How to receive notification of starting a business activity. Fine for failure to notify Rospotrebnadzor of the start of activities. Standard options are

In September 2018, Rostechnadzor, by order dated September 20, 2018 No. 452 (registered by the Ministry of Justice on October 11, 2018), approved new Administrative Regulations for accepting notifications about starting a business activity. What has changed, who needs to submit these notifications, and how to do this, we will consider in our article.

Russian legislation defines 41 types of business activities, the implementation of which is under the special control of non-tax supervisory services (Rospotrebnadzor, Federal Service for Labor and Employment, Ministry of Emergency Situations, etc.). About the start of work on any of these types of activities, the business entity is obliged to notify the relevant state control body according to its territorial affiliation by sending a notice of the start of business activities in the territory subordinate to the body.

Notification of starting a business activity: regulatory rules of law

The obligation to notify state control bodies about the start of certain types of activities is enshrined at the legislative level in paragraph 1 of Art. 8 of Law No. 294-FZ of December 26, 2008 (as amended on August 3, 2018). However, the need to provide this information to state control authorities does not apply to all business entities. Clause 2 art. 8 of the same law, the legislator establishes types of activities for which notification of the start of business activity is a mandatory norm.

Another regulatory normative act is “List of works and services as part of types of business activities...”, approved by Decree of the Government of the Russian Federation No. 584 of July 16, 2009 (Appendix No. 1). Its provisions are more specific, indicating OKVED codes, and define the work and services that are included in the types of activities listed in paragraph 2 of Art. 8 of the above law, as well as to which authorized bodies the notification should be sent.

Notification form and filling details

At its core, a notification is an information document through which a business entity notifies control authorities about the start of work in a registered type of activity, and also clarifies, indicating the OKVED code, for which specific type of work or service the activity has begun.

The notification is submitted on a standardized form. The standard form of notification of the start of business activity was approved by Resolution No. 584 of July 16, 2009 (Appendix No. 2).

Completing the Notification has some features. For example: if, when registering an enterprise or individual entrepreneur, the future business entity indicated wholesale and retail trade codes, but in one of these areas of activity due to what - or reasons, there will be no economic activity for some time, then the Notification must indicate the OKVED code only for the type of activity for which the entity is actually ready to begin real work. For other types of work, the Notification is submitted additionally.

Failure to provide a Notice of Commencement of Operations, entering false data and errors in filling out the document are fraught with liability for a business entity within the limits of Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation, therefore state control authorities recommend using when filling out samples published on official websites, for example, ]]> Rospotrebnadzor ]]> or use the forms posted on the portal ]]> State Services ]]> .

Procedure for submitting a Notice of Commencement of Work

The procedure and procedure for submitting notifications about the start of business activities, as well as making additions or changes to the initially submitted notification, are determined by regional and territorial state control bodies, taking into account the provisions provided for in Russian legislation, including in Resolution No. 584. Rostechnadzor, by order of September 20, 2018 No. 452, approved a new Administrative Regulation, according to which notifications from individual entrepreneurs and legal entities about the start of activities are accepted by the territorial bodies of Rostechnadzor, and the document can be submitted on paper or electronically in any convenient way (including . through the MFC and the State Services portal).

The form for notification of the start of entrepreneurial activity is filled out personally by the business entity in 2 copies - one remains with the applicant, the other is sent to the appropriate authority.

A business entity can submit a notification in the most convenient way for it:

by personally visiting the regional office of the authorized body;

by sending a valuable letter by Russian Post (please note - you must attach an inventory of the attachment) with notification;

through the customer service of the territorial branch of the MFC;

in the form of an electronic document (using an electronic document management system; please note that this form of notification is available only to EDF subscribers who have a registered electronic signature certificate);

by filling out the electronic Notification form on the official website of the State Services.

When submitting the Notification personally by an entrepreneur or legal entity, the document is provided according to the regional location of the place of actual activity, i.e. to the regional branch of the authorized government agency (or MFC) of the administrative entity where the business entity actually performs work or provides services.

After registration, the notification submitted by the business entity is registered and entered into the national Register of Notifications of the Start of Business Activities, and within 10 days the information is posted on the official website of the authorized government agency.

Many areas of activity in which small businesses are engaged are under additional control of government agencies. This refers to non-tax supervisory services, such as Rospotrebnadzor, Roszdravnadzor, Ministry of Emergency Situations, Rostransnadzor and others...

If you are planning to register an individual entrepreneur or have just done so, then you may need to submit a notice of commencement of activity. We'll tell you how to do this and what areas of business fall under such control.

Who must give notice

Notification of the start of business activities should be submitted only by those individual entrepreneurs who have started a real business using OKVED codes from the List approved by Decree of the Government of the Russian Federation dated July 16, 2009 No. 584.

The list of business areas in respect of which a notice of commencement of business activity must be submitted includes:

At first glance, it seems that you need to submit a notification for almost any area of business, but this is not so. The list indicates specific OKVED codes, the beginning of which must be implemented by submitting an application to the supervisory authority.

If you simply indicated these OKVED codes when registering an individual entrepreneur, but are not actually involved in them, then you do not need to submit a notification about the start of activities.

For example, in the application on form P21001 code 47.21 was indicated (Retail sale of fruits and vegetables in specialized stores), but you never opened a vegetable store. This means that you do not have the obligation to notify Rospotrebnadzor about the start of retail trade, because The retail outlet will not be open in the near future. And if it doesn’t, then there’s no one to control.

Thus, the obligation to submit a notification about the start of business activity (Rospotrebnadzor and other supervisory authorities) occurs only if several conditions are simultaneously met.

Under what conditions is a notice of commencement of activity given?

- Availability of a specific OKVED code under which you are starting an activity in the List approved by the Government.

- Readiness to begin real actions (providing services, organizing trade or production).

The Rospotrebnadzor notification of the start of activity must be submitted before you open a store or begin to provide services, and not in the first days of real work. The same applies to other areas - you need to report before you start producing something or serving clients.

There is judicial practice when entrepreneurs were fined just for advertising a new store before it opened, so don’t take risks - if you know for sure that you will start this activity, submit a notice.

Where to submit notification

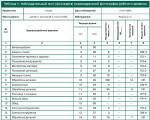

The areas of activity of small businesses are diverse and control over them is carried out by various supervisory authorities authorized to do so by regulatory legal acts. Government Decree No. 584 does not indicate where exactly to submit a notification in different situations, so we advise you to rely on our table.

Hotel, household, catering services, travel agencies

Retail and wholesale trade

passengers, luggage, cargo by all types of transport

Production of fire-technical products

units of quantities, standard samples and measuring instruments

Production of ready-made animal feed

From this table the relationship between the business area and the body supervising it is clearly understood. For example, is it necessary to notify Rospotrebnadzor about the start of activities when starting cargo transportation? No, it is not necessary, because the supervisory authority in this area is Rostransnadzor.

Unfortunately, it is not possible to provide a database of contact information for the territorial divisions of all supervisory authorities within the framework of our article, so look for these addresses on the official websites of the relevant federal departments.

Form of notification to Rospotrebnadzor about the start of activities approved by Government Decree No. 584 of July 16, 2009. The same form is used to inform other authorities about the start of a business. You can submit the document in person, by mail or through the government services portal.

An example of a completed notification of the start of activities in Rospotrebnadzor. Place a stamp (if any) and signature.

Responsibility for failure to notify

What happens if the notification to Rospotrebnadzor about the start of the individual entrepreneur’s activities is not submitted on time or not submitted at all?

For entrepreneurs who are equated to officials in relation to administrative sanctions, liability is established under Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation:

- For failure to submit - a fine of 3 to 5 thousand rubles;

- For submitting a notice with false information – from 5 to 10 thousand rubles.

However, this type of offense falls under Article 4.5 of the Code of Administrative Offenses of the Russian Federation, according to which the period for bringing to justice cannot exceed two months (and if the case is being considered by a court, then three months) from the date of commission. That is, if the store began to operate without filing a notice, and Rospotrebnador discovered this fact later than two months later, then it is no longer possible to prosecute under Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation.

A similar case was considered by the Supreme Court of the Russian Federation (Resolution of the Supreme Court of the Russian Federation of April 24, 2013 N 56-AD13-4 is freely available). The higher court overturned the court decisions that had already been made precisely because the deadline for holding the store accountable had expired.

The question arises: is it necessary to notify Rospotrebnadzor about the start of activities (the same applies to other inspectors), if the period for bringing to justice for this violation is so short, and few people face a fine? Yes, it is necessary, and regulatory authorities are also seeking to fulfill this obligation from businessmen through the courts.

In addition, in the case considered by the Supreme Court, the store was nevertheless issued court decisions obliging it to pay a fine. If you do not want to get involved in lengthy legal proceedings, it is easier to simply file the notice on time.

Now you know everything you need about the Notice of Commencement of Business Activities.

On liability for failure to provide notice of the start of business activities

In accordance with Article 8 of Federal Law No. 294-FKh “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control,” legal entities and individual entrepreneurs are required to notify the federal executive body of the start of certain types of business activities , authorized by the Government of the Russian Federation in the relevant field.

Legal entities and individual entrepreneurs who carry out these types of activities, in case of failure to provide notifications about the commencement of certain types of business activities or submission of such notifications containing false information, are liable in accordance with the legislation of the Russian Federation.

At the same time, the Code of Administrative Offenses provides for liability for this violation:

Article 19.7.5-1. Violation by a legal entity or individual entrepreneur of the established procedure for submitting notifications about the start of business activities (introduced by Federal Law No. 239-FZ of July 27, 2010)

1. Failure by a legal entity or individual entrepreneur to submit a notification about the start of business activities if the provision of such notification is mandatory, -

shall entail the imposition of an administrative fine on officials in the amount of three thousand to five thousand rubles; for legal entities - from ten thousand to twenty thousand rubles.

2. Submission by a legal entity or individual entrepreneur of a notice of the commencement of business activity containing false information, if the submission of such a notice is mandatory, shall entail the imposition of an administrative fine on officials in the amount of five thousand to ten thousand rubles; for legal entities - from twenty thousand to thirty thousand rubles.

65.rospotrebnadzor.ru

Department of Rospotrebnadzor for Res.

Based on a consumer request, an unscheduled inspection of the Belyashnaya kiosk, located in Gorno-Altaisk, Sadovy Boulevard, was carried out.

During the inspection, it was established: Individual entrepreneur Sarycheva L.A. did not provide the Office of Rospotrebnadzor for the Altai Republic with a notice of the start of business activities (the provision of public catering services is included in the list of works and services as part of certain types of business activities, the beginning of which by a legal entity or an individual entrepreneur provides a notification to clause 11 of Appendix 1 to Decree of the Government of the Russian Federation No. 584 of July 16, 2009). Thus, the Individual Entrepreneur committed an administrative offense under Art. 19.7. Code of Administrative Offenses of the Russian Federation.

In the absence of hot and cold water at the time of the inspection, the organization did not suspend its work. At the time of the inspection, there were no conditions for staff to wash their hands, and there was no water in the sink. Homemade products are used to make pies: sauerkraut, potatoes. Onions and fresh cabbage do not have documents confirming their origin, quality and safety. To prepare whites and chebureks, minced meat produced by Kompanion Plus LLC is used, the label of which does not have a production date, which does not meet the requirements of GOST. Fillings for pies are stored in the refrigerator - mashed potatoes, minced meat with onions, fried cabbage of unknown date of manufacture; the quality of semi-finished products and culinary products is not assessed. There is no production control of the quality of deep-frying fats, and the quality of deep-frying is not checked according to organoleptic indicators.

Wet cleaning is not carried out regularly, and there are no detergents approved for use in public catering establishments. In Belyashnaya, disinfection and deratization work has not been organized.

All identified violations can cause widespread infectious diseases. For identified violations, a fine of 2,000 rubles was imposed on the individual entrepreneur. The protocol drawn up under Art. 19.7 Part 5 was transferred for consideration to the court.

Dear consumers! Be careful when purchasing food. If possible, avoid buying food from places that make you suspicious. Report any facts of violation of your rights as consumers to the Office of Rospotrebnadzor in the Altai Republic. The public reception of the Department is open daily from 9-00 to 13-00 at the address: Kommunistichesky Ave., 173.

© 2018 Office of Rospotrebnadzor for the Altai Republic

Joomla! is Free Software released under the GNU General Public License.

Mobile version by Mobile Joomla!

pda.04.rospotrebnadzor.ru

Will there be a fine for late submission of an application to Rospotrebnadzor?

Good afternoon. I didn’t know that I needed to submit a notification to Rospotrebnadzor. Since the end of May 2017 I have been working in a hairdressing salon registered as my own. What should I do? And will there be a fine for not notifying?

Lawyers' answers (1)

In accordance with Art. 8 of the Federal Law of December 26, 2008 No. 294-FZ “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” (hereinafter referred to as the Law), legal entities and individual entrepreneurs are required to notify the start of certain types of business activity authorized or authorized in the relevant field of activity state control (supervision) body (bodies).

In accordance with the Rules for the submission of notifications on the commencement of certain types of business activities and the accounting of these notifications (approved by Decree of the Government of the Russian Federation of July 16, 2009 No. 584), a notification is submitted on the commencement of certain types of business activities, including:

Hairdressing services (OKUN 019300);

For submitting a notice of the start of a business activity containing false information (if filing a notice is mandatory), Part 2 of Art. 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation establishes administrative liability in the form of a fine in the amount of:

For officials (including individual entrepreneurs - from 5,000 to 10,000 rubles;

For legal entities - from 20,000 to 30,000 rubles.

At the same time, organizations and individual entrepreneurs must submit a notification after their state registration and registration with the tax authority, But before the actual performance of work or provision of services begins(Part 5 of Article 8 of the Law).

If you prove that you actually started carrying out the activity before notification, then a fine can be avoided. If a fine is imposed on you, you can ask for the application of Article 2.9 of the Code of Administrative Offenses of the Russian Federation on the insignificance of an administrative offense in which the fine is replaced by an oral warning.

Still, it is necessary to notify Rospotrebnadzor.

Moreover, in case

Changes in the location of a legal entity or place of actual activity;

- changes in the place of residence of an individual entrepreneur or the place of actual activity;

- reorganization of a legal entity.

Rospotrebnadzor is also notified within 10 working days.

Looking for an answer?

It's easier to ask a lawyer!

Ask our lawyers a question - it’s much faster than looking for a solution.

Case No. not determined

The magistrate of the judicial district of the district, having examined the administrative material on bringing to administrative liability under Part 1 of Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation an individual entrepreneur born, born, citizen of the Russian Federation, registered at the address:

Being an individual entrepreneur, he did not submit a notice of the start of business activity to the Rospotrebnadzor Office, if the submission of such a notice is mandatory, under the following circumstances.

at 15:00, during a scheduled inspection of an individual entrepreneur at address B, it was established that at the above address, activities were being carried out to provide hairdressing services by an individual entrepreneur in accordance with a lease agreement from an individual entrepreneur. Notification of the start of business activities to provide hairdressing services to not submitted to the Rosprotrebnadzor Office.

He did not appear at the court hearing and was notified in accordance with the procedure established by law.

The representative by proxy explained that they do not agree with the case of administrative offense brought against him and the protocol dated 2 and believe that the actions do not contain the event and elements of an administrative offense, and the protocol drawn up in relation is unacceptable evidence. 0 The individual entrepreneur entered into a lease agreement with the individual entrepreneur for non-residential premises located at the address for the location of a hairdressing salon and the provision of hairdressing services to the population. However, up until the time of the individual entrepreneur, he did not provide hairdressing services, but prepared the non-residential premises accepted under the lease agreement for the provision of services (cleaning, arranging furniture, arranging accessories, etc.). The individual entrepreneur sent to the Rospotrebnadzor body a Notification of the start of his business activities in the provision of hairdressing services, from which it follows that he will begin to carry out activities in the provision of hairdressing services to the population from, and therefore his actions do not contain the event of an administrative offense provided for in Article 19.7 .5-1 Code of Administrative Offenses of the Russian Federation and the case is subject to termination. The protocol on an administrative offense against an individual entrepreneur was drawn up in accordance with Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation, however, this article contains two parts and it is not clear what kind of offense the individual entrepreneur is charged with. In violation of the requirements of Part 2 of Article 28.2 of the Code of Administrative Offenses of the Russian Federation, the protocol on the administrative protocol does not Part of Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation is indicated.

The actions of the Rospotrebnadzor body, which resulted in the drawing up of a protocol for the inspection of premises from, as well as a protocol on an administrative offense, fall under the concept of an on-site unscheduled inspection, in which the subject of the inspection is to assess the compliance of the actions carried out by the individual entrepreneur with mandatory requirements. The individual entrepreneur was not familiarized with the order appointing an unscheduled inspection, the powers of the persons conducting the on-site inspection, the goals, objectives, grounds for conducting the on-site inspection, the types and scope of control measures, the composition of experts, and the terms and conditions of its implementation. These actions were not carried out, which violates the rights of individual entrepreneurs granted by Article 21 of the Law. The individual entrepreneur was not notified of the inspection activities being carried out on his premises; the protocol for the inspection of premises, belongings and documents belonging to the individual entrepreneur was drawn up without the participation of the legal representative of the individual entrepreneur, since the person who signed the protocol is not the legal representative of the individual entrepreneur, but is an administrator. The inspection report was drawn up in violation of the requirements of the law and cannot be admissible evidence. The provision of hairdressing services in accordance with civil law can be evidenced by the conclusion of an agreement on the provision of these services with the consumer; the individual entrepreneur did not provide any services until April 23. For these reasons, I asked that the proceedings in the case of an administrative offense provided for in Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation in relation to individual entrepreneurs be terminated.

The person questioned at the court hearing testified that a scheduled inspection was carried out at the address on Pervomaiskaya in agreement with the prosecutor's office of the individual entrepreneur, who was notified in advance of the upcoming inspection. The IP told them by phone the day before that he would not be there during the inspection, but a representative would be there. At the time of the inspection, a man was present in the premises of the Ideal hairdressing salon, located at 14, who introduced himself as a representative, but he did not have documents confirming his authority. The inspection protocol was drawn up in the presence of the administrator of the hairdressing salon. At the entrance to the hairdressing salon there was a sign “Hairdressing salon “Ideal” IP. At the entrance to the hairdressing salon there was a typical consumer corner, where there was all the necessary information for the consumer, including contact information, price list. That is, during a scheduled inspection of the individual entrepreneur, the fact was revealed that, in fact, hairdressing services from the address: were carried out by the individual entrepreneur, who did not notify the Rospotrebnadzor authority about the start of the specified activity. After establishing this fact, they left a summons addressed to the individual entrepreneur. After discovering this fact, the individual entrepreneur sent a notice to them about the start of business activities. They were not allowed into the hall.

The person questioned at the court hearing as a witness said that she applied for employment and was offered to come prepare the premises for work. She signed the protocol as a witness; she didn’t want to do it, but they asked her to do it. I didn’t read the protocol, because... she was not allowed to read it. Her residence address is indicated from her words. She works with her. She signed the inspection report after it was read by a lawyer. They did not provide any hairdressing services.

According to Part 1 of Article 8 of the Federal Law “On the Protection of the Rights of Legal Entities and Individual Entrepreneurs in the Exercise of State Control (Supervision) and Municipal Control”, legal entities and individual entrepreneurs are required to notify the authorized representative of the Government of the Russian Federation of the start of certain types of business activities. the relevant area of the federal executive body.

In accordance with paragraph 1 of the Regulations on the Federal Service for Surveillance in the Sphere of Consumer Rights Protection and Human Welfare, approved by Decree of the Government of the Russian Federation No. 322 (as amended, the Federal Service for Supervision in the Sphere of Consumer Rights Protection and Human Welfare (Rospotrebnadzor) is an authorized federal an executive body exercising control and supervision functions in the field of ensuring the sanitary and epidemiological well-being of the population, protecting consumer rights and the consumer market.

According to clause 5.2.3 of the Regulations on the Federal Service for Supervision of Consumer Rights Protection and Human Welfare, approved by Decree of the Government of the Russian Federation No. 322 (as amended by Decree of the Government of the Russian Federation No. 584 “On the notification procedure for the start of certain types of business activities” ), the Federal Service for Supervision of Consumer Rights Protection and Human Welfare receives and records notifications about the commencement of certain types of work and services by legal entities and individual entrepreneurs according to the list approved by the Government of the Russian Federation, with the exception of notifications submitted by legal entities and individual entrepreneurs operating in the territories subject to service by the Federal Medical and Biological Agency.

In accordance with clause 4 of the Regulations on the Federal Service for Surveillance in the Sphere of Consumer Rights Protection and Human Welfare, approved by Decree of the Government of the Russian Federation No. 322, the Federal Service for Surveillance in the Sphere of Consumer Rights Protection and Human Welfare carries out its activities directly and through its territorial organs.

Thus, officials of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare and its territorial bodies are authorized to draw up protocols on administrative offenses provided for in Article 19.7.5-1 of the Administrative Code.

Consequently, the protocol on an administrative offense against an individual entrepreneur was drawn up by an authorized official.

According to Part 2 of Article 8 of the Federal Law, the activity of providing hairdressing services refers to the types of activities, the beginning of which an individual entrepreneur is obliged to notify the authorized federal executive body in the manner established by the Decree of the Government of the Russian Federation dated “On the notification procedure for the beginning of certain types of entrepreneurial activity" and the rules for submitting notifications about the commencement of certain types of entrepreneurial activities and recording notifications.

From the protocol of inspection of premises, territories and things and documents located there belonging to a legal entity, individual entrepreneur, it is clear that - the leading specialist, and - the chief specialist of the department for supervision of working conditions and living environment of the Rospotrebnadzor Office in the region with the participation of the administrator of the hairdressing salon of the individual entrepreneur and in the presence witnesses and inspected the “Ideal” hairdressing salon, located at the address: .. The inspection established that at the specified address the individual entrepreneur had been providing hairdressing services until. At the time of the inspection, non-residential premises with a total area of 29.2 sq.m., located on the 1st floor of a residential building, were leased to an individual entrepreneur to provide hairdressing services to the population. At the entrance there is a sign with information about the individual entrepreneur providing these services (IP). On the consumer's corner there is contact information about the individual entrepreneur - certificate, TIN, OGRN.

According to Part 5 of Article 8 of the Federal Law dated, a notification of the start of certain types of business activities is submitted by a legal entity or an individual entrepreneur to the authorized federal executive body after state registration and registration with the tax authority before the actual performance of work or provision of services.

The rules for submitting notifications about the commencement of certain types of business activities and accounting for these notifications" establish the procedure for the submission by legal entities and individual entrepreneurs carrying out certain types of business activities to the authorized federal executive bodies (their territorial bodies) of notifications about the commencement of their activities (hereinafter referred to as the notification ), as well as the procedure for taking into account received notifications by these authorities.

Argument of the representative by proxy that the individual entrepreneur sent a notification to the Rospotrebnadzor Office in the region about the start of his activities in providing hairdressing services at the address from before the start of the actual performance of work or provision of services, i.e. the elements of an administrative offense in the actions of the individual entrepreneur are absent and cannot be accepted by the court as a basis for releasing the individual entrepreneur from administrative liability for the following reasons.

As can be seen from the inspection protocol from and established at the court hearing, during a scheduled inspection of the individual entrepreneur at the address: “Hairdressing salon “Ideal” it was discovered that the specified non-residential premises were leased for the provision of hairdressing services by the individual entrepreneur -IP Above the entrance to the specified premises there is a sign “Hairdressing salon” "Ideal". At the entrance there is a sign with information about the individual entrepreneur providing these services (IP). The front door is open to visitors. A typical consumer corner has all the necessary information, including a price list.

In accordance with paragraph 2 of Article 437 of the Civil Code of the Russian Federation, a proposal containing all the essential terms of the contract, from which the will of the person making the proposal is discerned, to conclude a contract on the terms specified in the proposal with anyone who responds, is recognized as an offer (public offer).

An analysis of the inspection protocol available in the case materials, indicating the presence of a sign above the entrance of the “Hairdressing Salon “Ideal”, indicating the person providing hairdressing services, a decorated consumer corner with a price list and other necessary information, free access to the premises of the hairdressing salon, testimony of a witness, testifies , that the individual entrepreneur has actually started performing work to provide hairdressing services.

The proxy representative’s argument that the start of actual work is evidenced by the existence of a concluded contract for the provision of hairdressing services, but there were no visitors at the hairdressing salon at the time of the inspection, is based on an incorrect interpretation of the law.

The argument of the representative by proxy that an unscheduled inspection was carried out cannot be accepted by the court as a basis for releasing the individual entrepreneur from administrative liability for the offense committed on the following grounds.

From the order of the state control (supervision) body, municipal control body on conducting a scheduled on-site inspection of a legal entity, individual entrepreneur, it follows that a decision was made to conduct an inspection in relation to an individual entrepreneur at the place of actual activity at the address, in order to implement the approved plan for conducting scheduled inspections for 2012, posted on the Internet on the official website of the Rospotrebnadzor Office for the region. Start the inspection and complete the inspection no later than the specified order was given to hairdresser Lopukhova.

A copy of the order was sent by mail to the individual entrepreneur at his home address: .

From the lease agreement dated 0 it is clear that this agreement was concluded between the individual entrepreneur (Lessor) and the individual entrepreneur (Tenant) that the Lessor undertakes to transfer to the Tenant for a fee for temporary possession and use non-residential premises at the address, Sovetsky district, Pervomaiskaya, for placement there hairdressing salon and provision of hairdressing and other related services to the population.

At the court hearing, the representative by proxy K.A presented an additional agreement to the lease agreement dated 0, clause 1 of which states that the rent for the premises is 35,000 rubles per month. In connection with the tenant's preparation for the start of the provision of hairdressing services in the period from to until, the rent for the first month is set at 10,000 rubles.

with a statement from notifies the Rospotrebnadzor Office that at the address indicated in the order it does not conduct any activities related to the provision of services to the population. The non-residential premises owned by him were transferred under a lease agreement from an individual entrepreneur. The specified application was sent to the Rospotrebnadzor Office by a valuable letter and received by them

Notification of the start of business activities from 0 by an individual entrepreneur at the address: c was sent to the Rospotrebnadzor Office by a valuable letter and received by them

Consequently, at the time of the scheduled inspection, the Office of Rospotrebnadzor for the region of the individual entrepreneur “Hairdressing salon “Ideal” was not aware of the existence of an IP lease agreement with the individual entrepreneur and a scheduled inspection was carried out at the address: “Hairdressing salon “Ideal””.

Clause 67 of the Administrative Regulations for the execution by the Federal Service for Supervision of Consumer Rights Protection and Human Welfare of the state function of conducting inspections of the activities of legal entities, individual entrepreneurs and citizens to comply with the requirements of sanitary legislation, legislation of the Russian Federation in the field of consumer protection, rules for the sale of certain types of goods ", approved by Order of the Ministry of Health and Social Development of the Russian Federation No. 1372n, provides that in cases where violations of mandatory requirements are detected during an inspection, the Rospotrebnadzor official authorized to conduct the inspection takes measures provided for by the legislation of the Russian Federation, within the limits of his competence.

Clause 68 of the Administrative Regulations stipulates that the administrative procedure “Taking measures based on the results of an inspection of the activities of legal entities, individual entrepreneurs and citizens to comply with the requirements of sanitary legislation, legislation of the Russian Federation in the field of consumer protection, rules for the sale of certain types of goods” includes certain actions, including including taking measures to bring those who committed the identified violations to justice.

At the court hearing, it was established that during a scheduled inspection, authorized employees of the Rospotrebnadzor Office in the region discovered a violation on the part of the individual entrepreneur, expressed in failure to notify the Rospotrebnadzor Office about the start of actual execution.

According to Part 9 of Article 8 of the Federal Law No., legal entities and individual entrepreneurs, in case of failure to provide notifications about the commencement of certain types of business activities, bear responsibility in accordance with the legislation of the Russian Federation.

The absence in the protocol of an administrative offense of an indication of the part of Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation under which an individual entrepreneur is held administratively liable does not mean that his actions do not constitute an administrative offense and can be eliminated during the consideration of the case.

The Supreme Court of the Russian Federation in paragraph 20 of the Plenum Resolution No. 5 “On some issues that arise for courts when applying the Code of the Russian Federation on Administrative Offenses and in the Review of Legislation and Judicial Practice for the first quarter of 2007 stated that despite the mandatory indication in the protocol on administrative offense, along with other information listed in Part 2 of Article 28.2 of the Code of Administrative Offenses of the Russian Federation, a specific article of the Code of Administrative Offenses of the Russian Federation or the law of a constituent entity of the Russian Federation, providing for administrative liability for an offense committed by a person, the right of final legal qualification of the actions (inactions) of a person of the Code of Administrative Offenses of the Russian Federation belongs to the powers of the judge.

Having examined the written materials of the case: protocol on an administrative offense dated 2, order to conduct a scheduled inspection dated, letter No. 3130 dated March 29, 2012, postal register, protocol of inspection of premises, territories and things and documents located there belonging to a legal entity, individual entrepreneur, letter of call No. 3891 from, lease agreement from 0, certificate of state registration of an individual as an individual entrepreneur, notification of registration of an individual entrepreneur, telegrams and telegraphic notifications, individual entrepreneur statements dated 04/11/20121, postal envelope, notification of the start of implementation entrepreneurial activity from 0, a copy of the envelope, an additional agreement from the lease agreement for non-residential premises from 0, an employment contract from, having heard the representative of the Rospotrebnadzor Office by power of attorney Mosina A.M., specialist G.N., the representative of the individual entrepreneur by power of attorney, witness Zudina N. V., magistrate comes to the conclusion that the individual entrepreneur’s guilt has been fully proven and his actions are qualified under Part 1 of Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation as failure by a legal entity or individual entrepreneur to submit a notification about the start of business activities in the event that the provision of such a notification is mandatory.

In accordance with Part 1 of Art. 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation, failure by a legal entity or individual entrepreneur to submit a notice of the commencement of business activities, if the submission of such a notice is mandatory, shall entail the imposition of an administrative fine on officials in the amount of three thousand to five thousand rubles; for legal entities - from ten thousand to twenty thousand rubles.

The court did not establish any circumstances mitigating the administrative liability of the individual entrepreneur.

The court did not establish any circumstances aggravating the administrative liability of the individual entrepreneur.

Grounds for applying the norm of Art. 2.9 of the Code of Administrative Offenses of the Russian Federation and there is no exemption of a person from administrative liability, because he committed an administrative offense against the management order.

In accordance with the note to Art. 2.4. of the Code of Administrative Offenses of the Russian Federation, persons carrying out entrepreneurial activities without forming a legal entity, who have committed administrative offenses, bear administrative responsibility as officials, unless otherwise established by this Code.

When assigning a punishment, the court takes into account the identity of the perpetrator, who has not previously been brought to administrative responsibility, the nature of the administrative offense committed by the individual entrepreneur, the absence of circumstances mitigating or aggravating the administrative responsibility of the individual entrepreneur

Based on the above, guided by Part 3 of Article 4.1, Article 19.7, 29.10, 29.11 of the Code of Administrative Offenses of the Russian Federation, judge

p o st a n o v i l:

find an individual entrepreneur guilty of committing an administrative offense under Part 1 of Article 19.7.5-1 of the Code of Administrative Offenses of the Russian Federation and subject to an administrative fine in the amount of 3,000 (three thousand) rubles.

Details for paying the fine:

Recipient of the Federal Penitentiary Committee for the region (Office of Rospotrebnadzor for the region

INN 7107087889 KPP 710701001 OKATO 70401000000

Payee account number 40101810700000010107 in GRKTs GU Bank of Russia for TO BIC 047003001

Explain to the individual entrepreneur that in accordance with Article 32.2 of the Code of Administrative Offenses of the Russian Federation: “1. An administrative fine must be paid by a person held administratively liable no later than 30 days from the date the decision to impose an administrative fine comes into force or from the date of expiration of the deferment period or installment plan period provided for in Article 31.5 of this Code. 3. The amount of an administrative fine is paid or transferred by the person held administratively liable to a bank or other credit organization. 5. In the absence of a document evidencing payment of an administrative fine, after 30 days from the period specified in part 1 of this article, the judge, body, official who made the decision, send the relevant materials to the bailiff to collect the amount of the administrative fine in the manner provided for by federal legislation. In addition, an official of the federal executive body, a structural unit or territorial body, as well as another government body authorized to carry out proceedings in cases of administrative offenses (with the exception of a bailiff), draws up a protocol on the administrative offense provided for in Part 1 of Article 20.25 of this Code, in relation to a person who has not paid an administrative fine.”

The decision can be appealed within 10 days from the date of delivery or receipt of a copy of the decision to the district court through the magistrate judge of the district judicial district.

The legislation stipulates the obligation of each entrepreneur, within a certain time frame and in accordance with the established procedure, to inform the authorized regulatory authorities about the start of his business activity. State structures carrying out supervisory actions strictly monitor the implementation of Law 294-FZ of December 26, 2008. carried out on the basis of this law if the scope of activity of the individual entrepreneur falls under its jurisdiction. Also, the entrepreneur himself must receive registration notifications from the Pension Fund (PFR) and Rosstat, in a situation where the tax office has not notified them of the need to register you.

In case of failure to comply with the deadlines set by law for notifying government agencies, an entrepreneur can begin his activities with a penalty in the form of a fine. Therefore, it is necessary to collect information in advance about what documents need to be submitted.

Let's consider the main list of government agencies where you need to register after registering as an entrepreneur or when starting work in certain types of activities.

Submitting a notification to Rospotrebnadzor

After registering with the tax office as an entrepreneur, you need to decide on the type of activity that will generate income. This must be done because a notification to Rospotrebnadzor must be submitted before you begin to make a profit. Therefore, it does not matter how many OKVED codes you indicated when opening an individual entrepreneur, you need to know in what area the financial income will be and register with Rospotrebnadzor in advance, in accordance with it. A detailed list of codes is listed in government decree 585 of July 16, 2009. The notification procedure can be carried out through the State Services website or in person.

After registering with Rospotrebnadzor, the entrepreneur is obliged to notify within ten days of making various changes:

- registration;

- location of the business.

If entrepreneurs violate the deadlines for submitting an application, government bodies authorized to monitor the activities of individual entrepreneurs and legal entities may open a case of an administrative offense against them and impose a penalty in the form of a fine. The amount of the penalty in accordance with Article 19.7 of the Administrative Code may be:

- from one hundred to three hundred rubles - citizens;

- from three hundred to five hundred rubles - officials;

- from three to five thousand rubles - legal entity.

Submitting an application to the tax office for registration as a UTII payer

Notification of the start of entrepreneurial activity as an individual entrepreneur as a UTII taxpayer is carried out on the basis of Article 346.28. Tax Code of the Russian Federation. This article also indicates the deadline within which it is necessary to submit an application that an entrepreneur has expressed a desire to switch to taxation in the form of a single tax. The corresponding notification must be issued within five days after the start of application of this form of tax payment. After five days, the tax office is obliged to issue a notice to the entrepreneur, which will indicate that he has become a UTII taxpayer. The date of commencement of application of this taxation system will be considered the date indicated in the application indicating the beginning of the application of UTII in the work of the entrepreneur.

For violation of the deadlines for filing an application, they may be held accountable in accordance with Article 116 of the Tax Code, which states:

- Violation of the deadline for filing an application will result in a fine of ten thousand rubles;

- in the case of conducting commercial activities by a legal entity or individual entrepreneur without registering with the tax authority, the code provides for a fine of ten percent of the income received while conducting unregistered activities, but cannot be less than forty thousand rubles.

Every entrepreneur who has decided to switch to paying taxes under the UTII system can submit an application at any time. The law does not provide any restrictions on the exercise of this right. Therefore, the tax authority does not have the authority to refuse registration.

Registration of individual entrepreneurs in the Pension Fund

After registering with the tax office as an individual entrepreneur, you must notify the regional representative office of the Pension Fund. To do this, the individual entrepreneur must submit the following documents:

- civil passport with registration stamp (copy);

- TIN certificate (copy);

- OGRN certificate (copy);

- USRIP certificate (copy);

- insurance certificate of compulsory pension insurance.

Each individual entrepreneur is required to make a fixed payment established by the pension fund, regardless of whether business activity is carried out or not after opening. Details of where to pay contributions will be indicated in the notification issued after entry into the register.

If an individual entrepreneur carries out his activities with the involvement of employees registered under an employment contract, he is obliged to register with the Pension Fund of Russia as an employer. The documents for submitting the application are the same as for the application, with the exception of the first employment contract, which is attached to the remaining documents. Registration deadlines must be met. The law gives thirty days from the date of conclusion of the first employment contract.

Registration with the social insurance fund

Individual entrepreneurs are required to register only if they hire employees under an employment contract. And also on a voluntary basis to receive benefits in case of temporary disability. In both cases, you must write an application in the form, samples of which are issued at the regional offices of the Social Insurance Fund.

The deadline for submitting an application for mandatory registration as an employer is ten working days. If they are violated, Article 19.7 of the Administrative Code of Russia, which establishes penalties for failure to comply with deadlines for submitting information to regulatory authorities, may be applied.

Registration with the Federal State Statistics Service

The law does not establish mandatory registration, but notification of registration with Rosstat may be required to open a current account.

Knowing the procedure for registering with government agencies that control the activities of entrepreneurs will ensure smooth work, prevent unwanted costs of fines and save time in the event of litigation. A notification to Rospotrebnadzor about the start of an individual entrepreneur’s activities is submitted in accordance with the type of activity that the entrepreneur carries out. Therefore, at the early stages of planning your work, it is necessary to find out whether OKVED codes are included in the list of mandatory control by Rospotrebnadzor. Entrepreneurship is a complex type of activity; it is necessary to think through every step in order to reduce the likelihood of risks not only in business, but also when interacting with regulatory government agencies.

Certain types of business activities require notification to the appropriate government authorities.

You need to know in what cases this is done and how the procedure is carried out. This will help you perform all actions in accordance with the law, avoiding violations.

What kind of document is this?

Previously, some types of businesses could not be opened until permission was obtained from certain authorities. In 2008, Law No. 294-FZ was adopted, which is aimed at protecting individual entrepreneurs and legal entities. It implies the abolition of obtaining permits, but obliges some businessmen to present a notice that confirms the start of activity.

Previously, some types of businesses could not be opened until permission was obtained from certain authorities. In 2008, Law No. 294-FZ was adopted, which is aimed at protecting individual entrepreneurs and legal entities. It implies the abolition of obtaining permits, but obliges some businessmen to present a notice that confirms the start of activity.

The document in question contains information about the individual entrepreneur or organization, and also confirms that the individual or legal entity is familiar with the requirements and norms of the law and undertakes to comply with them fully.

About when to notify the state. authorities about starting a business, you can watch in the following video:

Who is required to submit it and where?

The notification must be submitted by individual entrepreneurs and organizations that plan to engage in the types of activities that are provided for Law No. 294-FZ, and also Decree of the Russian Federation dated July 16, 2009 No. 584. The resolution implies the commencement of certain types of business under a notification procedure. However, some difficulties may arise in this matter, since the lists of activities in the law and the resolution do not completely coincide.

If an entrepreneur is faced with a similar situation, the document in question does not need to be sent.

A notification confirming the start of business activity is presented to different departments depending on the type. The main organ is Rospotrebnadzor. It is worth considering that its functions in certain territories have the right to perform FMBA– Federal Medical and Biological Agency. The list of territories was established by order of the Government of the Russian Federation No. 1156-r. These mainly include closed administrative-territorial entities.

A notification confirming the start of business activity is presented to different departments depending on the type. The main organ is Rospotrebnadzor. It is worth considering that its functions in certain territories have the right to perform FMBA– Federal Medical and Biological Agency. The list of territories was established by order of the Government of the Russian Federation No. 1156-r. These mainly include closed administrative-territorial entities.

It is also worth noting that there are several ways to send paper:

- personal presentation to the authorized body;

- with the help of the MFC (multifunctional center that provides public services);

- by mail with notification of receipt and a list of the contents;

- in the form of an electronic document, if available.

If the document is planned to be presented in writing, the entrepreneur should fill it out in duplicate. Both will be marked with a special mark by the authorized body. One of the copies will be returned. If the form is submitted electronically, the citizen will receive confirmation in a similar format.

If the document is planned to be presented in writing, the entrepreneur should fill it out in duplicate. Both will be marked with a special mark by the authorized body. One of the copies will be returned. If the form is submitted electronically, the citizen will receive confirmation in a similar format.

The presence of several presentation methods allows entrepreneurs to choose the most suitable one and save their own time. Although electronic submission is a convenient method, personal submission remains the most relevant.

Submission deadlines

It is necessary to notify the state about the start of activities immediately at the moment when an individual or legal entity plans to open their own business. Moreover, the document must be submitted to the authorized bodies after it has been passed or, but before the start of their activities.

Some individuals and legal entities plan to engage in several types of activities at the same time. Moreover, situations arise when all of them require notification of various government bodies. In this case, it is worth drawing up separate papers for each type and submitting them to the appropriate structures.

Liability for failure to provide

An entrepreneur should take into account that for conducting activities without notification, he bears administrative responsibility in accordance with Part 1 of Art. 19.7.5-1 Code of Administrative Offenses of the Russian Federation. In this case, individual entrepreneurs can be fined in the amount of 3 to 5 thousand rubles. For enterprises, this amount is much larger and ranges from 10 to 20 thousand.

An entrepreneur may also be fined if he presented a document on time, but the information in it is unreliable, in accordance with Part 2 of Art. 19.7.5-1 Code of Administrative Offenses of the Russian Federation. In this case, the fine for individual entrepreneurs ranges from 5 to 10 thousand rubles, and for enterprises – from 20 to 30 thousand.

An entrepreneur may also be fined if he presented a document on time, but the information in it is unreliable, in accordance with Part 2 of Art. 19.7.5-1 Code of Administrative Offenses of the Russian Federation. In this case, the fine for individual entrepreneurs ranges from 5 to 10 thousand rubles, and for enterprises – from 20 to 30 thousand.

According to Art. 19.7 of the Code of Administrative Offenses of the Russian Federation, entrepreneurs must also pay a mandatory fine for failing to notify the authorized bodies of changes after they presented a form with false information. The maximum sanction for individual entrepreneurs is 500 rubles, for companies – 5 thousand rubles.

Filling procedure

To draw up a document, it is advisable to use a ready-made form or example. The following information must be provided:

- name of the federal executive body;

- company name, legal form, registration number (for legal entities);

- Full name, INN and OGRN (for individual entrepreneurs);

- type or several types of activity;

- date and signature.

It is worth emphasizing that all information must be reliable. Therefore, before sending, the document should be carefully checked for errors. Otherwise, a refusal will be received.

Conclusion

It is useful for entrepreneurs to familiarize themselves with the presented material and directly with Law No. 294-FZ. This will allow you to determine whether it is necessary to notify the authorized bodies about the start of the activity, how to fill out the document and where it should be sent.

It is useful for entrepreneurs to familiarize themselves with the presented material and directly with Law No. 294-FZ. This will allow you to determine whether it is necessary to notify the authorized bodies about the start of the activity, how to fill out the document and where it should be sent.

Failure to comply with legal requirements will result in a fine being imposed on the businessman. This situation can be avoided by performing the procedure in a timely manner.

When a legal entity or individual entrepreneur plans to engage in a type of activity in Moscow included in the list of regulated bodies required to be notified, he is obliged to submit a notification immediately after registration of the individual entrepreneur or legal entity and before the start of activity.

Regulations

The need to notify about the start of a type of activity is justified by Federal Law No. 294-FZ “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” and the Decree of the Government of the Russian Federation No. 584 on the notification procedure for the start of certain types of business activities dated 16.07 .2009

Notification from Rospotrebnadzor about the start of activities in Moscow

A notification of business activity must be submitted to Rospotrebnadzor in a strictly established manner and according to a specific template. Let us next consider the main aspects that you should pay attention to when drawing up this document.

Which companies must notify about the start of a type of activity in Moscow

Any company or individual entrepreneur must send a notification of activity to Rospotrebnadzor if the activity falls into the following types:

- Hotel services, including provision of temporary accommodation or accommodation

- Household services

- Catering services

- Retail trade (except for goods with limited turnover under the legislation of the Russian Federation)

- Wholesale trade (except for goods with limited turnover under the legislation of the Russian Federation)

- Textile production

- Tailoring

- Manufacture of leather goods (including footwear)

- Dairy production

- Making bread and bakery products

- Making sugar

- Production of oil and fat products

- Making juices from vegetables and fruits

- Production of flour products

- Production of soft drinks

- Manufacture of wooden products and wood processing, excluding furniture

- Printing and publishing activities

- Information technology and computing

- Freight transportation

How to correctly draw up a notice of the start of an activity in Moscow

The notice of commencement of activity is drawn up in the form established by law. The following are points to consider when writing a notice:

1. The notification must indicate, first of all, information about the applicant, the date the document was drawn up, and the name of the body to which the notification is submitted.

2. Companies indicate their full, abbreviated and corporate (if any) name, and private entrepreneurs indicate their full name.

4. The next paragraph is the full legal and physical address at which the activity is carried out, including the addresses of branches and representative offices, if any. For private entrepreneurs, only the postal address of the place where the activity is carried out.

5. The notification should indicate the same types of activities and works, services related to these activities. OKVED or OKUN codes are given.

6. The start date of the activity is set.

7. The notification is completed by the signature of the head of the organization, the trustee (if any) or the individual entrepreneur. A stamp is also affixed. In the case of an individual entrepreneur, the seal does not need to be affixed.

9. If you intend to conduct several types of activities from the list of mandatory notifications, you must submit a notification for each of them separately.

10. Notification can be submitted in person at the territorial representative office of the authorized body, and can also be sent by mail in writing or electronically. Submission in electronic form can be made through the State Services portal www.gosuslugi.ru, as well as to the email address of the Rospotrebnadzor Office if there is a digital seal and electronic signature of the applicant.

11. Notification of an individual entrepreneur to Rospotrebnadzor about the start of activities is sent according to the same rules as for a legal entity.

12. You can send notification of the start of activities to Rospotrebnadzor free of charge.

13. If you have drawn up a notification in writing, then on the day of registration the authorized body assigns it a number and puts a mark indicating the date. One copy remains with the authorized body, and the second remains with you. If the notification is drawn up correctly and submitted electronically, on the day of registration you will receive an electronic confirmation certified by the electronic signature of the authorized body. If the notification is incorrect, you will receive a justified refusal with recommendations for correcting the situation.

Please note that the latest changes were introduced by government decree on March 4, 2017 and came into force on March 17, 2017. We have reviewed the most important points, and you can find the full text of the document on the Internet.

Liability for failure to notify about the start of an activity or for containing incorrect information

In the event that the notice of commencement of business activity has not been submitted or contains inaccurate information, Rospotrebnadzor has the right to choose a measure to suppress violations in accordance with the table below.