Beneficiary: who is this? The beneficial owner of a legal entity is... The ultimate beneficiary

Information about the beneficial owner - a sample of filling out this document in the form required by law must be in every organization. The special purposes for presenting this information also dictate special methods for obtaining it.

Where is the concept of beneficial owner used?

This is not the first year that the legislator has been taking measures aimed at implementing the possibility of bringing to property liability not only a legal entity, but also individuals in whose interests it acts and makes transactions. In our article we will look at when, how and in what form information about the beneficial owners that a legal entity is required to provide is generated.

Along with this concept, introduced by the law “On countering the legalization...” of August 7, 2001 No. 115-FZ (hereinafter referred to as Law No. 115-FZ), various systems of norms contribute to “lifting the corporate veil”:

- About affiliates. More details here: Sample of filling out the list of affiliated persons in 2018 - 2019, List of affiliated persons of a joint stock company (nuances).

- Interdependent persons. Read the article on the website at the link: Which persons are recognized as interdependent under the Tax Code of the Russian Federation? , and a little about the relationship between the concepts: Affiliated and interdependent entities - what are they? .

- Controlling and controlled entities (Article 189.23 of the Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ, Article 2 of the Law “On the Securities Market” dated April 22, 1996 No. 39-FZ), etc.

The peculiarity of each of the concepts of this kind is its strictly targeted (teleological) content, which is determined by law. It follows from this that the affiliation or control of a person, if proven, is important for determining beneficiary status only if the information received complies with Law No. 115-FZ.

The beneficial owner, therefore, is established only by Law No. 115-FZ. It must be distinguished from the beneficiary.

What is the difference between a beneficial owner and a beneficiary?

Etymologically, the terms “beneficiary” and “beneficiary” are almost identical, since a benefit is also a benefit, and a beneficiary is the one who receives it. But in Law No. 115-FZ, these 2 terms are meaningfully different:

- A beneficial owner is an individual who is determined based on his ability to directly or indirectly control the actions of the person being verified on a documented basis. This may be ownership of more than 25% of the authorized capital or another way to influence decisions made.

- Beneficiary is an individual or legal entity that is the recipient of income from a transaction carried out by a person. This may be the principal under an agency agreement or another entity; in this case, the possibility of controlling influence is not considered. Its special characteristic is that it benefits from the actions of the person being inspected only for a specific transaction being carried out, and not from all of its activities (see the information message on typical questions... published on the Rosfinmonitoring website).

From the above concepts it is clear that they can intersect; the same person can simultaneously perform two roles in relation to the person being checked.

Who identifies beneficiaries and why, how information about beneficial owners is provided through the Federal Tax Service of the Russian Federation

The purposes of obtaining information about beneficiaries are determined by the purpose of the provisions of Law No. 115-FZ - countering the entry into legal circulation of funds obtained by criminal means. This follows from the concept of legalization (Article 3 of Law No. 115-FZ).

Each legal entity is required to identify its beneficial owners on the basis of Art. 6.1 of Law No. 115-FZ. In addition, this information is collected by banks and other organizations (subparagraph 2, paragraph 1, article 7 of Law No. 115-FZ). To help them, special Methodological Recommendations have been developed (letter of Rosfinmonitoring dated December 4, 2018 No. 57).

Information must be submitted upon request to authorized bodies, which primarily include the Federal Tax Service of the Russian Federation and a specially created state body - Rosfinmonitoring, established by Decree of the President of the Russian Federation of June 13, 2012 No. 808.

Considering that all organizations have telecommunication channels (TCC) with tax authorities, it was decided that requests and responses to them should be sent via TCC through the Federal Tax Service of the Russian Federation (clauses 1-4 of the Rules for the provision by legal entities of information about their beneficial owners... , approved by Decree of the Government of the Russian Federation dated July 31, 2017 No. 913, hereinafter referred to as the Rules). The format for presenting information is approved by the Federal Tax Service of the Russian Federation. The legal entity is given 5 working days to submit them.

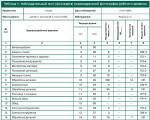

The form of the document that is drawn up in the organization can be downloaded from the link: Sample of filling out information about beneficial owners.

What information should the list of beneficial owners contain?

An individual is recognized as a beneficial owner if he has the ability to control the actions of the organization if the following signs are present:

- ownership directly or indirectly (through participation in legal entities) of more than 25% of the authorized capital or voting shares;

- the ability to influence the organization’s decisions on the basis of an agreement or other documents determined by the organization independently.

If it is not possible to identify the beneficiary, the head of the executive body is recognized in this capacity. The same rule applies to legal entities - participants or managing legal entity.

Composition of information about the beneficial owner (paragraph 2, subparagraph 1, paragraph 1, article 7 of Law No. 115-FZ):

- Full name;

- citizenship;

- date of birth;

- passport details;

- migration card data;

- registration address;

- TIN, etc.

Banks may require a number of additional information provided for in Appendix. 1 to the regulation of the Central Bank of the Russian Federation “On identification...” dated October 15, 2015 No. 499-P, for example, SNILS number.

Let us note that clause 2 of the Rules stipulates that documented information about beneficiaries or information about measures taken to obtain this information must be submitted to the Federal Tax Service of the Russian Federation and (or) Rosfinmonitoring as part of the performance of duties provided for by law. The transfer of such information is not a violation of the legislation on the protection of personal data (Clause 5, Article 6.1 of Law No. 115-FZ).

Obligations of legal entities under Law No. 115-FZ

Each organization is obliged:

- have documented information about your beneficiaries and update it regularly, at least once a year;

- store received documents and information for 5 years;

- provide information and documents at the request of authorized bodies or the Federal Tax Service of the Russian Federation.

Entities with predominant state participation, as well as international and some foreign organizations are exempt from collecting information (clause 2 of article 6.1, paragraphs 2-5, subclause 2 of clause 1 of article 7 of law No. 115-FZ).

To fulfill these obligations, a legal entity requests from its participants and controlling persons the necessary information that is required to be provided. What should be done in the event of refusal or evasion of their submission by the addressees of requests is not disclosed in the law.

There is no special administrative liability for obligated persons, since the subject of the administrative offense provided for in paragraph 1 of Art. 15.27 of the Code of Administrative Offenses of the Russian Federation (failure to exercise internal control), can only be the person specified in Art. 7 of Law No. 115-FZ (payment acceptance operators, etc., see the decision of the Lipetsk Regional Court dated September 21, 2017 in case No. 21-152/2017).

So, information about individuals who are the beneficial owners of legal entities is submitted upon request to government authorities and other organizations operating in accordance with Law No. 115-FZ, and includes information about citizens, which in this situation is not covered by the legislation on the protection of personal data .

The market economy in our country is developing, new terms and concepts are appearing that we have not previously encountered. Therefore, in order to be “on the crest of the wave”, you need to constantly expand your “economic vocabulary”. This is necessary not only for professionals, but also for ordinary citizens. After all, we all have something to do with finance.

The definition of the concept of beneficiary is somewhat different depending on which area it relates to - banking, general finance, legal, etc.

However, this term can also be defined in general terms. In simple words, a beneficiary is a person in whose favor certain actions that generate profit are carried out (for example, opening a bank account, transferring funds, opening a letter of credit, trust management of property, etc.).

Legislative framework

The legislation of our country will help you understand the concept of a beneficiary more specifically. The main regulatory act in this area is the so-called. “anti-money laundering law” 115-FZ. It defines the term “beneficial owner” (paragraph 13, article 3 of law 115-FZ):

beneficial owner- for the purposes of this Federal Law, an individual who ultimately directly or indirectly (through third parties) owns (has a predominant participation in more than 25 percent of the capital) a client - a legal entity or has the ability to control the actions of the client. The beneficial owner of a client who is an individual is considered to be this person, unless there are grounds to believe that the beneficial owner is another individual;

The same federal law stipulates the obligation of banks and other financial institutions involved in transactions with funds to identify beneficial owners. The law also specifies the specifics of identifying these persons.

The latest amendment to the law was approved on June 23, 2016 and recorded in 215-FZ. It clarifies the specifics of the disclosure of information by legal entities. According to this regulatory act, they must record data on beneficial owners in their databases.

There is a requirement to regularly update this information at least once a year. They are required to provide this information upon request:

- authorized bodies,

- tax authorities;

- federal executive body.

A legal entity that does not provide this information will be fined.

The improvement of the legislative framework was caused by the need to increase the transparency of the activities of organizations and reduce the risks of their involvement in questionable activities, including those related to money laundering and the financing of terrorist activities.

The improvement of the legislative framework was caused by the need to increase the transparency of the activities of organizations and reduce the risks of their involvement in questionable activities, including those related to money laundering and the financing of terrorist activities.

The legislative framework regulating relations with beneficiaries was supplemented by Bank of Russia Regulation No. 499-P dated October 15, 2015. It prescribes the specifics of identifying beneficiaries and beneficial owners by credit institutions to ensure the purposes of combating the laundering of criminal proceeds. The Regulations specify:

- criteria for identifying beneficiaries by credit institutions;

- documents provided by its clients for these purposes;

- features of maintaining a client's file;

- other questions.

At the same time, the Central Bank of the Russian Federation regularly explains to credit institutions the specifics of the operation of these laws and examines exceptional cases. These points are covered both in letters from the Central Bank of the Russian Federation and in conferences, round tables, etc.

Who is the beneficiary?

Federal laws 115-FZ and 215-FZ define the term “beneficial owner” in this way: this is an individual who directly or indirectly owns a legal entity, or has the ability to exercise direct control over its actions. In this case, “ownership of a legal entity” means the predominant participation of an individual in it in an amount exceeding 25% in the capital.

Federal Law No. 134-FZ of June 28, 2013 obligated banks to identify beneficial owners, not only legal entities, but also individuals. Thus, in the process of carrying out their functions, credit institutions face a number of problems. One of them is to identify clients' beneficiaries.

The concept of a beneficiary and the features of its identification will differ somewhat depending on whether it acts for the benefit of a legal entity or an individual.

Who is the final beneficiary of a legal entity?

The chain of beneficiaries ends with a specific person or group of people who receive a certain profit. This person is the final beneficiary. In simple words, this concept can be explained as follows: the final beneficiary of a legal entity is an individual who receives profit from the activities of the organization or property management.

Beneficiary and beneficiary: what is the difference?

If everything is clear with the final beneficiary, then the concepts of “beneficiary” and “beneficial owner” are often substituted. Indeed, both of these entities receive income from the client's actions. Thus, some sources generally consider them to be equivalent.

If everything is clear with the final beneficiary, then the concepts of “beneficiary” and “beneficial owner” are often substituted. Indeed, both of these entities receive income from the client's actions. Thus, some sources generally consider them to be equivalent.

However, Russian legislation gives different definitions to these terms. This can be seen in 115-FZ. Thus, a beneficial owner means an entity that owns a client - a legal entity, or has the ability to exercise control over its actions. To do this, he must own more than 25% of the company's shares.

And the beneficiary, according to the same law, is defined as the entity for whose benefit the client carries out its activities.

Thus, the concept of “beneficial owner” appears to be more specific and narrow, which specifically states that the beneficiary must own more than 25% of the shares in the capital of the organization in order to be considered its beneficiary. He must also have access to manage and control it. The beneficiary cannot do this because he does not have his own share in the company.

Based on this, when regulatory authorities identify illegal actions, they are interested, first of all, in the beneficial owners of organizations. This is explained by the fact that it is the latter who make decisions about illegal actions.

Features of identifying a beneficiary

There should be separate approaches to determining the beneficiary for individuals and legal entities.

For a legal entity

The beneficiary of a legal entity is either one or several actual owners of the organization, who have the right to exert direct or indirect influence on the company. This impact can be both direct and indirect.

The difficulty of identifying beneficiaries is made more difficult by the fact that information about them may not be indicated in company documents. Or their official participation in its activities may be underestimated. Their identity is established by bank employees and can only be known to them and commercial agents.

Some companies try not to disclose information about their beneficiaries, for example, in the following cases:

- when using offshore companies;

- when optimizing taxation and tax evasion;

- when laundering funds that were obtained by criminal means.

The voice of the beneficiary of a legal entity is dominant in resolving a number of key issues of the organization’s activities, such as: distribution of profits, participation in investment projects. For these purposes, the beneficiary has the right to participate in the meeting of shareholders of the company.

In order to ensure the participation of the beneficiary in the management of the company and to conceal information about his identity as much as possible, various schemes for registering property and title documentation are used.

As an example, let’s take the following situation – a beneficiary obtaining access to the organization’s accounts through a power of attorney, which is issued by a “dummy” director. The beneficiary owns the property through bearer shares. This can also be done through persons who act as nominee shareholders.

Example

Let us give an example of determining the ultimate beneficiary of a legal entity.

Thus, information was recently made public about the ultimate beneficiary of the Rusal concern and the Basic Element Management Company, Oleg Deripaska. He was forced to disclose information about the ownership structure of these companies under pressure from international investors. To do this, Deripaska was forced to admit that he is the sole owner of these companies.

In this example, the “ultimate beneficiary” means the sole owner of the company, i.e. Oleg Deripaska. He can own the assets of companies directly or indirectly, i.e. through some third party structures.

For an individual

Establishing information about beneficiaries of individuals is difficult for many reasons. This is, among other things, due to the fact that clients do not disclose this information either intentionally or unintentionally.

At the same time, identifying the beneficiaries of legal entities is easier due to the presence in the arsenal of credit institutions of such information portals as SPARK or Kommersant KARTOTEKA, in which this information can be found.

For information: the need to identify a beneficiary of an individual is provided for by the standards of international organizations. This is not just a “whim” of the Russian authorized body.

Let us highlight the possible beneficiaries of an individual:

- legal representative of this subject;

- trustee.

This is if we do not consider options that have criminal overtones. Here, as an example, we can cite the participation of the unemployed, students, or simply low-income people in cash-out schemes that have become more frequent in our country.

From a formal point of view, the persons who hired them will be the beneficiaries of these clients - individuals. However, these beneficiaries may not be identified by the bank.

Who requests this information?

First of all, inspection authorities need to obtain reliable information about beneficial owners. This information is so important for several reasons. They are needed to organize counteraction:

First of all, inspection authorities need to obtain reliable information about beneficial owners. This information is so important for several reasons. They are needed to organize counteraction:

- “laundering” of criminal proceeds;

- financing of terrorist activities;

- tax fraud;

- illegal withdrawal of funds abroad, etc.

In addition to inspection bodies, creditors also need this information when making an informed decision about the possibility of providing funds.

Credit institutions with which clients open accounts are required to identify information about beneficial owners. In the questionnaires, they are required to indicate whether they are acting in their own interests or for the benefit of third parties. The credit institutions themselves transmit this information to Rosfinmonitoring.

To combat money laundering, credit institutions must establish the following information about their client’s beneficiary: full name, nationality, date of birth, residential address, tax identification number, passport or migration card details.

A sample of filling out this information is given in 115-FZ.

Rights and responsibilities of beneficiaries

The beneficiary has the following rights:

- disposal of own shares;

- control over compliance with their duties by the management of the organization;

- participation in meetings held by the company’s management and making decisions in accordance with one’s own share in it;

- receiving income from the results of the organization’s functioning.

The beneficiary can protect his property by entering into a trust agreement. However, if its terms are violated, the beneficiary himself will be held responsible.

Some nuances

Not all organizations have ultimate owners. So, non-profit organizations do not have them. This is explained by the fact that the purpose of their activities is not to make a profit.

However, it is not always possible to obtain information about beneficiaries from a commercial organization. Therefore, despite the fact that credit institutions have many methods at their disposal to identify the ultimate beneficiaries, their identity in some cases may remain secret.

This is explained by the presence of well-developed schemes for concealing the final beneficiary. Such cases are especially typical for trust transactions.

Despite the importance of identifying beneficiaries, the Russian legislative framework has not yet been fully formed and has many shortcomings. HERE >>>

A beneficial owner is an individual who can control the activities of the company. Control is exercised both de jure and de facto.

Who is the Beneficial Owner?

Beneficiary– is an individual participating in a legal entity. The size of this dominant participation is more than 25%. The same person has the authority to control the actions of the legal entity. The meaning of the concept under consideration depends on the specific area.

The following persons may be the beneficial owner:

- Landlords.

- Account holders.

- Clients of trust firms who have given away their property on a trust basis.

- Holders of documentary letters of credit.

- Real owners of companies.

Often information about the beneficial owner is hidden. This is done to ensure the safety of the company’s activities, as well as to prevent claims from government agencies.

Legislative framework

The term “beneficiary” is given in Federal Law No. 115 (paragraph 13, article 3). This law regulates the area of combating money laundering. Federal Law No. 115 obliges financial institutions to identify beneficial owners. The criteria for identifying them are also given there. The amendment to the Federal Law is given in Law No. 215. The regulation contains nuances for the publication of relevant information of legal entities. The Federal Law obliges legal entities to enter information about beneficiaries into databases. Information must be updated once a year.

Determining beneficiaries allows you to increase the “transparency” of the work of companies and prevent the laundering of proceeds from crime. Relations with these persons are regulated by Central Bank Regulation No. 499. This Regulation contains the following information:

- Criteria for identifying beneficiaries.

- List of documents for identifying hidden owners.

- Rules for maintaining dossiers.

- Other items.

Additional information is disclosed in letters from the Central Bank. These letters contain various explanations and analysis of exceptional cases.

How to determine a beneficiary

Beneficiaries can be either one or several actual owners of the company. A distinctive feature of such owners is the possibility of varying degrees of influence on the company’s activities. Beneficiaries are usually difficult to identify. The fact is that information about such owners may not appear in the company’s documents at all. Also, information about the owners may be contained in official documents, but the degree of their participation may be underestimated. The lack of information about beneficiaries may be due to these reasons:

- Availability of offshore companies.

- Tax evasion.

- Legalization of money obtained from crime (laundering).

Various schemes are used to hide beneficiaries. To identify hidden owners, you need to know all these schemes. As a rule, to conceal information, a special method of registering property and title documents is used. For example, a person gains access to the company’s accounts by proxy. The power of attorney is provided by the “front” manager. As a result, the beneficiary is effectively given ownership of the bearer shares. Instead of a “dummy” director, nominee owners of securities may appear.

IMPORTANT! There is also the term "ultimate beneficiary". What does it mean? In the process of identifying the actual owners, a chain of beneficiaries is identified. This chain ends with the main recipient of the benefit - the final beneficiary. This is the person who receives income from the work of the company.

What is the difference between a beneficiary and a beneficiary?

In the legislation of other countries, beneficiary and beneficiary are identical concepts. However, the laws of the Russian Federation distinguish between these terms. Beneficial owner is a narrower concept. The beneficiary, unlike the beneficiary, owns more than 25% of the shares in the capital of the company. This person has control access. That is, the beneficial owner is a more significant participant. For this reason, it is the beneficiaries that official structures are trying to identify.

Who needs information about beneficial owners

Information is requested to combat the following offences:

- Legalization of money acquired illegally.

- Financing of terrorist structures and criminal groups.

- Illegal withdrawal of money to foreign accounts.

Information may also be requested by private legal entities. For example, these could be financial institutions that provide loans. To issue a loan, the institution requests information about the beneficiaries. This information allows you to assess the company’s reputation and also analyze lending risks. Financial companies, in turn, provide relevant information to Rosfinmonitoring. Financial companies mean the following entities:

- Representatives of the securities market.

- Insurance organizations.

- Pawnshops.

- Leasing companies.

- Credit institutions.

Information about beneficiaries should be transferred to the following structures:

- Authorized bodies.

- Tax structures.

- Federal divisions of the executive branch.

- Various state and municipal structures.

- Commercial firms associated with government agencies.

If firms refuse to provide the required information, they are subject to a fine. Beneficial owner information is requested when concluding contracts related to public procurement. In response to the request, the company must send a document that includes information about the owners, including individuals who are considered founders.

Beneficiary rights

The beneficial owner receives rights only if the relationship with them is formalized. Let's consider the rights of beneficiaries:

- Disposal of your share in the company. For example, a person can sell his share.

- Control over the performance of duties by the head of the company.

- Appointment and dismissal of the general director.

- Participation in various meetings: joint stock, constituent.

- Receiving profit from the company's work in the amount of dividends.

The exact list of rights depends on the specific area in which the beneficial owner operates.

Protection of beneficiary rights

The rights of the beneficial owner are often violated. Let's look at the most common offenses:

- Failure to comply with previously reached agreements.

- Reducing the possibility of control over the activities of the company.

- Restriction of access to information about the actual state of affairs.

- Limitation of the ability to earn income.

IMPORTANT! To prevent violation of rights, it is recommended to formalize agreements in writing. The contract must contain provisions establishing control over the organization. They can include clauses on the need for non-disclosure of information, compensation for damage from unlawful or unprofessional actions.

Can a company exist without beneficiaries?

Companies that do not include beneficial owners are generally non-profit entities. That is, the purpose of their activities is not to make a profit. If it is a commercial entity, there will always be individuals who are the ultimate beneficiaries of the income. However, it is often almost impossible to determine the ultimate beneficiary.

NOTE! Although government agencies attempt to identify the beneficial owner, it is rarely possible to obtain all the necessary information. This is due to the fact that there is an unlimited number of schemes that serve to hide the identity of the beneficiary.

In our market times, a lot of specific words have appeared that people did not know about before. Many of them are, as they say, “in the news,” for example, the beneficiary. What is it - in simple words we can say that this term is associated with monetary transactions, and this is generally true, but everywhere there are nuances.

Who is the beneficiary?

The interpretation of this term can be found in various economic, legal, financial dictionaries, and business directories:

- Translated from various European languages, it has the semantic meaning of profit, benefit, benefit, the owner of the letter of credit receiving money under it, etc.;

- Is a citizen receiving income from his property under trust management, as well as, for example, inheritance under a will;

- Can be a person in whose favor payments are made or who acquires profit as a result of renting out his property, hiring, when transferring the right to use it to third parties;

- Human, recipient of funds from an insurance policy, the credit card to which they were transferred to him for performing some work;

- A bank client who has assigned this credit institution managing your funds by contract or agreement;

In parallel to the specified term, the name “beneficiary” can be used.

History of the financial term

It has its origins in ancient times:

- During the heyday of Ancient Rome, this concept was widely used to refer to those people who were in military service and were exempt from hard work. Usually they served as guards for an official - a tribune. During the imperial era they could claim the title of centurion;

- During the Middle Ages beneficiary a certain land ownership was called, which, as a rule, was allocated on the terms of military service to those to whom it was given. However, there were options with administrative or court service;

- This word has been incorporated into modern language with meanings very different from its original ones. At the same time, the range of areas in which it is successfully and widely used has expanded significantly. This includes, in particular, the activities of financial, legal, and economic organizations. The term has become quite capacious and multifaceted.

Beneficiary and beneficiary: what is the difference?

Generally, these terms are synonymous, however, they have some differences in their practical application:

- The recipient of the benefit can be not only a citizen, but also an organization acting as a legal entity and acts mainly in the insurance business;

- He is mentioned separately in the text of the relevant contract concluded between the policyholder and the insurer, as a third party who, in a certain case, has the legal right to receive payment, either in kind (for example, in the form of a medical service) or in cash (in case receiving an inheritance). In the latter case, he is mentioned in the policy as a beneficiary, or in the will or disposition of the insured person;

- As a beneficiary, you can use not only a monetary, but also a commercial letter of credit in transactions between organizations and enterprises, companies;

- In a property trust management agreement, it can be either the founder of the management or a special person in whose interests this process is being carried out.

The above terminology also has the semantic concept of “recipient”.

Beneficial owner - who is it?

The wording was introduced in 2013 and edited in 2016 based on Russian legislation from 2001 regarding the fight against proceeds of crime (Law No. 115-FZ):

- The term means the presence of a specific a person who benefits from the activities of a company or having the ability to control it. Methods of influence can be direct or indirect, through ownership of a certain number of shares. If the client is a citizen, i.e. person is an individual, then he is considered the beneficial owner. In some cases, however, there are reasons to consider him a completely different person;

- The concept of a beneficiary is defined by law as the receipt of profit by an individual from a client as a result of an agreement concluded with him to perform a certain type of financial or commodity transaction;

- According to Article 6.1 of the above law, the company is obliged to have, update and provide information about its beneficial owners to government authorities. It also has the right to request information about these persons from its founders and shareholders.

The law of the Russian Federation provides the opportunity to disclose information about the true owners of a particular legal entity, which is reflected in the company’s reporting.

What types of agreements with the beneficiary are there?

There are different types of agreements for the purchase of profits:

- A bank guarantee that ensures the financial security of a transaction between the customer (beneficiary) and the contractor (principal). The essence is the mediation of a guarantor bank, which, for a certain amount of commission from the transaction, ensures that the customer fulfills the obligations of the contractor. If the latter fails to comply with the terms of the transaction, the bank pays the agreed amount and then seeks compensation from the principal;

- Agreements with trust organizations for the trust management of property, companies, money, securities, etc. on the terms agreed with the founder (beneficiary, owner), are concluded for a strictly defined period;

- Insurance policies of various subjects, where the role of the beneficiary can be either the policyholder or a specially designated person who, upon the occurrence of an appropriate event, will receive an indemnified amount, for example, under a will.

If you receive interest from a rich inheritance, congratulations, you are a beneficiary. What is this - in simple words it is defined as person receiving income, beneficiary, which you probably already understood from the text of the article. There are different forms of acquisition, but the essence is the same - profit.

Video: ordinary people answering complex questions

In this video, Yuri Antonov will survey people on the street about their knowledge of the financial term “beneficiary”:

The concept of “beneficiary” has several definitions. It is important to study them both for experienced businessmen and for those who are at the origins of foreign trade activities.

The beneficiary is the owner of documents that bring him material benefit. In this case, it is worth understanding the rights and responsibilities of this person, as well as the actions performed by him.

There are a large number of ways for a beneficiary to earn income and each of them has its own characteristics, disadvantages and, of course, advantages.

What is a beneficiary?

The term “beneficiary” has several explanations and comes from the French word benefice, which means profit, benefit.

The term “beneficiary” has several explanations and comes from the French word benefice, which means profit, benefit.

First of all, it is worth noting that a beneficiary is an individual or legal entity who, under an agreement or debt document, acquires benefits and income.

That is, when carrying out foreign trade activities, the beneficiary may be the company specified as the seller under the letter of credit.

The ultimate beneficiary is an individual who is considered the owner of the company and has all ownership rights. But, in this case, outsiders have the right of ownership.

The operation of hiding the final recipient of benefits is carried out in the process of opening offshore companies. To ensure confidentiality, a nominee service is created. Basically, the data of the real owner (the one who is the beneficiary) is indicated during the process of opening a bank account for the company. In addition, his name is known to an agent of the organization. In this case, the final beneficiary will be considered the owner of the bank account, which he has the right to dispose of.

“Ultimate beneficiary” is the most important concept.

Unlike nominee shareholders, a beneficial owner is the real owner of the organization or assets. From the legal side, the owners are other individuals who were mentioned earlier.

This also applies to cases where the beneficiary founder is the owner of shares. The beneficiary who owns the shares has the following opportunities and rights:

This also applies to cases where the beneficiary founder is the owner of shares. The beneficiary who owns the shares has the following opportunities and rights:

- Taking part in the process of forming the authorized capital;

- Transfer of shares to another beneficiary;

- Attendance at the shareholders meeting and voting rights;

- Taking part in the selection of nominal leaders of the organization;

- Participation in determining the profile of the organization's activities.

The beneficiary, in the case of using an insurance policy, is the recipient of the amount specified in the contract.

In the process of life insurance, you can specify any individual as the primary or conditional beneficiary if there is a clause about this in the document.

It is important to mention that the beneficiary is also the person who is the heir under the will or the recipient of the rent when the property is leased.

A representative of the trust is also considered a beneficiary if the management of the property is aimed at obtaining benefits for him.

Beneficiary rights

The beneficiary has certain rights, but they can be minimized in the process of receiving financial compensation under the bank guarantee. This threat is specified in detail in Article 174 of the Civil Code of the Russian Federation (384).

The beneficiary has certain rights, but they can be minimized in the process of receiving financial compensation under the bank guarantee. This threat is specified in detail in Article 174 of the Civil Code of the Russian Federation (384).

The interests of the beneficiary are considered violated if the relevant documents of the company provide for the restriction of powers to carry out transactions by the body of the legal entity representing the interests of the beneficiary, specified in the power of attorney, and the second party to the agreement, knowing about the existing restrictions, does not adhere to these rules in the process of completing this transaction. In this case, the situation will be considered by the court. The beneficiary in whose interests the legal entity acted may file a lawsuit. If during the trial it is proven that this legal entity was notified of the restrictions on the transaction or should have known about them, the transaction will be considered invalid.

The legislation also provides for the filing of a claim in court by a government agency, the founder of a company or a legal entity that controls the activities of the beneficiary of the company in case of violation of the terms of the contract. Article 173 of the Civil Code of the Russian Federation defines these violations as carrying out activities that contradict the goals of the company specified in the relevant constituent documents.

In addition, it is punishable to carry out certain actions for which the legal entity is not licensed. As in the previous case, the court recognizes the activity as illegal if there is evidence that the accused was notified of the conditions for its implementation and knowingly violated them.

In order for the transaction to be successful, it is necessary to study the legal capacity of the beneficiaries, including the final ones. Moreover, this problem has become less complex after the adoption of relevant laws.

A legal entity must competently check the guarantor’s documents in order to correctly resolve the issue of fulfillment of the main obligation. In this case, the documents must confirm the following conditions:

- Legality of the company's activities;

- The legality of the activities and execution of powers of bodies working on its behalf;

- Confirmation of appropriate legal capacity.

You can use the charter as a source for familiarizing yourself with the guarantor’s data. Moreover, the beneficiary must pay attention to whether he has been provided with the latest version of the document. In addition, he must familiarize himself with the documents of the legal entity indicating its state registration. Their authenticity is evidenced by special symbols that are located on the back of the document and reflect all changes made to it previously.

Bank guarantee: rights and obligations of the beneficiary and guarantor

Both parties to the agreement should become familiar with each other's basic rights:

Both parties to the agreement should become familiar with each other's basic rights:

- Beneficiary, according to the bank guarantee, has the right to collect claims against the guarantor. It is not allowed to be transferred to other persons unless this is previously indicated in the document.

- Purchaser of benefits must provide requests for payment of funds determined by the bank guarantee exclusively in writing.

In addition, the other party to the transaction must be provided with other important documentation as an appendix. It is in it that the owner indicates the essence of the violation when fulfilling the main obligation provided for by the bank guarantee.

Claims can be presented to the guarantor before the period specified in the agreement expires. - Beneficiary, in addition to the submitted documentation, must transfer copies of it to the other party and immediately notify the recipient about this.

- Guarantee is obliged to promptly consider the requirements presented by the recipient of the income and carefully study the documents. At the same time, he is engaged in determining the compliance of this operation with the terms of the guarantee.

- Guarantee has the right to refuse to satisfy the beneficiary's claim if the attached documentation was submitted after the end of a previously determined period or does not fully comply with the terms of the agreement. In this case, one party must notify the other of the decision as soon as possible.

In the event that the guarantor becomes aware of the fulfillment of the main obligations before a decision has been made in relation to the beneficiary's claim, he must inform the parties to the transaction about this. After re-submitting this request, the guarantor is obliged to satisfy it.

The list of rights and obligations of the guarantor and beneficiary is small, but when carrying out such activities it is worth considering on a larger scale and carefully checking all documentation.

A novice foreign trade participant needs to clearly understand various financial terms, for example. Read about this in our feature article.

If you have chosen the bill form of payment, then find out what allonge is. Here you will find information about the meaning and application of endorsement and its types.

Identification requirements

For confidentiality purposes, it is recommended that offshore companies be registered with a nominee shareholder, as mentioned earlier.

For confidentiality purposes, it is recommended that offshore companies be registered with a nominee shareholder, as mentioned earlier.

Information about the beneficiary will be indicated in the trust agreement, and in official documents and the public register of companies the owner of the company will be another person.

Bearer shares, as well as the presence of nominee managers, cannot guarantee absolute confidentiality to the beneficiary.

Disclosure of ultimate beneficiaries may take place in the trust declaration provided to the financial institution where the company account is opened if necessary.

The owner of offshore companies is the nominal shareholder.

In addition, by law, the identity of the recipient of services must be known to their representative. However, you should not use a front person as a beneficiary of a legal entity to ensure confidentiality. In this case, the real owner of the assets may lose the right to dispose of them in the event of any disagreements with the parties to the agreement.

It is also important to carefully select a bank and company, because a certificate of the beneficiary can be obtained by going through certain procedures provided by the institution.

Our specialist will advise you free of charge.