Capitalization of imported goods according to the customs declaration. How to enter a customs declaration for imports based on receipt. Tax accounting of import transactions

How to get a deduction for VAT paid at customs upon import, what date should be indicated on the customs declaration upon receipt imported goods the article will tell.

Question: What date should the customs declaration be carried out if the release date differs from the date in the goods declaration? The date of receipt of imported goods is the date of release according to the customs declaration, because the contract with the foreign supplier states that the transfer of ownership of the goods passes from the moment the goods are released into free circulation on the territory of the Russian Federation, determined by the date in the customs mark “Release permitted”, but the declaration is drawn up different date and different $ exchange rate. It turns out that I arrive according to the date of the stamp “Issuance is permitted”, and what date should the GDT be carried out? Posting date or DT date, is the $ exchange rate different for each date?

Answer: You do not need to carry out customs declaration in accounting at all.

You are obliged to receive the goods according to the terms of the contract - on the date of the customs mark “Release permitted”. The date of compilation of the customs declaration does not play any role for accounting purposes.

How to get a deduction for VAT paid at customs upon import

Situation: at what point does the right to deduct VAT paid at customs upon import arise?

The right to deduct VAT paid at customs arises in the quarter when the imported goods were accepted for registration, and is retained by the importer for three years from that moment. For example, if goods were accepted for accounting on June 30, 2016, then the right to deduct VAT paid at customs when importing these goods remains with the buyer until June 30, 2019 (Clause 3, Article 6.1 of the Tax Code of the Russian Federation).

VAT paid at customs can be deducted if the following conditions are met:

- the goods were purchased for transactions subject to VAT or for resale;

- the goods are credited to the organization’s balance sheet;

- the fact of payment of VAT is confirmed.

VAT is deductible if the imported goods were placed under one of four customs procedures:

- release for domestic consumption;

- processing for domestic consumption;

- temporary import;

- processing outside the customs territory.

This procedure for applying the deduction follows from the provisions of paragraphs, Article 171 and paragraphs, 1.1 of Article 172 of the Tax Code of the Russian Federation.

The organization’s own property and everything committed by it business transactions reflected in the relevant accounting accounts (clause 3 of Article 10 of the Law of December 6, 2011 No. 402-FZ). Thus, acceptance for accounting is a reflection of the value of property in the accounting accounts that are intended for this purpose.

If we are talking about inventory items, registration is the moment when their value is reflected on account 10 “Materials” or account 41 “Goods” with the registration of the corresponding primary documents(for example, a receipt order according to form No. M-4, a consignment note according to form No. TORG-12). This conclusion is confirmed by the Russian Ministry of Finance in a letter dated July 30, 2009 No. 03-07-11/188.

Deduction of VAT amounts paid on the import of fixed assets, equipment for installation and (or) intangible assets is made in full after they are registered (clause 1 of Article 172 of the Tax Code of the Russian Federation).

When registering imported goods, it is necessary to take into account the features associated with determining the moment of transfer of ownership of goods from the seller to the buyer. This moment (for example, shipment of goods to the carrier, payment for goods by the buyer, crossing of the Russian border by goods, etc.) must be recorded in the foreign trade contract. If there is no such clause, the date of transfer of ownership should be considered the moment the seller fulfills his obligation to supply the goods. Usually this point is associated with the transfer of risks from the seller to the buyer, which in turn is determined by the provisions International rules interpretation of trade terms "INCOTERMS 2010".

If imported goods have been cleared through customs, but ownership of them has not yet transferred to the buyer, they can be taken into account off the balance sheet. For example, on account 002 “Inventory assets accepted for safekeeping" In this case, the buyer also has the right to deduct VAT paid at customs. This conclusion can be drawn from the letters

Step 1. Settings for accounting for imported goods according to the customs declaration

It is necessary to configure the functionality of 1C 8.3 through the menu: Home- Settings – Functionality:

Let's go to the bookmark Reserves and check the box Imported goods. After installing it in 1C 8.3, it will be possible to keep track of batches of imported goods by customs declaration numbers. The details of the customs declaration and the country of origin will be available in the receipt and sale documents:

To carry out settlements in foreign currency, on the Calculations tab, check the Settlement in foreign currency and monetary units checkbox:

Step 2. How to capitalize imported goods in 1C 8.3 Accounting

Let's enter the document Receipt of goods in 1C 8.3 indicating the customs declaration number and country of origin:

The movement of the receipt document will be as follows:

By debit of the auxiliary off-balance sheet account gas turbine engine information will be displayed on the quantity of imported goods received, indicating the country of origin and the customs declaration number. The balance sheet for this account will show the balances and movement of goods in the context of the customs declaration.

When selling imported goods, it is possible to control the availability of goods moved under each customs declaration:

In the 1C 8.3 Accounting program on the Taxi interface for accounting for imports from member countries of the customs union, changes have been made to the chart of accounts and new documents have appeared. For more information about this, watch our video:

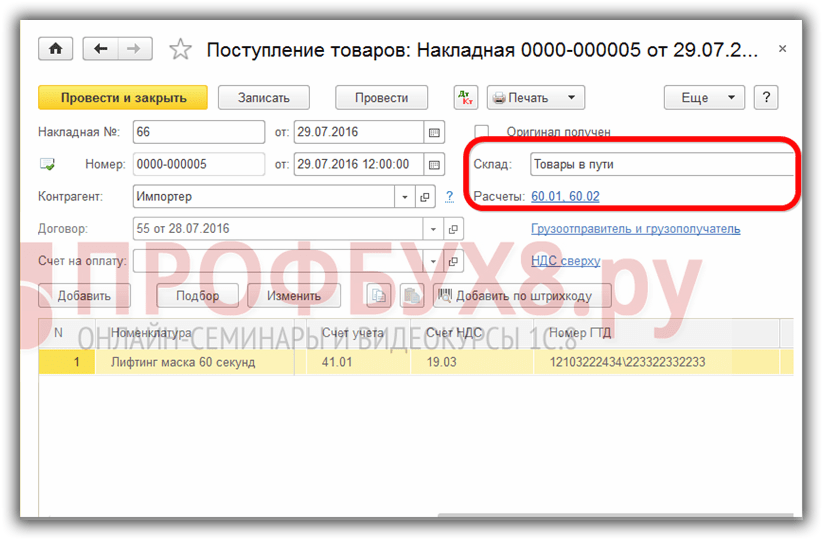

Step 3. How to account for imported goods as assets in transit

If during the delivery period it is necessary to take into account imported goods as material assets in transit, then you can create an additional warehouse to account for such goods as a warehouse Items on the way:

Account 41 analytics can be configured by storage location:

To do this, in 1C 8.3 you need to make the following settings:

Click on the Inventory Accounting link and check the box By warehouses (storage locations). This setting in 1C 8.3 makes it possible to enable analytics of the storage location and determine how accounting will be kept: only quantitative or quantitative-cumulative:

When goods actually arrive, we use the document to change the storage location:

Let's fill out the document:

The balance sheet for account 41 shows movements in warehouses:

Step 4. Filling out the customs declaration document for import in 1C 8.3

Enterprises that carry out direct deliveries of imported goods must reflect customs duties for the received goods. Document Customs declaration for import into 1C 8.3 can be entered based on the receipt document:

or from the Purchases menu:

Let's fill out the customs declaration document for import into 1C 8.3 Accounting.

On the Main tab we indicate:

- The customs authority to which we pay duties and the contract, respectively;

- What customs declaration number did the goods arrive at?

- Amount of customs duty;

- The amount of fines, if any;

- Let's put up a flag Record the deduction in the purchase book, if you need to reflect it in the Purchase Book and automatically deduct VAT:

On the Customs Declaration Sections tab, enter the amount of the duty. Since the document was generated on the basis, 1C 8.3 has already filled in certain fields: customs value, quantity, batch document and invoice value. Let's enter the amount of duty or the % duty rate, after which 1C 8.3 will distribute the amounts automatically:

Let's review the document. We see that customs duties are included in the cost of goods:

Study in more detail the features of the receipt of goods in the event that a customs declaration is indicated in the supplier’s SF, check the registration of such SF in the Purchase Book, study the 1C 8.3 program at a professional level with all the nuances of tax and accounting, from the correct entry of documents to the generation of all basic reporting forms - we invite you to our. For more information about the course, watch our video:

How GTD is translated, or rather how GTD is deciphered, is not a mystery to most accountants. And even for those who have never encountered in their practice foreign economic activity. For the customs declaration, the decoding is a “cargo customs declaration”.

However, such a document as the customs declaration is not currently used. From 01/01/2011, the cargo customs declaration was replaced by a declaration for goods (Decision of the Customs Union Commission dated 05/20/2010 No. 257).

However, often the declaration for goods, drawn up, for example, upon import, is still called the customs declaration.

And in our material, the terms “customs declaration” and “goods declaration” will be used as synonyms for ease of perception.

How to read the customs declaration for imports?

How to decipher the information contained in it using the customs declaration (customs declaration, declaration of goods)? To do this, you need to know the procedure for filling out a goods declaration.

Instructions on the procedure for filling out Approved by Decision of the Customs Union Commission dated May 20, 2010 No. 257.

The instructions contain how general provisions, as well as the procedure for filling out the declaration for various customs procedures.

In general, a single goods declaration declares information about goods contained in the same consignment that are placed under the same customs procedure. If goods contained in the same consignment are declared for placement under different customs procedures, separate goods declarations must be submitted for each customs procedure.

One customs declaration can contain information about no more than 999 goods.

The declaration of goods consists of the main (DT1) and additional (DT2) sheets. Additional sheets are filled out if information on two or more types of goods is declared in one declaration.

If the goods declaration is completed in in writing, then it is served on A4 sheets.

The main sheet of the customs declaration contains information about one product. And on one additional sheet there can be data on three products.

The declaration of goods is filled out in capital letters using printing devices, legibly, and should not contain erasures, blots or corrections.

Submission of the customs declaration in writing (in 3 copies) is accompanied by the submission of an electronic copy to the customs authority.

The detailed procedure for filling out the customs declaration is given in the Instructions approved by the Decision of the Commission Customs Union dated May 20, 2010 No. 257.

How to capitalize goods according to the customs declaration?

When imported goods arrive, careful accounting of the customs declaration and the ability to “read” the declaration of goods becomes especially important. After all, it is necessary not only to correctly formulate the initial cost of goods, taking into account customs duties, fees and reflect the VAT paid at customs, but, first of all, determine the date on which the goods should be recorded. After all, often the date of the customs declaration and the date of issue are different. And what will be the date of acceptance of goods for accounting? Here it will be important to take into account the terms of the import contract and the moment at which ownership of the goods passes to the buyer. As a rule, this is the date of issue indicated in column C of the main and additional sheets of the goods declaration.

Let us remind you that information about calculated customs payments and other payments, the collection of which is entrusted to the customs authorities (in particular, VAT, customs duties and fees), is reflected in the declaration of goods in column 47 “Calculation of payments”.

We talked about how the import of goods is reflected in accounting.

The cargo customs declaration is the most important when exporting and importing any goods across the border.

In our example we will take a closer look step by step instructions how to reflect in 1C 8.3 Accounting 3.0 the accounting of imported goods - Xiaomi RedMI Note 3 phones. We will capitalize it from China along with the costs incurred at customs.

Posting of imported goods

The first step when reflecting any purchase in the program is to create the “Receipts (acts, invoices)” document. You can find it in the “Shopping” section.

Please note that for the import item selected upon receipt, you will need to indicate the country of origin and the customs declaration number on the card. This data will automatically be transferred to the receipt.

A fully completed document in our case will look as shown in the figure below.

Customs declaration for import

Next, we will need to take into account customs duties in the program. This can be done in 1C 8.3 using the “GTD for import” document. You can find it in the purchase section, but for this example it would be more appropriate to create it directly from the receipt document. To do this, we will use the “Create from” menu.

In the “Customs” field we indicate that our batch of phones will be processed at Vnukovo customs. It is to her that we will pay a fee of 5,000 rubles. On this document tab, we only need to fill in the “Deposit” field, the value of which is selected from the contract directory.

Next, let's move on to the next tab of the document - “Sections of the customs declaration”. Due to the fact that we created this document based on the receipt of goods, some data in the tabular section “Products by section” has already been filled in.

In the upper table we indicate that the customs value of our phones is 560,000 rubles. The fee will be 33,600 rubles, which is six percent of the total cost.

If the import of goods was not subject to a fine when passing through customs, then you can not indicate any more data and submit the document.

In 1C programs, the customs declaration document for imports is used to reflect the customs value and customs VAT in the VAT accounting subsystem for the purchase book and to assign customs payments to the cost of a consignment of imported goods. It is convenient to create a customs declaration for imports from Receipts of goods and services using the Enter button based on:

Registration of customs declaration for import step by step

1. In the field CCD number the number of the cargo customs declaration for which information must be entered is indicated. The customs declaration number in this field must match the customs declaration number specified in the series of the Receipt of goods and services document. If the numbers do not match, then 1C will not allow you to carry out a customs declaration for imports.

2. In the Customs field, you must select a counterparty - customs authority, on which the customs declaration is drawn up.

3. In the Deposit at customs (RUB) field, you must select the agreement with customs under which the deposit was transferred. Important! Such an agreement should look like Other.

Contracts with the type With the supplier are not suitable for mutual settlements with customs.

4. You should not indicate the agreement in the Currency deposit field if foreign currency payments are not provided for under the customs declaration, because this causes an error. If the contract is entered in this field by default, it must be deleted.

5. Customs declaration for imports should be carried out for all types of accounting. Accounting flags are set automatically from the user settings. But, if the user is not configured, then the absence of posting flags by accounting type will cause document posting errors.

Important! If not all flags are checked, the document will be processed, but will not be fully reflected in accounting, which will lead to distortion of data on the cost of goods.

6. If there are amounts in the customs declaration customs duties and/or fines, they must be indicated on the Basic tab. You should not enter payments in rubles in the fields intended for indicating currency payments, as this will lead to errors. The names of the fields intended for entering only currency payments contain the symbols “(val)” or the symbol of the currency of the agreement specified in the “Currency deposit” field.

Important! If the “Currency deposit” field specifies an agreement in rubles, then for foreign currency payments the currency (rubles) will also be indicated. Thus, before entering payment amounts, you need to make sure that contracts with customs are filled out correctly in the header (fields 3 and 4).

7. By default, to indicate the customs value of goods on the customs declaration, the currency from the Receipt of goods and services is entered, the exchange rate is taken as of the date indicated in the header of the import customs declaration. In a normal situation, it is assumed that the date of the customs declaration document for import in 1C will correspond to the date of the real customs declaration.

8-12. It is possible to specify the rate manually or select the rate date for calculating fees.

To do this, go to the Prices and Currency tab. This tab shows the default currency and exchange rate for the date specified in the header of the customs declaration for imports.

The user can specify another rate manually or click on the calculator icon next to the rate and select a date for selecting the rate (usually this is the date specified in the customs declaration number).

13. The Customs value detail indicates the customs value for calculating duties and VAT. When filling out on the basis of the Receipt of goods and services, the customs value is set equal to the value according to the invoice (that is, the value according to the receipt document). This amount can be changed by the user, for example, in cases where, in order to calculate payments, it is necessary to include transport costs in the cost of the goods.

14. In the Duty rate field, the user indicates the rate actually applied to the customs declaration.

15. In the VAT rate field, the user indicates the VAT rate actually applied to the customs declaration.

16. Please note that if the customs declaration does not apply the calculation and payment of duties and VAT in foreign currency, then the Duty in foreign currency and VAT in foreign currency flags should be cleared.

17. In the Duty (rub) and VAT (rub) fields the calculated values of payments are displayed. These amounts can also be adjusted by the user.

18. Below in the tabular section, fill in the goods according to the invoice (from the document Receipt of goods and services). It is necessary to distribute the amounts of customs duties to document positions to calculate the cost of the batch.

19. There is a standard mechanism that distributes payment amounts to all positions in proportion to the line amount. However, the distribution can be made or adjusted by the user in any ratio.

How to fill out a customs declaration in 1C, consisting of several sections.

To enter an additional section, you must go to the Add item in the Customs Declaration Sections menu. When adding a section on the Sections tab of the customs declaration, a table of sections appears, each row of which is subordinate to the rows of the lower table Products.

For each section, you can specify your own rates of customs duties and/or VAT and distribute the amounts only to the items specified in the tabular part of this section.

The user distributes the goods into sections independently using the Fill button and removing extra lines from each section.

Important! it is necessary that the customs declaration indicate all the goods, the cost of which should be allocated to the amount of payments under the customs declaration.

The created customs declaration documents for import are stored in the subordination structure Receipts of goods and services and in the journal: Documents - Purchasing Management - customs declaration for import.

Learn new things every day and change your life for the better!