Rating of financial pyramids. Financial pyramids on the Internet actually pay. Reasons for the emergence of financial pyramids

Two years ago it appeared in the Criminal Code of the Russian Federation new article, according to which responsibility is provided for attracting money and property of citizens into the so-called financial pyramids, receiving dividends or interest exclusively from the funds of new participants. During? Late!

According to the law, he clarifies, for raising funds in the amount of more than 1.5 million rubles, the organizers of the “pyramid” face a million-dollar fine or imprisonment for up to 4 years. If the amount exceeds 6 million rubles, the violator will face a more severe punishment: forced labor for up to 5 years or imprisonment for up to 6 years, as well as a fine of up to 1.5 million rubles.

According to the Russian Ministry of Internal Affairs, in 2015, damage from the activities of only those identified in the country financial pyramids exceeded 22 billion rubles, which is comparable to the annual budgets of some constituent entities of the Russian Federation. In addition, in the first half of last year, law enforcement agencies conducted an investigation into 202 relevant criminal cases initiated under Article 159 of the Criminal Code of the Russian Federation (“Fraud”).

Almost to this day, the organizers of hundreds of financial pyramids in Russia feel quite comfortable. As experts note, the total profit of offices that fraudulently attract money from citizens exceeds the income of many banks from the top hundred. But, despite the fact that almost once a week, and sometimes more often, another “pyramid bubble” “collapses” in the country, the naive Pinocchio still cannot be translated.

According to an annual survey conducted last summer by the National Agency for Financial Research (NAFI), only 27% of Russians were able to accurately determine what constitutes a financial pyramid. And, according to NAFI, this disappointing figure has remained virtually unchanged from year to year over the past 7 years. That is, it turns out that about a third of our fellow citizens do not read newspapers, watch only entertainment shows on TV, have never heard of Mavrodi and are ready to run headlong and invest money anywhere and in anything, as long as the interest on the deposit is higher!

Ah, it’s not difficult to deceive me, “I’m glad to be deceived myself...” - Alexander Pushkin once confessed his love for a woman. Nowadays, times have changed, people have switched to prose and, in conditions of a severe economic crisis, with no end in sight, they are increasingly admitting their love for money, of which, in order to live normally, they want more and, preferably, like MMM, that is, freebie and quick.

The first financial pyramid

We understand perfectly well that we can be deceived, and yet we take risks, believing in a large percentage of profit and in the fact that disaster will pass us by. At the same time, there are always people who, in the end, left with nothing, begin to be sincerely indignant that they were cheated. It is interesting that there are millions and millions of such “inflated” ones throughout the existence of the notorious financial pyramids.

Carlo Ponzi

After all, this type of “business” was not invented by anyone. He just used an idea, the author of which is rightfully considered to be an Italian emigrant who lived 100 years ago in Boston, America. It was in his (I don’t want to say bright) head that a criminal scheme to deceive the broad masses of the population by attracting them to the general “pyramid building” first arose.

The schemer quite actively profited from what he guaranteed to his clients highest profit- 50 percent in 90 days, without investing the money received anywhere. All of the company's "investments" consisted in the fact that the second client who came to the Ponzi firm received income from the money invested by the first client, the third - from the money of the second, and so on. Naturally, investors had no idea about this outrageously simple scheme, so there was no end to those who wanted to become rich almost instantly.

Millions of ordinary (and not only) Americans brought tens, hundreds and thousands of dollars to the Ponzi office. At the same time, those who brought money three months earlier could take it, but they didn’t take it, letting it go “in the second round.” This was the first large financial pyramid in the world, as a result of which Carlo Ponzi enriched himself at the expense of robbed investors by almost 26 million dollars.

Financial pyramids in Russia

The creators of the current financial pyramids did not invent anything fundamentally new and “spud up” suckers in the same way as Ponzi did 100 years ago. They “spud up”, naturally, only until the number of investors stops increasing or the schemers themselves decide that that’s it – it’s time to “make their move.”

In any case, the extreme are the numerous Pinocchios who believe in the mythical Field of Miracles and perceive the clever authors of “pyramid building” no longer as “business partners”, but rather as some kind of evil geniuses taking advantage of the gullibility of the people. Of course, that's how it is. However, if you look from the other side, one cannot help but take into account the impenetrable stupidity of the “investors” themselves, who pay for their naive illusions with real money.

As law enforcement officials, as well as lawyers who defend the rights of the defrauded in courts, state, people themselves give rubles to the “heralds of easy money.” By their strength

No one takes it away from him, no one puts a gun to his head or a knife to his throat. The rules have been well known for a long time, the main thing is to understand them. And if they are completely satisfied, calling someone an evil genius is absurd! The fact that you were “shod” is, first of all, your personal choice!

As you know, the creators of MMM, in the seemingly distant 90s of the 20th century, managed to attract 15 million depositors to their numerous cash offices, opened in literally every city in the country! And after Lenya Golubkov disappeared from television screens, hundreds of thousands of them began unsuccessfully to storm, first, the representatives of the “people's”

companies, and then the courts, filing senseless lawsuits against them. Dozens of people who invested not only money in MMM, but also apartments, dachas and even their last underpants, became homeless and lost their jobs and took their own lives. It was the largest and most successful (for the creators) “pyramid” that went down in the history of modern Russia.

New financial pyramids

However, a holy place is never empty, and with the fall of MMM, “Khoper”, “Chara”, “Tibet”, “Russian House of Selenga” and others immediately appeared, like mushrooms after a summer rain, and continued the “work” of Mavrodi. It is clear that the undertakings of the new “great combinators” also could not last long. But even after they announced their bankruptcy and closure, hundreds of other companies, firms and small businesses immediately began to explore the “endless and vast field of miracles” and began to actively attract Russians who sincerely believe in fairy tales to “mutual” cooperation.

Valentina Ivanovna Solovyova paid a huge amount of money for the roof of the pyramid into the common fund of the Podolsk criminal group

The leaders of these organizations, taught by the bitter experience of their predecessors, now do not particularly “shine”, advertise themselves little in the media, and find new clients mainly through network marketing and, at every opportunity, declare that they have nothing to do with “pyramid building” . At first glance, this is true. The same

modern civil-consumer and simply credit cooperatives exist quite legally and in their activities are based on the law on credit cooperation. However, according to experts, the main danger for depositors comes precisely from these incredibly generous organizations offering truly fantastic interest rates on deposits.

“Cooperatives” are a dime a dozen today in any region of the country. Some, who have only recently opened their cash acceptance offices, are still regularly paying dividends to their clients. In others, where management suddenly stopped answering calls and left in an unknown direction, investigative and judicial authorities are dealing with them. Thus, in the Perm Territory, a court not so long ago passed a guilty verdict in the case of the director of an LLC, whose company in the city of Tchaikovsky received from local residents money with a promise to pay high interest on it every month.

However, no investment, construction or other economic activity the company did not conduct business, but settled with subsequent clients using funds received from previous clients. Part of the “profit”, naturally, ended up in the pocket of the organizer of the next “financial pyramid”. As a result, the swindler, who stole about 4 million rubles from gullible citizens, was put on trial, which sentenced him (on another article for fraud) to 6 years in a general regime colony with a fine of 110 thousand rubles.

Financial scams

Next up are court proceedings in a criminal case initiated against the management of a so-called investment company from Chuvashia. Local “investors” attracted money from “partners” by concluding loan agreements with them at 79 percent per annum! Numerous investors, understandably, did not think about what projects they invested money in to get such a huge profit. They were only interested in the prospect of increasing equity in a short time. As a result, another mess happened. According to investigative authorities, at least 1,000 people suffered from the actions of the “investment company” in Chuvashia alone, losing more than 100 million rubles overnight.

In addition to the above-mentioned cooperatives, today so-called venture or innovative enterprises, as well as a number of different construction funds, are pumping money out of the population. All of them begin their work within the framework of Russian legislation and for some time fulfill their obligations to clients. Therefore, according to government officials, “it is very difficult to assert that their activities are aimed at making profit through illegal means until there are no victims.”

However, “Day B” (from the word “bankrupt”) will come sooner or later, and, as quite often happens in such cases, deceived investors roll their eyes and begin to prove in court that they knew nothing and demand return their money. Even from the state budget!

Meanwhile, the Bank of Russia turned to the Moscow prosecutor’s office with a request to investigate the activities of a capital company that has all the “signs of a financial pyramid,” which, under the guise of “preferential loan repayments” on the Internet, offers its clients to take out a loan and invest the money received in “ highly profitable business"at 400% per annum!!! As a result, as the company’s management states, citizens’ investments will allow them to as soon as possible“return the loan amount and remain with interest income.”

Detecting signs of a financial pyramid is not so difficult for an ordinary person

Photo: Fotolia/Gajus

Companies with characteristics of financial pyramids dominate online investment searches. Projects of scammers masquerading as financial companies and promising fabulous profits are called HYIPs. The Central Bank explains specifically for readers of Banki.ru which companies should not be approached within a cannon shot.

Where does the hype come from?

Companies with signs of financial pyramids (paying money to investors from the funds of new clients) dominate the results of search queries on the Internet for investing funds. This is evidenced by the results of monitoring by the International Confederation of Consumer Societies (ConfOP), Izvestia reported.

The organizers of the monitoring studied the results of the Yandex and Google search engines for the query “it’s profitable to invest money” with settings that ensured the objectivity of the sample, and then analyzed the websites of non-banking organizations offering investment of funds. Among the most characteristic features of the 25 selected organizations are promises of profitability of over 100% per annum, stories about “ unique products» and misuse of symbols of state power.

Fraudsters can call themselves investment funds, hide behind well-known names and convince that the money is being invested in “highly profitable projects.” On the Internet, such projects are called “hype” (from the English HYIP - high yield investment program). HYIPs can vary by type of activity; the most popular are money games, services masquerading as a financial market broker, and mutual aid funds.

Which companies have no right to take your money or are potentially dangerous? And how to recognize them?

“We have learned to stop pyramid schemes on the Internet”

What is behavioral supervision? How do customer complaints help the Bank of Russia more effectively control banks? Do we need to disclose these complaints? Why aren't all clients of financial institutions subject to investment risk warnings?

Victims of illegal market participants

Before agreeing to any offer, you should carefully study financial products, consult with experts, read information materials and documents offered for signing, and inquire about information about a potential partner, so as not to become a victim of an illegal market participant, such as a financial pyramid.

Illegal financial market participants often very skillfully disguise themselves as well-known financial organizations that have licenses to operate, use similar names, Internet sites, etc. The Bank of Russia, together with law enforcement agencies, is quite actively working to suppress the activities of such pseudo-financial organizations: in 2015 Last year, about 200 pyramids were identified, in 2016 - about 180, and this year - about 70 in six months.

List of financial organizations that have licenses to operate on financial market, posted on the Bank of Russia website, as well as state registers MFOs and CPCs.

Companies that raise money from the public without legal grounds are subject to administrative and criminal penalties.

To the “financial pyramids” that attract cash citizens, measures are applied depending on the amount of funds raised. Criminal liability for “financial pyramids” was introduced in March 2016. Before this date, their activities were qualified as fraudulent actions under Article 159 of the Criminal Code of the Russian Federation (punishable by imprisonment for up to two years).

As of the date of introduction of criminal liability for the activities of “financial pyramids,” the investigative bodies of the Ministry of Internal Affairs of Russia were investigating 202 criminal cases regarding financial pyramids (instituted under Article 159 of the Criminal Code of the Russian Federation), in which 184 people were involved. Total amount of damage material damage exceeded 22.3 billion rubles.

In relation to microfinance organizations carrying out activities prohibited by law - raising funds by microcredit companies individuals who are not founders; microfinance companies attracting more than 1.5 million rubles from one individual (this rule does not apply to the founders of the MFC) - administrative liability is provided for under Article 15.26.1 of the Code of Administrative Offenses of the Russian Federation (fine from 50 thousand to 100 thousand rubles).

Belief in passive income

“It cannot be denied that the problem of unscrupulous organizations raising funds from the population has existed and continues to exist. This is primarily due to the fact that the majority of people continue to believe in the promises of large passive income. And, due to the lack of proper financial literacy, cannot evaluate this or that promise,” says investment expert at BGP Litigation Vladimir Rusakov.

1. Carefully study who you give your money to.

According to Russian legislation, companies that have the appropriate licenses can accept funds from the population for subsequent financial transactions. Including numerous agents of foreign brokers and dealers, they must also have licenses to carry out financial activities issued by the Central Bank of the Russian Federation. It is important to study reviews and information on a legal entity in open sources.

It is also worth noting that legal entities can raise funds from individuals under a loan agreement. But if you are not professionally engaged in this activity, then avoid such offers. This is due to the fact that before providing a loan, it is necessary to conduct a detailed legal, financial and other due diligence of the business. Without such checks, the risk of non-return is very high. Just put yourself in the shoes of the bank that issues the loan.

2. Understand the proposed investment product in detail.

3. Study the agreement under which the money is transferred.

Common fraud

So, banks and microfinance organizations can attract funds from citizens on a regular basis under the guise of a loan (deposit), information about which is entered into special state registers. In addition, the organization has the right to raise a loan by issuing bonds. All three cases are regulated in detail at the legislative level.

“In other cases, the activities of organizations to attract deposits can hardly be called legal, although the deposit agreement may have one name under which completely different legal relations will be disguised - you must always carefully study the legal documents. The very activities of organizations that advertise in connection with well-known financial institutions(essentially, without being associated with them in any way) and attract funds into deposits, may constitute ordinary fraud, misleading the consumer. And therefore it should become the object of attention of the competent authorities,” says Ivan Korshunov, a lawyer at the Kovalev, Tugushi and Partners bar association.

Payments are not guaranteed

Bank deposits do not generate income, but only allow you to protect money from inflation. Therefore, requests about where to invest money “at high interest rates” do not dry up. The Central Bank reminds that in addition to deposits, there are other financial products and instruments that can be used to place free funds. However, cash payments for all other products, except bank deposits, are not guaranteed by the deposit insurance system.

Bank deposits do not generate income, but only allow you to protect money from inflation. Therefore, requests about where to invest money “at high interest rates” do not dry up.

In general, the choice of a particular financial instrument depends on many factors. It is necessary to take into account the method of managing funds - whether the citizen will manage his money himself, or whether he is ready to entrust this to professionals.

For example, you can invest in a microfinance organization (MFO) and/or transfer your personal savings to a consumer credit cooperative (CCC). Rates on those attracted by these financial institutions funds are higher, but, as previously noted, these organizations are not included in the DIA insurance system, that is, investments in them are not guaranteed by the state. In addition, you need to keep in mind that among microfinance organizations, only microfinance companies (MFCs) have the right to attract funds from citizens who are not their founders, and only in an amount of at least 1.5 million rubles. Microcredit companies (MCCs) do not have the right to attract funds from citizens who are not their founders. As for the CCP, they have the right to attract only funds from their members (shareholders).

From January 1, 2015 you can open in brokerage company individual investment account and receive not only financial result from transactions with securities, but also a tax deduction of 13% per year. There are also many other financial instruments: bonds federal loan, investment life insurance, mutual funds (UIFs), investment coins and precious metals.

The Central Bank has counted 240 financial pyramids in Russia ... months of 2019, the Central Bank identified 240 organizations with signs of financial pyramids. According to Lyakh, Russians themselves more often began to inform the Central Bank about... cooperatives and others financial institutions. In Russia, interregional financial pyramid In general, in the first three quarters, the Central Bank identified 2,165 organizations... of which, 1,576 were illegal lenders. In June, the police liquidated the financial pyramid, which operated in several regions of Russia. Investors were offered investments in... An interregional financial pyramid has been liquidated in Russia ... The Ministry of Internal Affairs, together with a unit from the Yaroslavl region, detained the organizers of the financial pyramids, the damage from which is estimated at more than 1 billion rubles... In Kazan, the organizer of the Savings Union was sentenced to 7 years ... Organizer of financial pyramids"Savings Union" Anton Kirilyuk was sentenced to 7 years in prison. ...Finance, March 10, 11:35

The head of the OneCoin cryptocurrency pyramid was detained in the United States ... -Angeles detained Bulgarian citizen Konstantin Ignatov in the case of international pyramid, involving trading in the fraudulent cryptocurrency OneCoin. This is reported on the website... Roskomnadzor demanded that the provider block Cashbury sites ...to the register of prohibited sites. Why tens of thousands of people believed financial pyramid"Cashbury" At the end of September, the Central Bank announced that there were signs of financial pyramids. In particular, the regulator drew attention to the fact that the company’s activities... The owner of Cashbury announced the cessation of work due to the “hunt” for the company ... called it a "three-week holiday" to restore frozen accounts. Financial pyramid“Cashbury” continued to advertise on the MCC Earlier, the Bank of Russia discovered signs of financial pyramids. The regulator indicated that the group companies used the principles of network marketing, promising... Cashbury has suspended operations ...of this license. The regulator called Cashbury one of the largest financial pyramids identified in recent years: potential damage to clients is estimated at 1 billion rubles. Why tens of thousands of people believed financial pyramid Cashbury Cashbury positions itself as a “mutual lending platform” that “builds processes... The Central Bank estimated the possible losses of Cashbury customers at 1 billion rubles. ...,” explained the director of the Central Bank department. Why tens of thousands of people believed financial pyramid"Cashbury" In the activities of a group of Russian and foreign companies"Cashbury" contains "clear signs" of classical financial pyramids, the Bank of Russia reported at the end of September. These companies do not have...Finance, 27 Sep 2018, 20:53

The prosecutor's office filed a lawsuit in the Rostov court to block Cashbury websites ... tens of thousands of people believed the financial pyramid"Cashbury" It became known the day before that the Bank of Russia saw signs of financial pyramids in the group of Russian and foreign... Russia. Lyakh noted that “this is one of the largest financial pyramids” identified in recent years.Finance, 26 Sep 2018, 16:05

Why tens of thousands of people believed the Cashbury financial pyramid ... 600% attracted tens of thousands of people Classic pyramid The Bank of Russia saw “clear signs” of classical financial pyramids in a group of Russian and foreign companies operating... - consumer societies, two acted as individual entrepreneurs, and one financial pyramid was organized in the form of a joint stock company. A notable trend of the last year... In the Penza region, the organizers of a “pyramid” worth 1 billion rubles were arrested. ..., the criminal group operated in six regions, the attackers opened nine branches " pyramids", controlled from Penza. Police conducted seven searches in Moscow, St.... cases of fraud and organization of a criminal community. Four financial organizers pyramids sent into custody. 22 properties belonging to them were seized to... The Central Bank identified a financial pyramid in ATB for the sale of bills to the population ... from organizations associated with shareholder Andrey Vdovin. A “classical financial pyramid", explains the regulator, the Central Bank provided details about the situation in the Asia-Pacific... bills exclusively through the issuance of new bills. A classical financial pyramid, which was actually managed by ATB, the Central Bank states. FTC LLC was associated... The Central Bank warned about disguising financial pyramids as ICOs ... turnover of cryptocurrencies, comparing them with financial pyramid. “It is obvious that during the growth pyramids interest in this pyramid is actively fueled by high profitability,” he said in...,” the expert added. "Classical pyramid» Leading analyst of Amarkets Artem Deev compared fraud in the field of cryptocurrencies with construction pyramids, to which the Russians have... The Central Bank creates special services in the regions to combat financial pyramids ...organizations and Internet projects that have signs of financial pyramids. In 2015, 200 were identified pyramids, in 2016 – 180, over three quarters..., in general, the Bank of Russia notes a positive trend of declining financial activity pyramids. This is due to the preventive measures that the Bank of Russia is jointly taking... the Kazan district court sentenced the head of an organization with signs of financial pyramids. As investigators had previously established, the criminal accepted the personal savings of citizens and... The convicted banker has already stolen another 6 billion rubles from behind bars. ... Russia invested more than 6 billion rubles. Investigation of a financial case pyramid, which included more than two dozen consumer credit cooperatives... shareholders. Most of the money was transferred under loan agreements to counterparties pyramids, none of which, according to the investigation, financial and economic activities... from several tens to hundreds of millions of rubles. Searches in the case pyramids went to 180 addresses in Moscow and a number of other regions...Economics, 27 Sep 2017, 12:11

Oreshkin compared Bitcoin with MMM ... is investing in this,” Oreshkin said. MMM on Bitcoin: how to finance pyramids moved to chatbots It is clear that “the state will not be able to protect... funds,” she explained, since the mechanism for their use “has signs pyramids" The cost of cryptocurrencies is growing due to the fact that in transactions with... Bitcoin: how to mine at home At the end of August, the Deputy Minister finance Alexey Moiseev stated that the department advocates that the right...Society, 12 Sep 2017, 09:13

The head of China's largest financial pyramid was sentenced to life imprisonment ... involved in the case of the largest financial pyramid in China Ezubao, which raised investments of $7.6 billion. Organizers pyramids were sentenced to various... 100 million yuan (about $15.3 million). Financial work pyramids Ezubao was discontinued in 2015. The full scheme of its work... $150 million in luxury goods, real estate and cars. Before the crash pyramids its founders collected all the documents related to the work in 80 bags... The owner of the financial pyramid "Trust" was sentenced to 4 years in prison ... 31.5% per annum,” the press service said in a statement. Victims of financial pyramids There were 37 investors who suffered damage in the amount of more than 20... Personal contribution: How to avoid falling into a financial pyramid ...how to recognize financial pyramids experts from the National Bank of the Republic of Tajikistan said that in 2016, damage from the activities of financial pyramids amounted to 1.5 billion rubles... in the past, financial situation, own funds. “Working for a short time, modern financial pyramids carry out aggressive advertising campaign using the Internet, social media, mass media... The head of a financial pyramid received a prison term in Novosibirsk ... the verdict against financier Evgeny Olenev, who, according to investigators, created a financial pyramid and deceived about a hundred people. At the trial, he complained about... the organizations, in principle, did not carry out entrepreneurial activity. “This is a typical financial pyramid. From February 2013 to July 2014 thus... The organizer of the “financial pyramid” stole 427 million rubles from Tatarstan residents ... years Kirilyuk organized the attraction of funds from citizens according to the principle of “financial pyramids" Under the guise of investing in various commercial projects, allegedly guaranteeing... expensive real estate in Kazan,” the Tatarstan Prosecutor’s Office reported. Victims of financial pyramids became more than 1.5 thousand residents of Tatarstan, Mari El, Mordovia... In Tatarstan, the organizers of the “financial pyramid” stole 190 million rubles Fraudsters, under the guise of investing in various investment programs, stole a large sum of money. The prosecutor's office of the Republic of Tatarstan approved indictment in a criminal case against 35-year-old Ekaterina Nikonova. She is accused of fraud committed by an organized group on an especially large scale - 191 million rubles in damages. According to investigators, during the period... The Central Election Commission refused to monitor the legitimacy of the elections ... State Duma elections. Its executor in the 1990s headed the financial pyramid, and then worked as an assistant to the member of the Central Election Commission responsible for the competition. Elections... for a day he did not answer calls and messages from an RBC correspondent. Director pyramids Even before working with Galchenko, Bolshunov was mentioned in the media in... he was the director of the Yenisei trust company, organized on the principle of financial pyramids, wrote the Segodnya newspaper with reference to the investigation’s version. The investigation suspected... Herbalife will pay $200 million to get rid of the pyramid scheme label ... $200 million to clear himself of charges of organizing a financial pyramids, according to a message on the website of the US Federal Trade Commission (FTC... Pershing Square Capital Management Bill Ackman called Herbalife “the most effective pyramid in history." Herbalife, a direct selling company, was founded... “Financiers” who stole tens of millions from Surgut residents will be tried in Khanty-Mansi Autonomous Okrug ... In Ugra, the founders of the financial pyramids, who deceived 69 Ugra residents for a total amount of over 35 million rubles. ... Ministry of Internal Affairs of the Republic of Tatarstan: damage from scammers in Tatarstan amounted to 500 million rubles ... Human. In 2014-2015, the activity of “financial pyramids" Their activities resulted in the loss of a large number of funds... other measures of procedural coercion were chosen in relation to others. The largest financial pyramid Rinat Akchurin, head of the Department of Economic Safety and Internal Affairs of the Ministry of Internal Affairs of the Republic of Tatarstan, called “Growth... persons established and headed Altyn LLC, which operated on the principle of “financial pyramids" Fraudsters stole 12.5 million rubles. Tatarstan resident will be convicted of a financial pyramid with a profit of 12.5 million rubles ... a convicted resident of Bashkortostan, 31-year-old Maxim Dyachkov, in creating a financial pyramids. According to the investigation, at the end of 2013, Dyachkov, together with... individuals, established and headed Altyn LLC, which operated on the principle of “financial pyramids" In order to raise money, the accomplices opened offices of the company in Kazan... Scam at the expense of VIP clients: how the Vneshprombank pyramid collapsed ... -year anniversary, turned out to be a classic pyramid. It can even be compared to the Bernard Madoff scam - if not in scale ( pyramid Madoff turned out to be indebted to her...,” says the investor. Then, according to him, construction began at the bank pyramid: money from new creditors was used to pay off obligations to old ones. About this to RBC... the wife,” a top manager of one of the banks tells RBC. How it collapsed pyramid On November 6, 2015, the Bank of Russia completed a scheduled inspection of Vneshprombank... For organizing a pyramid, a Tatarstan resident received 5 million rubles and 10 years in prison ... a criminal case was opened regarding the theft of funds. Now the organizer of the financial pyramids faces imprisonment for up to ten years and a fine...Technologies and media, 01 Feb 2016, 14:48

The largest online lending scam has been uncovered in China ...with the Ezubao online lending system, which worked on the principle of financial pyramids, reports the Financial Times with reference to the Xinhua agency. From activities... . According to the Chinese authorities, such activities actually constituted financial pyramid, since 95% investment projects presented on the company's website turned out to be... Residents of Tatarstan donated 2 billion to financial pyramids ... finance", "Blago", "Platinum", "Inter Invest", "MarkFinance Garant", "Nostalgie Trade". In 2015, one of the 7 defendants in a criminal case regarding financial activities pyramids... proposing to tighten Russian laws against financial pyramids. Amendments to Civil code Russian Federation implied a ban on advertising financial pyramids, including in transport...The financial pyramid transferred 1 billion rubles from Russia to Ukraine. ... The Russian Ministry of Internal Affairs detained 19 financial organizers pyramids, which transferred money to Ukraine. According to the department's estimates, from the actions of the detainees..., Novosibirsk, as well as in Buryatia. An organization built on the principle of financial pyramids, attracted money from the population, promising an alternative to a standard loan in the form of...

Former Madoff programmer gets two and a half years in prison ... and a half years in prison for George Perez, assistant to the creator of the largest financial pyramids Bernard Madoff, CBS NewYork reports. This is the fourth of five employees... In 2008, the largest financial fraud in history was exposed in the United States. pyramid, which was created and headed by Bernard Madoff, the former chairman of the board of directors...14 Mar 2014, 09:18

The Ministry of Internal Affairs of the Republic of Tatarstan begins a criminal case into a large financial pyramid in Kazan ...in the coming days will initiate a criminal case against the organizers of the financial pyramids– “Center” LLC, which “purchased” citizens’ debts on bank loans... noted that in the actions of “Center” LLC there are all the signs of a financial pyramids, among which he named increased PR activity, focus on illiterate... name of the company. LLC "Center" became another in a series of financial pyramids, the investigation of which continues in Tatarstan. Since 2013, employees of the Ministry of Internal Affairs... pyramids. The company's clients were offered to transfer to it 20-30% of the previously received loan... a message that warned that DrevProm had signs of financial pyramids. According to SPARK data, DrevProm LLC is registered in Sterlitamak of the Republic...05 Feb 2014, 11:26

"DrevProm" became a defendant in a criminal case ... funds of the population." The police are checking commercial organization for signs of financial pyramids.As follows from the message of the Ministry of Internal Affairs of the Russian Federation, at the moment in ... the company, having received signals that DrevProm may be financial pyramid. During the inspection, department employees found out that “the company is engaged in attracting... a message in which it warned that DrevProm had signs of financial pyramids. At the same time, law enforcement agencies of Sterlitamak reported the receipt of more than 30... Three Russians were arrested in India for fraud under the MMM scheme ... their accomplices defrauded the people of Assam through financial fraud by organizing pyramid in the style of Sergei Mavrodi. Joint stock company was actively advertised on the Internet..., it was necessary to deposit about 5 thousand rupees (90 dollars). Activity pyramids soon affected other states of India, including Maharashtra, Gujarat, Punjab and Andhra Pradesh. At the same time, the activities pyramids contradicts what was adopted in 1978. Act, as well as three articles of the Criminal... The court sentenced the elusive "Ural Mavrodi" to 7.5 years in prison ... sentenced the creator of the financial pyramids Alexey Kalinichenko. "Ural Mavrodi" was found guilty under the article "Fraud... of a Forex trader." In fact, the structure he created functioned on the principle of financial pyramids- all payments to original clients were made exclusively from funds received...Hello, dear readers of my blog site. Well, today I will continue to talk and give examples of exposing financial pyramids on the Internet. Oh, sorry, network marketing based on recommendations from friends and family -))). Once upon a time I wrote an article about how network marketing works after which a huge wave of criticism and accusations fell on me that I myself could not make money there, and that I was such a loser. Well, it’s clear that those who invite people actively begin to write on various forms and blogs negative reviews so that people believe them, and not those who want to remove rose-colored glasses from the losers who believed them. I admit, yes, I attended seminars and business gatherings of 3 such pyramids in Kazan and they all closed, and criminal cases were brought against their owners.

I wonder if you took part in any business community gatherings in expensive restaurants and hotels. Let's remember what is required of those who want to join the club and start earning millions and living richly.

The essence of a financial pyramid

Let's look at the example of any financial pyramid and consider what is required from gullible sheep, forgive future rich people who are now bored in retirement and have a lot of extra money:

- New participants urgently need to buy a business place and only today at prices of 60,000 or more;

- It is required to wear beautiful evening dresses with expensive jewelry for the evenings, so that they seem rich and wealthy (and in the morning she goes to work at a factory or private security company as a security guard);

- Attract by word of mouth binary system new participants and receive interest from them, and then attract even more people.

And that's not all. You can get a couple of thousand rubles, which they will give you for scamming your friends, while you yourself are a member of a criminal group. I wonder how your friends, colleagues and loved ones will trust you in the future? Have you thought? If you get into trouble or want to do business with someone, then I would give you 3 letters for putting me on the spot. And no matter what you ask, everyone unanimously says that I believed so, it’s the whole government that prevents us from spending money, etc. Everyone ends up saying the same thing.

As one of the participants said, when asked what they were doing in the pyramids, she answered: “We have a business cooperative and we sing, dance and have fun.” Yeah. Looking at their faces and in general from the outside, I have the opinion that the people have gone crazy, mainly those who work in low-paid jobs and who want to get millions without doing anything on such fools, all this deception in financial pyramids is based. You know, I don’t even feel sorry for them at all, and since I have no brains, let them continue to suffer. Nobody forces them to deposit money without thinking without signing an agreement. In no pyramid you will receive documents stating that you have made your investments, but you will be given documents for loans and other receipts that you voluntarily gave the money -))).

I’m shocked that mothers with many children are running into network marketing and other financial pyramids, I don’t think so, and investing hundreds of thousands.

The number of people from year to year is becoming even larger in such pyramids, where due to the fact that the owners gave out large prizes to their people and demonstrably showed something, someone made money and you can too. All such close associates are already sitting as accomplices. Yes, they are great, they made money, but there are ten of them, and how many are divorced sheep who believed such scammers. The video will feature an interview with the regional manager of Mega Lux, who will tell, on condition of anonymity, how the pyramid works.

Konstantin Kondakov (managing stock trader), who recorded videos with Russian stars MMSIS (TOP-20 Index). Celebrities categorically refused to give interviews or comments regarding their participation and statements in the advertisement. But in fact, no one invested a penny in this system, but received a fee for the money and admitted it themselves (further in the video). The bottom line was that money in Ukraine and Russia immediately went to offshore companies and scammed everyone. The office itself was opened in an expensive building in Moscow City. When the payments stopped, Kondakov himself and his associates from MMCIS fled to Ukraine with the investors’ money -))). Well, how could it be different?

As soon as the owners fill their wallets and begin to understand that an irreversible peak of saturation of the pyramid is coming and the pair will close, well, the next thing you know, everyone starts running around and trying to get their money back and are left with loans and other obligations.

List of financial pyramids on the Internet that burned down

I will give an example of some pyramids and brief description what they did on the territory of Russia and Ukraine:

Russian social program- the point here was to attract investors who received certificates for the purchase of real estate and vehicles contributing only 20-30% of the final cost, and then it was promised that the investor would be able to buy back everything he invested in.

Pyramid GROWTH- a consumer cooperative that promised high interest rates. Promoted by Andrei Kharlamov, a football player of the Rubin team, and the organizer Andrei and Svetlana Makarov for finance and real estate today. Advertising was handled by Sergei Rost, the one who played with Nagiyev in “Caution Modern”. As there were so many participants, but the very first ones had nothing to pay with, the pyramid burst and everyone was closed. And as always, everyone began to deny it, especially the captain of “Rubin” Kharlamov, who promised money during the crisis.

Intway. com- I took part in this pyramid myself, but I was lucky that I left on time, and I was lured by the fact that they used a stock exchange as well as services for working in networks such as online stores and other gadgets. They sold business places that you need to buy so that you get interest from those who will buy the same places in the future using the binary system. I wrote about it in my TOP article (link in the first paragraph). A huge role was played by the so-called business coach Permyakov, who rushes from one network company to another and for some reason constantly tells everyone and promises to become millionaires, but for some reason it doesn’t work out for everyone, only for those who attract so many fools to him.

Mega Lux- One of the last high-profile financial pyramids, which was closed in the spring of 2015. There were more than 150 branches throughout Russia. On the website I saw that the last entry was at the 2015 New Year celebration. By the way, here is their website, which now, as I understand it, has been hacked and an advertisement for an online casino has been inserted on it, as well as parts of the materials have been removed and http://mega-luxe has ceased to be supported at all. ru. It’s interesting how millionaires who believed now talk about such pyramids. But it seems to me that they have already found new ones and invested their money there, taken on credit or set aside for the funeral.

Now everyone is sitting, and the site is selling its domain. Anyone who wants can buy and open the same pyramid -))).

ExpertPrav- well, like all such scams, it was already closed around 2015 (their website is expertprav.ru and the second domain is closed expert12.prav. tv). When you went to it, a player opened on the monitor from the computer monitor where they advertised a new business that anyone could join. I watched and studied this topic. The point was that the same Permyakov promises to sell us a super product, the essence of which was the use of special additives that need to be added to the fuel tank and gasoline consumption will be saved -))). I remember visiting their seminars where ordinary users used free services online broadcasts held seminars, and in their background hung an old carpet or even a communal apartment with a terrible interior, well, many who participated saw this.

Here is a video of these scammers and remember this person who constantly runs from company to company and is an important participant.

Colorsoflife. ru- also one of the scam companies, which was aimed at selling large quantities for amounts from 5,000 rubles to its customers. In Kazan, I am an acquaintance with whom, after such a divorce, I stopped communicating altogether; we went to their presentation at the expensive Bulgar Hotel, where everyone paid for their seats in the hall. Although representatives came there from France and did it all so beautifully that it was difficult not to believe them. As a result, the company became just an Internet platform where they sell goods and is something like Avon or Amway, whose products are sold by aunties for pennies almost on the streets -))). The site was last updated at the beginning of 2015.

ISIF- this company in the opinion of many, it was useful for shaking up the brains of young people, but the essence, as elsewhere, was the same. Everyone lost their money and were left with nothing. The point was personal growth and gaining financial independence and attracting more and more new clients to MLM.

It’s funny to me when, after the pyramids collapse, everyone runs around the courts and says that they were deceived and are asking for protection. From what? From yourself? So they show you the whole essence of your series, programs and TV shows, as well as investigations, and you still bear the money. Well then, there is no need to cry if you are complete sheep. Forgive me, of course, for my directness and rudeness, but I have seen a lot of such people and I think that they themselves are to blame for this and so be it.

This is a small list of financial pyramids that were well-known on the Internet, and there are hundreds more of them and new ones appear every day.

Advice: If you want to earn money, then do something with your hands and head. There is no easy money if you are asked to deposit a certain amount and you will become rich. Use your head and logic. There cannot be many rich people and no poor people. In this case, a social explosion will occur. If you want to ride on cruise ships and have expensive villas, then go earn money and open your own business, don’t blame everyone for their fault, but NOT YOURSELF !!!.

I hope in our country our citizens may stop believing and being a herd of sheep, and it’s time to wake up. Look at any news program like “Duty Unit” where almost every week they deceive one or another granny or pensioner aunt who has been scammed into buying a bracelet, dietary supplements or other investments.

Watch the investigation of the honest detective program about the recently closed MLM company Mega Lux and most likely you will see yourself or your friends in these people -))).

Good luck to everyone and see you soon. Leave your comments if you do not agree with my arguments or have experience making money online and such companies. You can attach statements and receipts in the comments to convince our readers that you are right.

Sincerely, Galiulin Ruslan.

Portuguese pyramid of Dona Branca 3. “Double Check” scheme This is why the scheme was called “Double Check”. Within a year and a half, the pyramid had grown throughout the country, more than three thousand investors gave him savings worth more than $880 million at that year’s exchange rate. 105. ATLANTIS GROUP 108. Global Network (www.inetworkspace.com, formerly Intway and Inspace) 111. Network of Partner Links - abbreviated as NPL 115. Center Region Company - with FSC plates 123. Gold Line International 125. Emirates Partners Travel 127. ADT - American Diamond Traders Inc. ----------- Financial pyramids 2015: Mega Lux, which deceived thousands of citizens, as well as a list of online pyramids in Russia As one of the participants said, when asked what they do in the pyramids, she answered: “We have a business cooperative and we sing, dance and have fun " Yeah.

List of financial pyramids 2018

In the offices of investors, they usually meet young girls who, over a cup of tea, tell them that the organization has a business that helps them feel confident even in a crisis - usually this is an extensive network of car service centers and car dealerships throughout Russia. Then the companies unexpectedly close. And many investors are left with nothing. Not everyone manages to get their money back. However, some clients were lucky: the police arrested the deceivers for fraud. And the defrauded investors now have hope of getting their money back.

Some of them even managed to win civil suits. Return the money along with the interest due under the contract. We are talking about amounts of hundreds of thousands of rubles. Among the victims were not only residents of the capital, but also of a number of regions of Central Russia.

Sunlight stores jewelry store gold jewelry - treasury of Yakutia

Canadian Diamond Traders (CDT) 2003 sluggish candiamond.ucoz.lv disguised financial pyramid gems City Emerald June 2010 cityemerald.com disguised financial pyramid gems Diamond Mine MLM April 7, 2012 2013 diamond-mine-mlm.com FP useless services Wazzub January 2012 2013 (in oblivion) wazzub.info disguised FP search engine Ideal Balance March 19, 2012 idealbalans.com FP deposits ISIF 2009 July 1, 2011 isifedu.com disguised FP training online business Mics Capital 2010 2012 micscapital.com disguised FP commercial social network Inmarket 2008 in oblivion inmarket.biz abandoned MLM online market Intway 2007 2011 intway.ucoz.com disguised FP script Online store ZeekRewards November 2011 August 2012 zeekler.com disguised FP auction EN101 200 5 since 2013 in oblivion en101.com disguised FP online foreign language training.

hype pyramids

Payments are not guaranteed Bank deposits do not generate income, but only allow you to protect money from inflation. Therefore, requests about where to invest money “at high interest rates” do not dry up.

Magazine headings

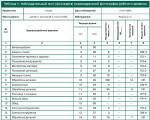

Russia Pays Conditions have changed 04/18/2018 Hashing24 hashing24.com May 8, 2016 hype, bitcoin mining about $20 about $3 10% per month 6400 forum 7,117 in Russia Pays 04/18/2018 Elysium Company elysium.company spring 2017 classic + investment. 0.03 BTC 1 year from 30% to 50% per year 3000 Unknown 04/18/2018 Alpha Cash alpha-cash.com September 1, 2017 hype, cryptocurrencies $10 360 days 10%-15% per month 15100 reviews 2,620 in Russia Pays 04/18/2018 CresoCoin cresocoin.org March 2017 hype, cryptocurrencies 650 rubles 20% per month 1300 ↓ Not known 04/18/2018 Stepium stepium.com September 2017 classic 0.06 ETH no passive income 1300 ↓ reviews Not known 04/18/2018 9mln 9mln.com b 2017 classic $3 passive income no 2000 Open 04/18/2018 * There are several types of financial pyramids.

- Investments - You invest money and wait for interest without doing anything.

Skeptimist

We will provide your protection and achieve your acquittal! Briefly describe the fact of the accusation against you and the lawyer will take the first steps to protect you today!

- We will competently build a position for your defense and will represent your interests in the police, prosecutor’s office, and court.

Classification of HYIPs and list of financial pyramids Recently, there are much more financial pyramids on the Internet than offline. And no wonder! After all, on the Internet, the organizer of an advertising campaign can remain anonymous, and launching mass advertising online is much easier and cheaper than in real life. The most popular type of financial investment on the Internet is hype (from the English HYIP - High Yield Investment Program). It differs from classic financial pyramids in that it regularly pays participants passive income for some time. Residents of Boston rushed to buy papers, while Charles maintained interest with paid articles in the press. 2.

What new Internet projects and financial pyramids in 2018 are not scams?

Net income per month financial group is more than 27%.

- “YES!Credit” - a loan can be obtained in 30 minutes at 2% per day. “DA!Invest” invests the funds provided by investors into “DA!Credit” and other reliable, highly profitable areas of business.

- Rostfinance Perm

RostFinance LLC (Company with limited liability) is registered in Moscow and operates in all regions of the Russian Federation. The company provides entrepreneurs step by step instructions on starting a business. From the moment the client opens a business, RostFinance takes upon itself legal support and produces free training personnel. The company helps an entrepreneur open an office in 5 days, with the average payback period for the business being 45 days.

Rostfinance LLC Perm also facilitates loan repayment on terms favorable to clients.

The Anglo-Saxons will let stupid Russian-Jewish oligarchs around the world

The rates on funds attracted by these financial organizations are higher, but, as previously noted, these organizations are not included in the DIA insurance system, that is, investments in them are not guaranteed by the state. In addition, you need to keep in mind that among microfinance organizations, only microfinance companies (MFCs) have the right to attract funds from citizens who are not their founders, and only in an amount of at least 1.5 million rubles. Microcredit companies (MCCs) do not have the right to attract funds from citizens who are not their founders.

As for the CCP, they have the right to attract only funds from their members (shareholders). From January 1, 2015, you can open an individual investment account with a brokerage company and receive not only financial results from transactions with securities, but also a tax deduction in the amount of 13% per year.

There are more and more financial pyramids in Russia

That is, from a legal point of view, they are not financial pyramids. But in practice, these companies operate exactly like financial pyramids. Most often this happens due to POOR-QUALITY or UNNECESSARY products (those that could not be sold on the free market) or because of their long implementation (for example, Sky Way).

Important

And also because of the management’s miscalculations when opening the company. In addition, many online MLM companies with intangible products fall into this category. Below is a table of such companies. Let us remind you once again that these companies are LEGALLY not pyramids - no need to write about this in the comments!!! Name Of.

Attention

And since the creators themselves are at the top, everyone else inevitably ends up losing. It would seem that this fact cannot but be understood by business representatives - people who not only have extensive life experience, but also have a high degree of pragmatism. But the whole point is that consumer psychology, along with an incredible thirst for money, also gives rise to a certain... belief in miracles.

This paradox has been repeatedly described by psychologists and lies in the fact that access to easy money leads to an overestimation of one’s capabilities. This is especially characteristic of those elites whose fortunes arose simultaneously, in a dubious way. A revolution takes place in their consciousness, reducing self-criticism to a minimum.

This happened to those who became rich as a result of the collapse of the USSR. The crazy money that fell into their hands taught them to think that they are smarter and more cunning than everyone else, the whole society.

Five main signs of financial pyramids READ