 28, 2020, since all subsequent days will be days off. | Even if the employer pays wages on May 3, that is, tomorrow after the due date, the delay period will be 5 days. |

| The salary transfer date is set on the 9th day of the month. May 9, 2020 will be a public holiday. | In this case, salary payment must be made on May 8, 2020 | If it is paid on May 10, then the delay period will be 2 days, since in this case the payment is automatically postponed to May 8. |

Compensation for delayed wages

Formula and example of calculating compensation for 1 day salary delay

At May LLC, salary payments are set on the 25th of the current month and the 10th of the next month.

The accounting department should have transferred the sales manager A.A. Korolev advance payment in the amount of 20,000 rubles. She did this not on the 25th, but on the 26th. Accordingly, the delay is 1 day.

Calculation of the amount of compensation for delay:

Compensation amount = advance amount*1/150*key rate valid on the day of settlement*number of days of delay

Compensation amount = 20,000*1/150*7.25% *1 = 9.6 rubles.

Personal income tax is not withheld from the amount of compensation, this follows from the Letter of the Federal Tax Service dated June 4, 2013 N ED-4-3/10209.

When must an employer pay compensation amounts?

The employer must provide compensation immediately with wages, reflecting it as a separate line on the payslip.

Example: May LLC was supposed to pay wages on the 5th, but delayed them by 1 day, and they were paid only on the 6th. In this case, compensation must be calculated and paid along with earnings on the 6th.

When should compensation be given for an overdue advance, when paying an advance or salary? Payment of compensation amounts for delayed advance payments is made on the day it is transferred to employees, and is not postponed until the date of wages.

What to do if the company management refuses to pay compensation

In most cases, the employer does not charge compensation for late wages by default, especially if the delay was only one day. The amount to be paid with such a delay will be very small, but in this case, workers must still defend their rights.

To begin with, you can contact the management of the enterprise in writing with a request to accrue the compensation due. The application is drawn up in free form.

If management refuses to calculate compensation, the employee can appeal the violation of his rights to the relevant organizations.

In the table below you can see where a person whose rights have been violated can turn:

| Organization name | Application procedure | Complaint consideration period |

| State Labor Inspectorate | The employee writes a statement listing all the facts of what happened. | Within 7 days |

| Prosecutor's office | The employee writes a statement (complaint) in which he indicates all the facts of what happened | Within 30 days |

| Judicial authorities | The employee files a statement of claim, which must contain the specific demand of the plaintiff, in this case the calculation of compensation | In the order of consideration of cases by the court |

Responsibility of the enterprise for delays in wages and non-payment of compensation

An administrative penalty may also be imposed on the employer for delaying wages. As well as for refusal to voluntarily accrue compensation for late payments. There is no separate article in the Code of Administrative Offenses of the Russian Federation for delayed payments, therefore the punishment is imposed in accordance with paragraph 6 of Article 5.27.

In this situation, the penalty is:

- From 1 thousand to 5 thousand rubles per individuals who are individual entrepreneurs;

- From 10 thousand to 20 thousand rubles for responsible employees of the company;

- From 30 thousand to 50 thousand rubles in relation to a legal entity.

This administrative penalty can be imposed on the employer even if the salary is delayed by 1 day.

If wages are delayed, the employer is obliged to pay compensation to employees, even if the delay is only one day. Compensation must be accrued by the employer in voluntarily Moreover, he must inform workers that they are entitled to compensation. As a rule, this information is included on payslips.

Employees of companies should receive remuneration for their work. The timing when the company must make such payments is fixed by the company’s regulations. Sometimes a situation arises in which employees do not receive the amounts due to them on time. Therefore, it is important to know if wages are delayed at an enterprise, what to do in this case. After all, there is no money, but you have to pay the loan, for example, on time.

The law establishes that wages must be paid at least twice a month. The employer can pay it more often, for example, every week. However, this point must be reflected in the local acts of the enterprise.

The company’s management sets the exact dates independently, taking into account the specifics of the organization’s activities and its own financial possibilities. They must also be strictly reflected in the Regulations of the organization.

Information about these deadlines must be brought to the attention of employees. If new employee arrives at the enterprise, he must be familiarized with this standard upon signature.

When setting payment deadlines, it is necessary to comply with the existing requirements of the Labor Code of the Russian Federation, according to them:

- The advance must be paid no later than the 30th of the current month, and the final salary amounts must be paid before the 15th.

- It is not allowed to set payment deadlines for periods; they must be recorded as an exact date. In addition, the period of time between the payment date cannot exceed 15 days.

- The following deadlines are provided for the transfer of vacation pay: 72 hours before the employee goes on vacation. If the application for registration was submitted less than the established deadline, then the deadline is set within 72 hours from the date of submission of the application.

- Payment of sick leave is made at the nearest salary payment date.

- Upon termination labor contract, salary payment must be made on the last day of work of this employee.

Attention! If it occurs controversial situation, as a result of which the amount of payment in favor of the employee is disputed, then on the last day the undisputed part should be transferred.

How long can they be detained?

If the company’s management does not comply with the deadlines for paying salaries, then the question arises about its delay and the emergence of responsibility of the company’s administration to the company.

For 2-3 days

If the payment of wages was untimely, with a delay of 2-3 days, the administration must accrue and pay compensation for the delay in wages. This compensation is calculated even for one day.

The company should carry out this action independently, without outside reminders. The minimum interest applied is 1/150 of the rate of the Central Bank of the Russian Federation for each day.

Regions are given the right to increase its size. In addition, the economic entity itself has the right to increase the value of this percentage in its local acts.

Attention! If the period does not exceed 15 days, the employer does not have any other liability.

For 2 weeks

The Labor Code of the Russian Federation considers untimely payment of wages with failure to comply with the two-week period as a minor offense, and does not define it as a delay in wages, which entails administrative and criminal liability for the employer.

After all, such liability arises after a significant period of delay. However, nothing cancels management’s obligation to calculate and pay compensation to the employee for late payment of wages. Its minimum size is 1/150 of the rate of the Central Bank of the Russian Federation.

Attention! The employee has the right to write a statement of suspension of work due to non-payment of wages and not to go to work until full payment is made.

For a month

Every manager should remember that if the salary is delayed for more than 15 days, then this is considered a serious offense, which leads to administrative liability for the business entity and its officials. In this situation, the employer will not be saved by accruing compensation payments to the company’s employees.

Official website: git77.rostrud.ru

Can I file a complaint anonymously?

Some employees, fearing sanctions from the employer for filing a complaint with regulatory authorities, want to file it anonymously. But this is impossible to do.

The law regulating the reception of citizens' appeals requires that each appeal contain information about the sender - his full name, address, contract information. If a complaint is submitted anonymously, it will be considered inappropriate and will not be considered.

Filing a complaint via the Internet also eliminates anonymity. In this situation, you must either also provide information about yourself or use the State Services portal for authorization.

Attention! However, the law makes it possible to keep your application secret from the employer. The employee has the right to indicate in the application that he requests that his identity not be disclosed during the inspection.

Is it possible not to go to work?

The Labor Code establishes an employee’s ability to protect his rights if the company’s administration does not pay wages on time. But this can only be done when the delay period exceeds 15 days.

The Labor Code establishes an employee’s ability to protect his rights if the company’s administration does not pay wages on time. But this can only be done when the delay period exceeds 15 days.

However, this must be done according to a clear algorithm, and not simply by not showing up for work one day. In the latter case, the employee faces dismissal under the article for absenteeism.

First of all, the employee must issue a written notice to the employer. It must refer to the article of the Labor Code and indicate that it suspends work until the arrears of wages are fully repaid.

It is best to prepare the notice in two copies, so that the second one bears a mark of delivery. If the secretary or manager refuses to accept the document, it must be sent by registered mail with confirmation of receipt.

After this, the employee has the right not to appear at his place. It is necessary to resume performance of duties after written notification to the employer that he is ready to repay the debt.

Important! During a work stoppage, the employee, according to the Labor Code, retains a salary in the amount of average earnings. If the debt is only partially repaid, then the employee is not required to resume work.

Is there any compensation for delay?

The law establishes that every employer, if he delays the payment of wages by at least one day, is obliged to calculate and give compensation to the employee in cash for each day of delay.

The amount of compensation depends on several factors: the amount of wage arrears, the period of delay and the percentage of compensation provided for by law or other regulatory documents(in an amount not less than that established by law).

The amount of debt is the amount of salary without personal income tax that the employee should have received in hand;

The percentage on which compensation is calculated must be fixed in employment contract, salary regulations or other regulatory act.

The law establishes that the smallest amount of compensation should be 1/150 of the existing Central Bank rate. If the amount of compensation is not fixed in local documents, then the minimum amount should be used.

The leadership of the subject of the federation has the right to revise the percentage upward. But for it to come into force, it is necessary to sign an agreement with a representative of the labor union in the region.

The key rate is set by the Central Bank of the Russian Federation. Periodically, the Central Bank revises it, which can be expressed either in an increase or a decrease. If the key rate changed during the delay period, then compensation must be calculated by dividing the period of debt into segments during which the rate was in effect.

Attention! The number of days of delay is calculated starting from the first day after the established date for the payment of wages and until the actual date of its payment. The period includes not only working days, but also weekends and holidays.

Responsibility of the organization and the leader

Directors

Administrative and criminal types of liability may be applied to the manager.

Administrative responsibility involves the imposition of official a fine of 1-5 thousand rubles. In case of repeated violation, the sanctions increase, up to the disqualification of the guilty person for a period of 1-3 years.

In addition, the manager may be held criminally liable if he had a selfish intent in not paying wages, or if he spent money intended for wages for personal needs.

In such a situation, the following may be imposed on him:

- Fine in the amount of up to 500 thousand rubles;

- A fine in the amount of the director’s earnings for a period of up to 3 years;

- A ban on working in this position or engaging in this activity for a period of up to 5 years;

- Carrying out forced labor for a period of 1-3 years;

- Imprisonment for up to 5 years.

Organizations

The main type of responsibility that an organization bears when a salary is delayed is the payment of monetary compensation, or financial liability. It occurs if there is a delay of at least 1 day.

In this situation, it is necessary to calculate and pay compensation. This must be done independently, without reminders from regulatory authorities. If during the audit it is discovered that the organization has not paid such compensation, penalties may be applied to it.

Attention! Administrative liability arises according to the Code of Administrative Offenses in case of violation of the provisions of labor legislation. It provides for the imposition of a fine on the organization in the amount of 30-50 thousand rubles, or suspension of activities for a period of up to 90 days. If there is a repeated violation in this area, the amount of the fine increases significantly.