Capitalization of imported goods 1s. Accounting for import transactions in 1C:Enterprise. Excavator taxes and fees

In the 3rd quarter, our organization begins to work with foreign suppliers directly in foreign currency (we opened a foreign currency account, made payments). We need information, step-by-step instructions on payment and accounting for imported goods with types of documents, settlement accounts, setting up contracts in 1C8..

In 1C: Accounting 8, it is necessary to determine the terms of the agreement in the “Agreements” directory. In the “Contract type” field, indicate “with supplier” and select the currency.

To transfer payment to a foreign counterparty, use the document “Outgoing Payment Order”. Operation – “payment to the supplier”, accounting account 52. Accounts for settlements with the supplier and advances – 60.21 and 60.22, respectively.

Please note: it is necessary to fill out the “Currencies” directory in a timely manner in order for the program to correctly calculate ruble amounts and exchange rate differences.

The receipt of goods is documented in the document “Receipt of goods and services”. Operation – “Purchase, commission”. By clicking the “Price and Currency” button, you must uncheck the “Take into account VAT” checkbox, because The price of the goods does not include the amount of tax. When filling out the tabular part of the “Products” tab, you must indicate the country of origin and the customs declaration number.

When conducting, the following wires should be formed:

Debit 41.01 Credit 60.21

Goods received at contract price

Debit 60.21 Credit 60.22

Advance credited (if any)

In addition, without correspondence on accounting accounts, the corresponding quantity of goods will be assigned to the CCD Debit (quantitative accounting only).

Reflection of expenses for payment of customs duties and duties specified in the customs declaration is carried out in the document “Customs customs declaration for imports” (main menu - Main activity - Purchasing). On the “Main” tab the number of the customs declaration and the amount of customs duties are indicated, on the “Sections of the customs declaration” tab - information about material assets and the amount of customs duties.

Debit 41.01 Credit 76.05

The amount of customs duties and customs duties;

Debit 19.05 Credit 76.05

Customs VAT.

Other expenses (for example, customs brokerage services) are reflected in the document “Receipt of additional expenses”.

When conducting, the following transactions are generated:

Debit 41.01 Credit 60.21

Amount of expenses;

Debit 19.04 Credit 60.21

The amount of accrued VAT.

Expenses associated with the acquisition, but not included in the cost of goods, are taken into account in accounts 44, 91 by posting the document “Receipt of goods and services”.

Rationale

Using a specific example. What postings to make and how to calculate taxes when importing

Example conditions: Progress LLC entered into an import contract

If your company is “simplified”

Companies operating under the simplified regime pay import VAT in the same manner as organizations operating under the general regime. But they cannot deduct tax.

Progress LLC entered into a foreign trade contract. Under this agreement, the company purchases a batch of goods worth 61,000 euros from an Italian supplier. According to the terms of the contract, ownership of the goods passes to the buyer after customs clearance. In July, Progress LLC must pay 30 percent of the cost of goods as an advance payment. The LLC will transfer the rest of the cost of the goods within ten days after their customs clearance.

In July 2012, the advance paid to the supplier is reflected

Progress LLC made an advance payment to the foreign supplier on July 16 in the amount of 18,300 euros (61,000 EUR ? 30%). The Bank of Russia exchange rate on this date is (conditionally) 40.5112 rubles/EUR. The LLC accountant reflected the advance payment with the following posting:

DEBIT 60 subaccount “Settlements on advances issued” CREDIT 52

- 741,354.96 rub. (18,300 EUR ? 40.5112 rubles/EUR) - prepayment was transferred to the seller.

In August 2012, goods received are taken into account

The declaration for imported goods was registered by customs officers on August 2, 2012. The customs value of the goods is equal to the transaction price - 61,000 euros. The exchange rate of the Bank of Russia on the date of customs clearance (conditionally) is 40.6200 rubles/EUR.

When importing goods, the LLC paid a duty of 5 percent of their customs value, that is, 123,891 rubles. (61,000 EUR ? ? 0.6200 rub/EUR) ? 5%). And also customs duty - 5500 rubles.

The amount of VAT paid upon import was RUB 468,307.98. ((61,000 EUR ? 40.6200 rub/EUR + 123,891 rub.) ? 18%).

Important detail

The tax base for import VAT includes the customs value of goods and import duties.

In addition, the LLC paid for the storage of goods, their delivery and loading and unloading. Only 75,000 rubles. According to the accounting policy of Progress LLC, the accountant attributes these expenses to the cost of goods both in accounting and when calculating income tax. In this case, the company partially paid for imported goods. Therefore, the accountant formed the cost of goods based on the amount paid to the supplier as an advance. To it he added the remaining 70 percent of the contractual value of the goods at the exchange rate at the time of transfer of ownership.

So, the accountant reflected the receipt of goods, payment of customs duties and other expenses with the following entries:

DEBIT 76 CREDIT 51

-123,891 rub. - import customs duties have been paid;

DEBIT 76 CREDIT 51

-5500 rub. - customs duty is transferred;

DEBIT 68 subaccount “VAT calculations” CREDIT 51

-468,307.98 rub. - “import” VAT has been paid;

DEBIT 19 CREDIT 68 subaccount “VAT calculations”

-468,307.98 rub. - reflected VAT paid;

DEBIT 76 CREDIT 51

-75,000 rub. - payment for storage, delivery, loading and unloading of goods is listed;

DEBIT 41 CREDIT 60 subaccount “Payments for goods”

-2,475,828.96 rub. (RUB 741,354.96 + (EUR 61,000 ? 70% ? ? RUB 40.6200/EUR)) - received goods are taken into account;

DEBIT 60 subaccount “Payments for goods” CREDIT 60 subaccount “Settlements for advances issued”

-RUB 741,354.96 - advance payment paid to the supplier is credited;

DEBIT 41 CREDIT 76

-204,391 rub. (123,891 + 5,500 + 75,000) - the cost of goods includes customs duties and customs fees, storage costs, delivery and loading and unloading;

DEBIT 68 subaccount “VAT calculations” CREDIT 19

-468,307.98 rub. - paid “import” VAT is accepted for deduction.

On the date of payment for goods, the exchange rate difference is determined

Progress LLC transferred payment to the supplier in the amount of 70 percent of the cost of goods on August 7, 2012. The exchange rate for this date (conditionally) is 41.7235 rubles/EUR. The accountant determined the exchange rate difference and compiled an accounting certificate (see below).

The accountant made the following entries in the accounting:

DEBIT 60 CREDIT 52

-1,781,593.45 rub. (61,000 EUR ? 70% ? 41.7235 RUR/EUR) - the remaining payment for the goods is transferred;

DEBIT 91 subaccount “Other expenses” CREDIT 60

-47,119.45 rub. (61,000 EUR ? 70% ? (41.7235 rub/EUR – – 40.6200 rub/EUR)) - negative exchange rate difference is taken into account.

In tax accounting, the accountant included this exchange rate difference in non-operating expenses.

In order to correctly reflect import transactions in accounting, it is necessary to answer the following questions:

- For what purposes were inventories purchased from a foreign supplier (resale or domestic consumption);

- Was the product sold in Russia?

When selling goods (works, services), VAT must be paid only if the sale took place in Russia. When selling goods (work, services) outside Russia (on the territory of a foreign state), you do not pay tax. This follows from subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation; 3. Whether goods were imported into Russia from member states of the Customs Union. FOR REFERENCE: At the moment, the following states are participants in the Customs Union: Armenia; Kazakhstan; Kyrgyzstan; Russia; Belarus.

Accounting for imported goods according to customs declaration in 1C accounting 8.3

Attention

Reflection of VAT for deduction To accept VAT for deduction, you must enter the regulatory document “Creating Purchase Ledger Entries” (Menu “Operations” - VAT Regulatory Operations) (Fig. 32) Fig. 32 When posting the document, postings will be generated (Fig. 33): Fig. 33 Information on VAT accepted for deduction is reflected in the Purchase Ledger. (Fig. 34) Fig. 34 The amount of VAT paid to the budget as a buyer-tax agent is reflected in the declaration on page 180 of section 3. (Fig. 35) Fig. 35 3. Goods imported from the countries of the Customs Union We have previously published an article on reflecting the acquisition of goods from member countries of the Customs Union.

Important

At that time, these operations in 1C software products were not automated. Now in the software "1C: Accounting 8" ed. 3.0, these operations are automated and are successfully used in importing enterprises.

Customs declarations (their copies certified by the head of the organization or the chief accountant) and payment documents confirming payment of VAT must be stored for four years (paragraph 5, paragraph 13 and paragraph 3, subparagraph “a”, paragraph 15 of Appendix 3 to the resolution Government of the Russian Federation dated December 26, 2011 No. 1137). Along with payment documents indicating payment of VAT at customs, you can use confirmation in the form approved by the order of the Federal Customs Service of Russia dated December 23, 2010.

No. 2554. This document confirms the payment of VAT when importing goods and is issued by customs at the request of the organization. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated August 5, 2011.

№ 03-07-08/252. 2.

Rice. 24 When posting the document, postings will be generated (Fig. 25): Fig. 25 Also, when posting this document, an entry is created in the Sales Book. (Fig. 26 -27) Fig. 26 Fig. 27 Filling out a VAT return The amount of VAT payable according to the tax agent is reflected in line 060 of section 2 of the declaration. (Fig. 28) Fig. 28 Transfer of VAT to the budget (Fig. 29) Fig. 29 When registering a document that reflects the payment of VAT to the tax authority as an analytics for account 68.32, it is MANDATORY to indicate the foreign supplier, the agreement and the document of payment to the supplier. (Fig. 30) Fig. 30 If the analytics are filled out incorrectly, VAT will not be automatically deducted. When posting the document, postings will be generated (Fig.

31): Fig.

Accounting for import transactions in 1C:Enterprise

You can find it in the purchase section, but for this example it would be more appropriate to create it directly from the receipt document. To do this, we will use the “Create from” menu.

In the “Customs” field we indicate that our batch of phones will be processed at Vnukovo customs. It is to her that we will pay a fee of 5,000 rubles. On this document tab, we only need to fill in the “Deposit” field, the value of which is selected from the contract directory.

Next, let's move on to the next tab of the document - “Sections of the customs declaration”. Due to the fact that we created this document based on the receipt of goods, some data in the tabular section “Products by section” has already been filled in.

Registration of receipt of imported goods in the 1c: accounting 8 program

This article is devoted to how to reflect business transactions for import accounting in the 1C: Accounting 8 version 3.0 program and correctly generate VAT reporting, depending on the terms of the transaction with a foreign supplier. From the point of view of accounting features in the software product, the following categories of imported goods can be distinguished:

- Goods for own consumption;

- Goods for subsequent sale on the territory of the Russian Federation;

- Goods imported from the countries of the customs union.

Note: Features of recording import transactions relate primarily to VAT.

Please note: All examples are implemented on release 3.0.44.124.

VAT to be deducted), you can select the “Reflect VAT deduction in the purchase book” checkbox directly in the primary document. Tab “Sections of the customs declaration” (Fig. 7) The customs value of goods is indicated in the same currency as the document for receipt of goods.

You must manually indicate the amount of duty (in rubles) Fig. 7 The amount of VAT payable is calculated using the formula = Customs value of goods * Central Bank exchange rate on the date of document execution + customs duty) * VAT rate (18%) When posting the document, postings will be generated (Fig. 8): Fig. 8 Acceptance of VAT for deduction The organization has the right to accept VAT paid upon import as part of an advance payment for deduction at the time of its registration.

Customs declaration for import in 1s. receipt of imported goods and their sale

Courses 1C 8.3 and 8.2 » Training 1C Accounting 3.0 (8.3) » Sales and purchases, warehouse accounting » Accounting for imported goods according to the customs declaration in 1C Accounting 8.3 Let's consider the actions in the 1C 8.3 Accounting 3.0 program for accounting for imported goods according to the customs declaration (cargo customs declaration), including studying how to reflect the receipt of imported goods in 1C 8.3 and filling out the customs declaration document for imports. Content

Features of accounting for import transactions in "1C: Accounting 8" (rev. 3.0)

In addition, the organization must have:

- foreign economic agreement (contract);

- invoice (account);

- customs declaration;

- payment documents.

In the program to reflect VAT for deduction, you must enter the document “Creating purchase ledger entries” (if VAT was accepted for deduction at the time of registration of the “Customs Customs Document for Import” document, this action can be skipped). (Fig. 9) Data for reflecting VAT for deduction will be automatically filled in on the “Purchased Assets” tab. Rice. 9 Please note: the transaction code must be “20” (filled in automatically), the type of value is Customs duties, the details of the document for the actual transfer of payment must be indicated. When posting the document, postings will be generated (Fig. 10): Fig.

In this case, the entry to the debit of account 15.02 and the credit of account 60 is made regardless of when the goods arrived at the organization - before or after receiving the supplier’s payment documents. The posting of goods actually received by the organization is reflected by an entry in the debit of account 41 “Goods” and the credit of account 15.02.

If the accounting policy does not provide for the use of account 15 or the transfer of ownership occurs at the moment the goods arrive directly at the buyer’s warehouse, then account 41.01 should be used. Let's consider the case when an organization uses account 15.02 to record goods and the transfer of ownership of the goods occurs at the time of its registration at customs, then the receipt document indicates account 15.02 as an accounting account, and the receipt is registered at a fictitious warehouse, for example, “Customs”.

Importers transfer an advance to the customs account, from which, when an obligation to pay tax arises, the customs writes off the required amount for customs duties, payments and VAT (Article 73 of the Customs Code of the Customs Union). Moreover, the enterprise in this case will not be a tax agent of a foreign company. VAT as a tax agent is paid only if the goods are sold in Russia and the foreign supplier is not registered as a taxpayer. This follows from paragraph 2 of Article 161 of the Tax Code of the Russian Federation. Goods are considered sold in Russia if at least one of the conditions is met:

- the goods are located in Russia (in territories under its jurisdiction) and are not moved during sale (subclause 1, clause 1, article 147 of the Tax Code of the Russian Federation);

- at the time of shipment and transportation, the goods are in Russia (in the territories under its jurisdiction) (subclause 2 p.

To accept VAT for deduction, perform the following actions in the program: 1. To confirm the payment of the tax, based on clause 2, enter the document “Confirmation of payment of VAT to the budget” (entered only after receiving a mark from the tax authority on the import application). (Fig. 41-42) Fig. 41 Fig. 42 2. Let’s reflect VAT for deduction by filling out the regulatory document “Creating purchase ledger entries” (Fig. 43) Fig. 43 When posting the document, entries will be generated to accept VAT for deduction. (Fig. 44) Fig. 44 Reflection of VAT in the Declaration In the Declaration, the amount of VAT deduction when importing goods from the territory of the member states of the Customs Union is reflected on page 160 of section 3. (Fig. 45) Fig.

Automatic selection and filling of customs declaration

for 1C: Enterprise Accounting 8, edition 3.0

platform 8.2, 8.3

Why is this processing needed?

As is known, in the standard solution “1C: Enterprise Accounting 8, edition 3.0”, accounting of goods in the context of customs declaration is not implemented flexible enough. However, as practice shows, there is a serious need for most trading enterprises for more serious automation of this important area of accounting. If a company trades in imported goods and keeps records in the 1C: Accounting 8 program, then filling out the customs declaration, upon implementation, turns into a real problem for the accountant. This processing expands the functionality of the standard configuration and allows you to automate work with the customs declaration, perform automatic selection of the customs declaration and automatically fill out the customs declaration in documents:

“Sales of goods and services”

"Write-off of goods"

"Retail Sales Report"

“Report of the commission agent (agent) on sales”

"Demand-invoice"

"Return of goods from the buyer"

“Nomenclature assemblage”

Processing is for configuration "1C: Enterprise Accounting 8, edition 3.0", running on the versions platform 8.2 And 8.3

Why this particular treatment?

- More than 90 successful implementations!

- High-quality technical support

- Works in 1CFresh

- Free demo version

- Timely updating and updating

- Extensive functionality

The undoubted advantages of processing include:

- Availability of a completely free demo versionallows you to evaluate the possibility of using this treatment at your enterprise before making a purchase

- Connection through the external processing mechanism, this allows the use of processing, without making any changes to the standard configuration

, this guarantees that there will be no problems with updating the configuration.

- Correct filling of the customs declaration, based on the balance of the customs declaration account; if necessary, one line of the document is split into several

- Correct work with document lines containing the same items at different prices

- Implementation of the FIFO/LIFO write-off method

- Automatic registration of the form greatly simplifies connecting the form to the configuration

- The open version of the processing has successfully passed the audit for use in 1CFresh

- Allows you to conduct full-fledged commission trade in imported goods, taking into account and correctly filling out the customs declaration numbers in the documents “Report of the commission agent (agent) on sales”, “Return of goods from the buyer (commission agent)”

Let's look at an example:

Balances on the customs declaration account for item N:

24000111/100103/0001859 --- 10 pcs.

28000222/141204/0018754 --- 15 pcs.

In the Implementation, the number of items is N --- 30 pcs.

As a result of processing, the implementation will contain three lines:

1. N --- 10 --- 24000111/100103/0001859

2. N --- 15 --- 28000222/141204/0018754

3. N --- 5 --- (Blank)

A warning will also be displayed in the message window:

Line No. 3, N - there are no free balances on the customs declaration account, 5 pieces are missing

How to install and use?

Attention! Processing is for configuration purposes only « 1C: Enterprise Accounting 8, edition 3.0 » (platform versions 8.2 and 8.3)

Attention! When registering processing, full rights are required.

Method 1:

In 1C enterprise mode, go to the main menu, select file->open... (), then specify the external processing file (Automatic SelectionGTD_BP_82_Red3.0_vX.X.epf), which you unpacked from the archive. If you have done everything correctly, the form () will open, click the “Run” button. After this, you will receive a message about the successful registration of the processing and it will be ready for use.

Method 2: Download the archive file and extract the external processing file from it Automatic Selection GTD_BP_82_Red3.0_vX.X.epf

In 1C enterprise mode, connect processing yourself in the standard way, using the “Additional reports and processing” mechanism located in the “Administration” subsystem ()

If you did everything correctly, then in the document forms “Sales of goods and services”, “Write-off of goods”, “Report on retail sales”, “Report of the commission agent (agent) on sales”, “Demand-invoice”, “Return of goods from the buyer” a new command will appear on the document form, as well as in the “More...” menu "Automatic selection of gas turbine engines"()

In older configuration releases the command "Automatic selection of gas turbine engines" can be located in a menu item "Filling..."

Attention! The location of this command in the interface may be influenced by user settings of the document form; if necessary, it is recommended to set standard settings for the document form.

Oh... it’s strange, but I don’t have the civil customs declaration and Country of origin columns in my documents!?

In fact, of course they are, but by default they are hidden. To make them visible in the document form in the menu All actions -> Change form... find the names of these columns (i.e. Customs declaration number and Country of origin) and check the boxes next to them. ()

I did everything as written, but the “Automatic selection of gas turbine engine” item did not appear!

In the program settings, enable the use of external printed forms, reports and processing. Administration -> Printed forms, reports and processing -> Additional reports and processing ()

How is the standard version different from the open source version? Which one should I choose?

The main difference between the open source version and the standard version is that your programmer (or any other programmer you hire) can modify the open source version to suit any of your personal requirements. The open source version is required if in your organization all external processing undergoes a mandatory security audit before installation. If your 1C database runs in the cloud (1Cfresh, etc.), then the service provider will definitely ask you to provide an open source version for auditing.

The open source version has an extended technical support period - 2 months(standard version 1 month) and extended period of free updates - 12 months(standard version 6 months)

Terms of use, technical support, update policy

1. Technical support for purchased processing is provided free of charge for 1 month (2 months, depending on delivery) from the date of purchase.

2. The author makes every effort to ensure the functioning of the processing in the current release of the "Enterprise Accounting 3.0" configuration. Updates are provided to the user free of charge within 6 months (12 months, depending on delivery) from the date of purchase. After this period, the user must purchase a subscription to receive updates.

3. It is permitted to use the acquired processing in an unlimited number of information databases within a legal entity (a group of legal entities united in a holding). 1C-Franchisee companies are required to purchase a separate copy of the processing for each legal entity (group of legal entities united in a holding) in the information databases of which the processing will be operated.

4. The processing is supplied with closed or open source, depending on the selected delivery version. No parts of the processing (forms, modules, layouts, etc.) can be used in third-party developments without the consent of the author.

5. If necessary, the purchased processing can be modified by the author to suit the client’s personal requirements for an additional fee. Customization of processing to suit the client's requirements is a separate additional service that can be provided to the client after purchasing the processing!

Would you like to receive an additional 1 year update subscription for FREE?

There are two ways to do this:

1. Recommend this treatment to your acquaintances, colleagues, friends. If they make a purchase based on your recommendation, then I will provide you with a free additional subscription to updates for 1 year (or I will extend an existing subscription for 1 year). To do this, you need to inform me via private messages of your order number, as well as the buyer’s order number (or any other information that will allow you to establish the fact of purchase)

2. Did processing help you in your work and save time? Amazing! Write a high-quality positive review about this with feedback, and I will provide you with a free additional subscription to updates for 1 year (or I will extend an existing subscription for 1 year)

See also similar treatments for other configurations:

Comparison of versions

Version 1.5

Added support for the “Item Assembling” document (the “Assembling” operation type is supported, provided that the components are accounted for on account 41)

Version 1.4

The processing was updated for the release of 1C Enterprise Accounting 3.0.66.53

An access error that occurs when a user who does not have full rights tries to start processing has been fixed.

Money back guarantee

Infostart LLC guarantees you a 100% refund if the program does not correspond to the declared functionality from the description. The money can be returned in full if you request this within 14 days from the date the money is received in our account.

The program has been so proven to work that we can give such a guarantee with complete confidence. We want all our customers to be satisfied with their purchase.

Step 1. Settings for accounting for imported goods according to the customs declaration

It is necessary to configure the functionality of 1C 8.3 through the menu: Home- Settings – Functionality:

Let's go to the bookmark Reserves and check the box Imported goods. After installing it in 1C 8.3, it will be possible to keep track of batches of imported goods by customs declaration numbers. The details of the customs declaration and the country of origin will be available in the receipt and sale documents:

To carry out settlements in foreign currency, on the Calculations tab, check the Settlement in foreign currency and monetary units checkbox:

Step 2. How to capitalize imported goods in 1C 8.3 Accounting

Let's enter the document Receipt of goods in 1C 8.3 indicating the customs declaration number and country of origin:

The movement of the receipt document will be as follows:

By debit of the auxiliary off-balance sheet account gas turbine engine information will be displayed on the quantity of imported goods received, indicating the country of origin and the customs declaration number. The balance sheet for this account will show the balances and movement of goods in the context of the customs declaration.

When selling imported goods, it is possible to control the availability of goods moved under each customs declaration:

In the 1C 8.3 Accounting program on the Taxi interface for accounting for imports from member countries of the customs union, changes have been made to the chart of accounts and new documents have appeared. For more information about this, watch our video:

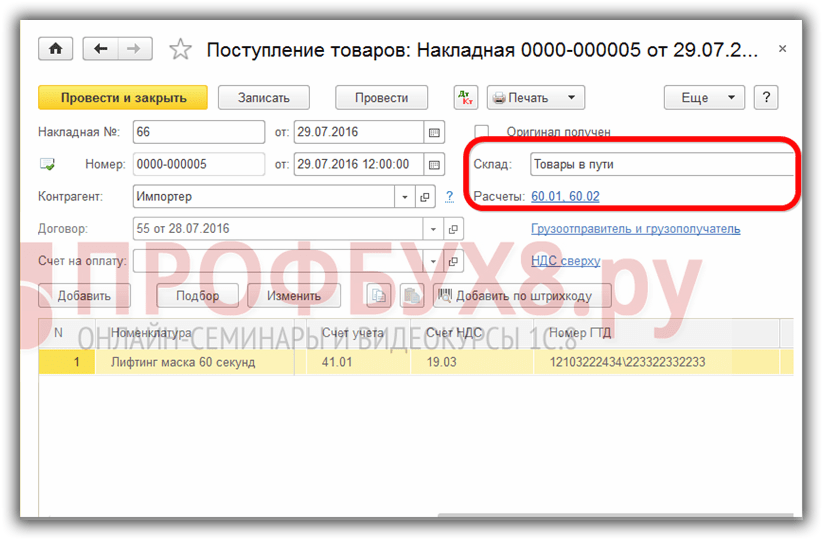

Step 3. How to account for imported goods as assets in transit

If during the delivery period it is necessary to take into account imported goods as material assets in transit, then you can create an additional warehouse to account for such goods as a warehouse Items on the way:

Account 41 analytics can be configured by storage location:

To do this, in 1C 8.3 you need to make the following settings:

Click on the Inventory Accounting link and check the box By warehouses (storage locations). This setting in 1C 8.3 makes it possible to enable analytics of the storage location and determine how accounting will be kept: only quantitative or quantitative-cumulative:

When goods actually arrive, we use the document to change the storage location:

Let's fill out the document:

The balance sheet for account 41 shows movements in warehouses:

Step 4. Filling out the customs declaration document for import in 1C 8.3

Enterprises that carry out direct deliveries of imported goods must reflect customs duties for the received goods. Document Customs declaration for import into 1C 8.3 can be entered based on the receipt document:

or from the Purchases menu:

Let's fill out the customs declaration document for import into 1C 8.3 Accounting.

On the Main tab we indicate:

- The customs authority to which we pay duties and the contract, respectively;

- What customs declaration number did the goods arrive at?

- Amount of customs duty;

- The amount of fines, if any;

- Let's put up a flag Record the deduction in the purchase book, if you need to reflect it in the Purchase Book and automatically deduct VAT:

On the Customs Declaration Sections tab, enter the amount of the duty. Since the document was generated on the basis, 1C 8.3 has already filled in certain fields: customs value, quantity, batch document and invoice value. Let's enter the amount of duty or the % duty rate, after which 1C 8.3 will distribute the amounts automatically:

Let's review the document. We see that customs duties are included in the cost of goods:

Study in more detail the features of the receipt of goods in the event that a customs declaration is indicated in the supplier’s SF, check the registration of such SF in the Purchase Book, study the 1C 8.3 program at a professional level with all the nuances of tax and accounting, from the correct entry of documents to the generation of all basic reporting forms - we invite you to our . For more information about the course, watch our video:

1. Payment to the supplier is made using the document “Write-off from the current account” with the transaction type “Payment to the supplier”.

For example, on 05/01/2012 the USD exchange rate was 29.3627, respectively, if you pay 300 USD, the ruble equivalent will be 8,808.81 rubles. and the program will generate transactions:

2. At the time of transfer of ownership of the goods in the program, it is necessary to create a document “Receipt of goods and services” from the importer, under an agreement in foreign currency and without VAT.

Depending on the accounting policy adopted by the organization, the receipt of goods can be reflected using accounts 15.02 “Procurement and acquisition of goods” and 16.02 “Deviation in the cost of goods” or without their use.

If an organization uses accounts 15.02 and 16.02, on the basis of suppliers’ payment documents received by the organization, an entry is entered to debit account 15.02 and credit the corresponding account (60, 71, 76, etc., depending on where the goods came from). In this case, the entry to the debit of account 15.02 and the credit of account 60 is made regardless of when the goods arrived at the organization - before or after receiving the supplier’s payment documents.

The posting of goods actually received by the organization is reflected by an entry in the debit of account 41 “Goods” and the credit of account 15.02.

If the accounting policy does not provide for the use of account 15 or the transfer of ownership occurs at the moment the goods arrive directly at the buyer’s warehouse, then account 41.01 should be used.

Let's consider the case when an organization uses account 15.02 to record goods and the transfer of ownership of the goods occurs at the time of its registration at customs, then the receipt document indicates account 15.02 as an accounting account, and the receipt is registered at a fictitious warehouse, for example, “Customs”.

First, for account 15.02, it is necessary to add the subconto “Nomenclature”; if we do not need to see the balances on account 15.02 by goods, but only collapsed, then this subconto can be negotiable:

For example, on 05/10/2012 the USD exchange rate was 29.8075, part of the goods was paid at the rate on 05/01/2012 (29.3627), the remaining part of the goods (700 USD) should be valued at the rate at the time of transfer of ownership.

A product worth 1,000 USD in ruble equivalent will be equal to 29,674.06 rubles. ($300*29.3627 +$700*29.8075) and the program will generate transactions:

3. Based on this document, it is necessary to enter the “Customs Customs Document for Import” document, which indicates the amount of customs duty, the percentage or amount of customs duty and the VAT rate paid at customs.

On the “Basic” tab, the customs declaration number and the amount of customs duty are indicated:

On the “Sections of the Customs Declaration” tab, the program automatically enters the customs value in USD (can be changed if necessary), the amount of duty and VAT are calculated in ruble equivalent based on the customs value at the exchange rate on the date of the “Customer Customs Declaration for Import” document.

If several sections are specified in the customs declaration, then an additional section is added using the “Civil declaration sections - Add” button. After specifying the duty and VAT rate, using the “Distribute” button, the program distributes the amounts of duty and VAT in proportion to the amounts of goods in the tabular part of the customs declaration section.

On the “Settlement Accounts” tab, you can change the account for settlements with customs:

On the VAT tab, to reflect the deduction in the purchase book, the corresponding flag is placed:

When posted, the document will generate the following transactions:

Note! If, for example, it is necessary to reflect customs duties and customs duties on the account where goods are accounted for (15.02 or 41.01), but on the cost account (44.01 or 91.02), then in this case in the document “Customs customs declaration for imports” you can manually change the accounting account on the tab “ Sections of the customs declaration”, record the document, close and reopen, indicate the required cost item or type of other expenses and income:

4. If the transfer of ownership occurred at customs, then after the goods arrive at the warehouse of our organization, it will be necessary to draw up the document “Operation (accounting and tax accounting).” The data for filling it out can be obtained from standard reports, for example, the balance sheet for account 15.02, grouped by item:

Because For account 15.02, quantitative records are not kept, then the data on the quantity can be viewed from the receipt documents.

The document “Operation (accounting and tax accounting)” will look like:

The account Dt is indicated as account 41.01. Subconto Dt1 - name of the received goods.

As a batch document (SubcontoDt2) for all imported goods received under one document, you must select one (!) document “Batch (manual accounting)”. For the first product from the list, you need to click on the “New batch document (manual accounting)” button to create a document in which you fill in the “Counterparty” and “Agreement” fields with data about the supplier-importer.

For all subsequent products, you must select the same document as a batch document using the “Select” button.

The “SubcontoDt3” field indicates the warehouse to which the goods are received. In the “Quantity of Dt” field, the amount of goods received is indicated.

Account Kt - 15.02, because for this account, only the “Nomenclature” analytics (revolving subconto) was added, then SubcontoKt1 selects the incoming product, or this field can be left blank. In the amount field, indicate the ruble cost of the received goods, taking into account all additional expenses (based on SALT).