Mortgage co-borrowers - who are these people and how to become them?

At the moment, few of the fellow citizens have sufficient income, which would be enough to buy their own square meters. And in some cases, it also happens that the income itself is not enough for the bank to issue a mortgage for the purchase of housing. However, in this case, you can find a way out of the situation, because you can attract a co-borrower, that is, an assistant who will help you get a loan.

Credit institutions usually agree to such conditions, because another person responsible for the return of money is an excellent guarantee. And for the borrower, this is not bad: both when applying for a loan and in the event of unforeseen problems with debt servicing.

However, for the attracted person, not everything is so joyful, because he bears the same risks of paying off the debt as the recipient of the loan. That is why you should carefully and responsibly approach this issue.

Assistant in obtaining a loan

Mortgage co-borrower a person with equal obligations and rights along with the borrower, including joint and several liability to the credit institution for repayment of debt obligations.

His income when determining the amount of the loan will also be taken into account by the financial institution. This person is quite often involved when long-term loans for large amounts are required. Due to the fact that this particular person, along with the person being credited, is indicated in the contract, then he has the corresponding obligations and rights.

Rights and obligations

From the moment of signing the loan agreement, which stipulates their joint and several obligation, because it is automatically subject to the Civil Code of the Russian Federation, namely Article 323 “The rights of the creditor, with a joint and several obligation”, according to which:

By the way, we recently wrote an article about the mortgage program. Its conditions may help some to purchase housing.

- 1. A creditor in case of a joint and several obligation of debtors has the right to demand performance both from all debtors and separately from any of them, both in part of the debt and in full.

- 2. A creditor who has not received full satisfaction from one of the joint and several debtors shall have the right to claim the uncollected debt from other joint and several debtors.

- 3. Solidary debtors will remain obligated until the moment they fulfill the obligation in full.

A co-borrower can generally act as an additional borrower in situations where:

- 1. The borrower does not have sufficient income to receive the required amount of a housing or other loan. In this case, the income of the assistant under the loan agreement, confirmed by a certificate, is taken into account when calculating the maximum loan amount.

- 2. The main borrower has the required income, but is married during the mortgage period. In this case, the spouse becomes the borrower's assistant. It is connected with Art. 45 of the Family Code of the Russian Federation, since the acquired property becomes common, and a guarantee of debt payment is important for a credit institution.

- 3. The main borrower at the time of the loan, as well as in the first years of lending, has no income. For example, a student (applicant), then the loan assistant will repay the loan at this time.

What are the things to think about

- 1. Before signing a loan agreement, it is recommended to conclude an agreement on mutual obligations with the borrower if you have to repay the loan, and the assistant is not considered the spouse (s) of the borrower and subsequently does not become a co-owner of the property as a result of the transaction. This condition may apply to friends and relatives of the borrower who decide to help him.

- 2. If a loan is issued to spouses who live in a civil marriage and will be equally responsible for the loan, repay the debt together, then it is advisable to indicate in the contract that the acquired property will be registered in the shared ownership of both. Otherwise, you need to use the first paragraph.

- 3. If the spouse (a) does not want to become an assistant under the loan agreement, then it is recommended to use the marriage contract, which specifies this condition in detail so that it suits the credit institution, and the borrower can apply for a loan for the housing being purchased.

4. It often happens that the assistant is subsequently denied other loans, because another one will already hang on it. Here, much also depends on the positiveness of the credit history and the amount of the loan. Therefore, it is worth thinking before signing a contract.

Remember: you can always get a tax deduction when buying an apartment and get some of the money spent back. How to do this, the editors of the site described the site in detail

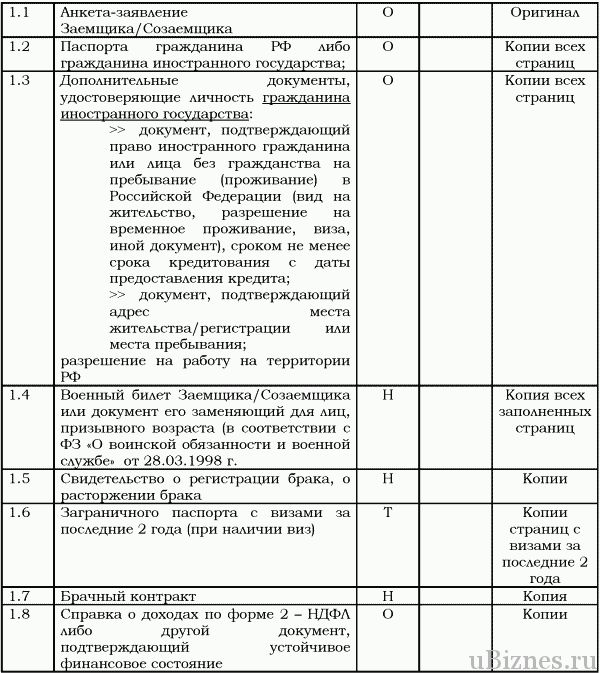

What documents should be provided

An assistant for housing loans needs to provide the same documents as the borrower:

Pros and cons

The pluses here include the fact that you help the borrower fulfill his dream, and if you register the property in shared ownership, then you become its co-owner. Therefore, it is necessary to correctly draw up contractual documents.

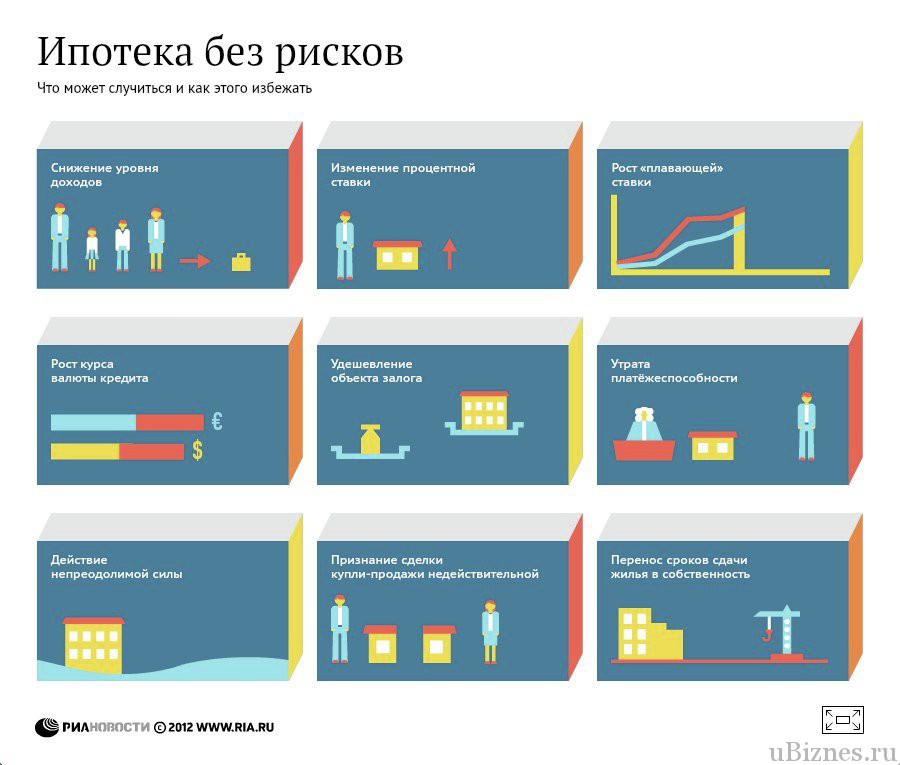

The disadvantages include enormous risks if the borrower fails and stops paying the loan. After all, life situations can be very diverse. There is a risk of losing property and remaining in debt to a credit institution.

What is the difference between a borrower and an assistant

When applying for mortgage loans, banks need to determine who will be the main person under this agreement, that is, who will receive statements, make payments, and so on. In a number of organizations, for the convenience of procedures, the main borrowers are called title borrowers.

As part of the contract being drawn up, quite often the right of ownership of the property is issued specifically to the title borrower. However, this is not a strict rule, because it is also possible to register in the shared ownership of the spouses.

Can a co-borrower apply for an apartment?

Co-borrowers are involved in order to take into account their income for the loan, as well as to simplify the procedure for collecting debt in case of improper performance of the contract.

The composition of the owners of the acquired property is usually indicated in the contract. However, the co-borrower has rights to the apartment if the borrower cannot fulfill his payment obligations and the debt, and he has to pay for it.